Futures Push To New Record, Nvidia Above $5 Trillion Ahead Of Fed Rate Cut And Mag 7 Earnings

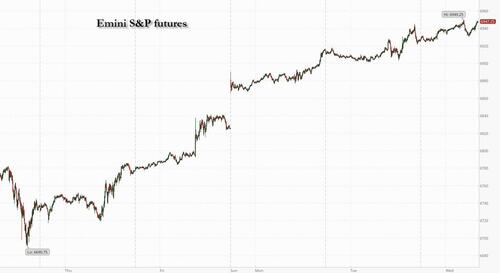

With the year-end performance chase officially open…

remove the almost https://t.co/wECpqhB3sL pic.twitter.com/3A7iAxOIjV

— zerohedge (@zerohedge) October 29, 2025

… US futures march higher into today’s Fed and Mag7 earnings (GOOG, META, MSFT adding up to more than $9TN in market cap) on relentlessly positive AI news, optimism about trade and expectations of a cut from the Fed later. As of 8:00am ET, S&P futures are up 0.3% and Nasdaq futures gain another 0.5%, with both indexes in record territory. Nvidia rose 3% premarket after Trump said he’ll discuss its Blackwell processors with China’s Xi Jinping (during their 3 hour meeting confirmed for tomorrow morning), setting the AI giant on course to become the first public company worth $5 trillion when it opens for trading. There are also reports that the US-China deal will include a reduction in the fentanyl tariffs from 20% to 10%, boosting overall sentiment. All Mag7 names are higher with Semis also bid. Bloomberg reported that China is set to purchase its first cargoes of US soybeans this season, while Trump also said that US and SKorea have reached a trade deal. Cyclicals are mixed despite a rebound in Metals / Miners abut Defensives are being dragged lower by Staples. Commodities are mixed but Precious / Base Metals are rallying after gold / silver look to form a level after correcting 10% and 15% (gold trading back over $4000) while copper hit a record above $11K amid a series of supply setbacks at leading mines. Bond yields are up 1bps across the curve and the USD is bid for the first time this week. Today’s big event is the Fed decision as well as earnings by 3 of the Mag 7; we also get September pending home sales at 10am.

In premarket trading, all Mag 7 stocks are all higher: Nvidia is up 4% after US President Donald Trump said he’ll discuss the chipmaker’s Blackwell artificial intelligence processors with Chinese leader Xi Jinping, putting the company on track to become the first $5 trillion business by market value (Apple +0.3%, Tesla +0.9%, Alphabet +0.2%, Microsoft +0.4%, Meta Platforms (META) +0.1%, Amazon (AMZN) + 0.1%.

- Avantor (AVTR) tumbles 17% after the maker of laboratory supplies reported net sales for the third quarter that fell short of the average analyst estimate. The firm also recorded a non-cash goodwill impairment charge of $785 million related to its Distribution reporting unit.

- Bloom Energy (BE) gains 18% after the company reported adjusted earnings per share for the third quarter that beat the average analyst estimate.

- Caterpillar Inc. (CAT) rises 4% after posting higher third-quarter revenue, with its energy and transportation business boosting earnings amid rising demand for equipment needed to fuel data centers for artificial intelligence.

- Enphase Energy (ENPH) declines 11% after the firm’s fourth-quarter revenue forecast missed the average analyst estimate. Several price target cuts from analysts including JPMorgan and Evercore.

- Etsy (ETSY) falls 9% after the online marketplace company reported its third-quarter results. It also named Kruti Patel Goyal, currently chief growth officer, to the CEO job, effective Jan. 1.

- Fiserv (FI) tumbles 27% after it slashed its outlook for full-year earnings and said it’s overhauling its top leadership committee.

- Generac (GNRC) plunges 9% after the power-equipment company cut its adjusted Ebitda margin and net sales growth forecast for the full year. The firm also posted adjusted profit and net sales for the third quarter that fell short of expectations. .

- Mondelez (MDLZ) is down 5% after the snack-food company cut its adjusted earnings per share forecast for the full year.

- Seagate Technology (STX) is up 5% after the computer hardware and storage company reported first-quarter results that beat expectations and gave an outlook.

- Stride Inc. (LRN) tanks 42% after the online education company gave an outlook that was much weaker than expected, prompting a downgrade. The company cited technical issues during the rollout of a new learning management system that fueled student withdrawals.

- Teradyne (TER) rises 20% after the company forecast adjusted earnings per share for the fourth quarter above the average analyst estimate.

- Varonis Systems (VRNS) plunges 29% after the data-security software company’s updated full-year revenue forecast came in below the average analyst estimate. It also reported third-quarter revenue that missed expectations.

