Futures Rise As Strong TSMC Results Reboot AI Optimism

Stock futures rose as an olive branch from Treasury Secretary Bessent calmed trade-war fears, while a guidance hike from chipmaker TSMC (which saw profit rise 39%) rejuvenated the AI narrative. Mood was boosted as earnings beats continue to roll in and some traders are ramping up bets for a half-point Fed rate cut by year-end. As of 8:00am ET, S&P futures are up 0.4%, with support from technology sector earnings, driving slight outperformance by Nasdaq 100 futures which are up 0.6%. Pre-market Mag7 names are all higher with Semis seeing a bid (AVGO +1.6%, NVDA +1.2%) with Cyclicals and Defensives indicated higher but Cyclicals outperforming. Europe’s Stoxx 600 also rose, with Nestlé SA jumping more than 8% after reporting a rebound in sales and unveiling plans to cut 16,000 jobs. Bessent floated a longer-term US / China truce with the current agreement set to expire on Nov 10; the rare earth restrictions are receiving pushback from G7. Bond yields are flat to down 1bp and the USD is indicated lower for the third consecutive day. Commodities are mixed with Energy leading, Metals lagging, and Ags mixed. Today we get the October Philadelphia Fed business outlook (8:30am) and October NAHB housing market index (10am); Fed speaker slate includes Waller, Barr and Miran (9am), Bowman (10am), Miran (4:15pm) and Kashkari (6pm).

In premarket trading, Mag 7 stocks are all higher (Tesla +0.2%, Nvidia +1.2%, Alphabet +1%, Apple +0.3%, Microsoft +0.4%, Amazon +0.3%, Meta +0.4%)

- Hewlett Packard Enterprise Co. (HPE) falls 9% after the computer hardware and storage company issued a full-year forecast for profit and cash flow that fell short of analysts’ estimates.

- Jack in the Box Inc. (JACK) rises 2% after entering into an agreement to sell Del Taco Holdings Inc. to Yadav Enterprises Inc. for $115 million in cash, subject to certain adjustments.

- JB Hunt (JBHT) gains 12% after the transportation and logistics company reported third-quarter earnings that beat the average analyst estimate helped by better cost control measures.

- Praxis Precision Medicines (PRAX) soars 54% as two studies in its Phase 3 Essential3 program of ulixacaltamide in essential tremor met their primary endpoints.

- Salesforce (CRM) rises 5.5% after the software company forecast that revenue growth will accelerate to double digits in the coming years.

- Sea Ltd. ADRs (SE) rises 4% after an upgrade from BofA Global Research to buy from neutral, with the analyst noting that there is “strong momentum” across businesses.

- Taiwan Semiconductor Manufacturing Co. (TSM) rises 2% after it hiked its projection for 2025 revenue growth for the second time this year, reinforcing hopes in the longevity of a global boom in AI spending.

- Travelers (TRV) falls 4% after the insurance company reported net premiums written that came in below the average analyst estimates.

- United Airlines (UAL) slips about 1% as analysts at Bloomberg Intelligence note that the airline’s results show signs of saturation, even for its premium seats.

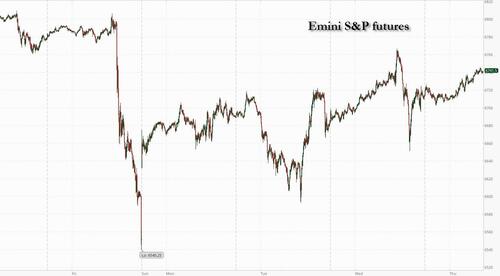

Futures resumed their meltup after Taiwan Semiconductor Manufacturing Co. hiked its revenue-growth target and raised its forecast for capital spending. TSMC’s results reinforced hopes on the AI megatrend, after the chipmaker increased its revenue outlook for the second time this year, and underscored how leading chipmakers stand to be among the biggest winners from an AI investment boom that’s expected to top $1 trillion in the coming years. The market’s response showed investors remain optimistic about the corporate outlook, even as renewed trade tensions cast a shadow.

