“World Is Changing”: Nestlé Shares Surge Most Since 2008 After Announcing Plans To Cut 16,000 Jobs

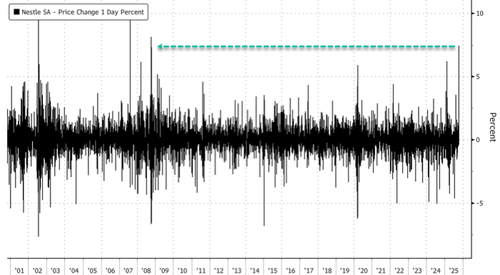

Shares of Swiss food giant Nestlé SA jumped more than 8% in Switzerland today, marking the largest intraday gain in 17 years. This followed the company’s announcement of an acceleration in its turnaround efforts, including aggressive restructuring measures such as slashing 16,000 jobs, or about 6% of its global workforce, over the next two years.

“The world is changing, and Nestlé needs to change faster. This will include making hard but necessary decisions to reduce headcount over the next two years, Nestlé CEO Philipp Navratil wrote in a statement.

The restructuring is part of a broadened cost-savings plan targeting $3.7 billion by 2027, paired with an earnings release that showed stronger-than-expected Q3 sales growth of 4.3%.

The news sent Nestlé shares surging 8.25%, the largest intraday surge in October 2008.

On the year, shares are up 10% after being nearly halved since peaking in late 2021. Shares recently bounced off late 2016 lows.

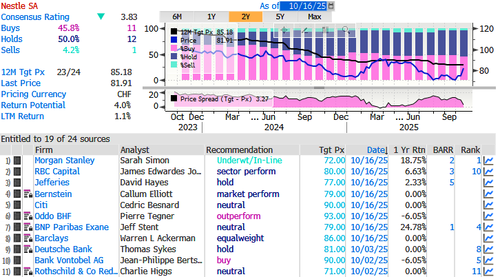

Wall Street analysts welcomed new signs of improvement in Nestlé’s Real Internal Growth. Nestlé also reiterated its guidance.

Here’s what Wall Street is saying (courtesy of Bloomberg):

RBC (sector perform)

Analyst James Edwardes Jones says this update could be the one that shows Nestlé is on the path to “rehabilitation” in RIG, noting a strong 120bps beat on this metric

Nespresso saw the strongest beat in 3Q, while Nestlé Health Science growth was also a meaningful beat

Maintaining of guidance is as expected

Morgan Stanley (underweight)

Results are a “step in the right direction,” with RIG +1.5% vs consensus at 0.3%, analyst Sarah Simon writes

However, still some drag effects from China, and notes that 4Q will face some tougher comparisons

Welcomes the higher cost savings ambitions and says this “suggests a greater sense of urgency to resolve underperforming areas”

Vontobel (buy)

3Q faced relatively easy comps, but Nestlé definitely delivered on RIG, which has been a key focus, analyst Jean- Philippe Bertschy says

Beyond the numbers, CEO comments help put Nestlé on the “offensive” and seemingly heading in the right direction

Jefferies (hold)

- Step up and transparency on cost savings is welcome, alongside better-than-expected results, according to analyst David Hayes

- Remains some concern that 4Q growth will step down, showing still plenty more to do, but this is a good start

Analysts hold 11 “Buys”, 12 “Holds” and 1 “Sell” on Nestlé with an average 12-month price target of 85 CHF.

. . .

Tyler Durden

Thu, 10/16/2025 – 08:25ZeroHedge NewsRead More

R1

R1

T1

T1