China GDP Grows At Slowest Pace In A Year Amid Crumbling Domestic Demand, Crashing Real Estate Market

China’s economic growth slowed to the weakest pace in a year in the third quarter as fragile domestic demand left it heavily reliant on the output of its exporting factories – which have sparked a global deflationary shockwave as China seeks to capture market share abroad through cutthroat price cuts sparking outrage among traditional Chinese clients – and stoking concerns about deepening structural imbalances.

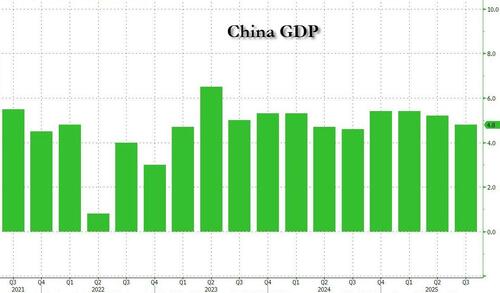

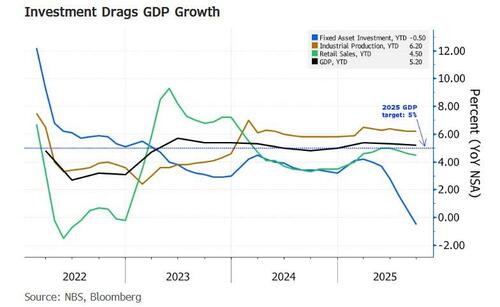

While the 4.8% GDP print for Q3 came fractionally above expectations and kept China on track to reach its target of roughly 5% this year, the economy’s dependence on external demand at a time of mounting trade tensions with Washington raises questions over whether that pace can be sustained. It’s why analysts said further policy support is urgently needed to maintain this stable trajectory and improve domestic demand.

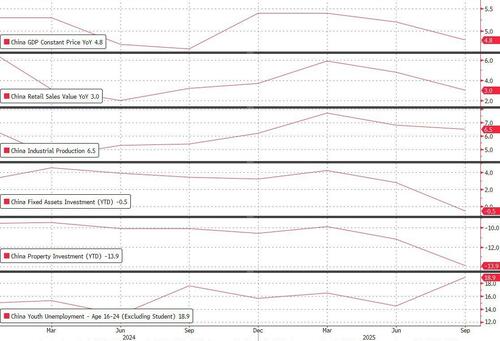

The rest of the Chinese data dump overnight was mixed:

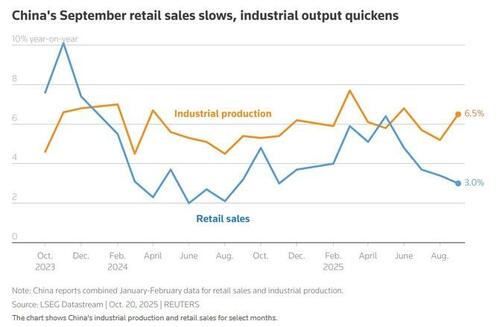

- Retail Sales came in line with expectations at 3.0% YoY (exp. 3.0%)

- Industrial Output beat expectations, printing at 6.5% YoY (exp. 5.0%)

- Fixed Investment missed expectations, printing down 0.5% for th Jan-Sept period (exp. 0.1%)

Some notes here from Goldman:

- Industrial production (IP): +6.5% yoy in September (consensus: +5.0% yoy), vs. +5.2% yoy in August. Note sequential figures are highly sensitive to the specific seasonal adjustment methodology (NBS estimates: +0.6% mom sa non-annualized in September, vs. +0.4% mom sa non-annualized in August; GS estimates: +1.4% mom sa non-annualized in September, vs. 0% mom sa non-annualized in August).

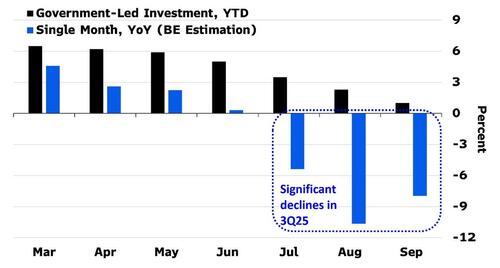

- Fixed asset investment (FAI): -0.5% ytd yoy in September (consensus: +0.1% ytd yoy), vs. +0.5% ytd yoy in August; September single-month by GS estimates: -6.7% yoy, vs. -6.8% yoy in August (sequential growth by GS estimates: -0.5% mom sa non-annualized in September, vs. -1.3% mom sa non-annualized in August).

