‘Cooler’ Than Expected CPI Data Leaves Fed On Track For Rate-Cuts

With vol markets fully clenched, this morning’s much-anticipated CPI print (no matter how full of guesstimated data) is sure to prompt an initial flurry of trading activity but as we detailed in our preview, absent some major outlier, is likely to be mostly irrelevant with rate-cut expectations now fully pricing in 2 x 25bps cuts for the rest of the year.

As a reminder, this data was supposed to originally be revealed on Oct 15 and would have been indefinitely delayed had the White House not intervened with a demand that the BLS recall staff and figure out what the number is and report it today at 8:30amET.

Just as we suggested, the headline data was a miss (cooler than expected)…

CPI Preview: Likely A Miss But Mostly Irrelevant https://t.co/hEwPttKmOG

— zerohedge (@zerohedge) October 24, 2025

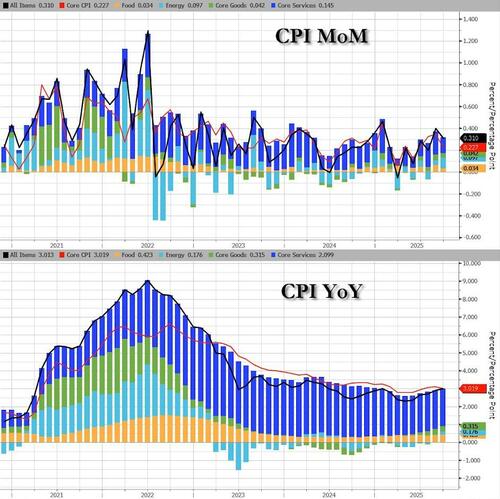

…rising 0.3% Mom (vs +0.4% exp), with the YoY print at 3.0% (below expectations of +3.1% but higher than the 2.9% YoY print in August).

Source: Bloomberg

That is the hottest YoY headline CPI since January.

Energy costs rose but Services slowed…

Source: Bloomberg

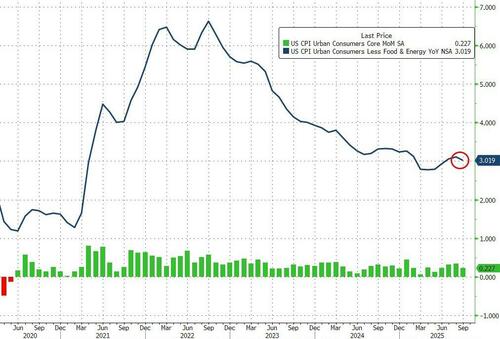

A similar pattern was seen in Core CPI data with the print rising 0.2% MoM (below expectations of +0.3%), but pulled the YoY print down to 3.0% (down from 3.1% in August), the lowest since June…

Source: Bloomberg

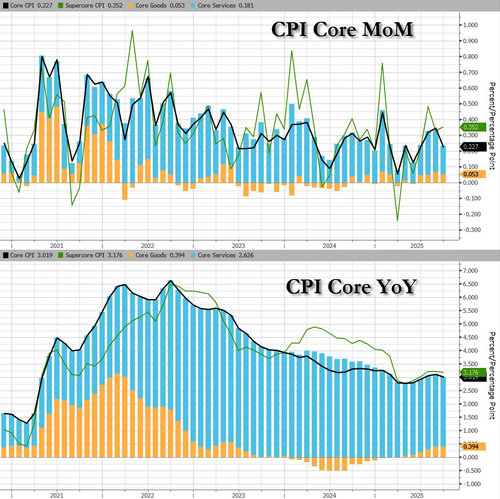

Core Services costs declined significantly…

Source: Bloomberg

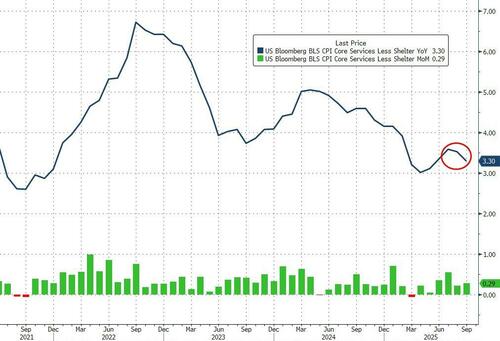

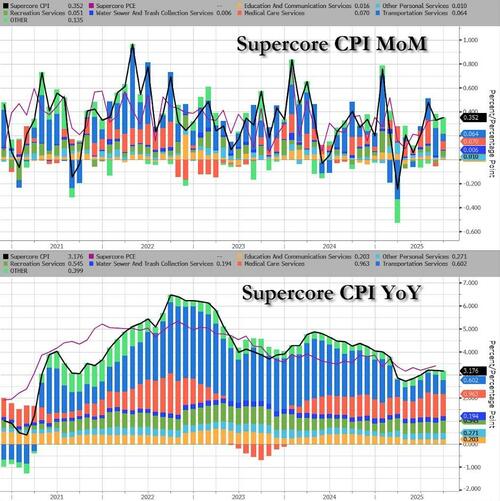

Finally, SuperCore CPI (Services Ex-Shelter) also saw its YoY print slow to +3.30% (the slowest since May)…

Source: Bloomberg

Transportation Costs slowed dramatically in September…

Source: Bloomberg

Summing up September’s (delayed) data, Services inflation slowed to its weakest since Nov 2021 and Goods inflation was flat at +1.5% YoY…

Source: Bloomberg

There’s certainly nothing here to stop The Fed cutting rates again next week.

Tyler Durden

Fri, 10/24/2025 – 08:39ZeroHedge NewsRead More

R1

R1

T1

T1