Futures Rise After Strong Earnings Ease Trade War Fears

US equity futures are again higher due a combination of softening trade rhetoric, a dovish Powell who reassured markets that another rate cut was coming, and solid results from BofA and Morgan Stanley. While cooking oil has become the latest flashpoint between the US and China, there are enough positive themes to offset trade-war worries for now. As of 8:15am ET, S&P 500 futures were 0.8% higher with Nasdaq 100 contacts +1.0%. Pre-mkt, Mag7 and Semis are looking to rebound from yesterday’s losses where Equal-weighted indices outperformed Mkt-weighted indices by 90-100bp. Cyclicals are poised to see outperformance with Banks, Industrials (esp. AI plays), and Materials leading the factor higher. In Europe, ASML gave another boost to the AI story after orders for its chip-making machines beat expectations. Bond yields are lower and the USD is weaker. In commodities, crude is up but other Energy products are lower; precious metals are higher with gold rising to a new record high above $4200 while base are lower. Ags are lower ex-coffee. The data drought continues: today’s CPI report has been pushed to Oct 24, so we only get the Empire Manufacturing print at 8:30am. Morgan Stanley and Bank of America are among companies due to report today; the BKX has fallen 7.5% over the last 3 weeks, albeit from ATHs, and now is ~4% below that level.

In premarket trarding, MAg 7 stocks are all higher (Nvidia +2%, Tesla +1.2%, Amazon +0.7%, Meta +0.6%, Alphabet +0.1%, Microsoft +0.1%, Apple +0.5%).

- Bank of America (BAC) rises 4% after third-quarter earnings beat estimates as investment-banking activity increased amid a long-awaited comeback in M&A.

- Bunge Global SA (BG) rises 5% after recasting its outlook.

- Dollar Tree Inc. (DLTR) climbs 6% after the US discount retailer projected earnings per share to gain as much as 10% annually over the next three years.

- Grindr (GRND) gains 5% after the company said its largest shareholders are exploring an acquisition that would take the company private at no less than $15 a share, confirming an earlier media report.

- Papa John’s (PZZA) shares jump 12% as Reuters reports Apollo Global Management submitted a bid within the last week to take the pizza chain operator private at $64 per share.

- Sable Offshore (SOC) falls 26% after the Santa Barbara Superior Court issued a tentative ruling indicating that it will deny the firm’s claims against the Coastal Commission for issuing cease and desist orders during Sable’s repair program on the Las Flores pipeline.

In corporate news, Apple is preparing to expand its manufacturing operations in Vietnam as part of a push into the smart home market and in an effort to lessen dependence on China. Data center developer Nscale agreed to build a site for Microsoft in Texas which will deploy around 104,000 of the latest Nvidia chips. Stellantis vowed to invest $13 billion in the US over the next four years as it seeks to reinvigorate its business in the critical market and mitigate tariff costs.

While the stocks meltup is back, there are mixed signals coming from the derivatives markets, with some pointing to a spike in near-term pricing as a signal froth had been blown out of the market. For others, the inverted VIX curve is a precursor of more pain for stock traders.

Citi’s chief global macro strategist says markets aren’t adequately pricing in risks of the latest round of trade tensions. Meanwhile, systematic investors have been maximum long, but with short-term trend dynamics being tested and volatility spiking, selling exposure is the clear next step. Goldman’s Cullen Morgan expects CTAs to be sellers under every scenario, potentially offloading as much as $232 billion across global stocks should a down market take hold over the next month.

On the monetary policy front, Powell, as well as Boston Fed’s Collins, suggested scope for further cuts this year in commentary on Tuesday. And Evercore founder Roger Altman said he doesn’t see inflation as a threatening factor amid solid economic growth.

Turning to earnings, while it’s still very early in the season, but of the 24 companies in the S&P that have reported so far, 71% have topped estimates. In Europe, ASML gave another boost to the AI story after orders for its chip-making machines beat expectations.

“We’re going into this earnings season with the view that it probably will validate that the corporate sector is still in relatively good shape,” Goldman Sachs Group Inc. strategist Christian Mueller-Glissmann told Bloomberg TV. “There’s a lot of uncertainty on politics and geopolitics, as always, and you want to be careful about making too many shifts in your portfolio.”