“We’re seeing that companies continue to spend, AI technology has been adopted and keeps being adopted,” said Anthi Tsouvali, a multi-asset strategist at UBS Global Wealth Management. “Equities should continue to move upwards. But having said that, I don’t think that it’s going to be a straight line.”

After several months of relative calm, friction between Washington and Beijing has flared up again, with stocks seeing sharp swings as dip buyers step in following selloffs. The latest development saw Treasury Secretary Scott Bessent float the possibility of extending a pause on import duties if China halts its planned controls on rare earths.

Despite the tensions, corporate earnings have reminded investors that the fundamentals for stocks remain strong at a time when the Fed is cutting rates. Among S&P 500 companies that have reported earnings through Wednesday, 78% have beaten estimates, according to Bloomberg Intelligence.

Investors are getting so used to “political ups and downs, that they are now realizing that unless they hurt the earnings of companies, which are the real drivers of risk markets, then they really cannot affect equity markets,” Fabiana Fedeli, chief investment officer for equities, multi-asset and sustainability at M&G Investments, told Bloomberg TV.

The debasement trade continued with gold soared as high as $4,247 an ounce, taking gains this year to more than 60% as trade frictions and expectations for further Federal Reserve interest-rate cuts lured buyers. The dollar slipped for a third day and Treasuries were little changed. French bonds underperformed European peers as premier Sebastien Lecornu survived two no-confidence votes.

Europe’s Stoxx 600 index also rose, with food beverage and automobile shares leading gains, while travel and insurance stocks lagged; Swiss equities outperformed thanks to a jump for food giant Nestle which soared more than 8% after reporting a rebound in sales and unveiling plans to cut 16,000 jobs. Here are the biggest movers Thursday:

- Nestlé shares surged as much 8.2% after the foodmaker posted a stronger-than-expected increase in quarterly sales and announced plans to slash 16,000 jobs, just weeks after replacing its chief executive officer

- Nordea Bank shares rose as much as 4.1% in Helsinki, reaching a record high, after the lender reported earnings that analysts said were solid, highlighting a beat for net interest income

- CCC fell as much a 9.4%, the most in two weeks, after Ningi Research issued a short report suggesting the Polish footwear retailer’s turnaround is a falsely engineered “illusion”

- Whitbread shares slid as much as 10%, the steepest drop since May 2020, after first-half results. Analysts pointed to higher-than-expected UK cost inflation and a cut in profit guidance for the Premier Inn owner’s German business

Asian stocks advanced, led by South Korea, as investors bet on improved prospects for a tariff deal with the US.

The MSCI Asia Pacific Index rose as much as 1.1%, poised for its biggest two-day gain since April. Korean chipmakers including Samsung and SK Hynix were among the biggest contributors to the gain. TSMC also jumped before the company announced third-quarter earnings that beat analyst estimates. Key equity gauges traded higher in Taiwan and Japan while those in Hong Kong shares fell as investors turned cautious on the tech sector’s outlook. Korea’s Kospi surged 2.5% to a fresh record as hopes for a trade pact drove exporters higher. US Treasury Secretary Scott Bessent expects some outcome from negotiations “in the next 10 days,” according to Yonhap News. Meanwhile, executives from Samsung, Hyundai and other Korean firms may meet with President Donald Trump later this week, according to Korea Economic Daily. For the broader region, while the return of US-China trade tensions threatens to derail the breakneck stock rally since April, many investors are still betting that Trump will eventually back down from his tariff threats. In other specific markets, Japanese stocks rose amid eased political uncertainty over next week’s parliamentary vote to decide the prime minister. Australian stocks climbed to a record after unemployment jumped more than expected, strengthening the case for a rate cut.

In FX, dollar-yen rises as Japanese parties hash out policy talks toward possible coalition agreements. French politicians are debating ahead of no-confidence motions, which Prime Minister Sebastien Lecornu is expected to survive.

In rates, treasuries are slightly richer across a flatter yield curve, with 5s30s spread edging back toward 100bp with bunds and gilts seening similarly steady price action during London morning. Long-end yields are richer by about 1bp, with curve spreads broadly flatter by less than 1bp, 10-year is near 4.02%. Minimal moves in European bond markets, slight outperformance in gilts at the short-end after the UK’s economy ekes out modest growth. Focal points of US session include several Fed speakers and potential for more corporate bond offerings by big banks.

