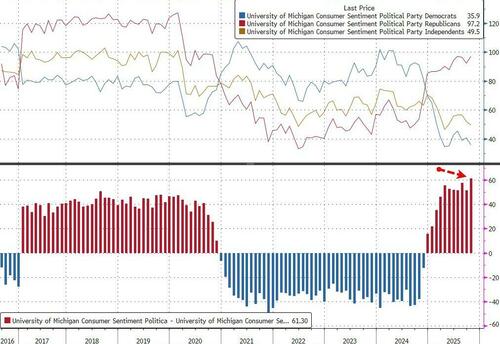

UMich Sentiment Slips In October Driven By Dems & Older Americans

The final October print for UMich Consumer Sentiment data slipped a smidge from the preliminary print, to its weakest since May as a modest increase in sentiment among younger consumers was offset by decreases among middle-age and older consumers.

The final October sentiment index fell to 53.6 from 55.1 in September, a deterioration from the preliminary reading, according to the University of Michigan.

The survey of sentiment showed the current conditions gauge dropped to a multi-year low of 58 – the lowest since 2022.

The University’s gauge of consumer expectations slid to 50.3, a five-month low.

Source: Bloomberg

“Overall, consumers perceive few material changes in economic circumstances from last month; inflation and high prices remain at the forefront of consumers’ minds,” according to Joanne Hsu, director of the survey, with the spread between Democrats’ and Republicans’ confidence at a record high…

Source: Bloomberg

Year-ahead inflation expectations ebbed from 4.7% last month to 4.6% this month. These expectations are currently midway between the readings seen a year ago and the highs seen this year in May in the wake of the initial announcements of major tariff changes. Long-run inflation expectations increased from 3.7% last month to 3.9% this month but remains below this year’s high point seen in April.

Source: Bloomberg

Notably the rise in longer-term inflation expectations was driven by Independents…

Consumers remain frustrated by the persistence of high prices, spontaneously mentioning high prices at various points throughout the interviews.

About 45% of consumers referenced that their personal finances were eroded by high prices, the highest reading since August 2024.

Labor market expectations were stable this month, albeit at generally unfavorable levels.

About 64% of consumers expect unemployment to increase in the year ahead, just shy of this year’s high of 66% seen in March. For the eleventh consecutive month, more than 60% of consumers expect any income gains over the next year to be outstripped by inflation.

The expected probability of job loss waned slightly but remained elevated

Finally, there was little evidence this month that consumers connect the federal government shutdown to the economy. Only about 2% spontaneously referenced the shutdown during this month’s interviews, compared with the 10% of consumers who did so in January 2019 during that 35-day shutdown.

Tyler Durden

Fri, 10/24/2025 – 10:10ZeroHedge NewsRead More

R1

R1

T1

T1