Futures Rise Ahead Of Key CPI Print

US equity futures are higher ahead of a Trump-blessed CPI print that is broadly expected to print in line or lower than expected, with optimism growing the meeting planned for next week between Trump and Xi will succeed in reducing trade tensions. With the wait nearly over for inflation data that’s will be key for the Fed’s to justify a rate cut next week, as of 8:00am S&P futures are 0.3% higher and Nasdaq futures gain 0.4%. Pre-market, Intel soared 8% after an upbeat revenue forecast. Ford gained 3% after signaling it will largely bounce back next year from a devastating fire that hobbled a key supplier. Newmont slumped after the precious-metals miner’s guidance disappointed investors.Mag 7 names are mostly higher led by GOOGL and NVDA. 10Y bond yields are fractionally higher, just above 4.0% as the USD trades near session highs. Commodities are mixed: base metals are outperforming, while precious metals are lagging and gold slides by about $100 to $4,050. Incremental macro news since Thursday’s close were mostly muted, but earnings announcements were mostly positive. Trump announced that all trade talks with Canada are finished over what he called a deceptive video ad featuring Ronald Reagan disapproving of tariffs. Today, the key focus will be CPI release at 8:30am ET and PMIs at 9:45am ET.

In premarket trading, Mag7 stocks are mostly higher (Alphabet +1.2%, Nvidia +0.6%, Microsoft +0.1%, Meta Platforms +0.4%, Apple +0.3%, Amazon -0.1%, Tesla -0.5%)

- Booz Allen (BAH) falls 8% after the defense contractor cut its adjusted earnings per share guidance for the full year.

- Deckers Outdoor (DECK) falls 12% after the owner of the Ugg and Hoka brands forecast 2026 net sales below the average analyst estimate. Analysts note the management annual outlook might be conservative.

- Ford Motor Co. (F) climbs 4% after the company reported third-quarter results that included a beat on profit and as traders weigh a 50,000 unit boost to pickup truck production against a $1.5 billion-$2 billion hit to Ebit from the Novelis aluminum plant fire.

- HCA Healthcare (HCA) rises 2% after boosting its revenue forecast for the full year

- Intel (INTC) gains 7% after the chipmaker returned to profitability and gave an strong revenue forecast, indicating signs of a comeback gaining traction.

- Mohawk Industries (MHK) falls 4% after the flooring manufacturer provided a disappointing fourth quarter earnings outlook.

- Newmont (NEM) is down 7% after the precious metals miner guided attributable gold production for 2026 that’s expected to be within the same guidance range provided for 2025.

- NEXTracker (NXT) is up 13% after the renewable energy equipment company reported adjusted earnings per share for the second quarter that beat the average analyst estimate.

- Procter & Gamble (PG) climbs 2% after reporting better-than-expected sales for its latest quarter as consumers snapped up the company’s Gillette razors and Secret deodorant.

Overnight, Trump said he is halting all trade talks with Canada for its “egregious behavior” over an ad comprising clips from a 1987 address by former President Ronald Reagan in which he defended free trade and slammed tariffs as an outmoded idea. At the same time, Trump has already been talking up the prospects for a trade deal with China, dangling an extension to the pause on higher tariffs on Chinese imports in exchange for a resumption of China’s purchases of American soybean, a crackdown on fentanyl and Beijing backing off restrictions on rare-earth exports. China’s Commerce Minister sounds optimistic, too.

Turning back to markets, Wall Street rediscovered an appetite for growth and momentum stocks, pushing indexes steadily higher during the back half of Thursday’s session. Confirmation came of a Trump-Xi sit-down next week, the first face-to-face meeting between the leaders of the world’s two biggest economies since Trump took back the keys to the White House in January.

At 8:30 a.m. markets deprived of economic data by the US govt shutdown now in its 24th day (yet with everything still working just fine) will finally get a look into the trajectory of consumer prices, which the median estimate sees rising 3.1% for both headline and core. September’s CPI report should give the Fed a green light to cut interest rates next week (see our CPI preview). Into the CPI data, Fed-dated OIS, steady over recent weeks, almost fully price in 25bp rate cuts at the October and December policy meetings

“Whatever the print looks like, it won’t deter the FOMC from delivering a 25 basis-point cut next week, or at the December meeting, even if there will probably be some knee jerk volatility as the data crosses,” said Michael Brown, a senior research strategist at Pepperstone Group Ltd.