Markets will hear from the Fed’s Christopher Waller, Jeff Schmid and Stephen Miran later today after Chair Jerome Powell reiterated concerns about labor-market weakness on Tuesday and signaled the central bank may stop shrinking its balance sheet in the coming months. Strategists warn that trade headlines will remain in focus as Washington and Beijing lay the groundwork for negotiations.

Meanwhile, trade tensions “continue to simmer in the background, of course,” said UniCredit equity strategist Christian Stocker. “But the news that we can now be certain, or almost certain, that the Fed will cut interest rates in October has already had a positive impact.”

In Europe, the Stoxx 600 rose 0.7% as investors welcomed better-than-expected earnings from LVMH and ASML as well as a reduction in French political uncertainty. Consumer products and media shares are leading gains, while healthcare and financial services shares are the biggest laggards. The CAC 40 outperforms its regional peers with a 2.7% gain. Here are the biggest movers Wednesday:

- LVMH shares rise as much as 14%, the most since February 2009, after the luxury group reported an unexpected return to sales growth in the third quarter

- ASML shares rise as much as 3.8% after the chip equipment maker reported the highest bookings for its cutting-edge EUV tools since 4Q23, showing a boost from a rapid increase in AI investments

- TotalEnergies shares rise as much as 3.2%, the most since June, after the French energy company published a trading statement that showed improving refining margins

- Bouygues and Orange jump after the pair — along with Iliad — offered to buy SFR from billionaire Patrick Drahi’s Altice France in a €17 billion deal that would reduce the French telecom market to three operators from four

- Nibe gains as much as 4.8%, the most in two weeks, after Pareto Securities upgraded its view on the Swedish heat-pump company to buy from hold, noting heat pump sales are continuing to grow organically at 8% in 3Q thanks to a recovery in the Nordics and Europe

- Pets at Home shares climb as much as 4.9% while peer CVS Group soars as much as 18% after the UK Competition & Markets Authority outlined its plan to reform the veterinary services market

- Pagegroup shares rise as much as 5.9%, the most since April, after the recruitment company posted a milder drop in gross profit in the third quarter compared to what was seen in the first half

- Aurubis shares slid as much as 7.8%, its biggest drop since April, to €106.70 after shareholder Salzgitter placed €500 million of bonds exchangeable into the copper smelting company’s shares

- Renk Group shares plunge as much as 5.9% after the propulsion and drive-train technology company was downgraded at Citi, with analysts arguing the shares are too expensive following a rally in defense names

- Strabag shares slid as much as 11% to €73.50 in Vienna on Wednesday, after the Haselsteiner family sold 2.5 million shares in the construction company at a discount

- Rathbones Group shares decline as much as 3.7%, the most since May, as outflows continued for the investment management firm in 3Q

Shares of Europe’s chip giant ASML are up 4% in pre-mkt after reporting strong order intake and above consensus 4Q25 guide. ASML’s 3Q25 revenue was below cons but EBIT of c.€2.5bn was 2% ahead. Bookings figure in 3Q was €5.4bn, broadly flat qoq from a strong 2Q25 order intake of €5.5bn and in-line with cons of c.€5.4bn including €3.6bn of EUV orders which came in materially above cons at €2.2bn. ASML highlighted that it does not expect 2026 total net sales to be below 2025 and anticipates 4Q25 stronger than 3Q25 and in line with historical seasonality.

Earlier in the session, a sense of relief rippled through Asian stock markets on Wednesday, after Federal Reserve Chair Jerome Powell’s rate cut signals gave some good news to investors once again confronting the risk of a trade war. A regional gauge of shares gained 2%, rebounding from its three-day slide. South Korea’s Kospi Index was the stand-out performer, jumping 2.7% on buying from local funds. Stocks in mainland China, Hong Kong and Japan also advanced. The reversal in sentiment was largely prompted by Powell’s comments on Tuesday, which reinforced expectations of an interest-rate cut later this month. That gave investors a reason to look past escalating trade tensions between China and the US, after President Donald Trump threatened to halt trade in cooking oil with China in response to the country’s refusal to buy US soybeans. “While the rhetorical tit-for-tat between the US and China remains a main concern for market participants, Powell’s signals on the Fed’s rate cut and end of quantitative tightening are providing a meaningful relief this morning,” said Homin Lee, senior macro strategist at Lombard Odier Singapore. Attention will now turn to the first three-way meeting among Japan’s main opposition parties since the collapse of the ruling coalition. The discussion, taking place after Japan’s market close on Wednesday, will focus on whether the three parties can close policy gaps and pick a candidate of their own for the nation’s premiership.

