Mediocre 7Y Auction Tails Most In 14 Months As Foreign Buyers Stay On Sidelines

If yesterday’s 5Y auction was stellar, with solid demand across the board including a jump in foreign demand, then today’s sale of $44BN in 7Y paper, the week’s final coupon auction in an abbreviated schedule ahead of tomorrow’s Fed decision, was mediocre at best.

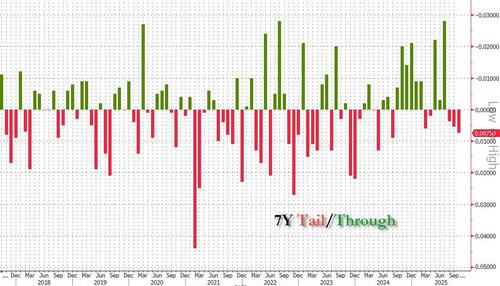

The auction priced at a high yield of 3.790%, down from 3.953% in September and the lowest since Sept 24; it tailed the When Issued 3.782% by 0.8bps, the third tail in a row and the biggest tail since last August.

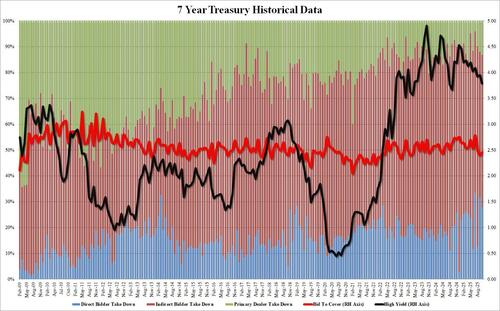

The bid to cover was 2.457, up from 2.395 which however was a multi-year low; in the context of recent auctions today’s btc was subpar, printing below the six auction average at 2.575.

Internals were also mediocre, if better than the dismal September auction: Indirects were awarded 59.0%, up from 56.4%, but below the six-auction average 67.3%. And with Directs dipping to 27.9%, Dealers were left with 13.14%, the highest since April.

Overall, this was a mediocre, forgettable, and very tailing “belly-busting” 7Y auction which is somewhat surprising ahead of tomorrow’s Fed decision which is expected to see not only a rate cut but put an end to QT as first noted here two weeks ago.

Tyler Durden

Tue, 10/28/2025 – 13:27ZeroHedge NewsRead More

R1

R1

T1

T1