“The risk sits firmly with a topside surprise,” said Nick Twidale, chief market analyst at AT Global Markets. A soft print is unlikely to impact Fed rate cut expectations at next week’s meeting or into 2026, he said

Next week is shaping up to be the busiest of this earnings season, with companies speaking for nearly 44% of the S&P 500’s market value slated to report. With earnings season approaching its apex, just 5% of companies in the S&P 500 Index that have released earnings this season so far have cut their forward guidance, a mere fraction of the 14% that did so by this stage of the reporting cycle in the past two quarters, according to data compiled by Citigroup.

The strong earnings season so far has helped markets to ride out geopolitical and trade tensions. With nearly quarter of the reporting done, year-on-year growth in earnings-per-share has been 4% in Europe and 14% in the US, better than expected, according to Barclays Plc strategists. The real test will come with big-tech results starting next week, they said. Alphabet Inc. and Meta Platforms Inc. are slated to report on Oct. 29 and Apple Inc. the day after.

“We do not think that we are out of the volatility period and market sentiment still feels fragile,” said Mohit Kumar, chief economist and strategist at Jefferies International Ltd. “Investor positioning has shown some signs of cleanup, but overall positioning still remains on the long side. Thus, we are keeping our low-risk mode for now, while maintaining our medium term bullish view.”

Europe’s Stoxx 600 reversed an opening gain, now down by 0.1%, with real estate and utilities shares leading declines, while technology and financial services stocks outperformered. Among companies reporting earnings in Europe, French drugmaker Sanofi SA, UK lender NatWest Group Plc, Swiss cement producer Holcim AG and Swedish defense firm Saab AB gained after beats, as did automobile component maker Valeo. Aluminum supplier Norsk Hydro ASA, Dutch lights manufacturer Signify NV and elevator specialist Schindler Holding AG dropped after missing analysts’ estimates. Here are the biggest movers Friday:

- Valeo shares rise as much as 8.5% to their highest intraday since May 2024 after the French firm posted revenue for the third quarter that beat estimates

- Lifco gains as much as 11% after the Swedish industrial conglomerate reported better-than-expected third-quarter earnings, with organic revenue growth of 4.9% coming in well ahead of consensus estimates of 0.2%

- Saab gains as much as 7.8%, the most since July, after the Swedish defense firm boosted its full-year sales guidance as well as posted a sales and Ebit beat in the third quarter

- Safran shares fall as much as 2.1% as the engine manufacturer’s third guidance increase this year is already largely reflected in estimates, according to analysts. The stock remains close to all-time highs

- Sanofi shares rise as much as 5.2% to the highest since May 29 after the French drugmaker reported sales and profit for the third quarter that beat market expectations

- GSK shares drop as much as 3.3% in London. FDA approval of the British pharma company’s blood cancer drug for a later-than-expected treatment line raised concerns about the medicine’s sales potential

- Kering shares drop as much as 3.6%, pulling back from the highest since April 2024 as HSBC downgrades the luxury-goods company following a strong rally in the share price

- Sika shares fall as much as 2.8% after the specialty chemicals company reported results that were “worse than feared,” with sales declining 1.2% compared to last year — the first quarterly organic decline since 2020

- Schindler shares drop as much as 2.6%, after the elevator and escalator specialist posted a drop in order intake during the third quarter, which analysts at Bloomberg Intelligence said could drag on its recovery

- Bravida falls as much as 11%, the most since May, after the Swedish building installations group reported its latest earnings. DNB Carnegie says poor margins in its core Swedish market disappointed

Earlier in the session, Asian stocks advanced, as confirmation of a meeting next week between US President Donald Trump and his Chinese counterpart Xi Jinping bolstered investor mood. The MSCI Asia Pacific Index rose as much as 0.6%, on course to end a three-day losing streak. SK Hynix, Samsung Electronics and Alibaba were among the top contributors to the advance. Most markets were in the green, with notable gains in South Korea, Japan and China. Taiwan’s market was closed for a holiday. Hopes for a thaw in trade tensions are rising ahead of a planned meeting between Trump and Xi next Thursday on the sidelines of the Asia-Pacific Economic Cooperation summit. Chinese stocks got an extra lift from the nation’s renewed emphasis on technological self-reliance at a key political gathering this week. “The plenum confirms the market expectations of the next five years, and the recent signs of deescalation from both sides is supporting risk sentiment,” said Hao Hong, chief investment officer at Lotus Asset Management in Hong Kong. Elsewhere, South Korea’s Kospi rose 2.5% to touch a fresh high on gains in its big chipmakers. Japanese stocks also rose as Intel’s bullish sales outlook lifted semiconductor-related shares, including Advantest, and optimism increased over corporate earnings.