In FX, the Bloomberg Dollar Spot Index falls 0.3%. The Aussie dollar and Norwegian krone are leading gains against the greenback, rising 0.5% each. Asian currencies bounced back against the dollar following losses this week. The Bloomberg Asia Dollar Spot index rose 0.4%, its best performance in more than a month.

In rates, treasuries climb, pushing US 10-year borrowing costs down 2 bps to 4.01% amid small, curve-flattening gains in early US trading with long-end yields richer by around 2bp on the day. Treasury yields are 1bp-2bp richer across the curve with 2s10s and 5s30s spreads about 1.5bp flatter; Bunds and gilts in the sector are outperforming by 1bp and 3bp. Gilts provide support, outperforming after Bank of England Governor Andrew Bailey flagged a weaker jobs market and heading for their biggest four-day gain since April. Three Fed officials are slated to speak.

In commodities, spot gold rises $50 having notched another record earlier today. Silver is up over 2%.

To the day ahead now, and central bank speakers include the Fed’s Miran, Waller and Schmid, the ECB’s de Guindos, Rehn and Villeroy, and the BoE’s Ramsden and Breeden. We’ll also get the Fed’s Beige Book, and the New York Fed’s Empire State manufacturing survey. Finally, earnings releases include Morgan Stanley and Bank of America.

Market Snapshot

- S&P 500 mini +0.5%

- Nasdaq 100 mini +0.7%

- Russell 2000 mini +0.9%

- Stoxx Europe 600 +0.7%

- DAX +0.2%

- CAC 40 +2.6%

- 10-year Treasury yield -2 basis points at 4.01%

- VIX -1.1 points at 19.71

- Bloomberg Dollar Index -0.2% at 1211.78

- euro +0.2% at $1.163

- WTI crude little changed at $58.68/barrel

Top Overnight News

- A menu of options is starting to emerge around what a compromise might look like for extending a suite of Affordable Care Act tax credits, which have become a focal point in the current government funding standoff. Behind the scenes, however, Republicans on Capitol Hill and inside the Trump administration are discussing potential pathways to prevent the tax credits from expiring at the end of the year. Politico

- The Fed’s Beige Book gains importance as delayed jobs data leaves policymakers relying on other indicators to assess September’s labor market. BBG

- In its trade standoff with Washington, Beijing thinks it has found America’s Achilles’ heel: President Trump’s fixation on the stock market. Xi Jinping is betting that the U.S. economy can’t absorb a prolonged trade conflict with the world’s second-largest economy, according to people close to Beijing’s decision-making. WSJ

- China’s downward price pressures eased slightly in September, but not quite as much as expected, as Beijing ramps up efforts to curb excess capacity and bolster domestic demand. China’s inflation numbers for Aug are largely inline, w/the PPI at -2.3% (vs. the Street -2.3% and vs. -2.9% in Aug) and the CPI at -0.3% (vs. the Street -0.2% and vs. -0.4% in Aug). WSJ

- Japan’s legislature will hold an extraordinary session on Oct 21, although it’s not clear when exactly a vote to elect the next PM will take place. Nikkei

- Japan’s opposition leaders are to meet today to discuss uniting behind Yuichiro Tamaki as a PM candidate to challenge the LDP’s Sanae Takaichi.

- Rachel Reeves has told Sky News she is looking at both tax rises and spending cuts in the budget, in her first interview since being briefed on the scale of the fiscal black hole she faces. Budget is set to be published on Nov 26. Sky News

- The ECB’s Gabriel Makhlouf said he’s more worried that inflation will come in above the 2% target than below it. Interest rates are probably in a “fine position.” BBG

- ASML shares gained (+~415 bps) after orders crushed estimates, fueled by investment in AI infrastructure. It expects sales next year to be not below those of 2025. China was ASML’s biggest market last quarter, accounting for 42% of sales. BBG

Trade/Tariffs

- Chinese Foreign Ministry Spokesperson Lin says the US and China should engage in talks.

- China files complaint to WTO over India’s EV and battery subsidies; vows resolute measures to protect domestic industry, says Indian measures hurt China’s interests.

A more detailed look at overnight markets courtesy of Newsquawk

A regional gauge of shares gained 2%, rebounding from its three-day slide. South Korea’s Kospi Index was the stand-out performer, jumping 2.7% on buying from local funds. Stocks in mainland China, Hong Kong and Japan also advanced. Asian currencies bounced back against the dollar following losses this week. The Bloomberg Asia Dollar Spot index rose 0.4%, its best performance in more than a month.

