A Dip Below $100k “Seems Inevitable”, But StanChart Sees Bitcoin At $200k By Year-End

The 10 October US-China trade war fear-driven selloff put paid to any further push higher in crypto, according to Standard Chartered’s Geoffrey Kendrick, and the question now is how far does Bitcoin need to fall before finding a base?

On that Kendrick is now thinking a dip below 100k seems inevitable, although the dump may be short-lived.

To determine when the turn higher comes, which I think it will, I am watching:

Gold v Bitcoin flows.

Yesterday’s sharp gold selloff coincided with a strong intra-day bounce in Bitcoin. This was presumably a sell gold, buy Bitcoin flow.

Medium term I expect more of this, and further such evidence would be constructive for a Bitcoin low being formed.

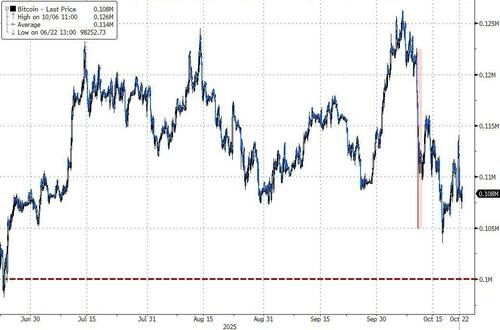

Gold has been outperforming Bitcoin a lot recently (as chart), something which has perhaps started to turn

Fig – Bitcoin/gold ratio

Liquidity type measures.

There are several of these which have mostly been getting tighter. The question for me is when does the Fed see them as “tight” and react by either acknowledging said measures or stopping QT…

Fig – USD Liquidity proxy

On a side note, liquidity on a global basis signals considerable upside for crypto…

Technicals

Although I am not a technical analyst I note that the 50 week moving average in Bitcoin has held since early 2023 (when Bitcoin was 25k and I forecast it to reach 100k by end-2024)

Stay nimble, Kendrick warns, and be ready to buy the dip below 100k if it comes.

It may be the last time Bitcoin is EVER below 100k.

As CoinTelegraph’s Zoltan Vardai notes, despite the volatility, he remains confident that Bitcoin will rebound as markets stabilize.

“My official forecast is $200,000 by the end of the year,” he told Cointelegraph during an exclusive interview at the 2025 European Blockchain Convention in Barcelona.

Despite the “Trump noise around tariffs,” Kendrick said he still sees a price rise “well north of $150,000” in the bear case for the end of the year, assuming the US Federal Reserve continues cutting interest rates to meet market expectations.

Kendrick said the aftermath of the liquidation event may take several weeks to settle, but investors may soon view the sell-off as another accumulation phase.

This could ultimately become the next significant “buying opportunity” for investors, he said.

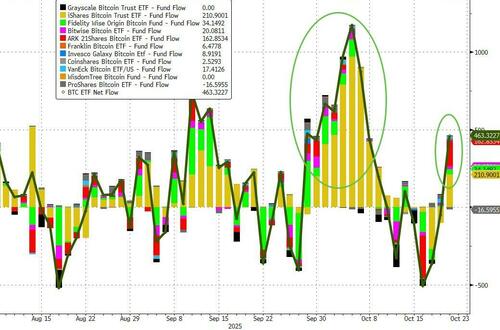

Kendrick predicted continued inflows to Bitcoin exchange-traded funds (ETFs) as the primary driver of Bitcoin’s price momentum for the rest of the year.

Bitcoin ETFs recorded a sharp rebound in flows this week after several days of politically driven outflows.

And sure enough, on Tuesday, the funds saw $477 million in net positive inflows, according to Farside Investors, breaking a four-day losing streak.

The current dip will prepare us for another leg up, “mostly on the back of the ETF inflows,” Kendrick said, adding:

“There’s no reason for them to stop. The US government shutdown, Fed rate cuts. All that story is playing out already in gold.”

Gold’s recent all-time highs will also translate into more momentum for Bitcoin, as its safe-haven asset narrative reemerges, he added.

Tyler Durden

Wed, 10/22/2025 – 13:35ZeroHedge NewsRead More

R1

R1

T1

T1