Goldman Spots Four Big Takeaways From Last Week’s U.S. Auto, Industrial Tech Earnings

Goldman analysts highlighted several critical themes, including AI, autonomy, and robotics, alongside solid US auto demand, after last week’s earnings from Tesla (TSLA), General Motors (GM), Ford (F), Visteon (VC), Gentex (GNTX), QuantumScape (QS), Mobileye (MBLY), Amphenol (APH), and Vertiv (VRT).

Analyst Mark Delaney found that datacenter capex remains robust, as indicated by earnings reports from Amphenol and Vertiv. He said General Motors and Ford had solid earnings, suggesting that healthy consumer credit performance is tied to prime borrowers. However, he warned that the Nexperia-related mess in the chip industry could disrupt auto supply chains worldwide (read here).

Delaney outlined four key observations after last week’s earnings reports:

-

Datacenter capex trends are robust per Amphenol and Vertiv;

-

Auto demand is solid in the US, per GM and Ford;

-

The export restriction on Nexperia (the former NXP standards product business) could lead to auto production disruptions in the coming weeks if there isn’t a resolution among governments very soon;

-

Ford and GM are both seeing healthy trends in their financial services businesses (which are mostly tied to prime borrowers). We detail these topics in more depth later in this note.

Here are the top questions Delaney’s team received from investors last week, centered on the stocks covered in this note:

-

The attainability of AV targets (e.g. can Tesla can take the safety monitor out of its robotaxis in Texas in 2025 as it plans);

-

The timing for humanoids including Optimus to ramp;

-

What can happen to auto EBIT in 2026 at Ford and GM as emissions rules change and given the Novelis fire that will limit truck supply and potentially support market pricing;

-

The sustainability of datacenter capex in 2026/2027 and beyond (and how good it needs to be for stocks like VRT to outperform).

An expanded view of the key themes from last week’s earnings:

Demand trends:

Datacenter: Both Amphenol and Vertiv reported robust datacenter related demand. Amphenol’s total orders grew 38% yoy and 11% sequentially, and Vertiv’s orders increased organically by about 60% yoy and 20% sequentially. Amphenol’s IT datacom segment sales were up 128% yoy organically, and Amphenol guided 4Q IT datacom segments sales to be up slightly sequentially. Both companies expect datacenter strength to continue. Importantly, Amphenol commented it expects to have a strong position on future AI platforms, which is consistent with our takeaways from a recent call with an industry expert.

Auto demand remains solid. GM and Ford both had strong 3Q results, and both companies expect the US light vehicle SAAR to be more than 16 mn this year. GM and Ford also both expect industry pricing to rise slightly in 2025 (GM expects up 0.5% to 1% in North America, and Ford expects up about 0.5% in the US).

US EV demand was strong in 3Q aided by the expiration of the IRA purchase credit at the end of the quarter. Tesla stated its North America EV deliveries were up 28% qoq (and we believe up >10% yoy in the US in 3Q), GM’s US EV sales were up 107% yoy and Ford’s EV sales in the US grew 30%. Several companies have suggested EV demand will slow for at least a period of time post the IRA EV purchase credit expiration, with GM saying it has seen slower EV demand in October, and Ford commented that EV mix could decline to ~5% in the near term (note that EV mix for the US market has been high single digits in the US YTD and was a low double digit share of the market in 3Q per Motor Intelligence). Similarly, per media reports, Rivian is laying off >600 workers (or about 4.5% of its workforce) reflecting the changing industry backdrop.

GM and Ford are both still investing in EV and battery technology. GM is working on LMR battery technology. In addition, GM announced plans last week to bring new technology to market in 2028 on the Cadillac Escalade IQ EV, including eyes-off driving capability and centralized compute. Ford commented it remains on track for its Universal EV platform to be out in 2027 with sourcing 95% complete, and that its Marshall plant is on track to start LFP production later in 2025.

