Rare Earths Stocks Soar After Mega US-Australia Minerals Deal To Slash Dependence On China

President Donald Trump and Australian Prime Minister Anthony Albanese signed a minerals deal on Monday at the White House to expand America’s rare earth supply and diversify away from China’s dominance in critical minerals used in EVs, semiconductors, and defense weapons. Beijing’s weaponization of rare earth shipments (read Goldman’s latest brief) to gain leverage over President Trump in trade negotiations underscores the urgency of diversification.

“In about a year from now, we’ll have so much critical minerals and rare earths that you won’t know what to do with them,” President Trump said at the White House on Monday with PM Albanese.

PM Albanese told the press that the U.S. and Australia will each invest over $1 billion within six months, targeting an $8.5 billion pipeline of joint mining and processing projects.

He noted that Australia has an $8.5 billion “pipeline that we have ready to go.”

President Trump is leading on critical minerals and defense. The new U.S.-Australia deal secures $53 billion in resources, strengthens the AUKUS alliance, and counters China’s rare earth export restrictions. This is a win for national security and the economy.

— Select Committee on China (@ChinaSelect) October 20, 2025

The new minerals deal aims to diversify away from China, which has tightened export controls on rare earths and metals like gallium, germanium, and antimony.

Following the signing of the deal:

-

Arafura Rare Earths Ltd. jumped up to 29% after the U.S. Export-Import Bank considered $300 million in financing for its Nolans project, alongside $100 million in conditional Australian government funding.

-

The Ex-Im Bank also issued letters of interest totaling $2.2 billion to six other miners, including VHM Ltd. (+30%) and Northern Minerals Ltd. (+19%).

-

Alcoa Corp. gained as much as 9.6% after its gallium joint venture with Sojitz received up to $200 million in equity funding.

-

Lynas Rare Earths Ltd., not yet a beneficiary, rose briefly 4.7%, while Iluka Resources Ltd. gained 9.1%.

“This is the most significant bilateral minerals cooperation we have seen between two major Western countries,” Gracelin Baskaran, director of the Critical Minerals Security Program for CSIS, told Bloomberg by phone, adding, “Today’s announcement really shows the U.S. isn’t trying to address critical minerals alone. It’s looking to find the right partners.”

Analysts at Canaccord Genuity said the minerals deal “includes the use of economic policy tools and investment to support the supply of raw and processed critical minerals/rare earths, and accelerate the development of diversified, liquid, and fair markets.”

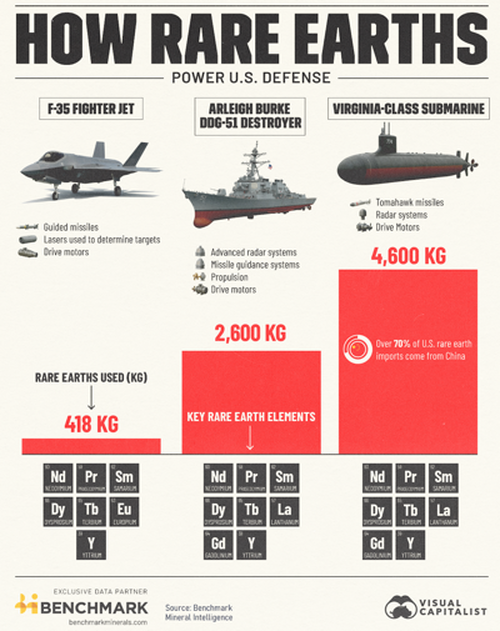

President Trump is leading the effort – a national security one – to diversify away from China because these critical minerals are used in defense weapons.

In the U.S., we’ve been focused on popular rare earth stocks like USA Rare Earths (USAR) and MP Materials (MP), as the Pentagon quietly ramps up its billion-dollar mineral stockpiling spree.

Recall that on July 11th, we wrote “The Coming Rare Earth Revolution And How to Profit” for our premium subscribers.

3 months later https://t.co/RHameHvU2H pic.twitter.com/F8A6faaNB7

— zerohedge (@zerohedge) October 12, 2025

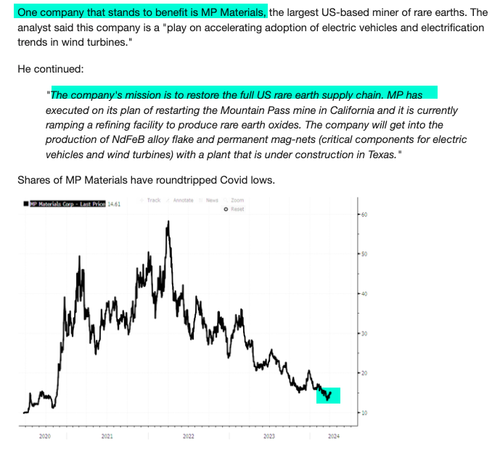

Eighteen months ago, we wrote in a note titled “Next Big Mineral Trade Revealed by Morgan Stanley” that MP Materials is the “one company that stands to benefit” from restoring America’s rare earth supply chain.

Rebuilding America’s supply chains and diversifying away from China will ensure the U.S. is prepared for not just the 2030s but also the world fracturing into a bipolar state. Remember, the whole posturing now is called “Hemispheric Defense“.

Tyler Durden

Tue, 10/21/2025 – 07:20ZeroHedge NewsRead More

R1

R1

T1

T1