Traders are gearing up for two pivotal days featuring a Fed decision, US-China trade talks, and earnings from five of the Magnificent 7, while Nvidia is set to be the world’s first $5 trillion public company. NVDA haares rallied after Trump said he expects to discuss Nvidia’s flagship Blackwell AI chip in Xi talks on Thursday. Trump also said he expects to lower tariffs the US imposed on Chinese goods over the fentanyl crisis as leaders of the world’s biggest economies seek to ease tensions in a meeting on Thursday. Meanwhile, China was reported to purchase first cargoes of US soybeans this season.

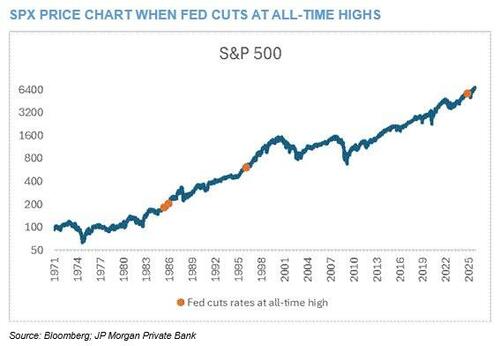

Looking ahead, JPMorgan this morning reminds us that “today will be the fifth time that the Fed cuts rates with the S&P 500 at all-time highs. All prior instances the S&P 500 was higher a year later with an average return of 20%. The worst one-year return was a 15% gain which occurred last year.”

In other trade news, Trump said he had reached a deal with South Korea, though he later tempered the comment by saying the agreement was close to being finalized. Futures on South Korea’s Kospi 200 stock index rose.

There are some clouds in the sky: the breadth of the S&P 500’s gain on Tuesday was the narrowest since at least 1993, replicated overnight by Japan’s benchmark Nikkei 225, adding to the theme of concentration with a strong gain generated by a relatively low number of advancers. BofA technical analyst Paul Ciana notes “the ghosts and goblins of Sept-Oct are fading away as we head into the most wonderful time of year,” while cautioning healthy bull markets are built on breadth and rotation “both of which have waned.”

“From an investment standpoint, while the narrative for US equities remains ‘bullish with conviction,’ sustaining this uptrend will require patience and disciplined risk management,” wrote Linh Tran, market analyst at XS.com. “Monetary policy decisions, trade developments, and corporate earnings are set to become the key catalysts driving the next phase of the market.”

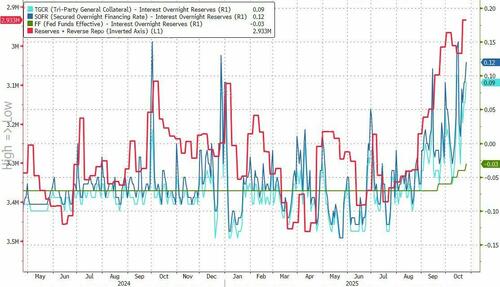

Turning to the main event, the Fed is set to cut by 25 basis points, and is likely to announce an end to Quantitative Tightening (QT) as there are increasing signs that bank reserves in the last two weeks have transitioned from an “abundant” to an “ample” level – the stopping point for QT, according to guidance from Powell (our full preview is here).

“The decisive factor will be Powell’s press conference and how he assesses the current situation with regard to the labor market, because we are not getting any real data at the moment due to the government shutdown,” said Unicredit strategist Christian Stocker. “The economy will continue to develop solidly if we get some interest rate cuts next year. That would certainly be very, very decisive for the stock market.”

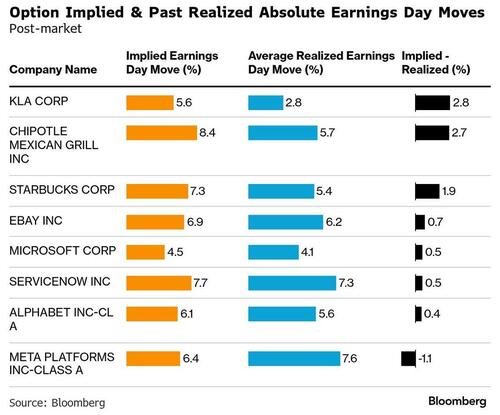

Besides the Fed, attention will be on the first batch of Mag 7 companies reporting after the close including GOOG, META, MSFT (full preview to follow). We also get earnings from ServiceNow, Starbucks, Chipotle, KLA, and eBay after the close. So far earnings season is very strong: of the 197 S&P 500 companies that have reported so far in the earnings season, 85% have managed to beat analyst forecasts, while 14% have missed. Boeing, Caterpillar, CVS, Fiserv, Phillips 66 and Verizon are among companies expected to report results before the market opens. Analysts have noted that, while tariffs and subdued demand have weighed on 2025 profitability, strong backlogs should provide Caterpillar a cushion, and tailwinds in power generation should support growth in the coming years.

