Jamie Dimon Says Gold Can “Easily Go To $5,000 Or $10,000”

Fresh from reporting a solid set of numbers for the third quarter, JPMorgan CEO Jamie Dimon said he sees “some logic” in owning gold, while declining to say whether he thinks the precious metal is overvalued after its record run-up (perhaps smart, considering his catastrophic attempts to assign value to bitcoin over the past decade).

“I’m not a gold buyer — it costs 4% to own it,” Dimon said Tuesday at Fortune’s Most Powerful Women conference in Washington, referring to storage costs for billionaires who have to store several hundreds gold bars worth billions, and clearly not referring to 99% of actual gold buyers who own a little gold at home and which costs them 0% to own it.

That said, Dimon admitted that gold “could easily go to $5,000, $10,000 in environments like this. This is one of the few times in my life it’s semi-rational to have some in your portfolio.”

Gold, which traded below $2,000 just two years ago, has outpaced gains in equities so far this year, this decade, and this century, reflecting investor demand for safe-haven assets amid inflation concerns and geopolitical unrest, after ignoring precisely the same arguments presented by “tinfoil hat” conspiracy blows such as this one. It continued its torrid advance on Tuesday, climbing to a record $4,184 an ounce, extending its gain this year to almost 60%.

“Asset prices are kind of high,” Dimon said, and “in the back of my mind, that cuts across almost everything at this point.”

Last week, billionaire Citadel founder Ken Griffin said investors were starting to view gold as safer than the dollar, calling the development “really concerning.” Like Dimon, Griffin is also very late to a party we first pointed out about 2 years ago when we showed that after the Ukraine war and the Biden admin’s idiotic decision to weaponize gold against Russia and, in parts, China, the flood of central bank buying was the primary driver of the relentless meltup in gold, a meltup that shows no signs of slowing.

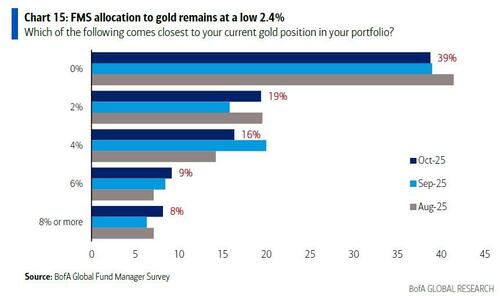

Amazingly, both Dimon and Griffin are very wrong in believing that capital is flowing from risk assets to gold. To get a sense of just how underowned gold is, read the latest BofA Fund Manager’s Survey to find that the allocation among Wall Street professionals to gold is a paltry 2.4%.

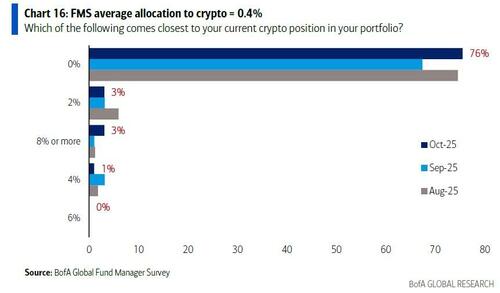

Which however is a huge amount considering the allocation to crypto is less than one-fifth that, or 0.4%.

Said otherwise, when the money really starts moving out of fiat and into gold and crypto, trust us: you will see a move in the price which makes the current spike looks like a quiet picnic.

Tyler Durden

Wed, 10/15/2025 – 07:45ZeroHedge NewsRead More

R1

R1

T1

T1