13 Reasons Why Gold Has Outperformed Stocks Since 2000

Authored by Timothy Nash, Anthony Storer, Jim Hop, & Tom Rastin via RealClearMarkets.com,

The recent increase in gold prices in the United States and around the world has been driven by a confluence of economic, financial, and political factors.

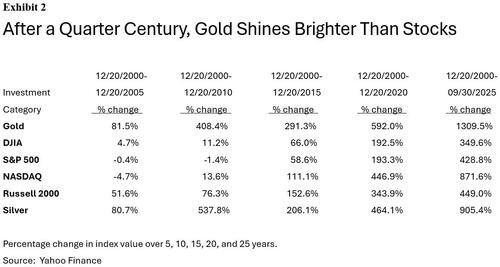

This environment, where gold has outperformed U.S. GDP and the four major U.S. stock markets, began in 2000 and has continued to date (see Exhibits 1, 2, 3).

We outline 13 reasons why gold has outperformed most major investments and why it is likely to continue attracting individual and institutional investors.

- A haven during uncertain times.

Throughout history, people — from merchants to royalty — have held gold as a hedge against inflation, economic uncertainty, and war. Having gold in your pocket allowed you to overcome political difficulties, especially when paper currencies collapsed.

- Geopolitical disagreements.

Recent geopolitical uncertainty has been a major catalyst in the rise of global gold prices. Instability in the Middle East, conflict in Ukraine, and the collapse of Hong Kong as a free state under the Sino-British Agreement have been constant sources of concern, driving up the price of gold.

- The Federal Reserve.

For more than half a century now, the price of gold has increased in part as a hedge against inflation and poor U.S. monetary policy. The U.S. dollar purchases 16.78% of what it did 50 years ago, according to the Bureau of Labor Statistics Inflation Calculator. Its purchasing power would be more than 100% if the dollar was still backed by gold.

- Inflation and the U. S. Dollar.

For most of our history, the U.S. dollar was backed by gold and/or silver. In the early 1900’s, it was believed 100 one-ounce gold coins should purchase an average-priced home. In 1980, gold averaged roughly $615 an ounce, while the median home price in the United States was roughly $64,600. According to the Federal Reserve Bank of St. Louis, the median home price is $422,600, while gold traded at almost $4,203 an ounce on October 15th, according to Yahoo Finance. In 1980, it took roughly 100 ounces of gold to buy a new home; the same is true today. Clearly, investment in gold has preserved and increased wealth. The same cannot be said about the U.S. dollar.

- Central Banks.

Many Central Banks and governments are purchasing gold as a hedge against inflation and growing concern over the value of the U.S. dollar. Consider the U.S. national debt, for instance, which has grown from just under $6 trillion in 2000 to almost $38 trillion today.

- The national debt and its global emulation.

The U.S. national debt is more than $37.85 trillion and is 124.86% of GDP, dramatically higher than the 34.68% in 1980. That is equivalent to $110,176 per citizen or $326,500 per taxpayer. Notably, irresponsible government spending is not exclusive to the U. S., with many countries, such as Japan and China, having larger deficits per capita.

- U.S. Political instability.

The annual U.S. federal budget deficit is running at roughly $1.9 trillion, with little chance of reduction given the lack of political cooperation. To reverse the trend of budget deficits, American voters must vote for both economic growth and financial stability.

- The global public policy divide.

Conflicts over public policy, in areas such as trade and tax policy, food production regulation, and electric vehicle production have sparked much disagreement, helping to drive gold prices higher.

- Philosophy and economic growth.

In recent decades, the United States and other countries whose economic wealth is largely based on free-market capitalism and the rule of law have experienced increased regulation, decreased entrepreneurship, and fewer profit opportunities. This has been negatively influencing economic growth and structures in the United States and the West, leading to increased investment in gold.

- The stock market and U.S. GDP.

Gold has outperformed the four major U.S. stock indices from 2000 to the end of September 2025. It has also outperformed silver and U.S. GDP in terms of economic growth and has dramatically outpaced inflation, proving once again that gold as a safe-haven investment continues to stand the test of time.

- The true intention of BRICS.

Brazil, Russia, India, China, South Africa, and a growing number of smaller, less-friendly other countries have purchased large quantities of gold, aiming to replace the U.S. dollar’s status as the world reserve currency. If the dollar is replaced, it will make international transactions more costly for U.S. producers and consumers, while rendering U. S. foreign policy less effective.

- Technological advancements and the AI boom.

Gold use in technology increased from 2000 to peak usage in 2010. Moreover, as AI technology and power stations have advanced, demand for gold has recently surged again due to its superior conductivity and corrosion resistance.

- The supply of Gold continues to be outpaced by demand.

The global demand for gold in 2024 and so far in 2025 has reached new record highs, while new supply from sources has been unable to keep pace. This seems to indicate that unless one or more of the above factors are mitigated, the price of gold in the years to come will increase.

Conclusion

On October 9th, the price of gold closed at just above $3,946 an ounce, down almost $100 for the day and the stock markets rose after the announcement of a settlement between Gaza and Israel. However, the next day, major stock markets dropped by more than 800 points as China announced restrictive policies on rare-earth mineral sales to the United States, driving gold again above $4,000 an ounce.

The only way to bring gold prices down is to adopt rational political and economic policies that enhance economic and political freedom across the United States and around the world. Policies that will provide an opportunity for ALL citizens to live in a freer, more competitive and prosperous United States and world, where freedom and hard work dictate success, not politicians and regulations.

Tyler Durden

Thu, 10/16/2025 – 13:35ZeroHedge NewsRead More

R1

R1

T1

T1