Don’t Tell ‘Commie Mamdani’: Wall Street Bonuses Poised To Smash Records

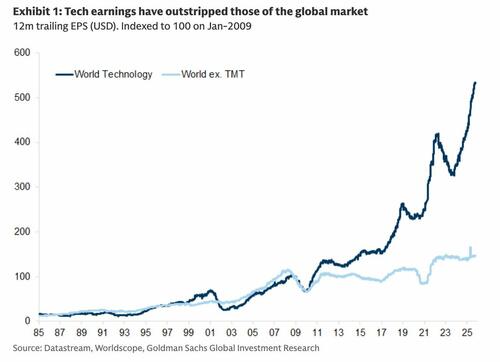

From quantum stocks to AI chips to crypto, the surge in asset price inflation this year has positioned Wall Street’s 2025 bonuses to shatter records amid rising profits and trading revenues.

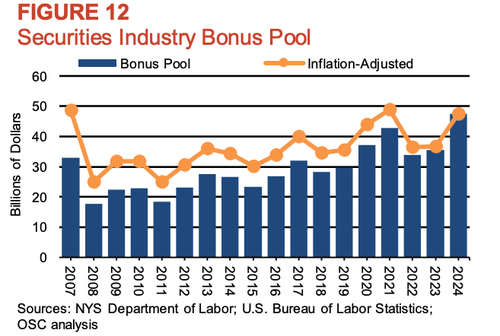

New York State Comptroller Thomas DiNapoli, in his latest annual report on the city’s securities industry, said that while Wall Street profits lagged in the first half of the year, they’re now on track to exceed a record high of $60 billion if momentum holds through year-end.

DiNapoli wrote in the report:

The City expects New York Stock Exchange (NYSE) member firm profits to slow significantly in 2025 to $33.8 billion, as of its May Financial Plan. Year-to-date industry performance has far outpaced this expectation, with total profits of $30.4 billion in the first half of the year alone. Market volatility has risen at times this year amid uncertainty around interest rates and federal fiscal and economic policies. Still, financial firms saw significant growth in revenues from securities trading and account supervision as investors made changes to their portfolios. If the rate of growth in profits continues in the second half of 2025, total annual profits have the potential to exceed $60 billion, setting a new record.

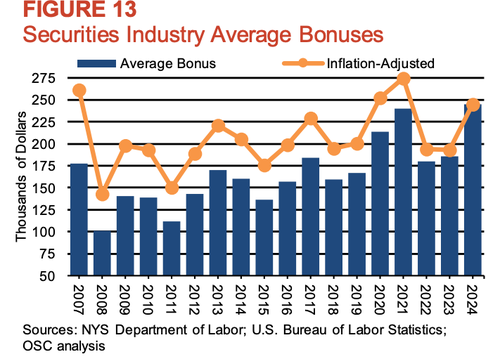

Compensation costs have already jumped nearly 10% in 1H25, signaling even larger year-end bonuses after last year’s record average of $244,700.

DiNapoli explained more:

In the first half of 2025, NYSE member firms increased compensation expenses by 9.9 percent from the prior year. As market activity and profits have increased, the overall bonus pool in 2025 is likely to increase as well. An August report by Johnson Associates (a compensation consulting firm) suggests that bonuses at financial firms for 2025 will likely increase, with a large range between the different business segments. The report suggested that while bonuses in investment banking (including equity and fixed income sales and trading) are expected to increase by around 20 percent, those in underwriting and commercial banking may decline by 5 percent.

The forecast for record Wall Street bonuses comes as major banks, including Goldman Sachs, JPMorgan, Morgan Stanley, BofA, Citi, and Wells Fargo, have posted $15.4 billion in third-quarter trading revenue, the highest in five years. This has been primarily driven by all things AI. Also, previous forecasts of shrinking bonuses have been reversed as M&A and deal activity expanded.

Last year, the average Wall Street salary rose 7.3% to $505,630, roughly five times the citywide private-sector average ($101,760).

Just don’t tell ‘Commie Mamdani,’ Democratic mayoral candidate Zohran Mamdani, about Wall Street’s record bonus prospects this year. His far-left Marxist agenda to strike at the heart of NYC could bode very well for the ‘Wall Street of the South’, Florida.

🚨As if being a crime-loving commie wasn’t bad enough, Mamdani is also blatantly racist.

His tax proposal specifically targets “richer and whiter neighborhoods”.

Why invoke race at all? It’s one more weapon for him to use to destroy NYC.

Is he really the best option for NYC? pic.twitter.com/H4yDLWdcoZ

— Fight With Memes (@FightWithMemes) October 22, 2025

In addition to being an Islamist jihadi, Mamdani is a full-blown communist: “We will slowly buy up the housing on the private market and convert properties into communes.”pic.twitter.com/iCYice83Qs

— Alexander Duncan (@AlexDuncanTX) October 22, 2025

Is it time for an exit plan?

Tyler Durden

Thu, 10/23/2025 – 17:20ZeroHedge NewsRead More

R1

R1

T1

T1