For Many, This Recession Will Feel Like A Depression

Authored by Charles Hugh Smith via OfTwoMinds blog,

The conventional means to drag the economy out of recession have all reached their limits and will no longer work as anticipated.

We’re often told this time it’s different, and this time, it’s true–but not in the way those issuing the claim expect.

I’m often dismissed as a doomer, and I interpret this as a reflection of the accusers’ intense commitment to The Fairy Tale version of the economy, in which a new technological or financial “innovation” enables us to consume more of everything forever and ever.

As you’ll see, what’s presented here are data–facts. How we interpret them is up to us, and this explains the profound need of apologists to distort or ignore the data to follow The Fairy Tale narrative.

The primary means of distorting data is to lump all 135 million US households / 340 million residents into one bucket. In doing so, we magically make unprecedented wealth and income inequality disappear: look at the vast pool of cash sitting in money market funds, look at the trillions of home equity, 401K accounts, and so on: we’re rich, so what’s the worry?

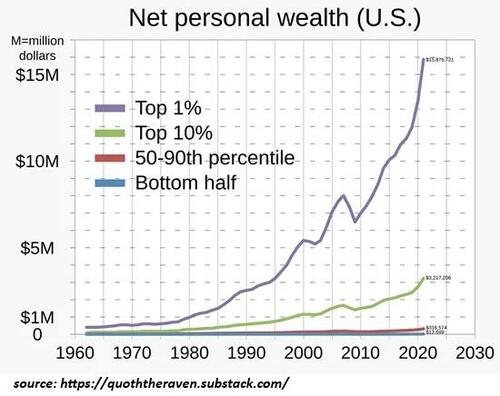

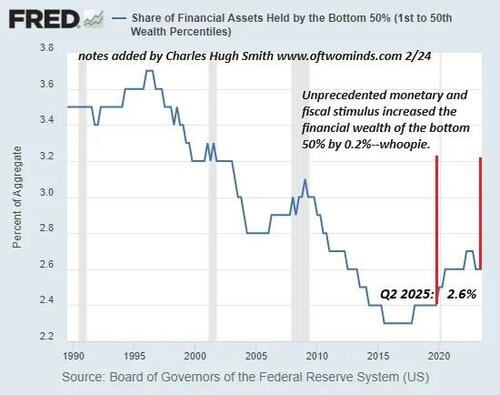

But this is artifice: the vast majority of this wealth (68%, $113 trillion) is in the hands of 13.5 million households, the top 10%. The bottom 50%–170 million people–own 2.5% of the wealth–$4 trillion, a wafer-thin 3.5% of the wealth held by the top 10%.

According to an article in the Wall Street Journal (April, 2025, WSJ.com, $1 Trillion of Wealth Was Created for the 19 Richest U.S. Households Last Year), 19 households own $2.6 trillion in net worth, the same as 110 million Americans.

The top 1% (3.4 million people) own 31% of all net worth ($52 trillion), more than the net worth of all those in the 50% to 90% segment (136 million people).

The top 10% collect the lion’s share of all income and account for 50% of all spending.

It’s been reported that 41.7 million American workers (31% of the workforce) earn under $12 an hour. A brookings.edu report (2020) found that the median hourly wage of 53 million American workers (ages 18-64, 44% of the workforce) is $10.22, and their full-time annual incomes are about $24,000.

Many of the lowest-paid workers have received a significant bump up in wages, but even a 10% to 20% increase barely moves the needle when we consider that the median full-time wage earnings in the US are $62,000.

I presented all this data in The Winners and Losers in 21st Century America.

