Retail Leverage Goes To Extremes

Authored by Lance Roberts via RealInvestmentAdvice.com,

U.S. markets surged on Friday, setting new all‑time highs for the S&P 500 and the Nasdaq Composite as investors cheered a cooler‑than‑expected inflation print (CPI for September at 3.0 % vs ~3.1 % expected). That report kept hopes alive for further rate cuts at next week’s FOMC meeting and hopes that the end of Quantitative Tightening (QT) is near. Retail “buy‑the‑dip” flows into familiar mega‑cap AI and technology names, which were fueling much of the upside, remains the recent trend. With markets again riding the momentum wave, when names such as Nvidia Corporation, Advanced Micro Devices, Meta Platforms Inc., and Apple Inc. dominate, it reinforces the notion of retail chasing headlines and technical breaks.

But beneath the surface, the environment remains fraught with risk, particularly regarding retail leverage, which we will discuss further today. In the meantime, we are still dealing with large portions of the U.S. federal government in a partial shutdown, which continues to delay key economic releases and injects uncertainty into the outlook. Furthermore, trade and tariff‑related jitters persist as the “battle of wills” between President Trump and President Xi continues. The administration has floated more challenging trade postures toward China, including potential new export curbs and elevated duties, hampering global supply‑chain visibility for semiconductors and AI hardware sectors. We will likely have more resolutions to this situation soon.

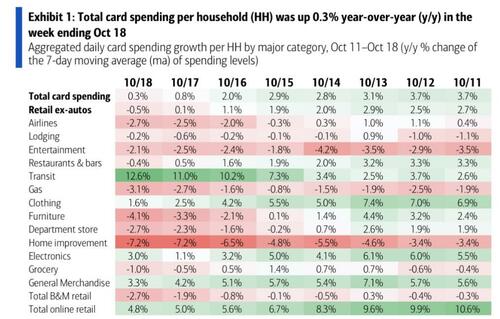

In addition to inflation, other signals suggest the consumer and broader economy remain delicate. As noted, while CPI came in weaker than expected, it is still well above the Fed’s 2% target. While overall inflation rates have decreased sharply over the last two years, they are still elevated enough to weigh on lower-end consumers. Such is why we are seeing a rise in bankruptcies of subprime lenders, as “making ends meet” is becoming more challenging. Overall employment and spending data remain cloudy due to the shutdown, but credit card spending data shows some weakness. As noted last week by Bank of America, total credit card spending growth only rose a modest 0.3% annually. Such is seen in the chart below, where spending declined in almost every category.

Notably, this divergence between rising investor sentiment and weakening economic data raises questions about how much underlying momentum exists beyond the underlying fundamentals. The market is betting heavily on a “soft landing” where moderate growth, easing inflation, stable policy, and strong earnings coexist. Historically, that has not been easy to achieve. However, with this week’s record highs, the message from the crowd is clear: “Buy the Dip” remains intact. But as an investor, you must ask exactly how much of this move is fundamentals, how much is leverage, and how much is pure speculation.

The margin for error is shrinking, and the assumption set is growing risk‑heavy.

📈Technical Backdrop – Stocks Drop To Close The Week

The S&P 500 closed Friday at a record 6,753, confirming a breakout above the previous resistance and setting all-time highs. That breakout vindicated the bulls after a successful test of the 50-DMA support level previously. Furthermore, the market reclaimed the rising bullish trend line from the “Liberation Day” lows and triggered a momentum (MACD) “buy signal, confirming that the bullish bias remains intact. Moving averages also continue to trend higher, reinforcing the overall bullish setup.

Notably, breakouts to new highs typically attract momentum buyers to chase prices higher, and the move continues to cement the “buy the dip” philosophy as a “risk-free” process. Unsurprisingly, retail investors flooded back into familiar trades, Nvidia, Meta, Apple, and AMD, meme stocks, more shorted and non-profitable stocks, and large buyback stocks. That speculative buying frenzy remains propelled by monetary accommodation hopes, AI enthusiasm, and algorithmic confirmation.

Technically, there are reasons for some short-term caution. Money flows show a “negative divergence,” which suggests the move is not as strong as it appears. Furthermore, the internal structure of the market remains a concern. Breadth remains weak, with fewer stocks participating in the rally, and most of the upside is concentrated in a narrow group of mega-cap leaders. This divergence between index performance and market internals creates a fragile foundation. Momentum indicators, such as the Relative Strength Index (RSI), are back near overbought territory but remain in a negative divergence, as shown above. Recent gains have come on declining volume, suggesting waning conviction.