- Retail sales: +3.0% yoy in September (consensus: +3.0% yoy), vs. +3.4% yoy in August (sequential growth by GS estimates: +0.2% mom sa non-annualized in September, vs. -0.3% mom sa non-annualized in August).

- Services industry output index: +5.6% yoy in September, vs. +5.6% yoy in August (sequential growth by GS estimates: +0.7% mom sa non-annualized in September, vs. +0.4% mom sa non-annualized in August).

Main points:

- 1. Based on NBS estimates, China’s real GDP growth moderated to 4.8% yoy in Q3 from 5.2% yoy in Q2, marginally above market consensus (4.7% yoy) on the back of US tariff impact gradually kicking in, fading effectiveness of some existing easing measures (e.g., the government-subsidized consumer goods trade-in program) and more adverse than usual weather conditions (mainly in July-August). In sequential terms, NBS estimated that real GDP growth edged up to 1.1% qoq sa non-annualized in Q3 from the downwardly revised 1.0% qoq sa non-annualized in Q2. NBS raised its sequential growth estimate slightly for Q3 2024 (to 1.5% qoq non-annualized from 1.3% qoq non-annualized previously), but lowered it slightly for Q4 2024 (to 1.5% qoq annualized from 1.6% qoq non-annualized previously). The official sequential GDP growth of 4.5% qoq annualized (implied by the 1.1% qoq non-annualized growth) is slightly below Goldman’s Current Activity Indicator (CAI) tracking of around 5.2% annualized growth in Q3. Year-on-year nominal GDP growth declined to 3.7% in Q3 from 3.9% in Q2 and GDP deflator has been negative for 10 quarters in a row.

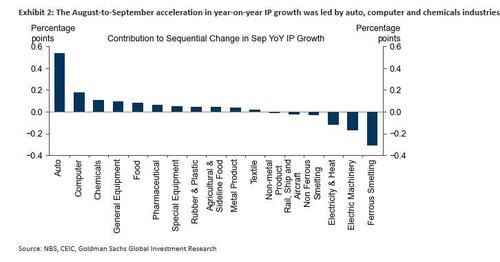

- 2. Industrial production (IP) growth rose to 6.5% yoy in September from 5.2% yoy in August thanks partly to the stronger-than-expected exports and an acceleration in auto output growth. On a sequential basis after seasonal adjustments, IP gained 1.4% mom non-annualized in September (vs. 0% mom non-annualized in August; Exhibit 1). By industry, the August-to-September acceleration in year-on-year IP growth was led by faster output growth in auto, computer and chemicals industries, more than offsetting slower output growth in the ferrous metal smelting industry (Exhibit 2). Among major industrial products (different from by-industry breakdown), auto output growth increased to +13.7% yoy in September from +10.5% yoy in August; computer and industrial robot output growth rose to -5.8% yoy and +28.3% yoy, respectively, in September from -13.1% yoy and +14.4% yoy in August. By comparison, year-on-year growth in power generation and cement output slowed to +1.5% and -8.6%, respectively, in September from +1.6% and -6.2% in August. Crude steel output growth dropped to -4.6% yoy in September from -0.7% yoy in August, and smartphone output growth also eased to +0.1% yoy from +3.2% yoy.

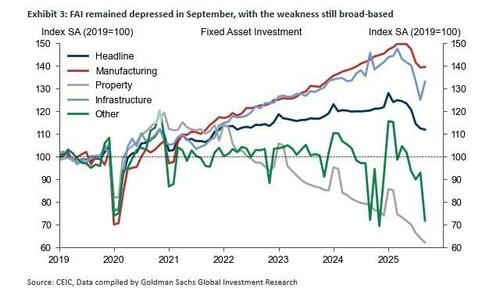

- 3. Fixed asset investment (FAI) growth remained depressed at -6.7% yoy in September (vs. -6.8% yoy in August) on a single month basis. The prolonged property downturn and the ongoing “anti-involution” policies (which should constrain manufacturing investment) remained a drag, while infrastructure investment improved sequentially (+6.4% mom sa non-annualized), reflecting better weather conditions than in July-August and an acceleration in government spending (Exhibit 3). Specifically, year-on-year growth in manufacturing, infrastructure and property investment registered at -1.8%, -8.2% and -21.1% in September, respectively, from -2.0%, -8.3% and -19.4% in August. Year-on-year contraction in “other” investment (i.e., services and agriculture-related investment) narrowed to -1.9% in September from -3.1% in August, thanks entirely to a low base.