In commodities, gold touches another record high, now up $40 to $4,240/oz. Oil choppy but higher, with Brent trading above $62.

Looking at today’s US economic calendar we get the October Philadelphia Fed business outlook (8:30am) and October NAHB housing market index (10am); October retail sales and PPI reports and weekly jobless claims data will be delayed due to government shutdown. Fed speaker slate includes Waller, Barr and Miran (9am), Bowman (10am), Miran (4:15pm) and Kashkari (6pm).

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.4%

- Russell 2000 mini +0.2%

- Stoxx Europe 600 +0.4%

- DAX little changed

- CAC 40 +0.4%

- 10-year Treasury yield little changed at 4.03%

- VIX -0.3 points at 20.31

- Bloomberg Dollar Index little changed at 1209.79

- euro little changed at $1.1654

- WTI crude +0.4% at $58.53/barrel

Top Overnight News

- Bessent said the US investment boom is sustainable and just getting started, while he stated there is pent-up demand and America is open for business, according to CNBC. Bessent said the only thing slowing the US and President Trump down is the government shutdown, and he has seen numbers that the shutdown is hurting the economy by up to USD 15bln a day.

- US Treasury official said the government shutdown could cost the US economy USD 15bln per week, correcting Treasury Secretary Bessent’s recent comments that estimated USD 15bln of costs per day.

- US bipartisan group of senators reportedly discussing several different potential off-ramps involving the enhanced Obamacare subsidies, discussing the possibility of two side-by-side votes intended to end the shutdown: Punchbowl.

- US Senate is set to leave for the week on Thursday and is nowhere near ending the shutdown: Politico

- Supreme Court on Wed sounded like it will rule against large chunks of the Voting Rights Act, potentially opening the door to a ~12 seat GOP boost in the House depending on how districts are redrawn. NYT

- Hamas said it’s handed over all the bodies of hostages that it can find without special machinery in the devastated Gaza Strip, but Israel countered it’s not trying hard enough and owes at least another dozen under the ceasefire terms. BBG

- China’s new rare-earth export curbs prompted a backlash from G-7 finance chiefs, with Scott Bessent signaling an emerging united front. Germany and Japan also said a joint response is being considered. BBG

- China Thurs morning clarified that its recent rare earth restrictions don’t amount to an outright ban and that exports will continue. “As long as the rare earths are used for civil purposes, [the exports] will be approved,” a spokeswoman for the commerce ministry said at a press briefing on Thursday. Newsweek

- TSMC posted a better-than-anticipated 39% jump in profit, the latest sign of robust AI spending. It also lifted its 2025 revenue growth outlook and said conviction in the AI megatrend is “strengthening.” BBG

- India will no longer purchase Russian oil, according to President Donald Trump, a major victory in his effort to pressure Vladimir Putin to end the war in Ukraine. Politico

- Defense Secretary Pete Hegseth on Wednesday warned the U.S. will “impose costs on Russia” if it does not seek to end the Ukraine war, his strongest criticism yet of Moscow and a signal of the administration’s increasing support for Kyiv. Politico

- Big investors are cutting back their exposure to riskier corporate debt, in a bet that a huge rally in recent years has left the market vulnerable to a sell-off if the global economy falters. FT

- President Donald Trump said he might go to the Supreme Court to personally watch oral arguments on whether the bulk of his tariffs pass legal muster. The Supreme Court will hear arguments Nov. 5 over whether import taxes imposed by Trump are legal, with Trump saying the tariffs are authorized under the 1977 International Emergency Economic Powers Act. BBG

- Seasonal job searches jumped 27% from last year and 50% from 2023, far outpacing postings and signaling a cooling US job market, according to Indeed. Retailers plan the fewest holiday hires since 2009. BBG

- BofA total card spending (w/e 11th Oct) +3.7% Y/Y (prev. 2.2%); surge driven either by higher prices during Amazon’s Prime Day amid tariffs, or strong demand.

Trade/Tariffs

- US President Trump said they are in a trade war with China, and if the US don’t have tariffs, they don’t have national security, while he stated that tariffs are a very important tool for defence.