With that said, as we move into November and December, the seasonal bias of the market is higher, and investors should remain committed to equity exposure. However, that does NOT mean the market won’t experience some bumps and bruises. As such, traders and investors should be cautious at these levels. While the breakout is technically significant, confirmation requires broader participation and follow-through. Without that, this rally becomes increasingly vulnerable to sharp reversals. For those with existing exposure, now is the time to tighten stop-losses, trim extended positions, and prepare contingency plans.

Support and Resistance Levels:

-

Resistance: ~6,8500-6,900 (top of rising trend channel shown above)

-

First Support: ~6,700 to (20-day short-term moving averages)

-

Second Support: ~6,600 to (50-day short-term moving averages)

-

Crucial Support: ~6,100-6,200 (significant structural support of breakout of February highs and the 200-day moving average.)

In this environment, investors should manage exposure with discipline. Participate in the trend if it extends, but recognize that there are risks as strength remains concentrated and fragile. The next phase will depend on whether breadth and earnings can confirm what price action is now signaling.

💰 Retail Leverage Goes to Extremes

Morning Star ran an interesting article this past week entitled “Are Investors Ignoring Red Flags?”

“Adding fuel to the fire are worries investors are taking on risk beyond what the market’s fundamentals can support. Sosnick of Interactive Brokers characterizes today’s stock market as one where ‘the equilibrium between risk and reward seems to have shifted dramatically.’ He’s seen investors chase dips and momentum-based plays in the technology and AI sectors, which trade at a high premium, and points out that many of the most actively traded stocks on Interactive Brokers’ platform can be considered “thematic” trades related to those sectors.”

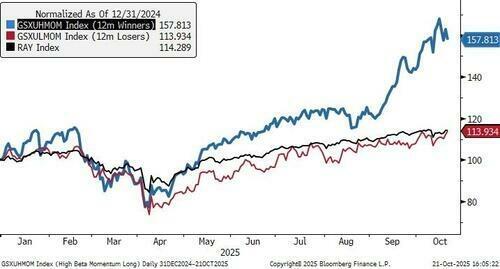

“This time is not different,” as we saw it happen in 1999. Then again, in 2021. You’re watching another speculative cycle unfold in real time. Retail investors are piling in, emboldened by rising prices and a fear of missing out. As stock indexes keep pushing higher, each new high incites more buying as investor caution fades. Such has been the case since “Liberation Day,” as momentum stocks continue to outperform strongly, particularly in areas of secular themes such as artificial intelligence or high-beta portfolios.

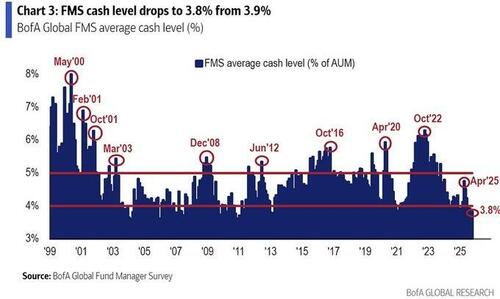

However, for prices to rise, additional buying power is required, and as shown, clients are running low on investible cash.

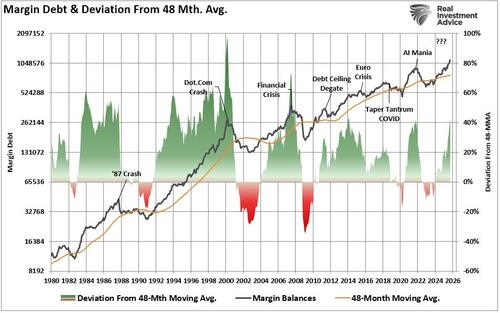

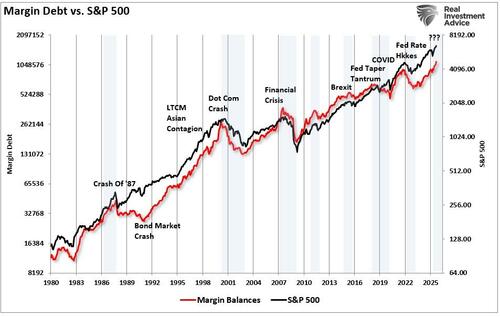

Therefore, for additional “buying power,” investors must turn to leverage. As prices continue to rise, the “fear of missing out” feeds the addiction for leverage, particularly when investor complacency to risk fades. Margin debt, which reflects borrowed funds used to buy stocks, has surged to a record $1.13 trillion. According to FINRA, the five-month spike in margin balances is the most aggressive since the last market peak. The deviation from the 48-month moving average is getting quite extreme.