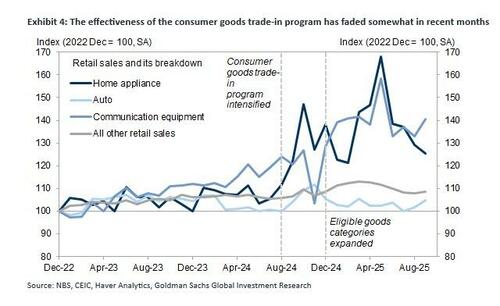

- 4. Nominal retail sales growth slowed to 3.0% yoy in September from 3.4% yoy in August, mainly dragged by weaker offline goods sales and restaurant revenue sales, year-on-year growth of which declined to 1.8% and 0.9% in September from 2.3% and 2.1% in August. By comparison, online goods growth edged up to 7.3% yoy in September from 7.2% yoy in August. Year-on-year growth in home appliance sales value dropped significantly to 3.3% in September from 14.3% in August, reflecting both a high base and fading effectiveness of the ongoing consumer goods trade-in program. However, year-on-year growth in auto and communication equipment sales value rose to 1.6% and 16.2% in September, respectively, from 0.8% and 7.3% in August (Exhibit 4). On a sequential basis, we estimate retail sales value rose 0.2% mom sa non-annualized in September (vs. -0.3% mom sa non-annualized in August).

- 5. Year-on-year growth in the Services Industry Output Index — which is on a real basis and tracks tertiary GDP growth closely (57% of China’s economy as of 2024) – fared better than retail sales growth and remained unchanged from August at 5.6% yoy in September. In sequential terms, the Services Industry Output Index rose 0.7% mom sa non-annualized in September (vs. +0.4% mom sa non-annualized in August).

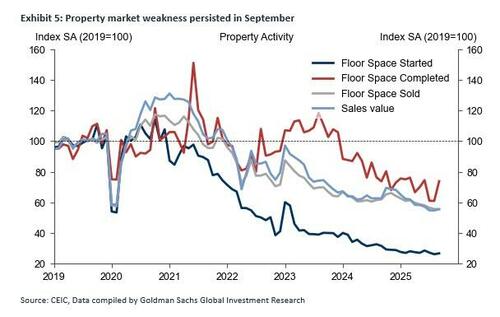

- 6. Property market weakness persisted in September, with year-on-year contraction in most property activity indicator . Specifically, year-on-year growth of new home starts and under construction remained depressed in September, registering -14.4% and -9.4%, respectively (vs. -20.3% and -9.3% in August), while new home completions growth improved to +1.5% yoy from -21.5% yoy. Property sales declined by 10.5% yoy in volume (floor space) terms and 11.8% yoy in value terms in September (vs. -10.3% yoy and -13.8% yoy, respectively, in August). Our high-frequency trackers suggest home transactions in large cities stayed tepid as of mid-October. Meanwhile, NBS and private sector data both showed continued downward pressure on home prices in September.

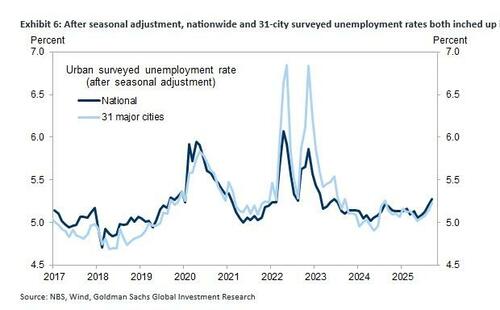

- 7. Regarding the labor market, the nationwide unemployment rate and the 31-city metric (not seasonally adjusted) both inched down to 5.2% in September from 5.3% in August. After seasonal adjustment, these two unemployment rate metrics continued to rise modestly in September. The unemployment rate for migrant workers (without local Hukou) was unchanged at 5.1% from August to September after seasonal adjustments. Following the NBS definition revisions (excluding students in schools) in January 2024, the release of youth unemployment rate data has been delayed by around three days vs. general labor market statistics. The latest data available suggests the unemployment rate of the 16-24 age group edged up to 18.9% in August from 17.8% in July, marginally above its recent peak of 18.8% in last August, given the 12.2 million college graduates this year (vs. 11.8 million in 2024). Goldman expects the youth unemployment rate to decline in coming months on seasonal factors, but caution it would be higher than year-ago levels due to weak domestic demand.