The Magnificent Seven are projected to post third-quarter profit growth of 14%, nearly double the 8% expected for the broader S&P 500.

“The story of AI is still intact,” said Anthi Tsouvali, a multi-asset strategist at UBS Global Wealth Management. “The fact that the Fed is cutting rates — and we do expect that the Fed will cut another 25 points — is very good for the economy. It’s easing financial conditions, boosting growth.”

In Europe, the Stoxx 50 also at a record after copper hit an all-time high on the London Metal Exchange. The metal — a bellwether for global growth — has surged as the US and China move closer to a trade deal. Automakers also gained after Mercedes-Benz Group AG’s upbeat earnings signaled confidence in its cash generation despite trade hurdles. Among other movers in Europe, Glencore Plc rose after saying it’s on track to hit full-year production targets. Banco Santander SA and Deutsche Bank AG gained after earnings beats. Adyen NV surged after the payments solutions company exceeded analysts’ revenue estimates. UBS Group AG fell on legals risks arising from a Swiss court ruling. Here are the biggest movers Tuesday:

- Deutsche Bank shares rose 4.6%, the best performer on the Stoxx 600 Banks Index, after the German lender beat estimates as revenue from fixed-income trading exceeded analysts expectations

- Temenos shares jump as much as 16%, the most in three months, after the software company reported beats across metrics in its third quarter and raised its Ebit forecast for the full year

- Neste shares gain as much as 9.7%, the most since July, after the Finnish energy group reported its latest earnings. Analysts highlight a strong Ebitda beat, and while the renewables segment performed well

- Sweco soars as much as 13%, the most since May 2024, after the Swedish engineering consultancy delivered third-quarter Ebita ahead of expectations

- Straumann shares rise as much as 10%, the most in over six months, after the dental implant maker reported organic growth ahead of expectations in the third quarter

- Mercedes-Benz shares rise as much as 7.9% to their highest intraday since March after the German carmaker confirmed its full-year outlook and said it plans to proceed with a €2 billion share buyback

- Next shares rise as much as 7.5% after the British clothing and homewares retailer boosted its profit guidance for the fourth time this year, to a level ahead of estimates and analysts say results were “impressive”

- OMV gains 3% after the Austrian oil and gas company reported its latest earnings, which analysts say is a solid showing, with a quarterly beat driven by an outperformance for its Fuels & Feedstock division as refining strength

- Moncler shares fell as much as 4.6% after the company reported “lackluster” third-quarter sales, according to Oddo BHF, whose analyst noted the Italian luxury group’s cautious tone for the rest of the year

- UBS shares declined as much as 2.4%, reversing earlier gains of much as 4%, after investor focus turns to potential legal risk from a Swiss court ruling canceling the controversial writedown of Credit Suisse bonds

- Epiroc falls as much as 8.1%, the most since July, after the Swedish mining equipment maker reported disappointing 3Q, with analysts flagging continued margin struggles and the print coming up short against elevated expectations

- Nordic Semiconductor shares fall as much as 8.8% after the chipmaker gave a 4Q sales guidance that met analyst estimates, but failed to inspire investors that had already pushed the stock up over 60% this year prior to the result

- Telenor shares drop as much as 4.9% after the telecom operator reported results that met expectations but flagged several risk factors in Asia, including an upcoming spectrum renewal at the Grameenphone subsidiary in Bangladesh

- SKF shares drop as much as 5.5%, pulling back from a four-and-a-half year high, after analysts at Citi said the maker of bearings and sealing systems pointed to weaker growth in the final quarter of the year

- Electrolux Professional falls as much as 10% after the company reported its latest earnings, with DNB Carnegie flagging misses on quarterly sales and Ebitda, with the latter weighed down by continued currency headwinds

Earlier in the session, Asian stocks also advanced, boosted by the technology sector on AI-driven earnings strength, as investors awaited a meeting between Donald Trump and Xi Jinping. The MSCI Asia Pacific Index gained 0.5%, with Nvidia suppliers Advantest and SK Hynix among the biggest boosts after reporting strong outlooks. Japan’s Nikkei 225 climbed 2%, with gains also notable in South Korean and Taiwanese benchmarks. Trump arrived in South Korea, with which his administration is slated to sign a deal Wednesday on bolstering cooperation in AI and other areas. The US president will meet his Chinese counterpart Xi on the sidelines of the Asia-Pacific Economic Cooperation summit on Thursday as they look to finalize a sweeping trade agreement. Onshore Chinese equities advanced, while Hong Kong’s market was closed for a holiday. Equities declined in Australia, Singapore and Malaysia.

In FX, the dollar is strengthening after recent bout of weakness, with Bloomberg Dollar Spot Index up 0.1%. Sterling underperforms.