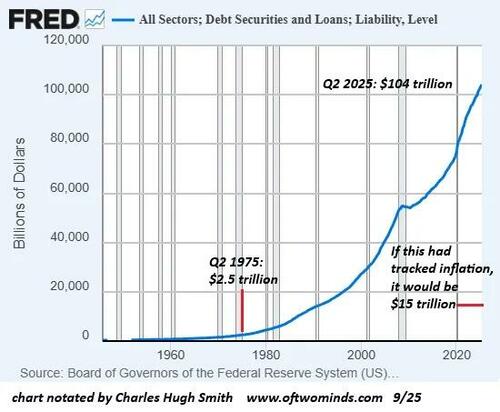

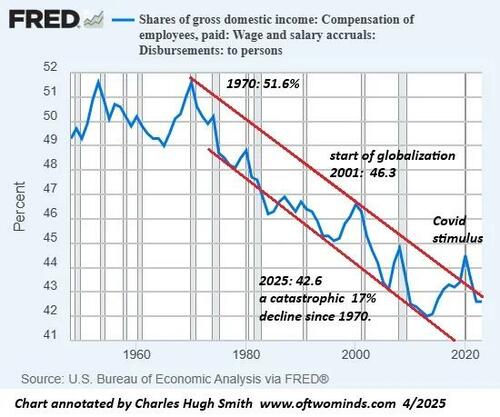

The real story of the US economy over the past 50 years is not The Fairy Tale narrative. The real story is easily visible in the data: wages’ share of the economy have plummeted, reducing the standard of living of wage earners, and the official response has been to rely on financial gimmicks to keep expanding consumption/GDP with borrowed money.

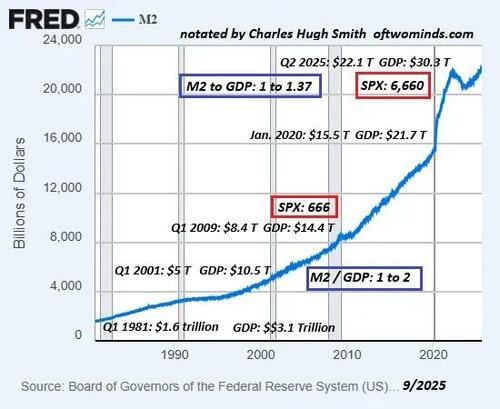

Money supply has expanded faster than the economy, as has debt, as reducing interest rates encourages more borrowing which then inflates assets, generating “the wealth effect” when then boosts more borrowing and spending, a so-called virtuous cycle of expanding debt based on assets expanding in value, enabling even more debt.

But this reliance on asset bubbles to generate wealth and consumption has exacerbated wealth and income inequality, as the system is designed to benefit those who already own assets and who have access to low-cost credit, i.e. the already-wealthy.

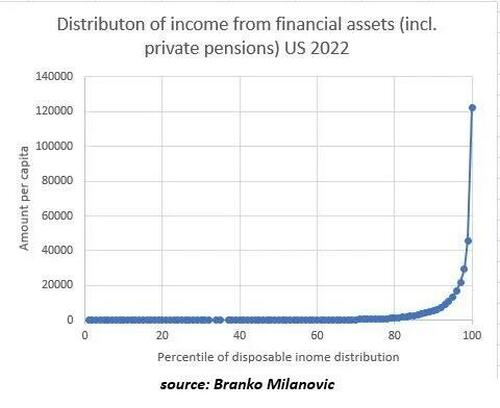

The vast majority of unearned income flowing from capital (rental properties, stocks, bonds, business ownership) flow to the top of the wealth pyramid.

According to economist Branko Milanovic, who studies wealth and income inequality, the median annual per capita income from financial assets in the U.S. is $21.89. Yes, $22, enough for a few Happy Meals.

This chart tells the real story: a relative handful of households (the top 0.1%) collect the vast majority of unearned investment income, while the vast majority of households collect a few dollars.

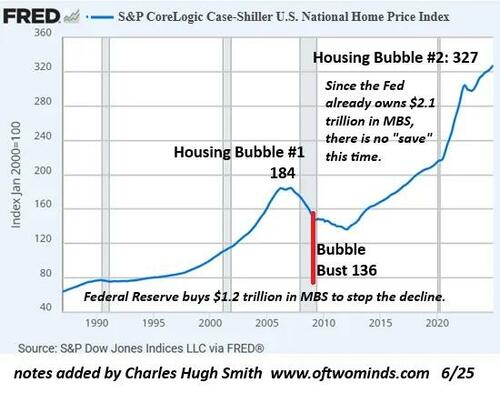

The strategy of replacing rising purchasing power of wages with asset bubbles has not just widened wealth and income inequality to levels that make social disorder increasingly inevitable, it also has left the entire economy increasingly precarious, as substituting debt and asset bubbles for earned income has left most households exposed to extraordinary risks they don’t control, i.e. the stock and housing bubbles bursting and the financial fallout as “the wealth effect” reverses. This will push the economy into a self-reinforcing feedback loop. a.k.a. doom loop.