- US President Trump claimed that South Korea signed a deal to make an “upfront” payment of USD 350bln to invest in the US, while it was also reported that Treasury Secretary Bessent said that South Korea and the US can resolve their differences over how to implement Seoul’s USD 350bln investment pledge, and that he expects “something” to come “in the next 10 days”, according to Yonhap.

- South Korean Presidential Policy Chief noted optimism when asked about tariff talks with the US, while South Korea’s Finance Minister said the US may accept South Korea’s proposal in tariff talks, according to Yonhap

- Mexican Economy Minister Ebrard said Mexico is in talks with the US to discount tariffs on heavy truck parts.

- Federal officials said they have found no evidence of widespread undervaluing of imported appliances after Whirlpool (WHR) last month accused its rivals of possible tariff evasion, according to WSJ.

- Russian Deputy PM Novak responds to US President Trump’s remarks on India: says Russia continues to collaborate with partners, and Novak is confident partners will continue to work with them.

- China’s Commerce Ministry said it took a constructive stance during recent US-China trade talks. Says rare earth export controls are different to an export ban. All licence applications for civilian use will be approved.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks took impetus from the positive handover from Wall Street, where most major indices ultimately gained despite a choppy performance as US-China frictions remained in focus. ASX 200 printed a record high with most sectors in the green amid a softer yield environment, which was facilitated by a rise in unemployment. Nikkei 225 climbed higher and was unfazed by disappointing Machinery Orders and comments from BoJ hawk Tamura. Hang Seng and Shanghai Comp lagged behind regional peers amid US-China frictions, and with the Hong Kong benchmark

underperforming amid weakness in Chinese tech stocks, while it was also reported that the FCC is to expel Hong Kong Telecom from US networks.

Top Asian News

- BoJ, PBoC and BoK governors held a tripartite meeting on October 15th in Washington, which BoJ Governor Ueda chaired, while they exchanged views on recent economic and financial developments.

- BoJ’s Tamura said the BoJ should push rates closer towards levels deemed neutral and the growth rate of Japan’s economy is likely to rise, with overseas economies returning to a moderate growth path. Tamura said don’t need to raise rates sharply or tighten monetary policy now, given both upside and downside risks, but stated that there is a strong possibility that the slowdown in overseas economies will not be as significant as initially expected. Furthermore, he said given upside price risks, the BoJ should push up rates closer toward neutral to avoid being forced to hike rates sharply in the future. BoJ’s Tamura declined to comment when asked whether to propose a rate hike at the October meeting, while he stated he believes it is necessary to adjust the degree of monetary easing to make rate closer to neutral rate. He added a weak JPY could accelerate upward price pressures.

- RBA Assistant Governor Kent noted signs that financial conditions are less restrictive after past rate cuts and said the cash rate is within the range of neutral estimates, but the range is very wide and uncertain, while he added that neutral rates are not a suitable guide to the near-term path of monetary policy.

- Japan’s Innovations Party, Fujita says another round of discussion with the LDP will take place this Friday . Both parties have found a lot of common ground. Not certain that a deal will be ultimately reached

European bourses (STOXX 600 +0.2%) opened broadly modestly firmer, and have traded sideways throughout the morning. A brief slip seen in the earlier part of the morning, with no clear driver. Thereafter, indices picked up off worst levels amidst constructive trade-related commentary from the Chinese Commerce Ministry; it noted that “All licence applications for civilian use will be approved”. European sectors are mixed . Consumer Staples has been boosted by post-earning strength after it reported decent Q3 metrics and announced job cuts. Elsewhere, Consumer Discretionary has been hampered by some downside in Luxury names; LVMH and Kering both received downgrades, with downside also likely some profit-taking after Wednesday’s considerable upside.

Top European News

- French PM Lecornu suvives 1st round of no confidence motion; with 271 lawnmakers voting against the government (vs 289 thresold to oust government).

- IFS writes that Chancellor Reeves would need to raise the fiscal buffer to around GBP 50bln vs the GBP 9.9bln she had in March, in order to have a better than 50-50 chance of avoiding additional tax increases and/or spending cuts, according to Bloomberg.