According to Goldman, despite recent developments in US-China tensions, we believe China’s full-year growth target remains largely on track, given that real GDP grew 5.2% yoy during the first three quarters of this year and exports (driven by tariff frontrunning) remain resilient. Additionally, Goldman does not think policymakers see an immediate need to launch broad-based, significant stimulus in the near-term, even though incremental and targeted easing appears necessary in coming quarters to ensure stable growth and employment into next year. The majority of the growth impulse of recent easing measures — including the nationwide childbirth subsidies, the RMB500bn policy bank new financing instrument, and the use of an RMB500bn unspent local government bond issuance quota accumulated from previous years – will likely be concentrated in late 2025 or early 2026.

That’s the optimistic view. A rather more realistic one comes from Reuters which writes that Beijing may be using the headline “resilience” in growth as a show of strength in talks between its vice premier He Lifeng and Treasury Secretary Scott Bessent in Malaysia in coming days and a potential meeting between presidents Donald Trump and Xi Jinping in South Korea later.

This downbeat view is reinforced by the latest observations from Bloomberg’s Econ team which overnight wrote that China’s 7% investment slump shows deep demand weakness. According to a note published by BBG overnight, China’s latest data dump reassures near-term growth but underscores long-term challenges. Third-quarter GDP growth of 4.8% means the economy only needs to clear a low bar of 4.5% in 4Q to meet the 5% full-year target, helped by a surge in production.

Yet the imbalance between supply and demand has aggravated. Consumption remains weak, and investment – including public investment – has emerged as the weakest link. That’s because Bloomberg Economics calculates that fixed-asset investment contracted for the fourth month in a row, by as much as 7% in September.

The same supply-demand imbalance is evident in the month-on-month comparison. Industrial production rose 0.64% — the highest in seven months and in line with the pre-pandemic trend – while retail sales fell 0.18%, the third monthly contraction in four months.

As shown below, the collapse in fixed-asset investment has become became the biggest drag on the economy, as government-led investment lost steam. Investment has deteriorated across the board, in both the private and public sectors. The latter is particularly concerning, as government-led investment has been the primary driver of investment over the past few years. BBG calculates that government-led investment declined year-on-year through 3Q, including an 8% drop in September.

Slowing consumption is another drag on the economy. BBG estimates that retail sales growth fell below the pre-stimulus trend for the first time in September since the government ramped up stimulus in September 2024. In September, catering revenue rose only 0.9% year on year, the same as in June — the lowest growth rate since 2023. This reflected cautious consumption of households — as they spent less on unnecessary items. In addition, home appliance sales have slowed rapidly, indicating that the boost from government subsidies is fading. Sales in September increased 3.3% from a year earlier, far lower than that in August (14.3%) or July (28.7%).

Meanwhile, the only silver lining – the ongoing export strength, which itself is a function of the trade war – belies weakness on home turf, where lacklustre demand gives manufacturers no choice but to fight price wars in foreign markets, and compromise on their profitability.

Jeremy Fang, a sales officer at a Chinese aluminium products maker, says his firm lost 20% of revenue as higher sales in Latin America, Africa, Southeast Asia, Turkey and the Middle East failed to fully offset an 80%-90% order plunge in the US. Fang said he is learning Spanish to get ahead of his Chinese competitors rushing to non-U.S. markets and is now traveling abroad twice more often than he did last year.

But that extra effort isn’t enough.

“You have to be ruthlessly competitive on price,” Fang said. “If your price is $100 and the customer starts bargaining, it’s better to drop $10-$20 and take the order. You can’t hesitate.”

This also explains why despite the surging tariffs, goods increases on US imports remains very tame.

This intense competition among Chinese exporters feeds further weakness at home, with many having to cut wages and even jobs to stay in the race. As noted above, while industrial output grew to a three-month high of 6.5% year-on-year in September, beating forecasts, retail sales slowed to a 10-month low of 3.0%.