The substitution of debt for income is self-liquidating, as at some point–what we call debt saturation–the borrower’s income is devoted solely to essential expenses and servicing existing debt: there is no more discretionary income left to fund more borrowing.

In other words, as debt expands, so too does the interest and principal due every month, and eventually this debt service plus non-discretionary spending consumes all income.

The conventional means to drag the economy out of recession–cut taxes, lower interest rates and increase federal spending to juice consumption–have all reached their limits and will no longer work as anticipated.

Federal taxes are already paid primarily by the top 10%, so “tax cuts” only benefit the already-wealthy. The “married filing jointly” tax brackets for 2026 are 10% up to $24,800 and 12% up to $100,800. If a two-income household only takes the standard deduction of $32,200, that means that a household income of $133,000 is only taxed at a maximum rate of 12%–not much above the lowest rate.

According to the US Census Bureau, the median household income in 2024 was $83,730.

So tax cuts won’t help the bottom 90% in any measurable degree.

As for lowering interest rates, as I’ve noted previously, the world has changed and the Great Moderation of 2000-2020 is no longer with us. What enabled rates to drop to near-zero was the deflationary impulse of China’s expansion as the world’s workshop: as China tapped its low-cost coal reserves and (at the time) low-wage workforce, that generated a global wave of deflation that offset the other forces pushing inflation higher.

With that deflationary wave gone, there are no replacement sources of deflation: with global trade wars and risks rising, the risk premium to borrow capital has risen globally and cannot be manipulated back down to zero.

Many expect the Federal Reserve to reach deep into its bag of tricks and push rates back to zero to “save the economy from recession,” but the Fed has seen what happens when you make this artifice your go-to policy: as Japan as shown, the result is stagnation, for the only way to clear the economy for a legitimate return to expansion is to let the asset bubbles deflate and absorb the resulting losses of bankruptcies, defaults and writedowns of debts that can never be paid back.

Since such a clearing of bad debt would hurt banks and the wealthy who own the debt as assets, this is anathema to the Fed and the political leadership.

Even if the headline interest rates drop, this won’t reduce credit card rates or student loan rates for the bottom 90%–they will remain at nosebleed levels. Those with less than excellent credit ratings will also find rates don’t drop because the Fed waved its magic wand.

In an economy that has reached debt saturation, lowering rates will accomplish nothing. The top 10% don’t need to borrow as they own 68% of the wealth and the bottom 90% will find their ability to borrow limited–and unwise.

As for the mortgage-refinance boom that fueled consumption in the Great Moderation, that’s also a non-starter, as relatively few homeowners have 7+% mortgages. The majority are sitting on mortgages at rates that may never be revisited.

And as for the federal government boosting its spending to extricate the economy from recession–the federal government is already borrowing and spending as if we’re already mired in a Depression.

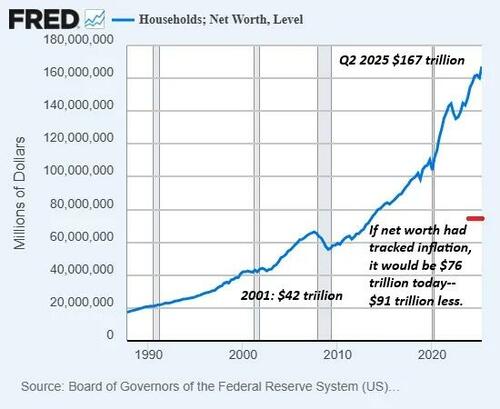

The asset-bubble wealth is largely phantom wealth, an artifact of goosing money supply, debt and stocks with corporate buybacks, which by some reports account for 80% of the entire stock market gains since 2009.