In FX, the Bloomberg Dollar Spot Index rose 0.1%, on track for a 0.5% gain this week. Overall, the dollar was bolstered as USD/JPY rose 0.3% to 153.06, after Japan’s finance minister signaled that it may be necessary to issue additional debt to fund Prime Minister Sanae Takaichi’s upcoming economic package. USD/CAD rose 0.3%, as the Canadian dollar took a hit after President Donald Trump said he would stop trade negotiations with Canada, citing a Canadian advertisement against US tariffs.

In rates, treasuries hold small losses following Thursday’s sharp selloff triggered by jump in oil prices. US yields remain within 1bp of Thursday’s closing levels, the 10-year just over 4%, with Germany’s lagging by almost 3bp and UK counterpart outperforming slightly. European bonds are falling after resilient euro-zone PMI readings, bolstered by German private sector activity at the strongest since 2023. That overshadowed a miss for French PMIs, hit by the recent political turmoil. German 10-year yields are up by three basis points, French yields by four basis points. UK retail sales also beat estimates. Focal point of US session is the delayed September CPI release at 8:30am New York time. Next week’s Treasury auctions are on an accelerated and compressed schedule before the Oct. 29 FOMC decision, beginning Monday with 2- and 5-year notes sales and concluding with 7-year notes Tuesday

In commodities, gold prices down by $56 to $4,070/oz. Oil prices stable following the surge in the previous session, with Brent holding around $66/barrel.

US economic calendar calendar includes September CPI (8:30am), October S&P Global US PMIs (9:45am), September new home sales and October final University of Michigan sentiment (10am) and October Kansas City Fed services activity (11am).

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.4%

- Stoxx Europe 600 -0.1%

- DAX little changed, CAC 40 -0.4%

- 10-year Treasury yield +1 basis point at 4.01%

- VIX -0.2 points at 17.12

- Bloomberg Dollar Index +0.1% at 1214

- euro little changed at $1.161

- WTI crude little changed at $61.8/barrel

Top Overnight News

- Trump says talks with Canada off after ad invokes Reagan as free-trader: RTRS

- Former Bundesbank chief Axel Weber has warned the coming disruption from artificial intelligence could usher in the rise of a new global elite that profits disproportionately from the adoption of the cutting-edge technology while leaving the rest worse off” BBG

- Hobbled by US tariffs, carpet weavers in India’s Kashmir struggle to stay afloat: RTRS

- After soaring as a global safe haven bet, the Swiss franc is wrapping up a volatile week against the euro with speculation the Swiss National Bank has intervened to curb the currency’s strength: BBG

- China’s New Strategy for Trump: Punch Hard, Concede Little: WSJ

- Investors Love Intel Again. That Still Doesn’t Solve Its Problems: WSJ

- Data-starved bond traders risk seeing the October rally in Treasuries spoiled by the key inflation figures they’ve been waiting for: BBG

- Strong Earnings Reassure Jittery, Data-Deprived Investors: WSJ

- White House Deputy Chief of Staff Blair made the case that, regarding the shutdown, US President Trump wants to spend time and political capital putting together a broader overhaul of healthcare. Blair says there will be a “number” of publicly traded pharmaceutical companies who’ll be “coming to the table” to “get the cost of prescription drugs down in the United States.”: Politico.

- A Turkish court dismissed a case that could topple the leader of the country’s main opposition party, offering relief to investors concerned about renewed political instability: BBG

- US states warn food aid benefits will halt if federal shutdown drags on: RTRS

- Fed has reportedly requested a formal consultation into a banking ruling around the treatment of cross-border loans for EZ banks: BBG

- JPMorgan to Allow Bitcoin, Ether as Collateral in Crypto Push: BBG

- Target to Eliminate 1,800 Roles, 8% of Headquarters Team: BBG

- Applied Materials to Cut 4% of Global Staff After Sales Slow: BBG

- Rivian Cuts About 600 Jobs in Latest Setback for EV Maker: BBG

- ConocoPhillips to Lay Off Canada Employees in November: Reuters

- Will India and China Be Able to Resist U.S. Sanctions on Russian Oil: WSJ

Trade/Tariffs

- US Trade Representative Greer is to travel to Malaysia, Japan and South Korea.

