ASML Orders Beat Expectations On AI Boost

ASML Holding NV shares climbed +4% in Europe after the world’s top supplier of photolithography systems for the semiconductor industry reported 5.4 billion euros in new orders for the third quarter, exceeding the Bloomberg Consensus estimate of 4.89 billion euros. Despite lower-than-expected quarterly revenue at 7.52 billion euros, versus the 7.71 billion euros forecast, analysts were pleased with stronger EUV demand and improved 2026 guidance. Shares are up 30.3% on the year, making ASML Europe’s largest company by market cap. This earnings report only suggests that tailwinds from artificial intelligence demand will continue for ASML’s chip-making machines.

ASML Q3 Earnings Snapshot: AI Demand Continues (Bloomberg Consensus):

Headline Results:

Bookings: €5.40 billion (-2.6% q/q) vs. €4.89 billion expected – beat Net

Net sales: €7.52 billion (-2.3% q/q) vs. €7.71 billion expected – slight miss

Operating income: €2.47 billion vs. €2.43 billion expected

Gross margin: 51.6% vs. 51.4% expected – margin beat despite lower sales

Operating margin: 32.8% vs. 31.3% expected

R&D: €1.11 billion vs. €1.2 billion expected

Cash: €5.13 billion (-29% q/q) vs. €5.91 billion expected

Dividend: €1.60 per share

Segment Breakdown

Net system sales: €5.55 billion (-6.3% q/q) vs. €5.66 billion expected

Service & field operations: €1.96 billion vs. €2 billion expected

Unit Shipments (Total 72 systems vs. 98.5 expected)

EUV: 9 systems (vs. 9.3 expected)

ArFi: 38 systems (vs. 31.9 expected) – strong double-patterning demand

ArF Dry: 4 systems (vs. 7 expected)

KrF: 11 systems (-31% q/q vs. 32 expected)

I-Line: 10 systems (-29% q/q vs. 16 expected)

Geographic Mix

- China accounted for 42% of net system sales, up from 27% in Q2 – reflecting front-loaded shipments ahead of tightening U.S. export controls.

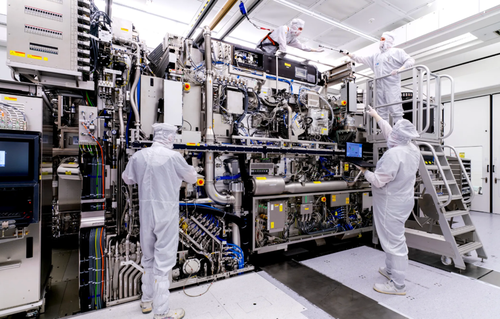

ASML is the only company that manufactures the extreme ultraviolet lithography machines required to produce the most advanced AI chips to power leading chatbots. The ongoing data center buildout, fueled partially by the “circle-jerk” vendor financing loop between OpenAI, Oracle, and Nvidia, along with a flurry of similar partnerships, has unleashed a massive wave of chip orders totaling in the hundreds of billions, if not more…

“We have seen continued positive momentum around investments in AI, and have also seen this extending to more customers,” ASML CEO Christophe Fouquet wrote in a statement, adding that tailwinds will continue favoring its cutting-edge machines, but business in China will be “significantly lower.”

Fouquet noted that 2026 net sales are expected to be on par with 2025 figures. This is a notable shift in guidance after his cautious tone in July, when he declined to confirm growth for next year.

ASML Q4 Forecast: Solid Guidance Above Consensus

Net sales: €9.2–€9.8 billion vs. €9.23 billion expected – in line to above range

Gross margin: 51–53% vs. 50.7% expected – margin beat expected

R&D expenses: ~€1.2 billion vs. €1.25 billion expected – slightly lower spend guidance

Full-Year Outlook:

- ASML maintained its full-year gross margin guidance at around 52%, in line with the 52.3% Bloomberg Consensus estimate, signaling continued profitability despite mixed regional demand.

The outlook is “a bit more enthusiastic” than previous commentary, according to Degroof Petercam analyst Michael Roeg.

“The outlook is still cautious, which must be because they expect sales to China to decrease significantly in 2026,” Roeg told Bloomberg via email, adding, “That must be compensated by higher sales in 2026 to customers in leading-edge logic and memory.”

In markets, ASML shares rose more than 4% in Europe and are up over 30% year to date.

“Semis are also trading well, with the UBS Semi’s basket [UBXESEMI] up 2.1%, driven by ASML (up 3.8%) after they reported solid bookings and as the AI boom is fueling demand for their chip making machines,” UBS analyst Eva Kindt told clients.

Here’s more commentary (courtesy of Bloomberg):

Barclays (equal-weight)

Market would have liked more positivity on 2026, but the fact that the firm is also mentioning China will be less in the mix helps reduce the risk for future estimates somewhat, says analyst Simon Coles

Given ASML is usually conservative when guiding for a year out, “this should be enough”

“We detect a hint of positivity on 2027 suggesting strong EUV growth on top of 2026”

JPMorgan (overweight)

Company didn’t provide full 2026 guidance but indicated that sales aren’t expected to be below FY25, meaning that the current consensus will stand, says analyst Sandeep Deshpande

“With this report, we believe the bearish view of a worse than expected FY26 will be put to rest,” and investors will focus on FY27 outlook on the back of a memory market upturn and investments among leading-edge logic chipmakers

Citi (buy)

The healthy — but not dramatic — 3Q order intake supports the view of revenue likely growing in 2026, particularly at the leading edge, says analyst Andrew Gardiner

“We think ASML’s 3Q results are strong enough to support gradually increasing expectations for 2026” and the growth beyond

Morgan Stanley (overweight)

Bookings were robust with €3.6bn recognized in EUV — around 15 to 16 tools — a number that’s much stronger than expected, says analyst Lee Simpson

42% of 3Q sales came from China versus 27% in 1H, suggesting a possible pull-forward in demand given ASML remarks of a significant drop expected for next year

. . .

Tyler Durden

Wed, 10/15/2025 – 07:20ZeroHedge NewsRead More

R1

R1

T1

T1