Top Asian News

- Japan Parliamentary Committee failed to agree on holding an election to choose the next PM on October 21st.

- Japan’s DPP Leader Tamaki suggested another party leader’s meeting on Monday if things can be sorted; still some distance with the CDP. Understood that LDP leader Takaichi is proposing to form coalition with DPP.

- RBA Assistant Governor Hunter said recent data has been a little stronger than expected and inflation is likely to be stronger than forecast in Q3, while she added the labour market and economic conditions might be tighter than assumed. Furthermore, she stated that employment growth has slowed by more than expected and uncertainty about the global outlook remains elevated, as well as noted that the Board will adjust policy as appropriate as new information comes to hand.

- RBNZ Chief Economist Conway said they do not expect to use additional monetary policy (AMP) tools again anytime soon, while he added they will continue to update their approach to remain as prepared as possible to help New Zealand weather whatever economic storms come their way. Conway also announced that the RBNZ reviewed the frequency of its monetary policy decision announcements and acknowledged the perception that the gap between the November MPS and February MPS is too long, while they are to reduce that gap over the 2026/2027 period.

- S&P affirms New Zealand at AA+ foreign currency rating.

- China’s state planner issues action plan for developing EV charging infrastructure; aiming to establish 28mln charging facilities nationwide by end-2027.

- RBI sees rupee under speculative attack and will intervene further, according to Bloomberg.

European equities opened higher, buoyed by strong updates from ASML and LVMH, with the CAC 40 (+2.4%) leading gains after LVMH (+13.4%) beat Q3 revenue forecasts and political stability improved in France. Most European sectors trade in the green, led by Consumer Products & Services (+5.9%) on strong luxury brand performance (LVMH, Kering, Hermes), while Healthcare (-0.3%) lags due to cyclical rotation; Media (+1.7%) and Technology (+1.6%) also firm, with ASML’s results and resilient Chinese demand underpinning sentiment.

Top European News

- UK Chancellor Reeves says she is looking at both tax rises and spending cuts in the budget, via Sky News. When asked if the economy is in a “doom loop”, says, “Nobody wants that cycle to end more than I do”.

- French Socialist Party (PS) Faure says the Zucman tax will be reintroduced.

FX

- After starting the week on the front foot, DXY was knocked lower yesterday by a combination of a pick-up in the EUR, US-China trade tensions and dovish comments from Fed Chair Powell. On the latter, the key takeaway was the ongoing acknowledgement of the softness in the labour market by the Fed Chair. Something which could be aggravated by the ongoing US shutdown and expectations of mass federal layoffs. One potential source will be today’s Fed Beige Book, which will provide anecdotal evidence on the performance of the US economy. ING argues that the Beige Book played a key role in the Fed’s 50bp cut in September 2024. Elsewhere, NY Fed Manufacturing and Cleveland CPI are due on deck, with the latter coming ahead of next week’s delayed BLS release. DXY has delved as low as 98.73 with the next target coming via the 9th October trough at 98.69.

- EUR remains buoyed following Tuesday’s French-induced bounce, which saw EUR/USD reclaim 1.16 to the upside. Markets took solace in the announcement by PM Lecornu to suspend pension reform. Whilst this itself is not seen as economically prudent, the move has been met with a positive response from the Socialists, who will not support any motion to censure the government. Elsewhere, the slew of ECB speak over the past 24 hours has failed to shift the dial for market pricing and that will likely remain the case with Villeroy, de Guindos, Lane & Lagarde due to give remarks. EUR/USD has ventured as high as 1.1644.

- The Yen’s gains vs. the USD have extended into a second session with the former underpinned by a broad haven appeal alongside US-China trade tensions. That being said, the domestic story remains a tricky one with political tensions front and centre. Following the recent collapse of the ruling coalition, opposition parties are scrambling to see if they can present a credible candidate as an alternative to Takaichi. Accordingly, Japan’s Parliamentary Committee failed to agree on holding an election to choose the next PM on October 21st, as proposed by the LDP. Comments from the DPFP leader suggested that there is still some distance with the CDP in talks, but if issues can be resolved, there could be another meeting on October 20th. USD/JPY briefly made its way onto a 150 handle, delving as low as 150.91 before reclaiming 151 status.