- South Korea’s Industry Minister said South Korea wants the US investment package to be smaller than USD 350bln as part of the tariff deal, while it was separately reported that South Korea and the US remain far apart on key sticking points in trade negotiations, although some progress has been made, according to a senior presidential aide.

- China’s Commerce Minister said regarding ties with the US, that dialogue and cooperation is the only right choice and can find a solution and correct way of coexistence. The minister also noted regarding FDI that they will not will not engage in zero-sum games in opening up and attracting investment, while they will further lower market access barriers to foreign investors.

- US President Trump posted “Canada has fraudulently used an advertisement, which is FAKE, featuring Ronald Reagan speaking negatively about Tariffs…They only did this to interfere with the decision of the U.S. Supreme Court, and other courts. TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A. Based on their egregious behaviour, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED.”

- Canada reportedly limits how many American vehicles Stellantis (STLAM IM) and GM (GM) can import tariff-free, while the move comes after companies dropped some Canadian production, according to CBC. Canada’s government later confirmed significant reductions to import quotas of General Motors (GM) and Stellantis (STLA IM), reducing the annual remissions quotas for General Motors by 24.2% and for Stellantis by 50%.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher as the region took impetus from the rebound on Wall St, where energy names were underpinned amid surging oil prices and with the improved risk sentiment also facilitated by confirmation of a Trump-Xi meeting for next Thursday. ASX 200 lagged as gains in tech were offset by weakness in defensives and the top-weighted financials sector. Nikkei 225 rallied at the open and reclaimed the 49,000 status alongside a weaker currency, while the latest CPI data from Japan printed mostly in line with forecasts but showed an acceleration in the headline and core figures. Hang Seng and Shanghai Comp conformed to the upbeat mood following confirmation of a Trump-Xi meeting next week, although gains were capped as it was also reported that the US is to probe China’s 2020 trade deal compliance, while an investigation could be announced on Friday.

Top Asian News

- Chinese President Xi said China’s development is facing both strategic opportunities and challenges, while he added that China should comprehensively promote the integrated development of education, science, and technology talent, as well as strive to break through key core technologies, according to Xinhua.

- China’s NDRC head said the economy relies on the real economy to move towards the future, and noted that strong domestic demand is strategic underpinning for China’s modernisation. NDRC head also stated that there is room and potential for China to expand domestic demand and they will implement some major investment projects, improve the structure of government investment and increase the proportion sent to people’s livelihoods. Furthermore, they will expand economic policy space during the next five years, will prevent improper government intervention in the economy and will increase coordination of macroeconomic policies.

- China’s Deputy Head of Office of Financial and Economic Affairs Commission said the external environment is uncertain and unstable, but noted the economy is on a solid foundation and fundamentals supporting long-term growth remain unchanged, while it was stated that they must move faster to implement a new development paradigm.

- China’s Science and Technology Minister said regarding AI, that they will accelerate development and seek breakthroughs, as well as step up efforts on the top-level design of artificial intelligence. China will also develop chips with high-level resources and will strengthen artificial intelligence governance, while it will step up efforts in quantum technology and biotechnology.

- Japan’s Finance Minister Katayama said they need to take into account various factors when asked regarding the possibility of raising financial income tax, while she added that monetary policy measures should be up to the BoJ and hopes the BoJ continues appropriate dialogue with markets. Furthermore, Katayama said she spoke with US Treasury Secretary Bessent for about 15 minutes via phone, while she told Bessent she wants to tackle various issues and will meet with Bessent next week.

- Japan’s Prime Minister Takaichi says ‘Economy first then fiscal policy’ will be the foundation of the government’s approach. Will not implement cash handout which was pledged during the upper House election due to lack of public understanding. Aims to pass legislation in the current diet session to abolish provisional gasoline tax rate. To provide assistance for electricity, gas bills during winter. Launching a Japanese growth strategy council to expand the economy.

