Existing Home Sales Rise Off Record Lows As Mortgage Rates Drop

With mortgage rates tumbling, housing market participants were disappointed this week by the lack of enthusiasm by homebuyers to apply for mortgages (though there was a decent bounce in refi activity). This morning’s existing home sales data (admittedly for September) will give us a further glimpse into the reality oh home-buying vs home-selling as the gap between current mortgage rates and the average existing mortgage rates remains vast…

Source: Bloomberg

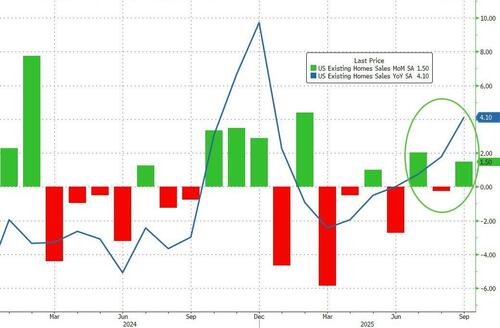

Analysts (rightfully, given the shift in rates) expected a bounce, albeit small (+1.5%), in existing home sales in September and they nailed it (which is a very modest bounce to say the least). On the bright side, existing home sales are up 4.2% YoY – the fastest pace since Dec 2024

Source: Bloomberg

Total Existing Home Sales SAAR moved modestly off the near-record-low levels…

Source: Bloomberg

Last month’s improved sales built on the flicker of momentum that started across both the existing- and new-home markets in August.

Mortgage rates started falling then and continued to decline in September.

Source: Bloomberg

The latest drop may bode well for sales in the coming months as homes typically go under contract a month or two before they’re sold.

“As anticipated, falling mortgage rates are lifting home sales,” NAR Chief Economist Lawrence Yun said in a statement.

“Home prices continue to rise in most parts of the country, further contributing to overall household wealth.”

“Demand is beginning to stir” as homes get slightly more affordable and buyers and sellers on the margin come back into the market, according to a blog post earlier this month from Odeta Kushi, an economist at title insurance giant First American Financial Corp.

However, any rebound is expected to be slow. Despite their recent dip, rates remain almost double what they were at the end of 2021.

The median sales price climbed 2.1% from a year ago to $415,200, continuing a run of annual price gains stretching back to mid-2023.

Year-over-year price growth averaged well over 4% in 2024.

Last month, individual investors or second-home buyers bought 15% of homes, compared with 21% a month earlier.

That “volatility” could be because investors are anticipating a downshift in rental prices going forward, Yun said on a call with reporters.

One positive sign, especially for buyers, has been the increase in homes on the market.

Last month, the supply of previously owned homes for sale surged 14% from a year ago to 1.55 million, one of the highest levels since before the pandemic.

First-time homebuyers accounted for 30% of closings, compared with 28% in the prior month as the affordability crunch may be slowly easing.

Two-thirds of the US’s most populous metropolitan areas were buyer’s markets last month, meaning sellers outnumber buyers by at least 10%, according to research from online housing marketplace Redfin.

Tyler Durden

Thu, 10/23/2025 – 10:12ZeroHedge NewsRead More

R1

R1

T1

T1