- After the Pound’s brief wobble vs. the USD yesterday in the wake of a dovish labour market report, the pound has since stabilised and briefly hit a new high for the week at 1.3373. Yesterday’s jobs report was followed up by remarks from BoE Governor Bailey, who noted that the data support his view of a softening labour market. Additionally, Taylor also stated that he now sees a “bumpy” landing as more likely than a soft landing. Additionally, the November 26th budget is a great source of uncertainty for the MPC. On which, in an interview today, UK Chancellor Reeves says she is looking at both tax rises and spending for next month. The next upside target for Cable comes via the 1.34 mark.

- Antipodeans are both on the front foot vs. the USD, albeit the AUD is slightly outperforming its antipodean peer following a strong Yuan fix by the PBoC and hawkish comments from RBA Assistant Governor Hunter, who said recent data has been a little stronger than expected and inflation is likely to be stronger than forecast in Q3.

Fixed Income

- USTs are marginally firmer (+1 tick at 113-14), extending Tuesday’s gains amid lingering haven demand and cautious sentiment following renewed US-China trade tensions after Trump threatened to end cooking oil business with China; support also comes from dovish Fed commentary, with Powell signalling rising job market risks, nearing the end of balance sheet runoff, and justification for a September rate cut, while today’s focus turns to Fed speakers and the Beige Book.

- Bunds trade higher (+17 ticks at 129.85) within a 129.68–129.95 range, supported by dovish ECB comments from Villeroy suggesting the next move is more likely a cut. A relatively poor 2050/2056 Bund auction sparked little move on price action. Elsewhere, OATs outperform after France’s Socialist Party backed PM Lecornu’s temporary pension reform suspension, tightening the OAT-Bund spread to 78.32 from Tuesday’s peak of 84.50.

- Gilts outperform global peers (+36 ticks at 92.31), holding near highs of 92.39 with potential to retest early-August levels (92.66), supported by reports that Chancellor Reeves may halve the annual tax-free ISA allowance to boost UK equity investment, while broader budget discussions point to potential tax rises and spending cuts ahead of remarks from BoE’s Breeden.

- UK sells GBP 1.5bln 0.125% 2031 I/L Gilt: b/c 3.49x, real yield 0.889%.

- Germany sells EUR 0.757bln vs exp. EUR 1bln 0.0% 2050 and EUR 1.182bln vs exp. EUR 1.5bln 2.90% 2056 Bund.

Commodities

- Crude benchmarks trade rangebound, oscillating in a c. USD 0.50/bbl band. WTI and Brent remain below USD 59/bbl and USD 62.50/bbl, respectively, as markets wait for delayed weekly Private Inventory data following the US holiday on Monday. Elsewhere, Russian Deputy PM Novak said the current oil price reflects the existing balance on the energy market, whilst Russia has the potential to raise oil production.

- Spot XAU has continued its historic rally, breaking beyond USD 4,200/oz, as Fed Chair Powell signals another cut this month. The yellow metal is currently trading at USD 4,218/oz, continuing with a broad consensus that XAU could reach USD 5,000/oz in 2026.

- Base metals remain choppy but paring back most of Tuesday’s losses as the dollar weakens on dovish Powell comments. 3M LME Copper peaked at USD 10.75k/t and is currently trading off its best levels despite a lack of newsflow.

- Russia’s Deputy Prime Minister Novak says the current oil price reflects the existing balance on the energy market. Russia has the potential to raise oil production. No plan for Russia to submit new oil output without a compensation plan to OPEC. Demand for global energy is growing, especially for electric power. Demand for oil is also rising and is on par with 2024.

- Russian Deputy PM Novak says Russian gas accounts for some 19% of European gas imports; Russia is ready for discussions on gas supplies to Europe.

- Russian Deputy PM Novak, regarding US President Trump’s remarks about gasoline shortages in Russia, says Russia has stable domestic market supply.

Geopolitics

- “Israel’s Channel 12: It is being investigated that one of the four bodies of the hostages handed over does not belong to an Israeli hostage”, according to Sky News Arabia.

- “Israeli Security: The Rafah Crossing will not be opened today for logistical reasons”, via Al Arabiya. “Technical checks before opening the Rafah crossing “take time”, Israeli security says.