European equities (STOXX 600 -0.2%) are softer after initially opening with upside. European market sentiment has failed to follow APAC and Wall Street where the tone was supported after confirmation of next weeks Xi and Trump meeting. There’s been no clear macro driver for the recent losses. European sectors have opened slightly negative this morning. Technology (+0.9%) takes the top spot, with sentiment boosted by post-earning strength in Intel (+8.3%). Financial Services is in second place driven by gains in LSEG (+4.3%) after a broker upgrade from JP Morgan. Real Estate is found at the bottom of the pack.

Top European news

- Turkish court ruling permits the opposition leader to stay.

FX

- USD is marginally firmer today, as traders digest a slew of trade-related updates and ahead of the much-awaited delayed US CPI report for September. DXY is currently in a 98.89-99.10 range. In brief, consensus looks for headline CPI to rise +0.4% M/M (prev. 0.4%), with the annual rate seen rising to 3.1% Y/Y (prev. 2.9%). On the trade front, the White House confirmed that the POTUS will meet a number of Asian leaders next week, namely Chinese President Xi on Thursday. It was also reported that Trump said he thinks he will come out well from the meeting with Xi.

- Up the northern border, Trump cancelled all trade negotiations with Canada, due to anti-tariff ads. In an immediate reaction, USD/CAD moved higher by 25 pips to 1.4030 from 1.4005 over two minutes; currently trading around 1.4028. ING suggests that the BoC would be more likely to deliver a 25bps cut at next week’s meeting, given how much trade uncertainty/existing tariffs are weighing on Canadian businesses.

- EUR is essentially flat/modestly lower vs the Dollar. Focus today has been on a slew of PMIs. Starting by way of release order; France was subdued, Germany upbeat and EZ-wide metrics also resilient. Delving into price action in detail, a slight tick lower in the Single-Currency on the downbeat French metrics, but then jumped higher and made fresh highs on the German figures, rising from 1.1607 to 1.1628. The pair has gradually cooled from those highs since.

- JPY is the marginal G10 underperformer today, continuing the pressure seen in the APAC session. USD/JPY is currently trading at the upper end of a 152.47-153.06 range; peak marks a fresh WTD high and now approaching last week’s best at 153.27. Focus for the region has been on inflation, whereby Japan’s National CPI Y/Y rose from the prior (in-line with expectations); the core figure also rose (as expected), whilst the super-core metric fell more-than-expected. From a policy perspective, the elevated inflation figures play in favour of a hike for the BoJ; ING opines that the ongoing US-China trade spat will keep the BoJ wary of hiking rates in October, and instead favour December.

- GBP is modestly lower vs the Dollar. Focus for the UK today was on Retail Sales, which topped analyst expectations; headline M/M +0.5% (exp. -0.2%), the Ex-Fuel figure cooled from the prior but not as much as expected. Thereafter, Cable slipped from those levels heading into the PMI metrics, which were overall resilient; Services ticked a little higher, whilst Manufacturing topped the most optimistic of analyst expectations. The accompanying report suggested that “Companies are clearly treading cautiously in terms of spending, investment and hiring ahead of the upcoming Budget”. Overall, Cable lifted from 1.3302 to 1.3321; the midpoint of the day’s range. On the Budget, it was reported that Chancellor Reeves is mulling raising income tax at next month’s budget, according to The Guardian.

- Antipodeans are modestly lower vs USD, after trading with modest gains overnight, which was facilitated by the generally positive risk tone. However, this has subsided a touch in recent trade. AUD/USD trades in a 0.6641-0.6707 range, and within the confines of this week’s range; NZD/USD trades in a 0.5743-0.5759 range, the high for the day just shy of the WTD best at 0.5761 and then the 21 DMA at 0.5763 thereafter.

Fixed Income

- USTs are contained overnight despite a handful of trade updates, with USTs very much waiting for the upcoming US September CPI report. A series that is being released, despite the shutdown, to facilitate social security adjustments. Consensus looks for headline CPI to rise +0.4% M/M (prev. 0.4%), with the annual rate seen rising to 3.1% Y/Y (prev. 2.9%). The core rate is expected to rise by +0.3% M/M (prev. 0.3%), with the annual rate of core inflation seen unchanged at 3.1%. Elsewhere, we await updates on the trade front. Firstly, a potential investigation into China’s adherence with Section 301 terms from Trump’s first term. Secondly, further details on Thursday’s upcoming Trump-Xi meeting. Finally, relations between the US and Canada have deteriorated significantly with Trump stopping discussions following the release of a Canadian tariff video.

