Futures Flat Ahead Of Two Huge Days As Gold Slides

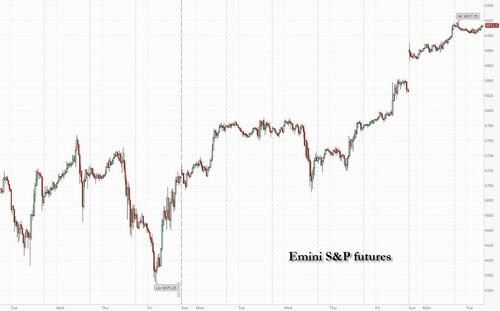

The record-busting stock rally paused ahead of two huge days which include an avalanche of Mag7 earnings, central bank meetings, and the Trump-Xu summit summit. As of 8:00am ET, S&P 500 futures are flat with Nasdaq futures up 0.1% as Mag7 names are flat to up small premarket. Cyclicals underperform, dragged by commodity-related Equities. Europe’s Stoxx 600 falls 0.3% dragged by real estate, construction and poorly-received results from BNP Paribas and Novartis. The Trump admin and Westinghouse sign $80bn deal to build nuclear reactions with Brookfield / Cameco to construct facilities. Google / NextEra sign a deal to restart a nuclear plant to power Google’s AI needs. Treasuries edge higher while the Bloomberg Dollar Spot Index down, with yen outperforming following the Trump-Takaichi summit and supportive comments on the currency. The commodity complex is weaker as both Energy and Precious Metals are down 1.7% – 2% with Ags / Steel in positive territory. Oil prices slide, with WTI testing $60/barrel and Brent below $65. Gold extends declines, having fallen below $4,000/oz yesterday; it dropped as low as $3,900 before rebounding. Though the government remains shut we are likely to receive regional Fed activity indicators, though these prints have not proven to be market moving. Keep an eye on housing prices given the recent weakness in the CPI’s OER metric

In premarket trading, Magnificent 7 stocks are mostly higher (Amazon +0.8%, Tesla +0.7%, Alphabet +0.4%, Microsoft +0.2%, Meta +0.3%, Nvidia +0.2%, Apple -0.2%)

- Amkor Technology (AMKR) falls 4% after the semiconductor manufacturing company reported third-quarter results that beat expectations and gave an outlook.

- Cameco (CCJ) gains 13% on its involvement in a strategic partnership with the US government and other firms that will see at least $80b of new nuclear reactors constructed in the US.

- Confluent (CFLT) rises 10% after the software company reported third-quarter results that beat expectations and raised its full-year forecast for adjusted earnings.

- Custom Truck One Source (CTOS) falls 6% after the supplier of specialty trucks and equipment posted third quarter revenue that missed estimates.

- NXP Semiconductors (NXPI) is up 2% after the provider of chips for automakers and industrial customers gave a stronger-than-anticipated forecast for the current period.

- PayPal Holdings Inc. (PYPL) rises 15% after the company raised its full-year earnings guidance and announced a tie-up with OpenAI to embed its digital wallet into ChatGPT.

- Qorvo (QRVO) climbs 10% as the Information reported that Apple-supplier Skyworks Solutions held talks in recent months to buy its rival.

- Royal Caribbean (RCL) falls 7% after the cruise operator’s fourth quarter adjusted EPS forecast fell short of the consensus estimate. The company said recent adverse weather, and the unplanned extension of the temporary closure of one of its exclusive destinations in Haiti will impact results.

- SoFi Technologies (SOFI) rises 3% after the online lender boosted its adjusted net revenue forecast for the full year.

- UnitedHealth Group Inc. (UNH) gains 3% after the company beat Wall Street expectations for third-quarter earnings and raised its outlook for the year, a sign that the health conglomerate has stabilized after a major meltdown.

- United Parcel Service Inc. (UPS) jumps 8% after third-quarter profit topped Wall Street’s estimates as the courier’s plan to reshape its delivery network starts to show results. Peer FedEx (FDX) gains 3%.

- Waste Management (WM) is down 3% after the waste management services company said its 2025 revenue outlook is now expected to be approximately $25.275 billion, the low end of the prior guidance range. The reduced guidance trailed the average analyst estimate.

In corporate news, Amazon plans to cut its corporate workforce by about 14,000 roles. Goldman aims to significantly expand its presence in Saudi Arabia, while Jamie Dimon said he continues to cajole JPMorgan staffers into the office because junior bankers aren’t able to learn as much when working from home. Uber is said to be planning to invest in the Hong Kong listings of Pony AI and WeRide.