US Event Calendar

- 7:00 am: Oct 10 MBA Mortgage Applications, prior -4.7%

- 8:30 am: Oct Empire Manufacturing 10.7, est. -1.8, prior -8.7

Central Banks Speakers

- 9:30 am: Fed’s Miran Speaks at Invest in America Forum

- 12:30 pm: Fed’s Miran at Nomura Research Forum

- 1:00 pm: Fed’s Waller Speaks on Artificial Intelligence

- 2:00 pm: Fed Releases Beige Book

- 2:30 pm: Fed’s Schmid Holds Townhall Event

DB’s Jim Reid concludes the overnight wrap

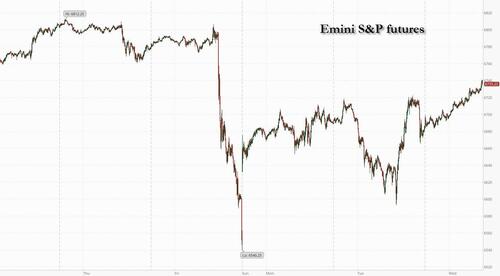

it’s certainly been quite a ride in markets since Friday’s trade escalation with many sentiment shifts in the subsequent 2-3 days. The last 24 hours has been a microcosm of that with the S&P 500 (-0.16%) only slightly lower after rallying hard from lows of around -1.5% just after the open and then bouncing off the highs of around +0.4% a couple of hours before the New York close. The rally back was caused by dovish comments from Fed Chair Powell after Europe went home, but a late social media post from President Trump reignited some fears of US-China escalations. S&P Financials (+1.12%) were among the outperformers after banks kicked off Q3 reporting season, joined by defensives like Consumer Staples (+3.04%).

In his post, President Trump said that he believed China was “purposefully not buying our Soybeans”, and that in response they were “considering terminating business with China having to do with Cooking Oil, and other elements of Trade, as retribution.” In turn, those comments revived Friday’s fears about a fresh escalation in the trade war, and it contrasted with some more emollient remarks from US Trade Representative Greer earlier in the day, who’d expressed confidence that tensions would ease in the coming weeks through ongoing trade talks. So risk assets have whipsawed over the last few sessions in response to the various headlines.

That backdrop meant the trade-exposed indices were the most impacted, especially after the late escalation. For instance, the NASDAQ Golden Dragon China index fell -1.95%, and that’s made up of companies publicly listed in the US who do most of their business in China. It did open over -3% lower though. Similarly, the Philadelphia Semiconductor index (-2.28%) struggled and closed near the lows of the day, given the importance of chips to the trade war. Indeed, it was tech stocks that lagged on a sectoral basis yesterday, with the NASDAQ (-0.76%) seeing a larger decline than the S&P 500 (-0.16%), with the Mag-7 (-1.33%) also lower, whereas small-cap stocks in the Russell 2000 turned round from a -1.74% early loss to a big +1.38% gain.

It was Fed Chair Powell who provided a big offset to the trade fears, as he struck a more dovish tone than expected. The main headline was a surprise discussion around ending the shrinking of its balance sheet in the coming months. While our rates strategists suggest this timeline could be deliberately vague, it puts December on the map in terms of a halt. Indeed, recent history suggests “coming months” with regards to balance sheet changes has resulted in action within 2-3 months. There wasn’t much new on rates and the economy but there was no pushback to a cut later this month and the labour market commentary leant in a dovish direction as well.

The combination of the trade fears and the dovish comments has led to a decent rally for US Treasuries. For instance, the 10yr yield was unchanged yesterday, but overnight it’s fallen -2.1bps to 4.01%, which would be its lowest closing level since early April around the Liberation Day turmoil. Another factor that’s helped to keep a lid on yields has been a fresh drop in oil prices. So Brent crude oil prices (-1.47%) fell to a five-month low of $62.39/bbl, and overnight they’ve seen a further drop to $62.12/bbl. So even as the tariff threats have escalated again, investor concerns about inflation have come down, with the US 5yr inflation swap (-2.1bps) closing at a 3-month low yesterday of 2.54%. Nevertheless, the ongoing decline in nominal and real yields has continued to push up gold prices (+0.79%), which hit a fresh record yesterday of $4,143/oz, and overnight they’re up another +0.91% to $4,180/oz.