- Bunds were contained early doors, holding just under the 130.00 mark. Thereafter, the softer-than-expected French PMIs pushed the benchmark to a 130.07 peak and also lifted OATs to a 123.06 high. However, this peak proved short-lived as the subsequent German measures came in firmer than expected across the board and eclipsed the forecast range. The German metrics sent Bunds down by c. 30 ticks at the time, a move that has since extended to a 129.50 base following the EZ figure.

- OATs underperforming vs peers. After-hours Moody’s will be reviewing France. Currently, Moody’s has France at Aa3 and is the last of the big-three to have a double-A rating on France; after S&P cut in an unscheduled move last Friday and Fitch earlier on. In politics, PS leader Faure spoke to BFM this morning and outlined that they are yet to see any signs of compromise from the government over an ultra-rich tax measure, and if there is no change by Monday then “it’s all over”; implying that they would submit a no-confidence motion, unless progress is made on taxing the wealthiest in society.

- A firmer start to the day for Gilts, but only by a few ticks. Thereafter, Gilts followed EGBs lower following the German and EZ figures before coming under more pressure and slipping to a 93.41 low in the wake of better-than-expected Flash UK PMIs. A series that confirms the relatively ok performance of the economy and corroborates the recent cooler-than-expected CPI report; furthermore, it chimes with the view of uncertainty ahead of the November Budget. On the point of data, this morning’s surprisingly strong retail sales figures spurred a slight hawkish reaction in November pricing, trimming the odds of a cut to c. 21% (pre-release c. 35%) but had no impact on December pricing; in sum, chiming with the above view on the BoE’s near-term trajectory. Elsewhere, we remain attentive to reports in UK press that Chancellor Reeves is said to be considering breaching a manifesto pledge and raising income taxes. However, a UK minister has since pushed back on this.

- China to issue up to USD 3bln of USD-denominated sovereign bonds in Hong Kong, during the first week of November.

Commodities

- Crude benchmarks are taking a pause following Thursday’s drive higher as the US placed sanctions on Russian oil companies. APAC trade was muted, with WTI and Brent trading in a tight USD 0.60/bbl range before slightly extending to a peak of USD 62.13/bbl and USD 66.30/bbl respectively as German and UK PMIs came in better-than-expected, but then pulling back modestly. Currently, benchmarks are off best and somewhat rangebound. Late in Thursday’s session, a White House official said a Trump-Putin meeting is not completely off the table and states that the US President has not seen enough action from Russia towards peace.

- Spot XAU is currently being weighed on as bond yields rise globally, reversing Thursday’s gains. XAU rose to USD 4144/oz early in the APAC session before gradually falling to a low of USD 4047/oz as the European session got underway.

- Base metals followed on Thursday’s rally as copper supply concerns come at a time of broad optimism over demand and a Trump-Xi meeting on the horizon. 3M LME Copper oscillated in a tight c. USD 65/t range during the APAC session, forming a low at USD 10.8k/t, before extending the prior week’s high and peaking at USD 10.97k/t as the red metal nears key USD 11k/t price point. Prices are currently off best levels, with 3M LME Copper pulling back to USD 10.89k/t.

Geopolitics: Middle East

- US President Trump said regarding Israel, that it will not be doing anything with the West Bank.

Geopolitics: Ukraine

- EU leaders failed to back a EUR 140bn loan to Kyiv using frozen Russian state assets following opposition from Belgium, according to FT.

- EU’s Costa said discussions at the EU summit showed a reparation loan for Ukraine is feasible, while he added that discussions with the ECB and Eurogroup presidents showed the reparation loan proposal is in line with European and international law. It was also reported that Belgium’s Prime Minister said Belgium does not want one euro of money returned to Russia, and on the legality of the reparation loan idea, it is not clear and it is a matter that needs to be solved. Furthermore, German Chancellor Merz said regarding Russian frozen assets that he assumes all EU countries will take part and it is complicated because there is no blueprint for such a step, as well as stated regarding Russian jets violating Lithuania’s airspace, that it is a further provocation and they will react with a sense of proportion.