Easing trade tensions have helped fuel the stock rally, with US companies largely unscathed by tariffs so far. The S&P 500 is on course for the most sales beats in about four years. That optimism faces a reality check this week as investors look to the Fed meeting for clues on the path of rate cuts, while major technology firms including Meta Platforms Inc. and Microsoft Corp. may reveal whether the artificial intelligence-fueled earnings momentum can be sustained.

“My central scenario is that the upward trend holds: there’s lots of liquidity out there, the earnings season is good and a Fed rate cut is expected and priced in,” said Stephane Deo, a senior portfolio manager at Eleva Capital in Paris. “There’s one risk, however, that may lay in the tech sector if analysts keep on aggressively pricing double-digit growth for some mega stocks.”

Overnight, Trump continued his trade tour of Asia and praised Japan’s new PM; Trump hailed the alliance between the US and Japan while the two nations pledged cooperation on defense and shipbuilding. Separately, Goldman’s Solomon, speaking at an investment summit in Saudi Arabia, said he expects the “incredible” pickup in M&A and IPO activity to continue, while recent issues in credit markets have been one-offs. BlackRock CEO Larry Fink said at the same event that the US is the place to be overweight for at least the next 18 months.

Equity bulls seems to agree. According to BBG, they’re lining up to wager that the S&P 500 will surge past the 7,000 level now that it looks as if a bout of volatility has passed. And Nasdaq 100 positioning has increased significantly as investors add new long risk, reversing the fading momentum seen in recent weeks, according to Citigroup strategists.

The most crucial reports of the season are still to come, but so far things are looking good. Almost 70% of S&P 500 members to have reported so far have exceeded sales estimates, according to Bloomberg Intelligence — the highest proportion of positive surprises in about four years. And 85% of benchmark companies have managed to beat on earnings, while just 14% have missed.

In Europe, the Stoxx 600 falls 0.3% as underwhelming quarterly results from heavyweight Swiss drugmaker Novartis and French banking group BNP Paribas weigh on the Stoxx 600 index, while earnings boost Nordex, Capgemini and HSBC. Here are the biggest movers Tuesday:

- Nordex gains as much as 15% after the renewable-energy equipment firm lifted its Ebitda margin forecast for the full year, citing strong operational execution across its projects and service-business segment

- Capgemini shares jumped as much as 9.6%, the most in six months, after the IT services firm raised its full-year revenue guidance and reported a stronger-than-expected third quarter

- HSBC shares rise as much as 3.2% in London, most since May, after the banking firm raised its profitability outlook for 2025 while reporting what analysts say are good quarterly results

- Storytel gains as much as 19%, the most since January 2024, after the Swedish audiobook and publishing group reported earnings which blew past analysts expectations, with a full-year guidance upgrade providing further boost

- Airtel Africa shares surge as much as 11%, hitting an all-time high after the telecoms company posted results ahead of expectations in the first half

- Amundi shares rise as much as 1.5% as the investment management group reports net income ahead of analysts’ forecasts for its third quarter

- Symrise shares drop as much as 6.4%, the most since July, after the diversified chemicals manufacturer cut its organic sales forecast for the full year

- Bucher shares fall as much as 7.9%, hitting the lowest level since April, after the Swiss building materials firm changed the wording of guidance for 2025 operating profit margin to “lower” from “somewhat lower”

- Novartis shares drop as much as 4.1%, the most since April 9, after the Swiss drugmaker reported weaker-than-expected earnings for the third quarter and maintained its outlook for the year

- BNP Paribas shares fall as much 4.3% after the bank reported mixed 3Q figures, where overall revenues fell short, but the lender’s capital position impressed

- Wartsila falls as much as 9.3%, the most since April, before trimming losses. The Finnish marine and energy equipment maker reported its latest earnings, with analysts calling it a mixed report

- Truecaller falls as much as 16%, the most in two years, after the Swedish caller-ID platform reported disappointing third-quarter earnings. Analysts say the results were weighed down by poor advertising sales

Earlier in the session, a key Asian stock benchmark slipped, led by declines in South Korea and Japan, as investors positioned ahead of key interest rate decisions, global megacap earnings and a summit between the leaders of the world’s two largest economies. The MSCI Asia Pacific Index fell 0.5%, pressured by tech names including Samsung Electronics and Tencent. Australian drugmaker CSL was the biggest drag, plunging to a near seven-year low after delaying plans to spin off its vaccines business. Investor enthusiasm was on display Monday as the regional gauge hit a new record high. But with key developments ahead — including policy decisions from the Federal Reserve and Bank of Japan, earnings from five of the US Magnificent Seven, and a potential trade deal between Donald Trump and Xi Jinping — markets now face a moment of pause and reassessment. Shares also slumped in China, Australia and Indonesia. Stocks gained in Vietnam and Singapore.

