Impressive 20Y Auction Sees Jump In Foreign Demand, First Stop Through In Months

With market risk mostly off, especially among high beta momentum stocks, bonds have again emerged as a flight to safety and this was certainly on display during today’s auction of 20Y paper.

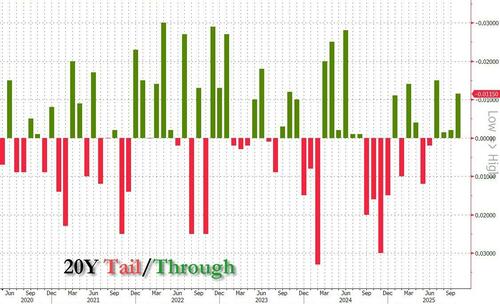

The reopening of 19 Year, 10 Month paper (cusip UN6) was the week’s only coupon auction, and was issued flawlessly and without a glitch amid solid -mostly foreign – demand; the high yield of 4.506% was up notably from last month’s 3.953% but more importantly, stopped through the When Issued 4.518 by 1.2bps, the first stop since July and followed two weak, tailing auctions.

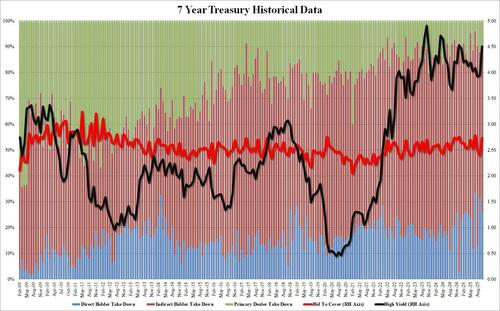

The bid to cover surged to 63.6% from 56.4%, but was still slightly below the six-auction average of 67.3%. And with Directs taking down 26.3% (just above the recent average of 23.1%), Dealers were left with 10.0%, which was also in line with the average of 9.6%.

Overall, this was an impressive auction, although to be expected in a day when suddenly everything in stock world is coming unhinged, and not surprisingly yields slumped back toward session lows.

Tyler Durden

Wed, 10/22/2025 – 13:24ZeroHedge NewsRead More

R1

R1

T1

T1