In rates, treasuries edge lower across the curve, underperform European bonds as markets brace for a busy session that includes Federal Reserve rate decision and ongoing Asia trade negotiations. Yields at 1bp-2bp cheaper across a slightly steeper curve, the 10-year near 3.99%, trailing German and UK counterparts by 1bp and 2bp. Fed-dated OIS contracts fully price in a 25bp rate cut for today’s policy announcement and a combined 47bp by year-end, a period including just one additional decision in December; today’s meeting is anticipated also to include guidance on Fed’s plans to stop shrinking its holdings of Treasuries. A decision on that has potential to drive outperformance by Treasuries vs interest-rate swaps, benefiting a recently popular trade.

In commodities, gold rises back above $4,000/oz and oil prices remain volatile. Brent futures holding above $64/barrel. Copper hits a new record high amid broad gains for base metals.

Looking ahead, today’s key events include the Fed and BoC decisions. Data releases feature US September advance goods trade balance, wholesale inventories, and pending home sales; UK September net consumer credit; Italy’s September PPI and hourly wages; and Sweden’s September GDP indicator. Earnings are due from Microsoft, Alphabet, Meta, SK Hynix, UBS, and others. The US will auction $30bn in 2yr FRNs. And we also have the early general election in the Netherlands.

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini +0.3%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 +0.1%

- DAX little changed

- CAC 40 little changed

- 10-year Treasury yield +1 basis point at 3.99%

- VIX -0.1 points at 16.33

- Bloomberg Dollar Index +0.2% at 1212.15

- euro -0.2% at $1.1628

- WTI crude -0.3% at $59.96/barrel

Top Overnight News

- Trump said he expects to lower fentanyl-linked tariffs on China as Beijing confirmed a high-stakes meeting between Chinese President Xi Jinping and the American leader. Trump said he might discuss Nvidia’s advanced AI chips with China soon. CNBC

- Trump announces trade breakthrough with South Korea on Asia trip: RTRS

- Trump said he threatened India and Pakistan with 250% tariffs to help spur the resolution of their conflict earlier this year. BBG

- China has started purchasing American soybeans according to Reuters, a sign of easing trade tensions between Washington and Beijing. RTRS

- Trump said they have secured commitments of over $18tln in new investments and that probably USD 21tln–22tln of investment is coming into the US by the end of the second term. Trump said he expects 4% GDP growth next quarter and that factories are booming in the US, while he commented that they will not have the Federal Reserve raising rates.

- The Republican-led Senate on Tuesday delivered a rare bipartisan rebuke of President Trump in a vote to terminate the emergency powers he has used to set tariffs on Brazil, part of a larger push to rein in the administration’s efforts to install trade barriers. This may prove to be just symbolic since Speaker Mike Johnson is unlikely to bring the measure up for a vote in the House. Politico

- Australia’s CPI overshoots the consensus in Sept (+3.5% vs. the Street +3.1%), dashing hopes for an RBA rate cut. WSJ

- Israel began re-enforcing a Gaza ceasefire after conducting overnight air strikes in retaliation for a Palestinian attack against its troops. BBG

- The US drugs regulator is preparing to accelerate approvals for cheaper generic versions of complex biological medicines, threatening to jeopardize revenue for some of the industry’s most profitable products. FT

- The BOC is expected to cut rates by 25 bps today to help an economy that’s suffering more damage from US tariffs, even as PM Mark Carney finalizes plans for a stimulative budget. BBG

- FOMC preview: The FOMC is set to deliver another 25bp rate cut to 3.75-4% at its October meeting next week. The median projection in the September dot plot showed a baseline of three cuts this year, and with the official data paused by the government shutdown and alternative labor market data mixed at best, there is no reason to deviate from the plan to support the labor market for now.

- The market cap of NVDA (~$4.86 trn) is closing in on the market cap of the entire Industrials S&P500 GICS (~$4.89 trillion), composed of 79 companies.

Trade/Tariffs

- Trump said he had a great trip so far and expects to lower fentanyl-linked tariffs on China, while he will discuss farmers and fentanyl with China. Trump reiterated that he thinks they will have a great meeting with Chinese President Xi and relations with China are very good. Furthermore, Trump said he may speak about NVIDIA’s (NVDA) Blackwell chip with Xi.

- Trump posts “Bringing back Trillions of Dollars to USA! A great trip. Dealing with very smart, talented, and wonderful Leaders. Tomorrow, President Xi of China. It will be a great meeting for both!!! President DJT”.

- Trump says the meeting with Chinese President Xi will be three hours long before returning back to the US; says things will work out very well with Xi tomorrow.

- China’s COFCO purchased three cargoes totalling 180k tonnes of US soybeans ahead of Trump-Xi meeting, according to sources cited by Reuters.