Growth over market a focus for auto tier 1s – Visteon undergrew its customer weighted production by 5% in 2Q driven by customer exposure/mix factors, but the company expects low single digit growth over market in 2025, and Visteon expects to return to outgrowth in the China market next year. Gentex’s implied growth under market in its primary markets for 3Q was 8%. Gentex highlighted certain decontenting and mix headwinds, particularly in Europe as drivers of its growth under market for 3Q.

Supply Chain Risks

Per comments from GM, Ford, Visteon, and Gentex – the auto industry could face disruptions from the Nexperia chip disruption if the government export control that began on 10/4 isn’t lifted very soon. Companies spoke to typical inventory buffers being ~3-4 weeks. Several companies commented they are already working on alternative sources of supply, but there may be limits in the short-term to finding pin for pin compatible chips for everything Nexperia (the former NXP standard products business) provides.

On the impact from the Novelis aluminum plant fire, Ford expects a $1.5-$2.0 bn EBIT impact in 2025 (reflecting lost volume of 90-100k vehicles), but believes it will make up $1 bn+ in 2026 by increasing F-Series production by 50K+ units in 2026. Novelis posted an update, stating it now expects the hot mill to come back online by the end of 2025 (compared to its prior expectation of this occurring in 1Q26). GM commented it was not materially effected by this event.

Policy – tariffs and emissions

Emissions rules: Both GM and Ford expect new emissions rules in the US to allow them to purchase fewer emissions credits and be able to better optimize mix next year. Conversely, Tesla expects reduced sales of regulatory credits going forward, but Tesla did enter into new contracts, and we expect international markets especially Europe to remain a source of regulatory credit revenue for the company.

Tariffs: The updated US auto tariff policy announced on 10/17 allowed both GM and Ford to reduce their assumption for tariff exposure in 2025 guidance (Ford now assumes a net headwind of $1 bn and GM a net headwind of about $2.6 bn). This updated policy not only extended the up to 3.75% MSRP tariff offset to be for five years (through April 2030), but allows credits to be used for a wider pool of parts and will also give credits for US made engines. Ford’s guidance assumes tariffs in 4Q will be a net tailwind (we think as it can now recognize more credits including some for costs incurred in 2Q/3Q). While the exact treatment of the updated tariff order is not finalized, we see the potential for GM’s tariff exposure to trend toward the lower end of its new guidance especially if a reduced Korea rate is finalized. Importantly, both Ford and GM believe tariffs in 2026 could be similar to the costs in 2025. Separately, the executive order from 10/17 also implemented tariffs on medium and heavy-duty vehicles, effective November 1st. Recall that Ford currently assembles all of its medium and heavy-duty vehicles in the US, and GM stated that it expects a minimal impact from this tariff (GM assembles heavy-duty trucks in Michigan).

However, per media reports, the Canadian government is cutting the amount of American-assembled vehicles GM can import tariff-free by 24% and reducing the amount for Stellantis by 50%, effective immediately. Based on vehicle sales and manufacturing data from Wards and IHS, we estimate that GM imported ~75-125K vehicles into Canada in 2024 from the US. While the media report does not cite a change in policy for Ford, for context, we estimate that Ford imported 200-225K vehicles into Canada in 2024.

Auto Finance

Auto finance has been topical post insolvency issues at First Brands and Tricolor. Both GM and Ford shared that their financial services businesses remain healthy (the financing businesses of both companies are mostly exposed to prime borrowers), and EBT in 3Q for both companies at their financial companies was up yoy. Ford noted that high risk borrowers are only 3% of its portfolio, and its FICO scores are >750. Ford Credit posted its 3Q25 results presentation, and characterized the business as strong and exhibiting typical seasonality. GM similarly stated that while its subprime book is very small, even in this part of its portfolio performance has been pretty consistent.

We consider the reports from GM and Ford as directionally consistent with our recent deep dive on auto finance trends. Recall we found delinquencies had risen but this was driven mostly by subprime borrowers and in the used market. Prime delinquencies have risen somewhat for the industry but to a much lesser extent than subprime. The majority of lending for the new vehicle market is to prime borrowers. And we found by reviewing >1K ABS filings that delinquencies/repossessions were well within typical ranges and low at both GM and Ford, and residual values of vehicles coming off lease remained positive. We appreciate that lending trends can quickly change, and we still believe this topic merits monitoring. However, we continue to view the new vehicle market as solid in the US.