- UK Chancellor Reeves is to launch an initiative next week with 20 of the UKʼs largest pension funds, which will try to make it more seamless for pension funds to back British infrastructure and growth projects, according to FT.

- ECB’s Dolenc says rates should hold steady unless new shock hits, inflation risks are balanced, growth on a solid path.

- Swiss Government forecasts: Higher US tariffs have further clouded the outlook for the Swiss economy; forecast reflects expectations of a weak second half of 2025 and is based on the assumption that international tariffs will remain at current levels.

FX

- DXY is a touch lower with the USD overall showing a mixed performance vs. peers. The US macro narrative remains fixated on the recent escalation of trade tensions between the US and China with the latest salvo from Trump being that, if the US doesn’t have tariffs, they don’t have national security. For now, the focus for the market is whether this is merely a negotiating tactic by Trump or a genuine intention to squeeze the Chinese economy. The US government remains shutdown and as such, tier 1 data points are lacking. For today’s agenda, the Philly Fed Business Index is due following yesterday’s solid NY Fed Manufacturing print. Elsewhere, the speaker slate includes Fedʼs Waller, Barkin, Barr, Miran, Bowman & Kashkari. DXY hit a WTD low overnight at 98.41 before trimming losses.

- EUR is a touch firmer vs. the USD in the run-up to the no-confidence votes in French PM Lecornu. The first motion put forward by the far-right National Rally (RN) will likely fail, as RN and the Union for Democratic Change (UDR) are the only major parties that are backing it. The second motion, put forward by the far-left, La France Insoumise (LFI), has a greater potential to pass given that it could see support from both the Left and the Right. If Lecornu survives, there will likely be some additional reprieve for the EUR and a narrowing of the GE/FR spread. If he falls, odds of fresh legislative elections will rise. Elsewhere, ECBʼs Lane, Lagarde, Wunsch and Kocher are due to give remarks later. EUR/USD has been as high as 1.1675.

- JPY is fractionally firmer vs. the USD with the pair extending above the 151 mark. The focus for Japan remains on domestic politics with LDP leader Takaichi scrambling to secure her position as PM. Her path to power appears to be reliant on forming an alliance with the Japanese Innovation Party (JIP) with the parties having met today and expected to continue discussions tomorrow. Overnight, BoJ’s Tamura said the BoJ should push rates closer towards levels deemed neutral. However, his comments had little follow-through to JPY, given he is the most hawkish member on the board. USD/JPY is still some way off yesterday’s peak at 151.87.

- GBP is firmer vs. the USD and extending on Wednesday’s upside. August’s M/M UK GDP printed in-line with expectations at 0.1% with the prior revised lower to -0.1% from 0%. On the budget, the latest trial balloon from the Treasury is that taxes on the wealthy “will be part of the story”. For today’s agenda, BoE’s Mann and Greene are due to give remarks. Cable has ventured as high as 1.3442 with the next upside target coming via the 50DMA at 1.3473.

- AUD is flat vs. the USD after shrugging off overnight losses that were triggered by the latest Australian labour market report .The release saw an unexpected uptick in the unemployment rate and a smaller-than-forecast increase in employment change. Subsequently, AUD/USD slipped onto a 0.64 handle, delving as low as 0.6480 with odds of an RBA rate cut standing at circa 71%.

- PBoC set USD/CNY mid-point at 7.0968 vs exp. 7.1186 (Prev. 7.0995).

Fixed Income

- USTs are slightly firmer thus far, in contrast to EGBs and Gilts . However, magnitudes are slim with gains of just 6+ ticks at most in a 113-08 to 113-13+ band. A parameter that is entirely within Wednesdayʼs 113-06+ to 113-17+ range. Thus far, the main points of focus are US President Trump saying they are in a trade war with China. Though, commentary this morning from Chinaʼs Commerce Ministry has perhaps been a little more conciliatory than we have seen in recent sessions. Ahead, Fed speakers in focus with six officials appearing a total of nine times across the day. Additionally, we await the Philly Fed manufacturing report, which follows this week’s upside surprise seen in the Empire manufacturing survey, and ahead of PMI data due next week.