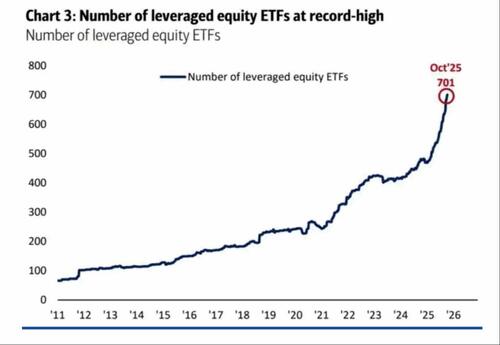

However, the problem with margin debt is that there is a limit to the available borrowing of investors. Therefore, in order to obtain additional leverage, and when demand for retail leverage is high, Wall Street is happy to provide products. As we discussed in Tuesday’s #DailyMarketCommentary:

“Wall Street is happy to produce products to meet investor demand, with the speculative risk soaring it is not surprising to see more speculative products surge in quantity. However, with that demand, is also the risk. These products in particular use options, which work great as long as the market is rising. However, these products can, and will, go to “zero” during a market decline. Most retail investors piling into these securities do not fully comprehend the risk they are taking.”

Most notably, regarding retail leverage, we are not talking about the run-of-the-mill 2x or 3x leveraged products. We are now seeing Wall Street provide 5x leveraged products, to which Jason Zweig, via the WSJ, took notice.

“[Retail] Leverage is all the rage. In the burgeoning market for perpetual futures, cryptocurrency traders can magnify their gains 10-fold, 20-fold, even 100-fold—or, of course, be wiped out. You thought ETFs that double or triple the daily gains or losses on single stocks and cryptocurrencies were extreme? A spate of new filings seeking Securities and Exchange Approval would quintuple the daily gains or losses on such stocks as Coinbase, Nvidia, Palantir, and Tesla—and cryptocurrencies like bitcoin, Solana, and XRP. If assets fall sharply in a single day, the ETF could go to zero.“

Of course, retail investors are potentially further increasing leverage by buying leveraged products on margin.

So…what’s the risk? As Doug Kass recently noted:

“The bigger picture trends of markets and economies using more and more leverage are quite clear. Leverage in increasingly crowded passive investing products and strategies (markets are not elastic enough to take in the rising inflows – this serves to lower the point in which quants may become a destabilizing market influence).”

FOMO distorts judgment. Investors believe everyone else is getting rich and don’t want to be left behind. But markets driven by borrowed money always carry hidden risk.

The thing about leverage to remember is that the “edge that cuts you, cuts the deepest.”

The Hidden Risks Of Retail Leverage

The real threat of leverage isn’t in the tools themselves. It’s how investors misuse them. Retail traders are no longer using leverage to hedge or manage risk. They’re using it to gamble. That shift in behavior is critical. Late-cycle psychology is now driving retail decisions. Traders assume that if a trade worked yesterday, it will work again tomorrow. They’re wrong.

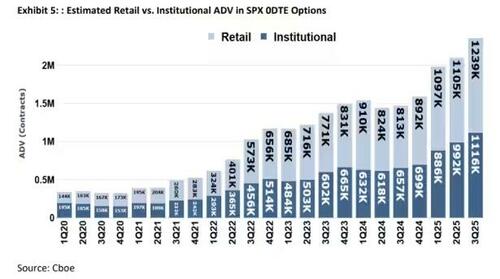

Jason Zweig pointed out that meme stocks have surged 363% year to date, and over 100 SPACs have raised nearly $22 billion, despite most of them now trading below their issue price. These are not rational bets on future cash flow. They are hopes pinned to momentum and hype. The same logic now drives retail leverage use. Options are the clearest example of retail leverage in action. The Options Clearing Corporation data shows that nearly 60% of zero-day options trades now come from retail accounts. These aren’t hedging strategies, but high-conviction, short-term bets on market direction. These contracts can double in value in hours. They can also go to zero. And when they do, it happens fast.

Consider this: if the S&P 500 moves against a trader holding an out-of-the-money call by 1%, that option could lose the entire value before lunch. The second problem is that these “bets” only work in one direction. If enough people hold the same bet, the unwind can fuel instability. Retail investors using these options are trading volatility, not investing.

Leveraged ETFs are another blind spot. JPMorgan recently warned that these instruments can turn a market dip into a rout. Most investors poorly understand the mechanics. Leveraged ETFs, especially 2x, 3x, or 5x funds, must rebalance their holdings at the end of each trading day. That means they buy more of a rising market and sell more of a falling one. It’s a built-in momentum amplifier.

Imagine a scenario where the NASDAQ falls 2% by mid-day. A 3x leveraged long ETF must begin selling futures or constituent stocks to maintain its leverage ratio. That selling adds pressure to the index. Other funds doing the same thing intensify the decline. Now add options market makers who must hedge their exposure as retail traders flood the market with calls or puts. Their hedging moves the market further. This cascade can push a 2% dip into a 4% drawdown, not because of fundamentals, but because of mechanical flows tied to leverage.

