Fed Cuts 25bps, Ends QT As Expected; Two FOMC Officials Dissent

In our preview we said that the Fed would cut 25bps and end QT… and that’s precisely what happened.

* * *

First, a quick preview of how we got here:

Since the last FOMC meeting (on Sept 17th), Gold has dramatically outperformed across asset-classes (even with its recent plunge) followed by US equities. Oil prices have tumbled the most while the dollar and bonds have risen in value. Bitcoin is basically unchanged since the last FOMC meeting, having collapsed after reaching record highs intramonth…

The market has grown more dovish since the last Fed meeting, now fully pricing in a 25bps cut today (and is almost certain that December will see another 25bps cut)…

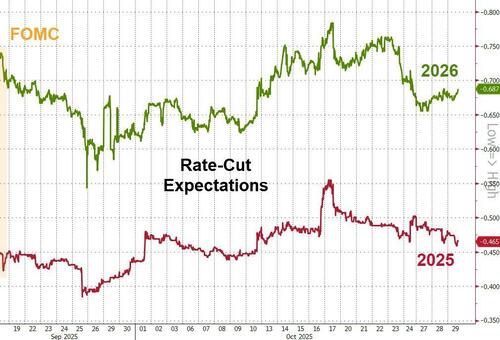

More notably, rate-cut expectations have barely changed since the last FOMC with 46bps of cuts priced in for 2025 and 69bps more priced in for 2026…

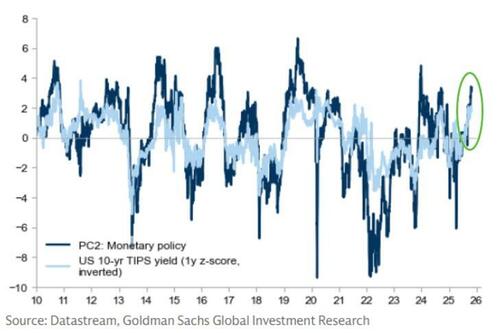

Finally, before we get to the meat and potatoes of today’s statement, we note that Goldman Sachs models show monetary policy at its most dovish in years…

And bear in mind that financial conditions have never been ‘easier’…

So as we detailed in the FOMC preview, the two main questions for traders today is:

1) will the statement/presser provide support for the market’s current dovish future take (given the market’s anticipation of a 25bps cut, Goldman notes that it would likely be a high bar for the FOMC to change its plan on the basis of alternative data, and in any case the data have not given them any reason to), and,

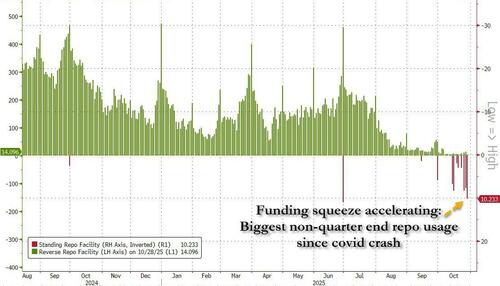

2) will Powell officially announce the end of QT, as we discussed extensively in recent weeks (here and here), as a result of deteriorating conditions in money markets, the Fed is expected to announce changes to its balance sheet program. Fed Chair Powell suggested that the level of reserves will likely hit an ample level within a couple of months, although as we highlighted, the combination of reserves and reverse repos is now the lowest it has been since 2020 resulting in a creeping increase in the SOFR rate.

Meanwhile, usage of the Fedʼs repo facility has picked up, suggesting that some participants may be growing tighter on cash.

With that in mind, here are the key headlines from the FOMC Statement:

- The FOMC cut the federal funds rate target range by 25 bps to 3.75%-4.00%, as expected.

- The Fed announced that QT (aka the run-off of Treasury securities from the Fed’s balance sheet currently capped at $5 billion per month) would conclude on December 1, as also became consensus in recent days as a result of turmoil in funding markets.

- There were twp dissents, one from Fed Governor Stephen Miran in favor of a 50-bp cut, and one from Jeffrey Schmid, who preferred no change to the rate cut.

Developing

Tyler Durden

Wed, 10/29/2025 – 14:03ZeroHedge NewsRead More

R1

R1

T1

T1