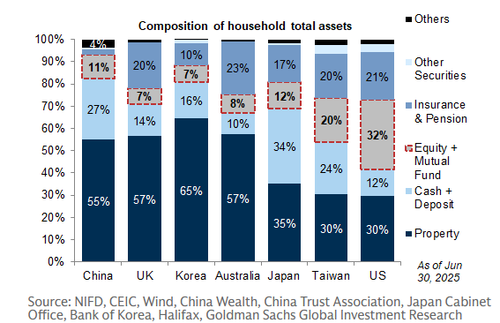

Further hitting consumers by making them feel less wealthy, data also showed new home prices falling at their fastest pace in 11 months in September. Investment in the crisis-hit property sector fell 13.9% year-on-year in the first three quarters, which is devastating for a country where some 55% of household net worth – among the highest in the world – is found in real estate.

“China’s growth is becoming increasingly dependent on exports, which are offsetting a slowdown in domestic demand,” said Capital Economics analyst Julian Evans-Pritchard.

“This pattern of development is not sustainable, and so growth is at risk of slowing further over the medium-term unless the authorities take much more proactive steps to support consumer spending.”

Such calls for structural measures that make China’s economy more reliant on household consumption have grown louder ahead of this week’s key Communist Party meeting, where its elites will discuss the country’s next five-year development plan (see “Trader’s Guide To Biggest China Political Meeting Starting Monday“).

But while the meeting is likely to result in pledges to boost domestic demand, it will also emphasize breaking through technological frontiers and upgrading the country’s sprawling industrial complex as a national security priority. This could keep the flow of economic resources tilted primarily towards manufacturers at the expense of households.

A change in its growth model would make China a bigger contributor to global demand and might help tone down trade tensions. But there is no sign that Beijing is willing to relent on the industrial front as competition with the U.S. intensifies. So far, it has been successful in diversifying away from U.S. markets. Its U.S. export sales were down 27% year-on-year last month, but shipments to the European Union, Southeast Asia and Africa grew by 14%, 15.6% and 56.4%, respectively.

And China is using its near-monopoly position in the production of rare earths as leverage to try to extract more concessions from Washington. This prompted renewed threats from Trump to add another 100 percentage points to tariffs on imports from China, but also messages from Washington that the two sides are willing to lower the temperature.

Triple-digit tariffs would effectively place a painful trade embargo on the world’s two largest economies, but Beijing might feel it can bear the pain for longer.

“Relatively speaking, China is in a better position than the U.S.,” said Yuan Yuwei, hedge fund manager at Water Wisdom Asset Management. “At worst, ordinary people may tighten their belts and some workers are left idle. But in the U.S., if you cut 10-20% of worker’s salary, people go out into the street to protest. China can suffer for longer than the U.S.”

If policymakers feel the economy is veering off target in the fourth quarter, one option is to speed up infrastructure investment given that they are currently frontloading 2026 debt issuance. After all, fixed-asset investment shrank 0.5% in January-September from a year earlier, suggesting room for improvement in that area.

Some analysts believe Beijing doesn’t need more stimulus measures this year. But others still see a strong case to offer support to underperforming sectors.

“With China on track to hit this year’s growth target, we could see less policy urgency,” said Lynn Song, chief economist, Greater China at ING.

“But weak confidence translating to soft consumption, investment, and a worsening property price downturn still need to be addressed.”

Sure enough, China’s consumer confidence never managed to recovery after the covid crash, suggesting that behind the cheerful rhetoric, the mood on the ground in China is cataclysmic and that contrary to soundbites, should Trump continue to push and prod China in the ongoing trade war, he may well get what he wants.

Looking ahead, Goldman writes that the divergent supply and demand trends underscore the need for the government to find effective ways to support growth, even if the economy does not require an additional boost in 4Q. The bank sees less monetary easing in 4Q, with only one possible cut in either the policy rate or the reserve requirement ratio, unlike earlier expectation of moves on both fronts. On the fiscal front, the focus will likely be on implementation and early groundwork for 2026, such as front-loading bond issuance and putting funds in place for projects. The sharp decline in government investment highlights the urgency of identifying more viable investment projects and social programs to spur consumption.

Tyler Durden

Mon, 10/20/2025 – 11:20ZeroHedge NewsRead More

R1

R1

T1

T1