In FX, Bloomberg Dollar Spot Index down, with yen outperforming following the Trump-Takaichi summit and supportive comments on the currency.

In rates, treasuries are narrowly mixed, keeping yields within a basis point of Monday’s closing levels. US 10-year is little changed at around 3.98% with Germany’s likewise steady and UK’s outperforming by about 1bp; curve spreads are also within a basis point of Monday’s close following muted price action during Asia session and London morning. Gilts outperform as UK borrowing costs approach lowest levels this year amid signs of cooling inflation. Focal points of Tuesday’s US session include 7-year note auction along with housing and consumer confidence data. This week’s Treasury coupon auctions conclude with $44 billion 7-year note sale at 1pm New York time, following good demand for Monday’s 2- and 5-year auctions.

In commodities, gold extends declines, having fallen below $4,000/oz yesterday; it’s currently trading down $77/oz to $3,904/oz.

Today’s US economic calendar calendar includes August FHFA house price index and S&P Case-Shiller home prices (9am), October Richmond Fed manufacturing index and Conference Board consumer confidence (10am) and Dallas Fed services activity (10:30am)

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini -0.4%

- Stoxx Europe 600 -0.2%

- DAX -0.1%, CAC 40 little changed

- 10-year Treasury yield -1 basis point at 3.97%

- VIX +0.1 points at 15.88

- Bloomberg Dollar Index little changed at 1211.08

- euro little changed at $1.165

- WTI crude -1.9% at $60.15/barrel

Top Overnight News

- Japan revealed potential projects for its $550 billion US investment fund, including ventures by SoftBank, Toshiba, and Westinghouse in AI, energy and critical minerals. The US will decide which projects will make the cut. BBG

- Daily share price swings worth hundreds of billions of dollars are becoming commonplace on Wall Street, highlighting the risks to investors as the Big Tech companies powering the stock market’s relentless rally grow more volatile. Individual stocks shave gained or lost more than $100bn in market value in a single day 119 times so far this year, the highest annual total on record. FT

- The nation’s largest federal workers’ union called for Congress to end the shutdown, now in its fourth week, putting new pressure on Senate Democrats who have repeatedly blocked a Republican measure that would reopen the government. WSJ

- The Federal Reserve is expected to end a 3 year phase of quantitative tightening this week, easing pressures on banks amid concerns that funding is getting too tight in money markets: FT, after ZH

- US President Trump says he will send in “more than the National Guard” into US cities if required.

- The EU is in talks with anchor investors including Denmark’s EIFO and the Novo Nordisk Foundation for its €5 billion fund to support AI, quantum and other strategic technologies, people familiar said. About €3 billion has already been committed. BBG

- Japanese PM Sanae Takaichi has pledged to reinforce Japan’s defense capabilities as she and President Donald Trump vowed to bring the US-Japan security alliance into a “new golden age.” FT

- South Korea’s economy accelerated at a stronger-than-expected pace in the third quarter, driven by government stimulus and exports’ resilience despite tariff headwinds. South Korea’s Q3 GDP comes in ahead of expectations at +1.7% Y/Y (vs. the Street +1.5%). WSJ

- PYPL +11% pre mkt on news that PayPal and OpenAi have signed an agreement to embed the payments wallet into ChatGPT. Starting next year, PayPal buyer and sellers will be able to complete transactions through the AI tool. BBG

- U.S. air travel turmoil deepened as nearly 7,000 flights were delayed nationwide on Monday, with air traffic controller absences surging as the federal government shutdown reached its 27th day. RTRS

- While the recent short squeeze has been unusually sharp, the still-elevated magnitude of short interest signals more room to run. Data released by FINRA shows that, as of last Wednesday, the median S&P 500 stock carried short interest equal to 2.3% of market cap. This ranks in the 67th percentile of the past 30 years and far above the 1.5% share that marked the peaks of the squeezes in 2000 and 2021. Goldman

Corporate News

- US equity futures (ES U/C NQ U/C RTY -0.3%) are mixed with the ES and NQ trading around the unchanged mark whilst the RTY is subdued. The DJIA saw some modest upticks following strong Q3 results from UnitedHealth, after the Co. beat on headline metrics and upgraded FY guidance.

- UnitedHealth Group Inc (UNH) Q3 2025 (USD): Adj. EPS 2.92 (exp. 2.84), Revenue 113.2bln (exp. 113.05bln), raises FY Adj. EPS to 16.25 (prev. guided 16.00).

