Philly Fed Survey Signals ‘Widespread Expectations For Growth’, Lower Inflation

After yesterday’s surge in the New York Fed’s Manufacturing survey (showing strong new orders and employment), this morning we get their neighbor – the Philly Fed’s – manufacturing survey data… and it’s, umm, quite different…

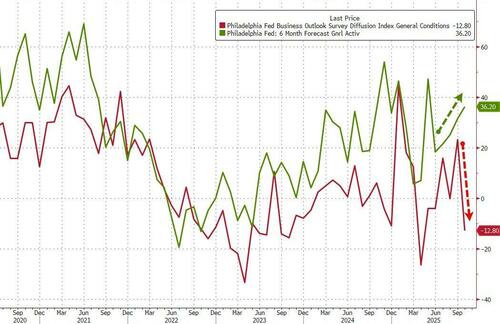

The survey’s index for current general activity fell significantly and turned negative (-12.8 vs +10.0 exp), more than offsetting last month’s increase.

Source: Bloomberg

However, while the headline sentiment index tumbled, the survey’s future indicators suggest “widespread expectations for growth over the next six months“ according to the Philly Fed…

Source: Bloomberg

Additionally, while the headline sentiment signals tumbled, rather confusingly we see the new orders index rose and the employment index ticked down but continued to reflect overall increases in employment.

Source: Bloomberg

And one more item of note, both future price indexes declined – The future prices paid index declined 10 points to 59.8, and the future prices received index fell 19 points to 45.7…

Source: Bloomberg

Finally, we note that in this month’s special question, manufacturers were asked about their plans for different categories of capital expenditures next year. Almost 36 percent of the firms expect to increase total capital spending, compared with 19 percent expecting to decrease total spending; 45 percent expect total spending to stay the same.

As you would expect, expectations for higher capital expenditures were most widespread for computer and related hardware, noncomputer equipment, and software.

Tyler Durden

Thu, 10/16/2025 – 09:00ZeroHedge NewsRead More

R1

R1

T1

T1