Beige Book Finds “Little Change” In Economic Activity, AI Gets Blamed For Weak Labor Market

With econ data indefinitely postponed as a result of what is rapidly shaping up as the longest government shutdown on record, today’s otherwise sleepy Beige Book was sure to get abnormal attention as it was one of the few incremental economic data points in a calendar bereft of actual news. Alas, it proved to be a dud, if only because there was virtually nothing new there: as the report which looked at recent data across the Fed’s 12 district notes, economic activity was little changed on balance since the previous report, with three Districts reporting slight to modest growth in activity, five reporting no change, and four noting a slight softening. The was a continuation of the boring update we got one month ago when the Beige Book again found “little change” in econ activity (although like today, it noted that wages grew while inflation mentions slumped).

The outlook for future economic growth varied by District and sector: sentiment reportedly improved in a few Districts, with some contacts expecting an uptick in demand over the next 6 to 12 months. However, many others continued to expect elevated uncertainty to weigh down activity. One District report highlighted the downside risk to growth from a prolonged government shutdown: that must be whatever district DC is in because the only people in America impacted from the government shutdown are life-long government bureaucrats.

Here is what else today’s report found, starting with overall activity

- Overall consumer spending, particularly on retail goods, inched down in recent weeks, although auto sales were boosted in some Districts by strong demand for electric vehicles ahead of the expiration of a federal tax credit at the end of September.

- Demand for leisure and hospitality services by international travelers fell further over the reporting period, while demand by domestic consumers was largely unchanged.

- Spending by higher-income individuals on luxury travel and accommodation was reportedly strong.

- Several reports highlighted that lower- and middle-income households continued to seek discounts and promotions in the face of rising prices and elevated economic uncertainty.

- Manufacturing activity varied by District, and most reports noted challenging conditions due to higher tariffs and waning overall demand.

- Activity in agriculture, energy, and transportation was generally down among reporting Districts.

- Conditions in the financial services sector and other interest rate-sensitive sectors, such as residential and commercial real estate, were mixed;

- Some reports noted improved business lending in recent weeks due to lower interest rates, while other reports continued to highlight muted activity.

In labor markets, the picture remains one of muted stability and rising wages (thanks to the collapse of labor supply from illegal aliens). One notable change was the discussion of Artificial Intelligence as potentially taking away from labor demand. Oh, just wait: it’s only starting… and it ends with Universal Basic Income. Here are the details:

- Employment levels were largely stable in recent weeks, and demand for labor was generally muted across Districts and sectors.

- In most Districts, more employers reported lowering head counts through layoffs and attrition, with contacts citing weaker demand, elevated economic uncertainty, and, in some cases, increased investment in artificial intelligence technologies.

- Employers that reported hiring generally noted improved labor availability, and some favored hiring temporary and part-time workers over offering full-time employment opportunities.

- Nevertheless, labor supply in the hospitality, agriculture, construction, and manufacturing sectors was reportedly strained in several Districts due to recent changes to immigration policies.

And the logical consequence of slamming shut the pathway for illegals to get jobs: Wages grew across all reporting Districts, generally at a modest to moderate pace. A rare victory for ordinary, working Americans.

Last we look at prices which according to the Beige Book “rose further during the reporting period. Several District reports indicated that input costs increased at a faster pace due to higher import costs and the higher cost of services such as insurance, health care, and technology solutions.” None of those, however, are the result of higher tariffs.

- Tariff-induced input cost increases were reported across many Districts, but the extent of those higher costs passing through to final prices varied.

- Some firms facing tariff-induced cost pressures kept their selling prices largely unchanged to preserve market share and in response to pushback from price-sensitive clients.

- However, there were also reports of firms in manufacturing and retail trades fully passing higher import costs along to their customers.

- Waning demand in some markets reportedly pushed prices down for some materials, such as steel in the Sixth District and lumber in the Twelfth District.

In short, for yet another month, and despite the constant fearmongering of liberal economists, the sky is not falling and in fact the economy continues to grow at a solid pace.

Here is a snapshot of highlights by Fed District:

- Boston: Economic activity expanded slightly, with modest growth in consumer spending. Employment was flat, as both hiring and layoffs increased modestly. Prices increased at a moderate pace, although certain cost pressures intensified. Home sales were flat from a year earlier. The outlook was neutral to cautiously optimistic, but contacts saw mostly downside risks.

- New York: Economic activity continued to decline slightly. Employment held steady, and wage growth remained modest. The pace of price increases remained elevated but was little changed. Manufacturing activity held steady after a summer uptick. Consumer spending increased modestly, buoyed by mid- to upper-income households. Businesses did not expect activity to increase much in the months ahead.