If net worth had tracked inflation, total net worth would be $76 trillion, not $167 trillion. This suggests net worth could fall by half and still have registered gains from 2001.

Back to the self-reinforcing feedback loop. It’s been 45 years since the US experienced a real recession, one that couldn’t be reversed with the gimmicks of goosing money supply and debt and lowering interest rates.

In a real recession, job losses trigger further job losses, as enterprises, households and local governments (that can’t borrow to fund their general-fund expenses) reduce spending. As I noted in Crunch Time for Cities, Counties and States, local governments have few ways to trim expenses other than firing employees.

If AI follows even part of the script promoted by its boosters–that AI will replace millions of human workers–this will only accelerate the self-reinforcing feedback of job losses, reduced hours, slashed benefits, business closures, etc.

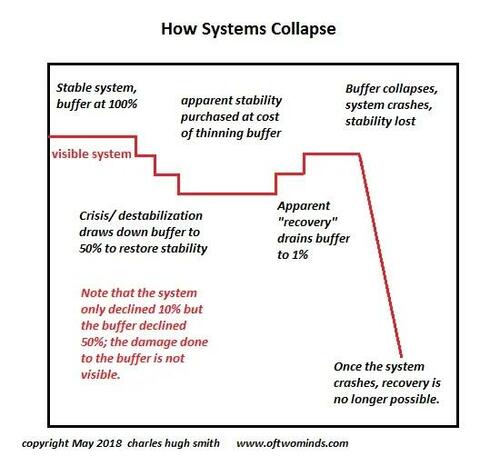

The problem is the artifices of depending on asset bubbles and soaring debt to generate “growth” have hollowed out the economy at the most basic level, leaving many households, local governments and small businesses in an extraordinarily precarious position: all credit-asset bubbles pop, and the more gimmicks that are applied, the greater the destruction.

A great many households are not prepared for the loss of a job. Many others are not prepared for a historically “average” 40% drop in their stock portfolios and home equity. Local governments are not prepared for severe declines in income taxes, sales taxes, property taxes and business-related fees.

Many small businesses are barely hanging on due to soaring costs and proprietor burnout.

The official policies of replacing increases in the purchasing power of wages with the artifices of expanding debt and credit-asset bubbles have reached their limits, and rather than solutions they are now the problem–a problem whose only resolution is the destruction of the phantom wealth via bankruptcy, default and writedowns of debt that will never be paid back.

This is not what the wealthy who own the debt want to hear, so their lackeys and apologists spin Fairy Tales about AI, modular nuclear reactors, fusion, and so on, as if the problems were somehow technological rather than the extremes of inequality created by extremes of financial artifice.

Those with the thinnest buffers may well experience the recession as a Depression. In maintaining the illusion of “growth” and “wealth,” we’ve thinned the system’s buffers to the point where any shock will collapse structures that looked solid because maintaining the appearance of stability was the entire point.

This extraordinary exposure to risks and precarity is not new. This report is from 2017: We Tracked Every Dollar 235 U.S. Households Spent for a Year, and Found Widespread Financial Vulnerability.

In many ways, the official response to the fraud-speculation driven Global Financial Meltdown--save the banks and goose “growth” by expanding debt and inflating asset bubbles–generated this massive increase in exposure to risk and precarity.

Those with the thickest buffers–those with zero debt, extremely frugal lifestyles and low fixed costs (i.e. owning a home free and clear in a low-property tax region, etc.) and recession-proof incomes may well wonder what all the fuss is about–they’ll do fine.

Build a fake structure fabricated of artifice, debt and gimmicks, and it should not be a surprise that it comes apart when the wind rises. (Charts below)

Total debt:

Money supply:

Wages share of the economy:

Housing bubble #2:

Net personal wealth:

Financial wealth held by the bottom 50%:

As I have noted, it’s free to prepare a Plan B and a Plan C, with Plan B being a response to the loss of a job or a decline in home valuations, and Plan C being our response to losses from which there is no plausible road to recovery.

Tyler Durden

Mon, 10/13/2025 – 11:20ZeroHedge NewsRead More

R1

R1

T1

T1