- OATs marginally bid as the French PM survives the 1st no confidence motion; now awaiting 2nd vote . Into the second vote, OATs trade slightly heavier than Bunds with the OAT-Bund 10yr yield spread wider today and as high as 78.5bps. Of the two motions, the one filed by La France Insoumise (LFI) has a chance of passing; full Newsquawk primer available on the feed. For the motion to pass, a majority in the Assembly of 289 votes is needed. Elsewhere, no move to the morningʼs French tap which, while taken down well enough and without reaction, was a little softer than the last very strong outing.

- A slightly softer start to the day. Bunds have at most posted losses of 21 ticks at a 129.93 trough . However, this has since moderated a touch to losses of just under 10 ticks in a 129.93 to 130.14 band. Specifics for the benchmark were a little light, no supply from Germany though the Spanish tap was received well enough and spurred no discernable reaction. Elsewhere, the final Italian inflation print for September was unrevised

- Gilts opened unchanged at Wednesdayʼs 92.43 close . External leads prior to the open were a little mixed, with USTs firmer while Bunds were softer but both within reach of the unchanged mark. The morningʼs main update for the UK was August growth data. Overall, the series came in broadly as expected though the return to growth for the headline was offset by a downward revision to negative territory for Julyʼs M/M figure. The data doesn’t change the narrative for the BoE of a hold in November and a cut being possible in December. With a move dependent on how the next data points print (particularly CPI) and the November Budget. On that, the Guardian adds to recent reports around taxes for the wealthiest members of society while the FT previews the launch of a pension funds initiative next week.

- Spain sells EUR 4.442bln vs exp. EUR 4.0-5.0bln 1.25% 2030, 2.55% 2032 and 3.20% 2035 Bono.

- France sells EUR 11.499bln vs exp. EUR 9.5-11.5bln 2.40% 2028, 2.50% 2030, 2.70% 2031, and 0.00% 2031 OAT.

Commodities

- Crude benchmarks remain rangebound throughout the APAC session despite increased Russian oil restrictions and rising trade tensions. WTI and Brent oscillate in a USD 58.55-59.11/bbl and USD 62.18-62.75/bbl band respectively, as markets wait for further confirmation of Russian oil export restrictions. Most recently, crude futures have dipped down to fresh lows, but lacks a clear driver.

- Spot XAU continues to climb to record levels, peaking at USD 4242/oz during the APAC session and currently trading just shy of best levels at USD 4230/oz. This comes as US-China tensions, ongoing US government shutdown and further expectations of rate cuts in the US drive the precious metal higher.

- Base metals currently trading relatively muted as trade tensions weigh on the metal space while structural challenges support the metal space. 3M LME Copper is currently oscillating in a c. USD 130/t range as the market waits for more news.

- Vice President of Transneft says companies have not reduced oil supplies to the pipeline system; have enough capacity as Russia’s OPEC+ oil output quota increases.

- “Russian Energy Minister: Oil refineries will postpone maintenance work to meet market needs”, according to Al Arabiya.

- UBS sees the decline in real rates, potentially into negative territory, further boosting the portfolio appeal of gold, which could rise towards UBS’ upside case of USD 4,700/oz.

- Equinor (EQNR NO) says production has started at its Bacalhau field (220k BPD)

- US Private Inventory Data (bbls): Crude +7.4mln (exp. -0.3mln), Distillate -4.8mln (exp. -0.3mln), Gasoline +3.0mln (exp. – 0.1mln).

- US President Trump said Indian PM Modi assured him that they won’t buy Russian oil, while he added that they now need to get China to stop buying Russian oil. It was later reported that some Indian oil refiners are preparing to cut Russian oil imports, with refiners expecting a gradual reduction in imports, according to Reuters sources.

- Saudi Aramco CEO warned of a global oil shortage if the industry fails to invest, according to FT.

- Ukraine’s military says it struck Russia’s Saratov oil refinery (140k BPD) overnight

Geopolitics

- IDF says “Sirens sounding in Eilat following a hostile aircraft infiltration”, via X; Eilat alarms in Israel were a false alarm, according to Al-Hadath correspondent.

- Israel reportedly gave the US new intelligence that shows Hamas has access to more of the bodies than it claims, according to Axios’ Ravid, while it was separately reported that the Red Cross received the remains of two new hostages, according to Sky News Arabia.

