In An Extremely Fragile Market, How To Gain An Edge When Volatility Spikes

Friday’s sharp selloff dropped the S&P 500 more than 2.7% as we experienced one of the largest single-day declines of the quarter, as headlines spooked traders.

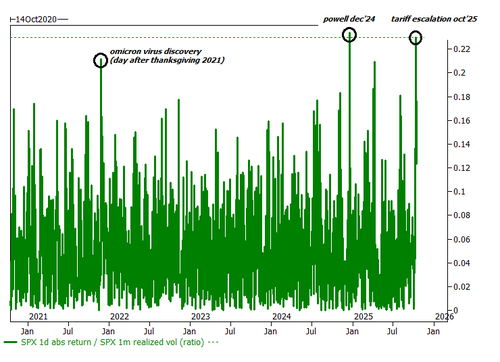

What made the drop especially remarkable is that it took place in an extremely complacent context, with realized vol at the lowest level in years.

So, traders are asking, what’s next?

The next major move can come this Friday with the October Options Expiration: See if the Market May Flip

OPEX occurs on the third Friday of every month, when monthly options contracts expire for both major indices, ETFs, and single stocks. This expiration date acts as a “reset date” for markets, often causing volatility to spike or collapse.

And whether you know it or not: you are trading volatility, and you need to see how volatility shifts can drastically affect your PnL.

In conjunction with our partners at SpotGamma, we are offering free access to webinar on Wed, October 15th at 1pm ET, where SpotGamma Founder, Brent Kochuba, will unpack what’s happening in the options market and how it can drive your PnL.

Free Webinar: Limited Seats Available

How to Track Volatility: The Hidden Force Behind Options Pricing

Whether we expect more chaos or calmer markets, options pricing can change dramatically based on trader sentiment — and these shifts don’t happen in plain view. You need a tool that will track IV for you and show you how your PnL changes as news rocks the markets.

SpotGamma’s new Options Calculator lets you model new positions, track shifting volatility, and improve your trade setups for any environment featuring real-time pricing.

This new tool goes beyond what’s happening now — if you want to model a calmer period with reduced volatility, you can visualize how your PnL would shift:

In this example, the yellow line in the image above represents the previous PnL, while the green and red section shows what the return profile looks like in a calmer market.

Using the SpotGamma Options Calculator, you can see how setups like this put fly might appeal to traders betting that Friday’s panic fades and that volatility mean-reverts.

The Takeaway: Hidden Forces Impact Every Trade

Last Friday’s move reminded every options trader of one truth: If you are trading options, you are trading volatility. OPEX establishes a date each month to watch, so you can capitalize on shifts in volatility as options contracts expire and positioning resets.

That’s exactly what readers will explore during the OPEX webinar, a live session unveiling how you can use SpotGamma’s new options calculator to measure the impact of volatility on your trades. Sign up now and you’ll also get first access to five new SpotGamma tools built to help you discover the impact of the options market on your trades.

Tyler Durden

Wed, 10/15/2025 – 09:35ZeroHedge NewsRead More

R1

R1

T1

T1