Goldman’s “6 Ps” Framework: The Forces Driving Growth & Constraints In AI Data Center Universe

What’s becoming very clear is that data center power demand is set to surge through the end of the decade, requiring vast amounts of electricity and water to keep advanced AI chips operating smoothly, powering chatbots. Goldman Sachs analysts warn that this AI infrastructure expansion will hinge on six key drivers – the so-called “6 Ps” – shaping growth potential and the constraints facing data center buildouts.

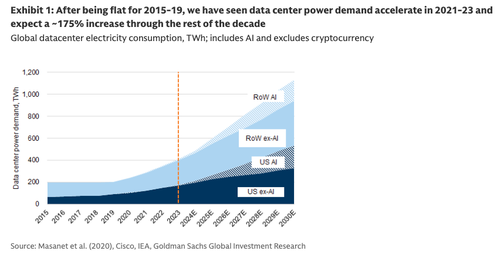

A team of Goldman analysts led by Brian Singer and Carly Davenport told clients that global data center power demand is set to jump 175% from 2023 levels by 2030. In other words, this increase is equivalent to adding a top 10 electricity-consuming nation to the global grid. The revision, up from a prior estimate of 165%, reflects stronger-than-expected AI server shipments, larger data center capacity buildouts, and more bullish outlooks on the digital economy.

Those “6 Ps” that will shape the next decade of data center growth include:

- AI’s Pervasiveness,

-

AI compute and energy Productivity,

-

Electricity prices needed to expand supply,

-

Government policy incentives,

-

Parts availability, and

-

People availability for infrastructure construction and maintenance.

Data center power demand is set to accelerate.

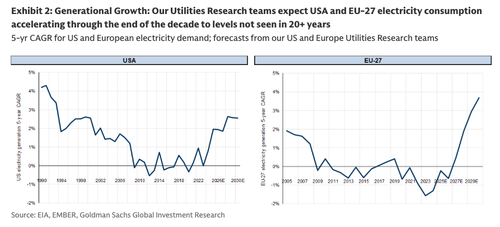

… and focusing more on the U.S. and Europe.

Four key questions driving the outlook for AI/Data Center Power Demand:

-

Parts & People: Will equipment and labor availability constrain power infrastructure? Equipment availability will be the principal driver of sourcing power capacity growth from renewables (in particular utility-scale solar and battery storage) and natural gas peaking plants in the near term, natural gas combined cycle in the medium term and nuclear in the long term. Our outlook for labor demand suggests the need for a substantive increase in skilled workers in transmission/distribution in the near to medium term.

-

Price & Policy: Will power demand be constrained by rising supply cost of Green and non-green power options? We believe Big Tech will continue to take an all-in approach to data center power sourcing, with continued willingness to pay Green Reliability Premiums while at the same time prioritizing time-to-market. We do not believe the sunsetting of Inflation Reduction Act incentives as part of the One Big Beautiful Bill Act will have a meaningful near-term impact on power sourcing.

-

Productivity: Will new-gen AI chips and more efficient compute usage in the latest AI models drive lower or higher aggregate power demand? We assume Big Tech cash flow/budgets will be the key constraint, leaving upside risk if there are no constraints and downside risk if compute speed or token demand are finite.

-

Pervasiveness: Will AI server demand be constrained by AI results/innovations? This will remain key to watch, particularly from a Sustainability perspective whether we see accelerated efficiency solutions in the health care, energy, agriculture and education sectors.

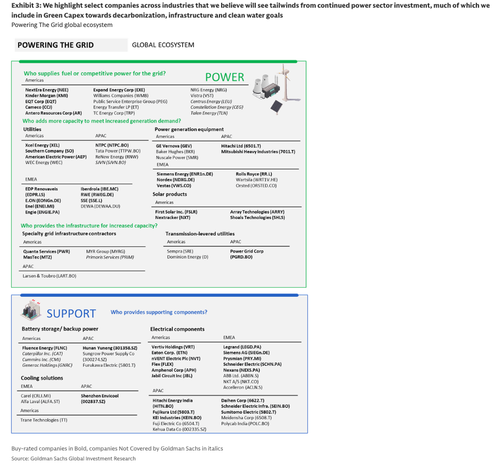

The analysts highlighted their favorite companies that are expected to receive “tailwinds” across the data center power demand ecosystem. The companies shown in bold are Buy-rated stocks.

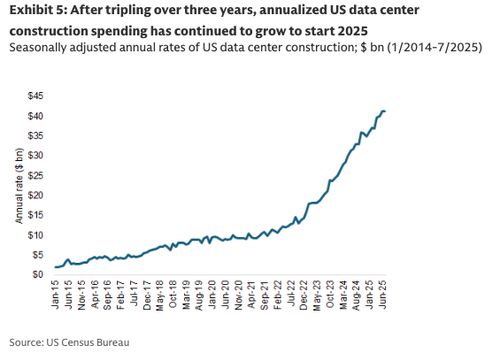

The data center buildout phase is well underway in the U.S.

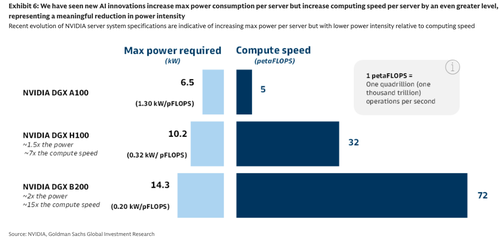

Every new AI chip increases computing, thus the power demanded for server racks.

Related:

-

Could AI’s Growing Thirst For Water Usher In Localized Resource Wars

-

Goldman Identifies “Vulnerable Link” At Center Of Energy Security

The key takeaway is that the data center buildout will be anything but linear, propelled by the AI vendor financing “circle jerk” growth drivers, but also tempered by inevitable constraints. While potential bottlenecks could weigh on AI equity valuations if they intensify, those current constraints remain manageable and are not yet posing a material threat to valuations.

ZeroHedge Pro Subs can read the full note in the usual place.

Tyler Durden

Thu, 10/16/2025 – 05:45ZeroHedge NewsRead More

R1

R1

T1

T1