- US President Trump posted “For those that are asking, we didn’t come to South Korea to see Canada!” Trump separately commented that a trade deal with South Korea will be finalised very soon.

- South Korean President Lee’s office said that South Korean President Lee and US President Trump will discuss trade, investment and Korean peace, while it noted that Lee is to gift a mock-up of a golden crown to Trump and hopes that Trump’s visit will lead to a tangible outcome of cooperation.

- US Senate passed a bill to terminate Trump tariffs against Brazil.

- Chinese President Xi confirms meeting with US President Trump on Oct 30th in South Korea, via Xinhua. Chinese Foreign Ministry, on the meeting between Presidents Trump and Xi, says will inject new momentum into steady development of US-China relations; stands ready to work with the US for positive outcomes.

- Japanese PM Takaichi told US President Trump that banning LNG imports from Russia will be difficult according to Nikkei.

- US President Trump says, “we did reach a deal on trade with South Korea”, via Bloomberg.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were predominantly in the green following the tech strength on Wall St, where most indices extended on record highs, while participants now await the approaching flurry of risk events, including the FOMC and mega-cap earnings. ASX 200 retreated with the index dragged lower by notable weakness in health care, real estate, industrials, financials and tech, while firmer-than-expected inflation data further dampened hopes for a cut at next week’s RBA meeting. Nikkei 225 extended its rally and outperformed against regional peers after climbing above the 51,000 level for the first time, with tech stocks buoyed after the gains in US counterparts and strong Advantest earnings. Shanghai Comp was positive but with gains capped amid thinner volumes, with Stock Connect trade shut alongside the closure of markets in Hong Kong for a holiday, while it was also reported that China’s COFCO purchased 180k tonnes of US soybeans ahead of the Trump-Xi meeting.

Top Asian News

- South Korean President Lee said the global economy is facing various challenges, including supply chain shifts, while he added that a deepening trade and investment partnership is fundamental to Asia-Pacific nations, and he will propose an AI initiative at the APEC summit.

- US Treasury Secretary Bessent commented that he looks forward to working with Japan’s Finance Minister Katayama and is encouraged by her understanding of how Abenomics has moved from a reflationary policy to a program that must balance growth and inflation concerns. Bessent also stated that “The Government’s willingness to allow the Bank of Japan policy space will be key to anchoring inflation expectations and avoiding excess exchange rate volatility.”

- Japanese Chief Cabinet Secretary Kihara said ‘no comment’ on US Treasury Secretary Bessent’s X post, while Kihara added that monetary policy falls under the jurisdiction of the Bank of Japan and he expects the BoJ to conduct monetary policy to appropriately achieve the inflation target. Furthermore, he said the government will continue to closely coordinate with the BoJ.

European bourses (STOXX 600 +0.1%) are mixed, with price action this morning fairly rangebound awaiting today’s key risk events which include the FOMC policy decision and a slew of earnings. European sectors hold a negative bias. Autos takes the top spot, boosted by post-earning strength in Mercedes Benz (+6.9%) – headline Q3 metrics were not so great, but sentiment was already dampened heading into the results and investors may instead focus on the EUR 2bln buyback. Analysts at Jefferies suggested that the divisions figures saw “comfortable beats”. Other key movers today; GSK (+3%, headline beats and upgraded 2025 guidance), Deutsche Bank (+1.3%, strong Q3 profit growth), UBS (U/C, strong Q3 Net Income, plans USD 900mln buyback in Q4).

Top European News

- Politico reports that the full debate on a French wealth tax (i.e. the Zucman tax) will not happen on Wednesday or Thursday, but is likely on Friday.

FX

- DXY is on a firmer footing and trades at the upper end of a 98.62-99.00 range. Focus this morning has been on the ongoing US-China related updates, which in-brief have been positive. US President Trump said he had a great trip so far and expects to lower fentanyl-linked tariffs on China, while he will discuss farmers and fentanyl with China – most recently the President posted on Truth that “it will be a great meeting” for both countries. Elsewhere, Reuters reported that China’s COFCO purchased three cargoes totalling 180k tonnes of US soybeans ahead of Trump-Xi meeting, according to sources cited by Reuters. Focus ahead is ultimately on the Fed policy announcement, where a 25bps cut is expected. Decision aside, traders will be keen on any guidance (particularly in the context of policymakers’ visibility surrounding the shutdown), and look out for details on plans to end QT.

- EUR is on the backfoot and trades within a 1.1620-1.1660 range; largely moving at the whim of the USD, given the lack of European specific newsflow. On the data front, Spanish Estimated GDP Q/Q printed in-line with expectations (0.6%), whilst Y/Y was a touch softer at 2.8% (exp. 3%) – no move in the Single-currency on this. Attention now turns to the ECB on Thursday, but will ultimately lack surprises as markets almost entirely price in no change to the current policy.