- United Parcel Service Inc (UPS) Q3 2025 (USD): Adj. EPS 1.74 (exp. 1.3), Revenue 21.40bln (exp. 20.79bln); sees Q4 revenue around 24bln (exp. 23.87bln).

- Amazon (AMZN) announces organisational changes across the Co. that will impact some teammates; reduction in corporate workforce of approx. 14k roles. “We expect to continue hiring in key strategic areas while also finding additional places we can remove layers, increase ownership, and realise efficiency gains”.

- PayPal (PYPL) signs deal with OpenAI to become the first payments wallet in ChatGPT, via CNBC

Trade/Tariffs

- US President Trump and Japanese PM Takaichi signed an agreement on the US-Japan alliance and framework for securing the supply of critical minerals and rare earths. White House said that the US and Japan plan to use economic policy tools and coordinated investment to accelerate the development of diversified, liquid, and fair markets for critical minerals and rare earths. Furthermore, within six months of the framework’s date, Japan and the US intend to take measures to support projects that generate end products for delivery to buyers in the US, Japan, and like-minded nations, while they will work to secure their critical minerals and rare earths supply chains by addressing non-market policies and unfair trade practices.

- Japanese senior government official said Japan and the US governments are preparing to release a fact sheet that includes potential investment projects in the US, while the fact sheet will include power generation and automobile-related products as potential investment projects and is expected to include company names such as Mitsubishi Heavy Industries.

- China and ASEAN signed a free trade area 3.0 upgrade protocol, according to Xinhua.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks failed to sustain the momentum from the record highs on Wall St and were mostly subdued amid some profit taking and positioning ahead of this week’s upcoming risk events. ASX 200 retreated in the absence of major catalysts and was dragged lower by weakness in healthcare, tech and miners. Nikkei 225 pulled back from all-time highs amid a firmer currency and despite US President Trump’s visit to Japan, where he met with PM Takaichi and signed an agreement on US-Japan alliance and securing supply of critical minerals and rare earths. Hang Seng and Shanghai Comp were choppy ahead of the major risk events later in the week including the central bank decisions and the Trump-Xi meeting, while participants also reflected on recent comments from PBoC Governor Pan that they will resume government bond purchases and sales in the open market, as well as continue to maintain a supportive monetary policy stance and implement a properly loose monetary policy.

Top Asian News

- China releases proposal for 15th five-year plan, according to Xinhua; says China faces difficult challenges in global trade order, economic growth potential to be fully released. Vows to strengthen national security barriers. To combine an efficient market with a proactive government. Tech self-reliance to be greatly improved. To deepen reform and continue high-quality development. Economic growth potential to be fully released. Domestic demand continues to play a stronger role. Economic growth remains within a reasonable range. Faces difficult challenges in the global trade order. To foster emerging sectors and future industries. To improve the level of tech self-reliance. To promote coordinated development of the economy, society. To drive reasonable economic growth in the next five years. Transformation to accelerate breakthroughs. To increase international influence significantly by 2035. To drive a significant consumption rate among residents. Vigorously boost consumption. To build a modernised infrastructure facilities system. Enhancing fiscal sustainability. Give full play to the role of proactive fiscal policy. To form growth model more driven by consumption and demand. To increase share of central government fiscal spending.

- Japanese PM Takaichi thanked US President Trump for his enduring friendship with late PM Shinzo Abe, while she added that President Trump contributed to Asia’s peace, including the Thai-Cambodia deal, and stated that the Middle East deal was an unprecedented historical achievement. Takaichi said she highly values Trump’s commitment to world peace and stability, as well as expressed readiness to promote further collaboration with the US to achieve a free and open Indo-Pacific. Furthermore, Takaichi said she will continue to strive as Japan’s leader to strengthen the nation’s power, including defence capabilities, and wants to realise a new golden age of the Japan-US alliance with President Trump.

- US President Trump said former PM Abe was a great friend of his and noted that the US has received Japan’s orders of military equipment, which Trump appreciates, while Trump said they are signing a deal and that the US-Japan trade deal is a very fair deal. Furthermore, Trump said this will be a relationship that will be stronger than ever before and that the US is Japan’s ally at the strongest level.

- US Treasury Secretary Bessent highlighted in a meeting with Japanese Finance Minister Katayama the important role of sound monetary policy formulation and communication in anchoring inflation expectations and preventing excessive exchange rate volatility. It was also stated that conditions are substantially different twelve years after the introduction of Abenomics, while Bessent was glad to hear Katayama’s perspective on Japanese fiscal measures under consideration and expressed eagerness to learn more as the full package is developed to better understand its potential impact.