Otherwise, we’re now on day 15 of the government shutdown, which means we’re very close to overtaking the third longest shutdown in 2013, which lasted for 16 days. Moreover, a record 35-day shutdown certainly doesn’t look implausible anymore. There are still no signs of compromise either, and the Office of Management and Budget posted yesterday that they were “making every preparation to batten down the hatches and ride out the Democrats’ intransigence”. So the rhetoric doesn’t sound at all like either side is preparing for a deal. If it weren’t for the shutdown, we’d have been writing about today’s CPI print for September, but that’s been delayed as well, so we’re flying blind on a growing amount of economic data right now. That said, this CPI print is one of the few things that will come out even if the shutdown continues, as it’s used in the social security calculations, so it’s currently scheduled for October 24.

Back in Europe, there was a big rally for French OATs as investor hopes grew for some sort of budget compromise. The main catalyst was that PM Lecornu proposed suspending the 2023 pension reform until after the presidential election, meaning no increase in the retirement age between now and January 2028. The Socialist Party have now said they won’t vote to topple the government. The proposed 2026 draft budget would aim for a 4.7% deficit of GDP, which is broadly in-line with the previous outlook, and without the pension reform puts the trajectory of deficit/GDP closer to 5.0% over time. So even though that might read negatively from a debt sustainability point of view, markets were reassured because it was seen as raising the chances that Lecornu would remain as PM and a snap legislative election would be avoided. Polymarket now have the probability of an election being called by year-end at 36%, down from 72% on Monday afternoon. So that meant French assets outperformed, with 10yr yields down -7.4bps, which brought the Franco-German 10yr spread down to a four-week low of 78.3bps. Moreover, the CAC 40 (-0.18%) outperformed the Europe-wide STOXX 600 (-0.37%), with a strong performance for French banks including Société Générale (+2.42%), Crédit Agricole (+0.67%), and BNP Paribas (+0.41%).

Meanwhile in the UK, gilts were another outperformer after the UK labour market data was weaker than expected, which in turn led investors to price in more rate cuts from the BoE. Specifically, the unemployment rate ticked up to 4.8% in the three months to August (vs. 4.7% expected), whilst private sector regular earnings growth fell to +4.4% (vs. +4.5% expected) at the same time, the weakest since December 2021. So that meant more rate cuts were priced in, with the amount expected by the June 2026 meeting up +5.9bps on the day. In turn, gilt yields fell across the curve, with the 10yr yield down -6.8bps, whilst sterling weakened -0.10% against the US Dollar. The weaker pound also supported the FTSE 100 (+0.10%), which was a relative outperformer on a day that most of the major global equity indices lost ground.

Otherwise in Europe, markets put in a weaker performance, with the DAX (-0.62%) posting a stronger decline, even if they closed before Powell’s speech. That came as the latest ZEW survey for October was underwhelming, with the current situation component falling to a five-month low of -80.0 (vs. -74.2 expected). Indeed, sovereign bonds rallied across the continent, in line with the broader risk-off tone, with yields on 10yr bunds (-2.6bps) and BTPs (-4.1bps) both falling back.

In Asia, most equity markets are recovering this morning, as the effect of Fed Chair Powell’s dovish remarks has offered support. Plus they’d already reacted to some of the more negative trade headlines yesterday, so they’re now catching up with some of the more positive comments we’ve had since, unlike the S&P 500 which was reacting to both. So that’s seen gains across the region, with the Nikkei (+1.35%) rebounding, the KOSPI (+1.93%) at a record high, and the Hang Seng (+1.21%) increasing after a run of 7 consecutive declines. And looking forward, US and European equity futures are also pointing higher, with those on the S&P 500 (+0.24%) and the DAX (+0.32%) both rising. However, stocks in mainland China have been weaker, with the Shanghai Comp (+0.10%) and the CSI 300 (-0.03%) both seeing little change. That follows data this morning showing that Chinese CPI was weaker than expected, with a -0.3% decline in prices in September compared with the previous year (vs. -0.2% expected). Meanwhile, PPI inflation was at -2.3%, in line with expectations, marking a 36th consecutive month in deflationary territory.

To the day ahead now, and central bank speakers include the Fed’s Miran, Waller and Schmid, the ECB’s de Guindos, Rehn and Villeroy, and the BoE’s Ramsden and Breeden. We’ll also get the Fed’s Beige Book, and the New York Fed’s Empire State manufacturing survey. Finally, earnings releases include Morgan Stanley and Bank of America.

Tyler Durden

Wed, 10/15/2025 – 08:51ZeroHedge NewsRead More

R1

R1

T1

T1