- JPY is very modestly lower today, with USD/JPY trading within a 151.55-152.44 range. Out of favour today after strengthening in the prior session thanks to the US-Japan trade deal and mild haven allure. Some focus has been on US Treasury Sec Bessent who said “The Government’s willingness to allow the Bank of Japan policy space will be key to anchoring inflation expectations and avoiding excess exchange rate volatility”.

- GBP is one of the worst performing currencies today, continuing some of the underperformance seen in the prior session. The Pound has been out of favour recently, following the FT article which suggested Chancellor Reeves may face a GBP 20bln hit to UK public finances after a productivity downgrade. Currently towards the lower end of a 1.3199 to 1.3280 range.

- Antipodeans are mixed; the Aussie remains a touch firmer but off best levels following the region’s hotter-than-expected inflation report, whilst the Kiwi has been dragged lower by the USD.

Fixed Income

- USTs are lower by a handful of ticks, following on from a soft 7yr auction on Wednesday and as traders now await the Fed policy decision. A 25bps cut is all but certain. A decision that will likely be subject to dissent with Miran seemingly set to vote for 50bps again, after remarking since the September Fed that 25bps is too slow a pace of easing. Commentary from Powell will focus on December, -46bps implied by end-2025, and the balance sheet. QT forms the other part of the decision. Desks expect an announcement from the Fed on the balance sheet as Chair Powell suggested that the level of reserves hit an ample level in the coming months vs the current “abundant” level, a point the Fed has previously suggested it would want to hold reserves at. USTs are marginally pressured in a thin 113-11+ to 113-16+ band.

- Bunds are contained with a very marginal bearish bias, as is the case for USTs. Specifics light so far. Supply once again in focus from Germany, this time Bunds are offered after another dismal Bobl tap earlier in the week. Bunds currently at a 129.47 low, with downside of 10 ticks at most. Moving to France, another chance for a compromise to be found between the Lecornu government and Socialist Party. As Politico reports that the full debate on a French wealth tax (i.e. the Zucman tax) will not happen on Wednesday or Thursday, but is likely on Friday. Currently, the OAT-Bund 10yr yield spread is holding just shy of the 80bps mark.

- Gilts follow the mood across peers. The morning’s data showed an increase in individual mortgage borrowing to the highest since March 2025 with mortgage approvals also increasing. Activity driven by the effective interest rate on new mortgages dropping to 4.19%, its lowest since January 2023 when the rate was 3.88%. Gilts at the lower-end of a 93.71-89 band, within Tuesday’s 93.62 to 93.96 confines. No real move on the UK auction, which drew a b/c above 3.00x.

- UK sells GBP 3.75bln 4.125% 2033 Gilt: b/c 3.04x, average yield 4.191%, tail 0.3bps

Commodities

- WTI and Brent are trading choppy today. Morning action saw the complex pressured, despite a bullish private sector inventory report in the prior session. A quite marked bout of pressure was seen at the European cash open, which happened to coincide with commentary via the Israeli military; they suggested that it begun a renewed enforcement of the Gaza ceasefire agreement, after striking the region in the past day. However, this has since entirely reversed, with the complex now slightly higher on the session. Brent Dec’25 trades in a busy USD 63.92-64.79/bbl range.

- Spot gold is back on a stronger footing today, after a three days of losses. Nothing really fresh for the upside, but likely some modest-buying after falling below the USD 4k mark earlier in the week; as it stands the yellow-metal trades in a USD 3,907.92-4,021.79/oz range and awaits the Fed policy decision.

- Base metals are entirely in the green, amidst the broadly positive sentiment across the APAC region in anticipation of the Trump-Xi meeting on Thursday. 3M LME Copper currently in a USD 10,987.75-11,146.3/t range.

- India’s MRPL Exec says they will not be purchasing Russian oil due to risks.

- US Private Energy Inventory Data (bbls): Crude -4.0mln (exp. -0.2mln), Distillate -4.4mln (exp. -1.7mln), Gasoline -6.3mln (exp. -1.9mln), Cushing +1.7mln.

- Ukraine hits two oil depots in Russian-occupied Crimea, according to an SBU official.

Geopolitics

- Israeli Military says it begins renewed enforcement of Gaza ceasefire agreement.

- North Korea fired a missile and stated that the missile is part of its nuclear forces, according to KCNA.

- Chinese Defence Ministry said it held talks with India about the border, while it added that both sides had active and in-depth communication on the control of the western section of the China-India border. Furthermore, they agreed to continue to maintain communication and dialogue through military and diplomatic channels.

- US Defense Secretary Hegseth said the security situation around Japan remains severe and noted that their alliance is critical to deterring Chinese military aggression.