- Japanese Economy Minister Kiuchi said foreign exchange moves are determined by various factors and it is important for foreign exchange moves to reflect fundamentals and remain stable, while he added it is important to avoid rapid, short-term fluctuations in foreign exchange moves.

- Japan and South Korea are coordinating to hold the first summit meeting between PM Takaichi and South Korean President Lee on October 30th on the sidelines of the APEC summit meeting in South Korea, according to Asahi.

- Japan’s Finance Minister Katayama says there’s been no direct talks about the direction of Japanese monetary policy when asked about US Treasury Secretary Bessent’s readout. There’s no change to US-Japan joint statement on Forex. Bessent wasn’t urging BoJ to raise interest rate.

European bourses opened mostly lower across the board, continuing the subdued mood seen in the APAC session. Price action today has been fairly choppy in a tight range, with traders ultimately awaiting this week’s key risk events. European sectors opened mixed but now display a clear negative bias; Utilities takes the top spot, joined by Banks, whilst Basic Resources lags given the losses across metals prices. In terms of key movers today, HSBC (+2.5%, solid Q3 figures and raised RoTE guidance), BNP Paribas (-2.3%, missed expectations on bad loans), Novartis (-3.9%, Core EPS missed some analyst expectations).

Top European News

- UK is to stop disclosing identity of stock market short sellers, with the FCA overhauling regulations in a break from EU rules to be more in line with the US, according to FT.

- UK Chancellor Reeves says too much cost trading with the EU is pushing inflation up; sees “huge benefits” in rebuilding some EU relationships.

- ECB Consumer Expectation Survey: 1-year CPI 2.7% (prev. 2.8%), 3-year 2.5% (prev. 2.5%), 5-year 2.2% (prev. 2.2%)

- ECB October 2025 euro area bank lending survey Small, unexpected net tightening of credit standards for loans to firms, Credit standards unchanged for housing loans and moderately tighter for consumer credit. Demand for loans to firms increased slightly, but still weak overall. Housing loan demand continued to increase strongly.

- Nexperia’s owner Wingtech says the Co. faces an “existential threat” after the Netherlands took control of management, via FT; hundreds of jobs potentially at risk.

FX

- DXY is essentially flat and trades towards the upper end of a 98.56 to 98.79 range. Initial European action saw mild pressure in the Dollar, hampered by strength in the JPY and as the USD/CNY was once again fixed lower. Most trade-related headlines have been focused on US-Japan (discussed below), and with traders now counting down the clock to the Fed policy announcement on Wednesday. Before that, focus will be on US Consumer Confidence and the S&P Case-Shiller house price index later today.

- JPY is the clear G10 outperformer today, for three main factors. 1) Haven allure, given the subdued risk tone (also reflected in modest CHF upside), 2) some jawboning from the Japanese Economy Minister who said it is important to avoid rapid, short-term fluctuations in foreign exchange moves, 3) positive US-Japan trade developments. On the latter, US President Trump and Japanese PM Takaichi signed an agreement on the US-Japan alliance and framework for securing the supply of critical minerals and rare earths. Trump appeared pleased with the meeting, offering Takaichi “anything you want”. USD/JPY trades towards the mid-point of a 151.77-152.87 range.

- EUR is flat vs the Dollar. Focus today has been on the latest ECB SCE; 1yr inflation expectation revised a touch lower whilst the 3yr and 5yr remained unchanged – little move on this release. The ECB BLS, at the same time, highlighted that “Demand for loans to firms increased slightly, but is still weak overall”. Overall, traders are now awaiting the ECB policy decision on Thursday, but will likely lack fireworks given that markets almost entirely price in no change to the current rate. EUR/USD in a 1.1645 to 1.1667 range.

- GBP is slightly softer vs the Dollar. Started the European session flat, but was subject to a bout of pressure soon after. Nothing really behind the downside, but perhaps as traders focused on the recent FT article, which highlighted that the OBR is expected to cut its trend productivity growth forecast by about 0.3%, which is said to threaten a GBP 20bln hit to UK public finances. The move could also be technical, with EUR/GBP making a breach just above the 0.8750 mark, to make a peak at 0.8764.

- Antipodeans are essentially flat, and ultimately little reactive to the subdued risk-tone and the pressure across the metals space.

