India Funds Halt Silver ETF Investment Amid Unprecedented Global Shortage

Amid the unprecedented shortage in the physical silver market (that we detailed here), a number of Indian asset managers have halted all new investments into Silver ETFs.

In India, the world’s biggest silver consumer, silver premium over official domestic prices jumped as much as 10% on Thursday because of strong investment demand ahead of a key festival and limited supplies, bullion dealers said.

Kotak Mutual Fund on Thursday temporarily halted new purchases in a plan linked to its Indian silver exchange-traded fund, citing a domestic shortage that has driven prices above global levels.

“Kotak Silver ETF is an open-ended Exchange Traded Fund replicating/tracking price of Silver, which reflects the domestic price of silver. Therefore, the premium in domestic silver prices directly impacts the valuation of the Scheme,” the company said.

Kotak Silver ETF Fund of Fund invests in units of Kotak Silver ETF, which tracks the local price of the precious metal. The fund had assets of 2.25 billion rupees ($25 million) in August, and has risen over 80% this year.

“Investors are requested to note that in recent weeks, silver has witnessed a sharp surge in demand, driven by global macroeconomic factors and increased investor interest in commodities.

However, the current limited availability of physical silver has constrained the creation of new units by ETFs at the indicative NAV (iNAV).”

Following Kotak’s decision, EconomicTimes.com reports that UTI Mutual Fund and SBI Mutual Fund have also now suspended fresh subscriptions to their Silver ETF Fund of Funds, effective immediately.

Since silver-linked funds must purchase the physical metal to back up new investments, the asset managers chose to pause fresh inflows until supply conditions stabilize.

“Whenever the spot premium aligns with the import parity price, the fund-of-fund will open for subscription,” Chief Executive Nilesh Shah said in a post on X.

Redemptions will continue as before, he said.

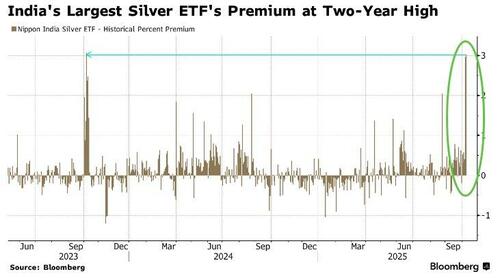

Bloomberg reports that Nippon India Silver ETF has surged 86% this year, pushing its historical premium to net asset value to a two-year high, data compiled by Bloomberg show. The fund has 152 billion rupees in assets.

“This is a global phenomenon, not limited to India, and festive and seasonal demand has provided an additional boost,” said Vikram Dhawan, fund manager and head of commodities at Nippon India.

As we previously detailed, Goldman believes this squeeze will be temporary expecting that within 1-2 weeks we’ll see significant physical inflows from China and the US into LBMA and the curve ultimately eases, but the path will be bumpy, euphemistically speaking.

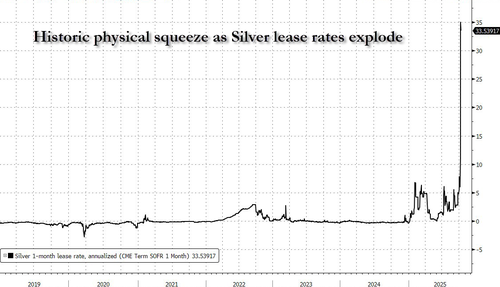

A quick glimpse at the annualized 1 month silver lease rate…

…tells you the unwind of the physical shortage is far from over.

Tyler Durden

Mon, 10/13/2025 – 09:25ZeroHedge NewsRead More

R1

R1

T1

T1