- “The strikes in the Gaza Strip are nearing completion”, according to i24’s Stein citing Israeli officials from Jerusalem Post; “In light of the ongoing violations, additional response measures will be taken.”.

US Event Calendar

- 7:00 am: Oct 24 MBA Mortgage Applications 7.1%, prior -0.3%

- 8:30 am: Sep P Wholesale Inventories MoM, est. -0.15%

- 10:00 am: Sep Pending Home Sales MoM, est. 1.2%, prior 4%

- 2:00 pm: Oct 29 FOMC Rate Decision (Upper Bound), est. 4%, prior 4.25%

DB’s Jim Reid concludes the overnight wrap

Another post-op day of not too much pain during the day and then a lot of pain at night. I never knew I had hip flexors before they had to bear the brunt of my recent spinal adjustments. Although the most pain yesterday was actually shaving off a two-week-old beard. That was agony!

A quick reminder that our latest annual Long-Term Study, The Ultimate Guide to Long-Term Investing, was published on Monday. It’s currently featured as the lead report on the Deutsche Bank Research Institute site here, and is open access—so feel free to share it widely. While it may not rival the billion-plus streams of Taylor Swift’s latest album released earlier this month, I’ve been genuinely humbled by the response: around 8,000 downloads in the first 36 hours. Thank you all for the great support but let’s get a little bit nearer to Taylor.

Turning to markets, while global equities have largely consolidated over the past 24 hours, US stocks continued their upward trajectory yesterday. The S&P 500 rose by +0.23%, the Nasdaq gained +0.80%, and the Magnificent 7 advanced +1.27%, all notching fresh highs. Despite the headline gains, the breadth of the rally was rather narrow. In fact, there were only 104 advancers in the S&P 500, the fewest in over two weeks, and actually the fewest on an up day as far back as my data on advancers and decliners goes (to 1990). So remarkable. This came ahead of today’s widely anticipated 25bps Fed rate cut—which is fully priced—and earnings releases from Microsoft, Alphabet, and Meta after the bell.

The rally was once again driven by tech and AI momentum, despite a packed macro and geopolitical backdrop. Notably, the US announced new trade initiatives with Japan and South Korea, while the new ADP’s preliminary private payrolls data helped ease some labour market fears. In contrast, European equities gave back some recent gains, with the STOXX 600 down -0.22%, while yields were little changed.

Nvidia (+4.98%) again topped the list of standout corporate developments, with CEO Jensen Huang dismissing concerns about an AI bubble as he unveiled a flurry of new partnerships with the likes of Uber, Palantir and Crowdstrike as well as a $1bn investment into Nokia and a new system to connect quantum computers to Nvidia’s AI chips. Nokia itself rose nearly 21% to the highest in around a decade. Maybe they’ll bring back the (wonderful) game snake! Meanwhile, Microsoft rose +1.98% after revealing a 27% stake in OpenAI, which in turn committed to purchasing up to $250bn in Azure services. That move left Microsoft back above $4trn market cap mark, with Apple (+0.07%) also flirting with that level intra-day before closing at a $3.99trn valuation. PayPal also rallied +3.94% following an earnings upgrade and news of a partnership with OpenAI. If you’ve been tracking OpenAI’s deal flow lately, you’ve had your hands full. The AI-driven exuberance lifted the Magnificent 7 by +1.27%, even as Amazon (+1.00%) announced plans to cut around 14,000 corporate roles as part of a broader resource reallocation strategy.

The equal-weighted version of the S&P 500 was down -0.91% as defensive sectors such as utilities (-1.66%) and consumer staples (-0.95%) struggled. Meanwhile, the Nasdaq Golden Dragon Index, which tracks US-listed Chinese firms, fell -1.23% amid some investor nerves ahead of the anticipated Trump-Xi meeting at the APEC summit. However, sentiment improved slightly after reports from the Wall Street Journal suggested the two leaders may discuss rolling back some of a 20% fentanyl-related US tariffs in exchange for Chinese action on fentanyl precursor exports. Overnight Trump has confirmed he expects progress this week on fentanyl. On Monday we mentioned this as a key metric on which to judge the Trump-Xi meeting.

US tech sentiment also benefited from trade announcements. The US and Japan unveiled plans to collaborate on AI infrastructure and critical minerals, tied to Japan’s $500bn investment pledge and a 15% tariff agreement. Bloomberg later reported that a similar deal with South Korea—focused on AI, quantum computing, and 6G—could be signed later today. Details remain sparse, but more clarity is expected imminently.

Today’s marquee event, aside from earnings, is the FOMC meeting. A 25bps rate cut is widely expected, bringing the target range to 3.75–4%. With the US government shutdown now in its fifth week, our economists anticipate that Chair Powell’s press conference will pivot away from economic data—given its scarcity—and instead focus on balance sheet policy, the policy framework review, and financial stability. For a full preview, see here. On QT, our team expects the Fed to announce an end to the programme today, with run-off concluding next month.