- Philadelphia: Business activity increased slightly in the current Beige Book period. Employment levels increased slightly, and wages again rose at modest pre-pandemic rates. Prices continued to rise moderately. Activity increased slightly for nonmanufacturers and moderately for manufacturers. Generally, firms expect modest growth over the next six months, but heightened economic uncertainty remains.

- Cleveland: Fourth District business activity was flat in recent weeks, but contacts expected activity to increase modestly in months ahead. Commercial construction and financial services contacts noted an uptick in demand because of lower interest rates. Contacts said that cost growth remained robust, while their selling prices increased modestly.

- Richmond: The regional economy grew modestly in recent weeks. Consumer spending continued to grow modestly and import activity rose. Manufacturing activity declined slightly and growth in the remaining industries was largely flat. Employment levels were largely unchanged and wage growth remained moderate. Price growth remained moderate, overall, despite some pickup in price growth in the manufacturing sector.

- Atlanta: The Sixth District economy was unchanged. Employment levels were steady, and wages grew modestly. Prices increased moderately. Consumer spending fell, and leisure travel softened. Home sales declined, and commercial real estate was unchanged. Transportation declined. Manufacturing grew slightly. Energy grew moderately, and agriculture was healthy.

- Chicago: Economic activity in the Seventh District was flat. Consumer spending increased modestly; construction and real estate activity increased slightly; employment was flat; nonbusiness contacts saw no change in activity; business spending declined slightly; and manufacturing activity declined modestly. Prices rose moderately, wages were up modestly, and financial conditions loosened slightly. Prospects for 2025 farm income were unchanged.

- St. Louis: Economic activity and employment levels have remained unchanged since our previous report. Contacts continue to report that immigration policies have been resulting in labor shortages. Prices have increased moderately, with contacts reporting that inflation is eroding consumer purchasing power. Banking activity has remained unchanged since our previous report, with overall credit conditions remaining strong. Agriculture conditions are strained and have further deteriorated. The outlook remains slightly pessimistic.

- Minneapolis: District economic activity contracted slightly. Labor demand softened, according to firms and job seekers, though wage growth remained moderate. Price increases remained modest, but input price pressures increased. Manufacturing and commercial real estate were flat, but most other sectors contracted. Agricultural contacts were concerned about China’s elimination of soybean purchases.

- Kansas City: Economic activity in the Tenth District fell slightly over the past month. Employment levels declined slightly, and bankers noted consumer loan portfolios deteriorated moderately. Though activity fell recently, expectations for sales and employment in 2026 were broadly optimistic. Expectations for the pace of price growth in 2026 were similarly above 2025 levels.

- Dallas: Economic activity was flat. Service sector activity contracted mildly. Retail sales fell, while the pace of manufacturing output growth moderated. Loan demand grew, but the housing market remained weak, and drilling and well completion activity was flat. Employment dipped, and wage growth was modest. Price pressures were subdued in services but remained elevated in the manufacturing sector. Outlooks deteriorated with slowing demand, policy uncertainty, and inflation highlighted as the top concerns for businesses.

- San Francisco: Economic activity edged down slightly. Employment levels were little changed. Wages grew slightly, and prices rose modestly. Activity in retail trade, agriculture, and residential real estate decreased somewhat while commercial real estate activity was unchanged. Manufacturing and lending activity remained stable. Conditions in consumer and business services were mixed.

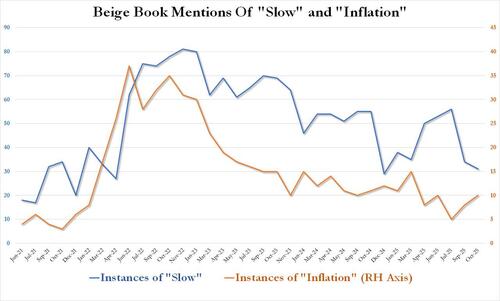

And finally, confirming that contrary to conventional wisdom the economic picture appears to have improved notably since April, the latest Beige Book found that despite media narratives to the contrary, mentions of inflation remained near a 4 year lows, at just 10 in September, and up from the cycle low of 5 in July (effectively before the Biden inflationary explosion period) while mentions of “slow” tumbled from a two year high of 56 in July to just 31, a new 2025 low, indicating that according to the Fed respondents, neither inflation nor an economic slowdown are major concerns

All of which suggests that the US economy – while hardly on fire as it was during the hyperinflationary period of Biden’s admin – continues to chug along and is hardly collapsing as so many Trump foes would like to see; and it certainly is not seeing prices explode higher.

Tyler Durden

Wed, 10/15/2025 – 14:51ZeroHedge NewsRead More

R1

R1

T1

T1