Geopolitics: Other

- US President Trump said reports that B-1 bombers flew near Venezuela are not accurate, while he added that China is using Venezuela for Fentanyl smuggling. Furthermore, he said they will be seeing land action in Venezuela soon and may go to Congress about targeting land drugs.

US Event Calendar

- 8:30 am: Sep CPI MoM, est. 0.4%, prior 0.4%

- 8:30 am: Sep Core CPI MoM, est. 0.3%, prior 0.3%

- 8:30 am: Sep CPI YoY, est. 3.1%, prior 2.9%

- 8:30 am: Sep Core CPI YoY, est. 3.1%, prior 3.1%

- 9:45 am: Oct P S&P Global U.S. Manufacturing PMI, est. 52, prior 52

- 9:45 am: Oct P S&P Global U.S. Services PMI, est. 53.5, prior 54.2

- 9:45 am: Oct P S&P Global U.S. Composite PMI, est. 53.45, prior 53.9

- 10:00 am: Sep New Home Sales, est. 708k, prior 800k

- 10:00 am: Sep New Home Sales MoM, est. -11.5%, prior 20.5%

- 10:00 am: Oct F U. of Mich. Sentiment, est. 54.5, prior 55

DB’s Jim Reid concludes the overnight wrap

Geopolitical news dominated markets over the past 24 hours. Concerns over the impact of new US sanctions on Russia oil saw Brent crude post its largest two-day jump since 2022, which drove a sell-off in government bonds with 10yr Treasury yields posting their biggest rise in over a month (+5.1bps) ahead of today’s delayed September CPI print. More positively, White House confirmation of a meeting between Trump and Xi next week helped ease recent trade fears. Combined with improved tech optimism, this boosted risk assets, as the S&P 500 rose +0.58% while in Europe the STOXX 600 (+0.37%) reached a new all-time high.

Starting with oil, markets wrestled with the impact of sanctions announced by the US against Russia’s two largest oil companies the previous evening, in particular how these will impact oil flows to China and India, which have been the main buyers of Russia’s crude exports. Reports yesterday pointed to initial disruption, with Bloomberg reporting that Chinese state oil majors have suspended seaborne Russian oil purchases due to concerns about Western sanctions, while Reuters reported that Indian refiners are poised to sharply cut imports of Russian oil. Also the EU yesterday approved its new Russia sanctions package, which targets some Chinese entities for buying Russian oil and tightens restrictions on transactions with Russia’s largest state-owned oil producers. Our view is that while the new US sanctions are likely to disrupt Russia’s oil exports in the near-term, especially to India, the medium-term impact will depend on ongoing enforcement and adaptation. Indeed, looking at previous restrictions on Russia’s oil exports, their impact typically faded after a few months. In response to the new US sanctions, Russia’s President Putin downplayed the impact on Russia’s economy and criticised the impact on global energy markets but suggested that his meeting with Trump was delayed rather than cancelled.

With all said and done, Brent crude prices spiked by +5.43% yesterday to $65.99/bbl. Following Wednesday’s +2.07% rise, this marks the largest two-day jump since April 2022, when oil markets were in turmoil following Russia’s February 2022 invasion of Ukraine. Meanwhile, the geopolitical noise helped gold prices find a firmer footing (+0.68%) after falling by nearly 6% over the previous two sessions.

The rise in oil prices led to a sizeable sell-off in government bonds. In the US, Treasury yields moved higher across the curve, with 10yr yields posting their largest rise in over a month (+5.1bps) back to 4.00%, while 2yr yields rose +4.6bps to 3.49%. That said, while breakevens rose, it was real yields that saw the larger increase, suggesting some broader correction of the recent Treasury rally ahead of today’s delayed CPI print. In Europe, 10yr bund (+2.0bps) and OAT (+2.7bps) yields saw a more moderate increase, while gilts (+0.6bps) outperformed.

The other major geopolitical news came with the White House saying that President Trump will meet with China’s President Xi next Thursday (October 30) on the sidelines of the APEC summit, which buoyed hopes of a détente between the world’s two largest economies. This would be the first in-person meeting between the two leaders since Trump returned to office in January and comes as the current 90-day US-China tariff truce is due to expire on November 10. Meanwhile, we’ve seen negative news on US-Canada trade overnight, with Trump posting that “ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED”, in an apparent response to an advertisement against tariffs funded by the government of Ontario.