- US senior advisor said there were very positive conversations involving the US on making sure aid reaches Gaza, while the advisor stated that stabilisation forces are starting to be constructed and that many countries have raised their hand to be part of a Gaza stabilisation force.

- “Senior Egyptian official to Saudi Al-Hadath TV: The issue of the return of the dead hostages may lead to the postponement of the next stages of the Trump plan”, according to Kann News.

Geopolitics: Ukraine

- US President Trump said Ukraine would like to go on the offensive in the war with Russia, while he also suggested that Russian President Putin could make a settlement.

Geopolitics: Other

- US President Trump confirmed that he authorised the CIA to operate in Venezuela.

- Venezuela’s government said it rejects the statement by US President Trump in which he publicly admitted to having authorised operations to act against the peace and stability of Venezuela, while it stated the US statement constitutes a violation of international law and the UN Charter. Furthermore, it stated that US manoeuvres seek to legitimise an operation of “regime change” with the ultimate aim of appropriating Venezuelan oil resources.

US Event Calendar

- 8:30 am: Oct Philadelphia Fed Business Outlook, est. 10, prior 23.2

- 10:00 am: Aug Business Inventories, est. 0%, prior 0.2%

- 10:00 am: Oct NAHB Housing Market Index, est. 33, prior 32

Central Bank Speakers

- 9:00 am: Fed’s Waller Speaks at Council on Foreign Relations

- 9:00 am: Fed’s Barr Speaks on Stablecoins

- 9:00 am: Fed’s Miran in Moderated Conversation

- 10:00 am: Fed’s Bowman Speaks at Stress Testing Research Conference

- 4:15 pm: Fed Governor Stephen Miran in Moderated Conversation

- 6:00 pm: Fed’s Kashkari Speaks in Town Hall in South Dakota

DB’s Jim Reid concludes the overnight wrap

Markets recovered some ground yesterday as strong earnings and more positive signals on the US-China relationship helped to boost investor optimism. So that meant the S&P 500 (+0.40%) closed at its highest level since Trump’s tariff announcement on Friday, whilst US HY spreads also tightened a further -16bps. Similarly in Europe, France’s CAC 40 (+1.99%) posted its best performance since May amidst a surge for LVMH (+12.22%) after its earnings release, and the STOXX 600 (+0.57%) also hit its highest level since the Friday tariff news. So there’s been some more positivity returning to markets, with investors hoping that an escalation in the trade war can still be avoided.

Starting with that trade news, there were a few positive signals from Treasury Secretary Bessent yesterday which raised hopes that the 100% additional tariffs on China wouldn’t end up being implemented. Bessent said that as far he knows, President Trump “is a go” for meeting with President Xi this month. And he also suggested that the US could extend the trade truce for a longer period if China didn’t pursue its plan to put export controls on rare earths. That said, there was little sign of backing down by Trump, and shortly after the US equity close, he suggested that the US was in a trade war with China and again signalled 100% tariffs.

This backdrop led to a topsy-turvy session, with a positive mood dominating overall as the S&P 500 closed +0.40% higher, though it had been up as much as +1.20% shortly after Bessent’s comments. The trade-exposed areas saw a clear outperformance, seemingly reflecting investors’ growing confidence that the full 100% tariffs will ultimately be avoided. For instance, the NASDAQ Golden Dragon China index (+1.70%) and the Philadelphia Semiconductor index (+2.99%) posted strong gains, with latter also helped by positive commentary from ASML (+3.12%). So that meant the NASDAQ (+0.66%) and the Mag-7 (+0.79%) also outperformed. And there was a further boost from solid bank earnings, with Morgan Stanley (+4.71%) and Bank of America (+4.37%) both rising after their latest results.

In others news, Bessent also confirmed that he had narrowed the number of Fed chair candidates from 11 to 5, who CNBC have reported are Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Christopher Waller, National Economic Council Director Kevin Hasset, former Fed Governor Kevin Warsh and BlackRock’s Rick Rieder. And Bessent also said that the next round of interviews would begin later in November, after which he imagines sending 3-4 names for Trump’s consideration. Bear in mind that incumbent Fed Chair Powell’s four-year term as Chair comes to an end in May, and as it stands on Polymarket, Kevin Hassett is considered the most likely to be nominated as Chair, with a 34% chance, with Kevin Warsh in second on 19%.