Fixed Income

- A firmer start to the day, but only modestly so for USTs. USTs at a 113-18+ peak, taking out the 113-16 peak from Monday and now approach the cluster of highs from last week between 113-20+ to 113-29. Upside that comes as equities fail to sustain the momentum seen yesterday to the benefit of FX havens and fixed, though XAU continues to slide; note, JPY also influenced by overnight trade developments. For fixed, specific a little light since Monday’s auctions. Firstly, the 2yr sale passed without impact, featuring an in-line cover though it did see the first tail, 0.1bps, for a 2yr tap since April. Thereafter, the 5yr tap stopped through by 0.1bps vs when issued, improving from the last outing. Additionally, the b/c marginally surpassed the six-auction average. Ahead, USD 44bln of 7yr notes due.

- Bunds were firmer early doors, in-fitting with the above. A move that has since continued, as, despite European equity sentiment lifting off worst levels, the tone remains a tepid one for the region. Bunds to a 129.73 peak, as is the case in USTs, this takes us above Monday’s 129.64 peak and closer to but yet to test the cluster of highs from last week between 130.02 and 130.38. For EGBs generally, the latest ECB SCE passed without impact with the 3yr and 5yr inflation views maintained while the 1yr view eased to 2.7% (prev. 2.8%). Ahead, a German Bobl tap.

- Elsewhere, France remains in focus as the debate around potential wealth taxes opens up day. The results of this will likely determine whether Lecornu’s 2nd attempt at government lasts or not in the near-term, as the Socialist Party have made clear that a workable compromise on wealth taxes is a key condition for their support.

- Gilts gapped higher, acknowledging the modest bullish bias in EGBs that emerged into the European cash equity open. Opened higher by 18 ticks and then climbed another 13 to a 93.96 peak. UK newsflow remains focused almost exclusively on the budget. The FT reported that the OBR is expected to cut its trend productivity growth forecast by about 0.3pps, a cut which equates to around a GBP 21bln hit to the fiscal situation. As a reminder, reports in recent weeks had generally been looking for a 0.2pps cut to the productivity view, equating to a GBP 14bln hit. If correct, the Chancellor will need to find another GBP 7bln from tax rises and/or spending cuts in the Autumn Budget.

Commodities

- WTI and Brent are significantly lower today, but without a clear driver. The complex began the European session with very mild losses, but then extended lower as the morning progressed. Geopolitics have been a little more tense (oil positive), with Israeli PM Netanyahu reportedly to hold an emergency meeting related to Hamas’s “violations” of the Gaza ceasefire. Perhaps more focus on the recent Bloomberg report, which suggested that OPEC+ is leaning towards another small oil output increase. Brent Dec’25 is currently trading just off lows in a USD 64.08-65.76/bbl range.

- Spot gold is also posting hefty losses, down by around USD 90/oz thus far; the yellow metal has slipped below the USD 3.9k mark and trades at the bottom-end of a USD 3,894.86-4,019.72/oz range. Nothing fresh is really driving the pressure today, but very much a continuation of the pressure seen over the past few days for the metal.

- Base metals are entirely in the red, as the complex pares back some of its recent advances and given the subdued risk-tone overnight. 3M LME currently at the lower end of a USD 10,864.35-11,052.4/t confine.

- Indian companies will not buy oil from Rosneft and Lukoil supplied by traders, according to Reuters, citing Indian government sources.

- IEA chief Birol said a significant chapter for LNG is starting soon and that 300bcm of LNG is to hit markets in the next five years. Birol said that, absent major geopolitical tensions, oil and gas prices are expected to be lower, while he added that sanctions could push oil prices upward, but the effect is likely to be limited due to surplus capacity and slowing demand.

- Venezuela’s President Maduro announces immediate suspension of energy agreements with Trinidad and Tobago.

- Russia’s Kremlin, on US President Trump’s statements that countries should cease buying Russian oil, says many say they will figure it out for themselves, partners will make up their own mind about whether or not to buy top-quality Russian energy product.

Geopolitics: Middle East

- Palestinian TV reported that Israeli vehicles fired on the eastern areas of Gaza City, according to Sky News Arabia.

- Israeli PM Netanyahu is to hold an emergency meeting today to discuss Hamas’ “violations” of the Gaza ceasefire, via Sky News Arabia.

- “Channel 12 quoted an Israeli official: We will take steps against Hamas’ violation of the agreement to return the bodies”, via Al Jazeera.

Geopolitics: Other

- Russia’s Kremlin, on Ukraine peace negotiations, says Russia cannot assess the prospects and Kyiv caused the pause; says there are foreign fighters at the front line in Ukraine and “we shall destroy them”. Military overhears foreign languages spoken repeatedly at the front line in Ukraine.

