UBS: “French Prime Minister Sebastien Lecornu Might Not Make It Until Year-End”

The French blue-chip stock index CAC 40 is higher in Paris afternoon trading, reaching levels not seen since May 2024 and well above those of last week’s political crisis. Prime Minister Sebastien Lecornu’s defeat of no-confidence votes in the French government late last week has certainly cooled the turmoil. However, one UBS analyst tracking the headlines from France believes that Lecornu “might not make it until year-end,” as a highly polarized parliament could make passing a budget nearly impossible.

UBS analyst Simon Penn briefed clients that Lecornu’s ability to pass a budget may suggest the political storm is far from over:

French PM Lecornu Might Not Make It Until Year-End

Political advisory group Forefront isn’t convinced French Prime Minister Lecornu will remain in office until the end of the year.

His basic problem is the same one that each of his predecessors has faced — he is going to struggle to pass a budget.

The Socialists were clear last week: they were willing to lend their support to get Lecornu through confidence votes, but that didn’t mean they supported his budget proposals. Forefront noted that the first thing Lecornu will need to do is enact the suspension of pension reform. He might be able to get that through the National Assembly, but the right-leaning Senate is opposed. If it fails in the Senate, it will go to a joint committee, and since that has a center-right bias, a decision to suspend pension reform will likely hinge on a raft of other requirements. This brings it full circle — the National Assembly is unlikely to accept those.

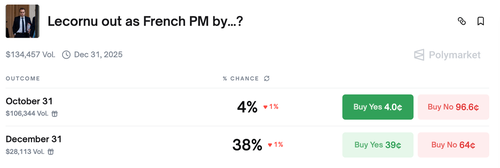

The latest data from the cryptocurrency-based prediction market Polymarket shows that Lecornu’s odds of being ousted are 4% between now and the end of October, but rise to 38% by year-end.

Ignoring S&P Global’s cut of France’s credit rating last Friday due to political instability and the eurozone’s second-biggest economy’s inability to get its finances under control, the CAC 40 index has pushed higher, exceeding recent political turmoil levels and reaching highs not seen since May 2024.

“With the current downgrade, France falls below AA- from two of the three rating agencies, and it should result in forced selling from a number of institutional investors who are sensitive to ratings,” Mohit Kumar, chief economist and strategist for Europe at Jefferies, told clients.

Lecornu plans to reduce the budget deficit to 4.7% of GDP next year from 5.4% in 2025. This is the first step toward bringing it below the EU’s 3% ceiling and putting the country on a sustainable path. But the fractured parliament might make getting a budget passed near impossible. And back to UBS’s note above: Lecornu is likely on borrowed time.

Tyler Durden

Tue, 10/21/2025 – 08:55ZeroHedge NewsRead More

R1

R1

T1

T1