Against that backdrop, front-end Treasury yields moved slightly higher yesterday, as the more positive sentiment led investors to dial back their expectations for rapid rate cuts. So the 2yr yield (+1.6bps) ended the day at 3.50%, though the 10yr yield was down -0.4bps to 4.03%, its lowest in four weeks. Matters were also helped by some decent economic data, with the New York Fed’s Empire State manufacturing survey rising to 10.7 (vs. -1.8 expected). But of course, we didn’t get the previously-scheduled CPI release because of the government shutdown, which is coming out on October 24 instead. And concern about a prolonged shutdown has continued to mount, with no signs yet of a compromise emerging between Republicans and Democrats. Indeed, Polymarket odds of the shutdown lasting beyond November 16 are up to 32% after a federal judge ordered the administration to pause plans to fire federal workers during the shutdown. And we’re already on day 16 now, making this shutdown the joint-third longest with 2013. Only two others have gone on for longer, which are the 21-day shutdown in 1995-96, and the most recent 35-day shutdown in 2018-19.

Over in Europe, sovereign bonds put in a stronger performance, in part because of lower oil prices, which is helping to ease concerns about inflation. Indeed yesterday, Brent crude oil prices (-0.77%) closed at a 5-month low of $61.91/bbl, though they are back up to $62.45 overnight after Trump suggested that India would halt purchases of Russian oil. So yields fell across the continent yesterday, with those on 10yr bunds (-4.0bps), OATs (-5.4bps) and BTPs (-3.6bps) all moving lower.

Meanwhile, the Franco-German 10yr spread tightened to a one-month low of 77bps, as investor expectations grew that PM Lecornu’s government would survive two no-confidence votes today. As a reminder, Lecornu proposed suspending the 2023 pension reform until after the presidential election, meaning no increase in the retirement age between now and January 2028. So that led the Socialist Party to say they wouldn’t vote to topple the government, which has increased Lecornu’s chances of winning. But the National Assembly remains fractured between different political groups, and all eyes will be on the result, particularly given two former PMs (Barnier and Bayrou) have lost confidence votes in the last 12 months.

Otherwise, European equities were also relatively upbeat, with the STOXX 600 (+0.57%) advancing thanks to strong company earnings. Most of its gains were supported by the CAC 40 (+1.99%), which posted its biggest jump since May after LVMH (+12.22%) reported strong earnings. However, it was a different across the rest of Europe, with the FTSE 100 (-0.30%) and the DAX (-0.23%) both losing ground.

Overnight, the equity rally has stalled out following Trump’s comments, with futures on the S&P 500 (-0.04%) basically flat. But we have seen a decent performance from several indices in Asia, including the KOSPI (+2.11%), which is on track for another record, alongside a strong advance for the Nikkei (+1.08%). Chinese equities have seen more muted gains however, with the CSI 300 (+0.33%) and the Shanghai Comp (+0.10%) only posting modest gains. And over in Australia, the S&P/ASX 200 (+0.81%) has risen after the latest employment data for September was weaker than expected, with the unemployment rate rising to 4.5% (vs. 4.3% expected). In turn, that’s led investors to price in a growing chance of a rate cut at the next RBA meeting, with futures now suggesting a 63% probability of a cut in November, up from 36% yesterday. So that’s led to a rally for government bonds too, with the 10yr yield (-4.8bps) down to 4.16%, and the Australian dollar has weakened -0.35% against the US dollar.

To the day ahead now, and we’ll get UK August monthly GDP, Italy’s August trade balance, Eurozone August trade balance, Canada September existing home sales, housing starts. Central bank speakers include the Fed’s Waller, Barr, Bowman and Miran, and the ECB’s Lagarde, Kocher, Wunsch and Lane. Notable earnings for today include Charles Schwab and Interactive Brokers

Tyler Durden

Thu, 10/16/2025 – 08:37ZeroHedge NewsRead More

R1

R1

T1

T1