AI, AVs and robotics topical on earnings calls and industry podcasts Autonomy and Robotaxis

Tesla reiterated its plan to take the safety monitor out of its AVs in Austin by year end, and also commented that it believes its new v14 series of FSD should be capable of reaching eyes-off functionality and allowing users to perform tasks such as texting. Mobileye commented it remains on track to start driver-out deployments of its Drive robotaxi solution in 2026 (Mobileye plans for its AV tech to be a part of both the Uber and Lyft networks).

Separately, GM announced it plans to bring eyes-off/hands-off driving to the market in 2028 with the Escalade IQ, and its management team emphasized in a podcast (with CEO Mary Barra and Chief Product Officer Sterling Anderson) its focus on safety and track record with its L2 product Super Cruise. GM also intends to bring Gemini conversational AI into its vehicles starting in 2026, and plans to move away from Apple CarPlay and Android Auto in future vehicle launches. Separately, Andrej Karpathy, the former Senior Director of AI at Tesla (he departed Tesla in 2022) and a founding member of OpenAI, was on a podcast that was published on 10/17, and commented that AGI may be about 10 years away, but also that this technology is achievable. He added that truly solving self driving is nowhere near done in his opinion. Using the ‘March of Nines’ framework (i.e. the AVs needs to reach well over 99% accuracy to be deployed due to safety issues), he described getting the tech 90% right as only the first nine, and each nine can take as long as the last, and there are several more nines still left. He highlighted that there were very good AV demos as far back as 1986, and that an actual product is very different from a demo.

Robotics

Tesla commented that it expects to unveil Optimus V3 in 1Q26 with production potentially beginning towards the end of 2026. Recall the company had commented on its 2Q call that it expected to have a prototype late this year and scale production next year. Separately, recall that management has previously noted that it believes it can get to >1 mn annual units per year for Optimus by the end of the decade.

GM’s CEO and CPO commented on a podcast that GM has roughly 30K robots deployed in 11 sites where it has about 97K production workers, including AMRs and cobots, with development led by its Advanced Robotics Center (with labs in Warren, MI and Mountain View, CA).

We hosted Jabil for a virtual meeting on robotics and automation on 10/24. Rafael Renno (SVP, Global Business units) and Adam Berry (SVP, IR and Corporate Communications) joined for the webinar. Jabil believes that humanoids have promise (both for its own operations and to manufacture for customers), but thinks it could be 2-3+ years before humanoids are a meaningful part of its own operations due to safety, technology, and cost dynamics. The company also commented that there are other robots/cobots/robotic arms that work well today and not every robot needs to be bipedal.

Separately, per a New York Times article, Amazon has a goal to automate 75% of its warehouse operations.

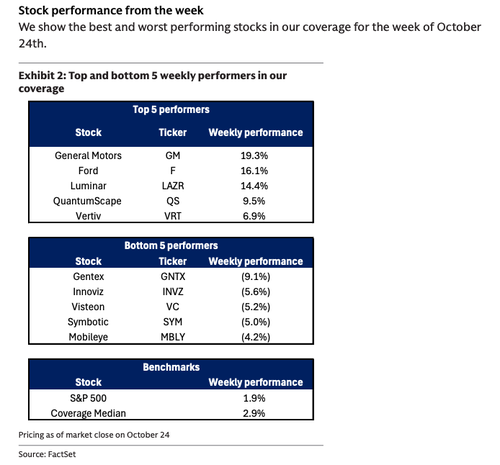

Top and bottom 5 weekly performers in the GS coverage

ZeroHedge Pro Subs can read the full note in the usual place.

Tyler Durden

Mon, 10/27/2025 – 14:00ZeroHedge NewsRead More

R1

R1

T1

T1