- US State Department senior official said the US expects Thailand will work with Cambodia to begin the release of 18 soldiers immediately, while the official added that US policy towards North Korea remains aimed at denuclearisation, and that US policy on Taiwan has not changed.

- North Korea said Foreign Minister Choe met with Russian President Putin and discussed many businesses to strengthen bilateral relations, while Choe and Russia’s Foreign Minister Lavrov agreed on all points while holding strategic discussions on global issues. Furthermore, the North Korean side expressed support for Russian measures to remove the root of the Ukraine conflict, and the Russian side expressed support for North Korean efforts to protect its current position, security interests, and sovereign rights, according to KCNA.

- Ukrainian President Zelensky says Ukraine will ‘take no steps back’ on the battlefield to cede territory; Ukraine is ready for peace talks anywhere besides Russia and Belarus if it ends the war.

US Event Calendar

- 9:00 am: Aug FHFA House Price Index MoM, est. -0.05%, prior -0.1%

- 9:00 am: Aug S&P Cotality CS 20-City YoY NSA, est. 1.3%, prior 1.82%

- 9:00 am: Aug S&P Cotality CS U.S. HPI YoY NSA, prior 1.68%

- 10:00 am: Oct Richmond Fed Manufact. Index, est. -11.5, prior -17

- 10:00 am: Oct Conf. Board Consumer Confidence, est. 93.35, prior 94.2

DB’s Jim Reid concludes the overnight wrap

Back in the EMR hot seat, although I’m actually trying not to sit down for long after undergoing back fusion surgery 13 days ago. I spent last week quietly wrapping up the annual long-term study — more on that below. The surgery was a success, though at 4.5 hours long and with my insides squeezed to one side for most of it, I’ve been left feeling a bit like a washing machine after a particularly aggressive spin cycle. The silver lining? I’m now over a centimetre taller and edging back closer to the six-foot mark I claimed on my internet dating profile 15 years ago — the one that led me to my wife. She’s finally reconsidering her legal action for misrepresentation after weighing in at 5 foot 11 since the discs in my back collapsed.

Pain levels have actually increased this week, as my newly aligned spine is activating muscles that haven’t been used in years. My hip flexors are particularly sore at night, which isn’t ideal for sleep. I’m walking on the spot as I type this trying to distract myself from the pain. I’m not allowed to bend, lift or twist, so stretching is off the table. Now begins the slow process of waiting for the bone to fuse around the cage in my back. Best-case scenario: back to golf in five months and 18 days. Not that I’m counting.

If that sounds long-term, yesterday marked the release of the 20th anniversary edition of my long-term study — a report that draws on data going back, in some cases, to the 18th century. It analyses nominal and real returns across 56 economies to explore how different assets have performed under varying conditions, helping investors tilt the long-term odds in their favour. This year’s edition, titled “The Ultimate Guide to Long-Term Investing”, is the lead piece on the Deutsche Bank Research Institute site (link here). It’s open to all, so feel free to share it with clients, colleagues, family and friends. Hopefully it resonates, as almost everyone has a reason to invest for the long term — whether it’s building a pension, planning for early retirement, funding a child’s education, helping them onto the property ladder, outperforming peers in the financial world, or simply saving for a rainy day.

From 200+ years of data to the last 24 hours, and markets delivered another ebullient performance yesterday. Optimism around a potential US-China trade truce and tech-positive developments helped push multiple indices to record highs globally. That said, we’re heading into a pivotal week with four major central bank meetings, earnings from five large tech firms still to come, starting with Microsoft, Meta and Alphabet tomorrow, and a potential Trump/Xi meeting. Ahead of this, the S&P 500 (+1.23%) and STOXX 600 (+0.22%) began the week on a positive note. However, in Asia this morning, the Nikkei (-0.75%) and KOSPI (-1.48%) in particular are giving some of their gains back from yesterday as we await a week of heavy newsflow.

Investor anticipation of a constructive outcome from President Trump’s expected meeting with President Xi on Thursday was reinforced by Trump’s remarks to reporters: “I have a lot of respect for Xi. I think we’re going to come away with a deal.” He also hinted that a resolution on TikTok might be reached during their discussions. As a reminder, Treasury Secretary Bessent first mentioned a “framework of a deal” back in September, before October’s move on rare earth exports by Beijing drove an escalation in rhetoric. Yesterday’s renewed optimism helped push the S&P 500 (+1.23%) and Nasdaq Composite (+1.86%) to new highs, with the S&P seeing its best three-day (+2.62%) run since May. US futures overnight are pretty flat. Trade-sensitive indices like the Nasdaq Golden Dragon Index (+1.59%) and the Philadelphia Semiconductor Index (+2.74%) outperformed yesterday. Front-end US Treasuries sold off amid the risk-on mood, with the 2yr yield rising (+1.0bps), but 10yr (-2.2bps) and 30yr (-4.1bps) bonds rallied.