Retail investors don’t see this chain. They see only the potential reward but not the hidden cost, which is fragility. When you use leverage, you don’t just magnify your returns; you become exposed to the behavior of the “herd” who are all doing the same thing. If they panic, the system reacts. If it is highly leveraged, like we are today, reactions aren’t gradual; they are fast, brutal, and unforgiving.

That’s what most people miss: cracks don’t widen slowly in highly levered markets; they shatter all at once.

The Risk Of Margin Debt You May Not Know About

Howard Marks, in a December 2020 Bloomberg interview, said:

“Fear of missing out has taken over from the fear of losing money. If people are risk-tolerant and afraid of being out of the market, they buy aggressively, in which case you can’t find any bargains. That’s where we are now. That’s what the Fed engineered by putting rates at zero…we are back to where we were a year ago—uncertainty, prospective returns that are even lower than they were a year ago, and higher asset prices than a year ago. People are back to having to take on more risk to get return. At Oaktree, we are back to a cautious approach. This is not the kind of environment in which you would be buying with both hands.

The prospective returns are low on everything.”

That seems appropriate to today’s commentary.

Margin debt is not a technical indicator for trading markets. What it represents is the amount of speculation occurring in the market. In other words, margin debt is the “gasoline,” which drives markets higher as the leverage provides for the additional purchasing power of assets. However, leverage also works in reverse, as it supplies the accelerant for more significant declines as lenders “force” the sale of assets to cover credit lines without regard to the borrower’s position.

The last sentence is the most important. The issue with margin debt is that the unwinding of leverage is NOT at the investor’s discretion. That process is at the discretion of the broker-dealers that extended that leverage in the first place. (In other words, if you don’t sell to cover, the broker-dealer will do it for you.) When lenders fear they may not recoup their credit lines, they force the borrower to put in more cash or sell assets to cover the debt. The problem is that “margin calls” generally happen simultaneously, as falling asset prices impact all lenders simultaneously.

Margin debt is NOT an issue – until it is.

As shown, Howard was eventually right. In 2022, the decline wiped out all of the previous year’s gains and then some.

History makes this clear. Every time margin debt spikes sharply, markets don’t keep rising. They top out or crash. The 2000 tech bubble, the 2008 housing collapse, and the 2020 COVID selloff were all preceded by a surge in borrowed money chasing gains.

Zweig points out that leveraged crypto traders are now chasing 100x returns. These aren’t hedge funds with sophisticated controls. They’re retail traders who believe the party won’t end. But all it takes is one reversal. When Bitcoin drops 5%, a 100x leveraged trader is wiped out instantly. The same dynamic applies to leveraged ETFs and options.

When many investors use leverage at once, the system becomes fragile. A simple pullback turns into a liquidation wave. ETFs must sell to rebalance. Options traders are forced to unwind positions. Margin accounts are closed out. Selling begets more selling. Liquidity vanishes.

-

You can’t stop the cascade once it starts.

-

You won’t be able to sell when you want to.

-

You’ll sell when told to, after the market has already moved against you.

Most investors don’t have the tools or discipline to manage that kind of exposure. They’re buying high and assuming that volatility won’t return. But it always does. The more leverage you use, the less room you have for error.

Markets reward discipline and patience. Leverage punishes both.

🔑 Key Catalysts Next Week

The week ahead is packed with high-impact events that will likely dictate market direction through the end of the year. Investors face a convergence of macroeconomic data, central bank policy, and heavyweight earnings from the five most prominent technology firms. The current rally has been fueled by optimism around inflation moderating, stable growth, and substantial corporate profits. However, next week, we will put all three assumptions to the test.

With the Government still shut down, we will be missing a lot of macro data. This week should have provided updates on durable goods, and most importantly, the first estimate of third-quarter GDP, along with data on personal income, consumer spending, and the employment cost index, all key inputs into the Fed’s inflation outlook. However, with the CPI report released on Friday, the Federal Reserve will announce its interest rate decision on Wednesday, October 29. Markets expect the Fed to hold rates steady, but the tone of the statement and Powell’s press conference could shift sentiment dramatically, primarily if he provides a more “hawkish” tone.

At the same time, the five most influential S&P 500 companies (Microsoft, Alphabet, Meta, Amazon, and Apple) will all report earnings. These firms comprise over 20% of the S&P 500’s market capitalization. Their results will either confirm the narrative of resilient profits and AI-driven growth or raise new concerns about slowing consumer demand and margin compression.

The week ahead is not just busy; it will likely define what happens next. With valuations stretched and markets pricing a perfect scenario, any negative surprise on earnings, growth, or policy could trigger a sharp reversal. Conversely, a clean sweep of strong data and tech earnings beats would reinforce bullish sentiment and push indexes to further new highs.

Tyler Durden

Sun, 10/26/2025 – 16:20ZeroHedge NewsRead More

R1

R1

T1

T1