Ahead of the Fed, we received a few data points yesterday that modestly surprised to the upside. An ADP report showed a weekly average gain of 14,250 private-sector jobs in the four weeks to October 11, so translating to a +57k monthly pace—which would represent some stabilization after recent slowing in the ADP jobs series. Notably, ADP will now publish weekly preliminary job estimates, offering a more high-frequency lens on labour market dynamics. Meanwhile, the FHFA house price index rose +0.4% m/m, its strongest monthly print since last year, while the Conference Board’s Consumer Confidence index came in at 94.6 (vs 93.4 expected), though still a point below the prior month’s upwardly revised figure. These data points helped nudge Treasury yields higher early in the US session, but both the 2yr (-0.2bps) and 10yr (-0.4bps) reversed this move later on as breakevens fell amid a decline in oi price (-1.84% to $64.41/bbl for Brent).

Elsewhere, the Bank of Canada is also expected to announce a 25bps cut today. You can see our FX strategists’ quick take on the BoC and the Canadian dollar here.

Today will also see the Dutch general election, with polls closing at 9pm CET tonight. The early vote was triggered when the right-wing populist PVV pulled out of the ruling coalition in June. PVV has led in opinion polls but its lead has ebbed away most recently and it appears likely to get fewer seats than in the last election two years ago.

Looking at European moves yesterday, French equities saw a modest pullback amid the ongoing budget deliberations as the centre-left has pushed for more changes while the government seeks to keep the deficit below 5%. As a reminder, the first part of the French budget bill—covering revenues and the overall balance—is currently under debate in the National Assembly, with a vote expected by 4 November. The CAC fell -0.27%, though 10yr OATs (+0.3bps) marginally outperformed bunds (+0.8bps).

Across the continent, the STOXX 600 slipped -0.22%, while the FTSE 100 continued its record-breaking run, up +0.44%. The DAX edged down -0.12% after Germany’s GfK consumer sentiment forecast for November disappointed (-24.1 vs -22.0 expected), driven by a sharp drop in income expectations amid job security concerns. The ECB’s Bank Lending Survey also pointed to a slight softening in credit conditions, suggesting that the transmission of recent monetary easing may be slowing. While unlikely to alter Thursday’s rate decision—expected to remain on hold at 2%—at the margin, the survey may give cause for a more dovish tilt. For more, see our economists’ analysis here.

Asian equity markets are mostly higher this morning, supported by record closing highs on Wall Street overnight. The Nikkei is leading the gains, up +2.28%, reaching a new record high amid renewed optimism over US-Japan trade relations. The KOSPI has also rebounded strongly, rising +1.26% after losses in the previous session, with sentiment buoyed by enthusiasm around AI. Mainland Chinese stocks are also in positive territory, with the CSI 300 up +0.74% and the Shanghai Composite gaining +0.42%, while the Hang Seng remains closed. In contrast, Australia’s S&P/ASX 200 is underperforming, down -0.97%, following hotter-than-expected inflation data that has dampened expectations for near-term policy easing. US equity futures are pointing higher, with the S&P 500 up +0.21% and the NASDAQ 100 up +0.37% at the time of writing.

In Australia, inflation accelerated during the September quarter, with consumer prices rising at an annual rate of +3.2%, above the +3.0% consensus and up from +2.1% in the June quarter. Headline inflation rose +1.3% quarter-on-quarter, marking the strongest quarterly increase since March 2023. The Reserve Bank of Australia’s preferred trimmed mean measure also surprised to the upside, increasing +1.0% over the quarter versus an RBA assumption of +0.6% and a recent market expectation of 0.8%. This pushed the annual trimmed mean rate to +3.0%, up from +2.7% in June. The hotter inflation print has led to a sell-off in short-dated Australian government bonds, with yields on the policy-sensitive 3-year bonds climbing +12.0bps to 3.57%, and 10-year yields rising +5.1bps to 4.22%. The Australian dollar continues to strengthen, rising for a fifth consecutive session and currently trading at 0.6597 against the US dollar, up +0.18%.

Looking ahead, today’s key events include the Fed and BoC decisions. Data releases feature US September advance goods trade balance, wholesale inventories, and pending home sales; UK September net consumer credit; Italy’s September PPI and hourly wages; and Sweden’s September GDP indicator. Earnings are due from Microsoft, Alphabet, Meta, SK Hynix, UBS, and others. The US will auction $30bn in 2yr FRNs. And we also have the early general election in the Netherlands.

Tyler Durden

Wed, 10/29/2025 – 08:29ZeroHedge NewsRead More

R1

R1

T1

T1