Easing US-China fears supported an overall risk-on mood, with the S&P 500 (+0.58%) yesterday closing less than a quarter of a percent from its all-time high. The NASDAQ (+0.89%) was helped by a rebound in chip stocks, as the Philadelphia Stock Exchange Semiconductor Index rose +2.54%. That advance was supported by a WSJ story Wednesday night that the Trump administration was considering taking equity stakes in domestic quantum-computing firms, with Rigetti Computing later saying that it is in ongoing talks with the US government on funding. Recovery for the Mag-7 (+0.88%) was led by Tesla (+2.28%), which saw a spectacular intra-day move after falling as much as -5.71% just after the open following its earnings release that we discussed yesterday. So a buy-the-dip mentality holding strong in the US. The positive mood also carried over to Europe, where the STOXX 600 (+0.37%) and the FTSE 100 (+0.67%) reached new record highs, while the DAX (+0.23%) and CAC (+0.23%) also advanced.

The positive equity market mood has continued in Asia this morning, with the Trump-Xi meeting announcement alleviating concerns on trade. The KOSPI (+2.22%) is leading the gains across the region, posting a new intraday record, while the Nikkei is also strongly higher (+1.50%). Amid Chinese equities, the Hang Seng (+0.59%), the CSI (+0.66%) and the Shanghai Composite (+0.42%) are all seeing decent gains as the CCP released more details on China’s new five-year economic plan focusing on advanced manufacturing, technological self-sufficiency, and enhanced domestic demand. US equity futures are also higher, with the NASDAQ 100 (+0.30%) futures outperforming the S&P 500 (+0.19%) following an upbeat revenue outlook from chipmaker Intel.

On the data front, in Japan core consumer prices rose by +2.9% year-on-year in September (vs +2.7% August), though the ‘core-core’ measure, which excludes both food and energy, was a touch below expectations at +3.0% (vs +3.1% expected; +3.3% in August). Meanwhile, the flash PMIs in Japan show manufacturing activity declining to its lowest level in 19 months in October (48.3 vs 48.5 previous). The services PMI also slowed, albeit to a still solid 52.4 (vs 53.3 previous). With this backdrop, 10yr JGB yields are -1.4bps lower this morning at 1.66%, while the Japanese yen (-0.21%) is extending its decline against the dollar to a sixth consecutive session. Elsewhere, the flash October PMIs in Australia show a decline in manufacturing activity for the first time in ten months (49.7 vs 51.4 previous) though the services PMI rose from 52.4 to 53.1.

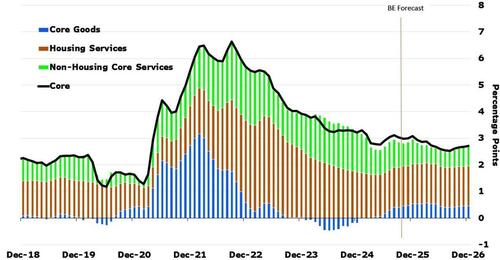

Looking ahead to today, we will get the postponed US CPI release for September at 8.30am EST (13.30 LDN) ahead of next week’s FOMC meeting. Our US economists expect headline CPI to come in at +0.42% m/m, which would push up the year-on-year rate to +3.1%, and be the strongest monthly print since January. For core CPI, they project +0.32%, or +3.1% year-on-year. Within the data, they’re still looking for signs of tariff impacts in core goods, with a focus on categories like apparel and new vehicles that haven’t yet seen a meaningful pass-through. See their full preview here.

In terms of yesterday’s data releases, the shutdown-affected calendar saw US existing home sales post a slight uptick in September to their highest in 7 months (+1.5% m/m as expected). In Europe, France’s INSEE business confidence survey (97 vs 96 expected) and Euro area consumer confidence (-14.2 vs -15.0 expected) were both a touch stronger ahead of today’s flash PMI prints. So data also providing some support to the higher-rates higher-equities backdrop.

To the day ahead now, we’ll get data including the global October flash PMIs, US September CPI, final October University of Michigan survey, UK September retail sales and France October consumer confidence. Central bank speakers include ECB’s Nagel, Cipollone and Villeroy. Notable earnings include Procter & Gamble, Sanofi, NatWest and Porsche. We also have Moody’s review of France’s credit rating.

Tyler Durden

Fri, 10/24/2025 – 08:29ZeroHedge NewsRead More

R1

R1

T1

T1