Equities also benefited from a series of tech-positive headlines. Qualcomm shares jumped +11.09% after unveiling a new semiconductor chip expected to rival Nvidia’s — though Nvidia itself didn’t miss a beat (+2.81%). Reuters reported that the US Department of Energy is forming a $1bn AI partnership with AMD (+2.67%) to build two supercomputers. These developments contributed to the Philadelphia Semiconductor Index’s outperformance, while the Mag-7 (+2.60%) saw their best day since May.

Staying in the US, Bessent confirmed the final five candidates for Fed Chair: Kevin Hassett, Kevin Warsh, Christopher Waller, Michelle Bowman and Rick Rieder. He plans to submit the shortlist to Trump after Thanksgiving. However, Trump responded that he was thinking about Bessent himself for the Fed Chair job, as well as Secretary of State Marco Rubio and US Trade Representative Jamieson Greer. While those Trump comments may not have been entirely serious, it’s also not clear how much weight investors should place on Bessent’s shortlist. Our economists continue to expect a 25bps rate cut this Wednesday, alongside an announcement to end QT in response to tightening financial conditions. (See their preview here).

On the data front, in the US the Dallas Fed Manufacturing Activity Index came in at -5.0, better than expectations of -6.2. Germany’s IFO Business Climate survey also beat expectations slightly (88.4 vs 88.0). That was driven by business expectations (91.6 from 89.7) improving to their highest level since February 2022, though the current situation assessment deteriorated (85.3 vs 86.0) to an 8-month low. So the recent pattern of greater optimism about the future, but little improvement in the present continued. Encouragingly it is IFO expectations that tend to have the better predictive power for growth. Still, headwinds remain, including the impact of the second “China shock” on German manufacturing. In a note yesterday (link here), our Germany economists discuss Germany’s evolving relationship with China and the potential policy response.

With IFO expectations rising, German bunds underperformed their European peers, with the 10-year yield falling -1.1bps, compared to -2.4bps and -1.7bps for Italian and French equivalents. UK Gilts (-3.0bps) continued their strong run, now at their lowest yield since December 2024.

Gold prices fell another -3.18%, dropping below the $4,000/oz threshold — the second steepest daily decline since November last year. Last Tuesday’s -5.20% drop was the largest in five years. Gold is now down -8.59% from its peak just a week ago. Brent crude oil (-0.49%) retreated slightly after last week’s rally, despite positive US-China trade signals and comments from Ukrainian President Zelenskiy that Ukraine will expand strikes on Russian refineries.

Elsewhere, Mexico’s President Claudia Sheinbaum announced that the US will extend its trade deadline by several weeks, allowing more time to resolve non-trade barriers. The Mexican peso rose +0.28% in response, while the Argentine peso surged as much as +9.9% before settling at +4.15%, fuelled by investor enthusiasm following President Milei’s party victory over the weekend.

Returning to Asia, most equity markets are experiencing declines, as hinted at the top. Other than the bigger falls for the Nikkei and KOSPI already mentioned, most Asian markets are down a few tenths of a percent. Data revealed that South Korea’s GDP increased by +1.7% y/y (compared to the +1.5% anticipated), marking its fastest growth in over a year during the third quarter, propelled by government stimulus and resilient exports despite challenges from tariffs. The economy had expanded by 0.6% in the second quarter.

In other areas of the market, the yuan appreciated by +0.13%, reaching 7.0995 against the dollar, its strongest position in nearly a year, fueled by optimism regarding a potential trade agreement between China and the US. Furthermore, the Japanese yen (+0.65%) is also gaining strength, rising to approximately 151.89 against the dollar, recovering from near eight-month lows as the meeting between Prime Minister Sanae Takaichi and President Trump seemed to go well with lots of positive headlines on trade and defence.

Looking ahead today, we’ll get Germany’s November GfK consumer confidence, Italy’s October consumer confidence and economic sentiment, manufacturing confidence, and EU27 September new car registrations. Central bank events include the ECB’s bank lending survey and a speech from ECB’s Panetta. Earnings releases include Visa, UnitedHealth, Novartis, HSBC and PayPal. The US will also auction $44bn in 7-year notes.

Tyler Durden

Tue, 10/28/2025 – 08:36ZeroHedge NewsRead More

R1

R1

T1

T1