Sustaining The Unsustainable

By Rabobank

The Dow Jones, NASDAQ and S&P500 closed around half a percentage point higher on Friday following comments by Donald Trump to Fox News that elevated tariffs on China are not “sustainable”. Markets seem to be interpreting this line as the latest incidence of TACO (Trump Always Chickens Out) and bidding up risk (except Bitcoin) as a result. Gold prices dipped from record highs, yields on 10-year Treasuries fell 3.5bps and the DXY index strengthened to 98.43

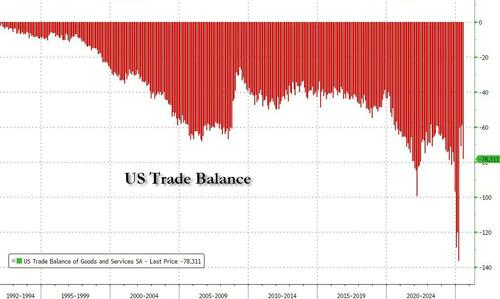

Unfortunately, Trump didn’t quite clarify who the tariffs were unsustainable for, and neglected to mention that other features of the US economic relationship with China are not sustainable either. Large and growing trade imbalances and Chinese power over critical supply chains are cases in point. Treasury Secretary Scott Bessent pointed to these last week when he accused China of pointing “a bazooka at the supply chains and the industrial base of the entire free world.” Saying “we’re not going to have it.” Thems don’t sound like TACO words to me.

Happily, for markets, Bessent DID say that there is a good chance that the additional 100% tariff on China slated to come into effect on November 1st won’t actually happen, but he framed this as a decision that would ultimately depend on the outcome of an upcoming meeting between Trump and Xi Jinping later this month. Effectively, this should be read as a statement that the ball is in China’s court.

If Beijing engages on rebalancing its economy towards domestic consumption and walks back restrictions on the export of critical minerals, the tariffs won’t happen (this might be called the ‘XACO trade’). If Beijing doesn’t engage, well… Bessent also just warned that national policy won’t be directed by the price action of the S&P500 – he doesn’t care about your stock portfolio.

The United States is hardly standing still on addressing its own weaknesses when it comes to supply chains. US port fees on Chinese-owned and Chinese-built vessels took effect last week, and the Australian PM Albanese will be meeting with President Trump today with a menu of offerings to help solve US vulnerabilities regarding rare earths.

Albanese himself will be walking something of a geopolitical tightrope as he seeks to offend China (Australia’s #1 trading partner) as little as possible while also securing US investment in rare earths mining and processing to break China’s monopoly, US commitment to the China-oriented AUKUS defence pact and a sweetheart deal on tariffs (perhaps emulating the UK’s arrangements for steel and aluminium), all while resisting Scott Bessent’s suggestion of last week that the world should “decouple” from China over rare earths. Securing US subsidies for investment in foreign commodity production is likely to be a tall ask. Might Trump seek to extract a 3.5% of GDP defence spending commitment in return? Would Albo agree? What will Beijing say if he does?

Needless to say, the US continues to make waves geopolitically. This is particularly the case regarding the revamped Monroe Doctrine in South America. Trump recently disclosed that the CIA has been active in Venezuela while holding out the possibility of land strikes. The FT yesterday reported that Trump’s goal has now shifted from countering drug trafficking to toppling the Maduro regime, who happens to preside over the world’s largest proven oil reserves alongside deposits of gold, diamonds and coltan (used for capacitors, aerospace applications, electric vehicles and 5G infrastructure).

Additionally, Trump has recently tied commitments to provide financial bailouts and US Dollar swaplines to Argentina to Javier Milei’s fortunes at upcoming midterm elections. “If he wins, we’re staying with him. If he doesn’t win, we’re gone.” He has also suspended aid payments to Colombia, accusing the country’s left-wing President of being a “drug dealer”. Bolivia, meanwhile, looks set to close the book on 20 years of socialist government to elect a right-wing hardliner in what US Secretary of State Rubio described as “one of the more promising developments” in Latin America.

Clearly, the US is directing traffic in its own backyard. The ‘Western Hemisphere’ is seen as the US’s exclusive domain, and other Great Powers are not invited. For evidence of this think the tariff treatment of Brazil after cozying up to China, the bolstering of US naval supremacy across two oceans by taking back the Panama Canal, and the joking-but-not-really offers to make Canada the 51st state and to buy Greenland to freeze China and Russia out of Arctic shipping and resources (to whit, the US is now collaborating with Finland to build a new fleet of icebreakers). Expect all of this to feature in the updated National Defense Strategy set to be published soon.

Additionally, the US has been racking up wins in the Middle East and denting the ambitions of Russia and China to exert influence in central Asia – a geography that virtually every Great Power since Alexander the Great has understood to be vitally important. The Gaza peace is holding, despite wobbles over the weekend, and Iran has been cowed (for now). Oil continues to be priced in Dollars and the Israeli strike on Qatar seems to have sufficiently put the wind up other regional players to convince them to play ball with US foreign policy goals. Saudi Arabia is reportedly in talks for a new defense pact with the USA that is likely to be signed next month, the Abraham Accords are suddenly back in play and hints of trade détente with India might put the IMEEC corridor back on the horizon as a challenger to China’s One Belt One Road initiative.

So, geopolitically the cards still look to be falling the way of the United States in many respects but the huge structural imbalances on trade remain. Before we get too carried away with buying the dip on the latest hopes of TACO perhaps it is worth remembering that the advocates of TACO theory are mostly the same people who told us that universal tariffs would never happen, yet here we are. To predict what is likely to be the direction of travel on trade there is only one indicator you need to watch, and that is the US goods trade balance.

Tyler Durden

Mon, 10/20/2025 – 13:20ZeroHedge NewsRead More

R1

R1

T1

T1