GLD Loses Its Shine: What’s Next After This Volatility Trap

Submitted by SpotGamma

It seemed like gold just could not lose in 2025. GLD – the largest gold ETF – had surged over 30% in just two months as traders flocked in, driven by inflation concerns and tariff headlines. Spot gold found itself well beyond the $4,000/oz milestone for the first time ever during this rally, fueled by both institutional and retail interest.

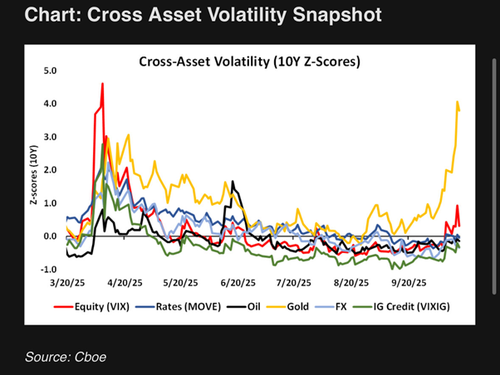

Beneath the shiny surface, the options market sounded a more ominous note: volatility was exploding. Traders bid up calls to capitalize on the momentum, while they also bought up puts to hedge against downside. This psychology is as old as markets: fear of missing out collides with fear of loss.

For GLD, these dynamics created a volatility trap where both call and put options had become absurdly expensive.

When the correction finally arrived, it came fast: GLD crashed 6.4% in a single session on Tuesday, October 21. This marked the largest single-day price decline since April 2013.

Free Webinar: Save Your Spot Now

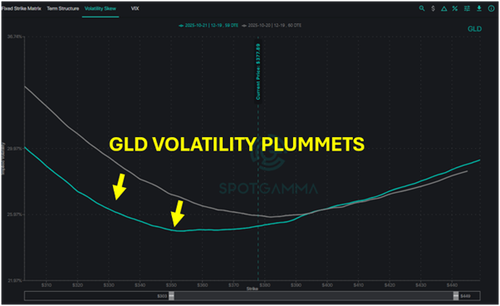

Normally, significant drops cause volatility to spike. Yet as GLD sold off, volatility dropped hard — especially for downside puts.

The morning of October 21, SpotGamma Founder laid out this exact scenario – ahead of the drop: “This is clearly a ‘stock up, vol up’ paradigm… vol is likely to contract if/when gold prices contract.”

What makes this a volatility trap? Extremely expensive option prices force traders to make a difficult choice, should they choose to play the game: either pay heavily for premium, or risk being short options by betting against volatility.

If a trader bought puts during the frothy GLD rally, they could actually see their position lose value despite a major drop in the underlying asset.

Using SpotGamma’s new Options Calculator, you now can visualize this exact phenomena in action to see how volatility can make or break a successful trade:

This calculator combines the impact of volatility, time, and price to model your PnL through expiration, so you can see the forces impacting your positions.

As Monday’s market action revealed, even gold can lose its shine when facing a volatility trap. And as a trader, you need to stay aware of how vol shifts can take a bite out of your position. Because if you trade options, you are trading volatility.

GLD is just one example of volatility dynamics at play, and as a trader you need to pay attention to the hidden forces that affect your PnL.

To understand how volatility drives your PnL, SpotGamma is hosting Hidden Forces Unmasked on October 28. Sign up now for this FREE live event and get access to multiple deep dive sessions plus exclusive access to five new SpotGamma tools.

Tyler Durden

Thu, 10/23/2025 – 13:05ZeroHedge NewsRead More

R1

R1

T1

T1