Meta Tumbles, Microsoft Slides, Alphabet Soars After Mag 7 Earnings Deluge

With the Fed decision in the history books, attention turned to the barrage of Mag 7 earnings after the close today, which as previewed could move dramatically based on what they reported. And at exactly 4:05pm we got the releases which were 1 out of 3, with META and MSFT sliding, and GOOGL jumping.

Here are the details, starting with today’s winner Alphabet, which reported quarterly sales that beat analysts’ estimates, buoyed by the performance of its cloud unit, which is growing as artificial intelligence startups seek Google’s support and computing

- Revenue ex-TAC $87.47 billion, +17% y/y, beating estimate $85.11 billion (Revenue $102.35 billion, +16% y/y, also beat estimate $99.85 billion)

- Google Services revenue $87.05 billion, +14% y/y,beating estimate $84.67 billion

- Google advertising revenue $74.18 billion, +13% y/y, beating estimate $72.46 billion

- Google Search & Other Revenue $56.57 billion, +15% y/y, beating estimate $54.99 billion

- YouTube ads revenue $10.26 billion, +15% y/y, beating estimate $10.03 billion

- Google Network Revenue $7.35 billion, -2.6% y/y, missing estimate $7.39 billion

- Google Subscriptions, Platforms and Devices Revenue $12.87 billion, +21% y/y, beating estimate $12.35 billion

- Google Cloud revenue $15.16 billion, +34% y/y, beating estimate $14.75 billion

- Other Bets revenue $344 million, -11% y/y, estimate $429.4 million

- EPS $2.87 vs. $2.12 y/y, beating estimate $2.26

Alphabet’s cloud division stood out, delivering revenue of $15.16 billion versus the $14.75 billion estimate, underscoring ongoing enterprise demand for AI workloads on Vertex. The company also reported a hefty $155 billion backlog in Google Cloud, signaling sustained momentum into next year.

Turning to costs and expenses:

- Total TAC $14.88 billion, +8.4% y/y, above the estimate $14.84 billion

- Operating income $31.23 billion, +9.5% y/y, below estimate $32.11 billion

- Google Services operating income $33.53 billion, +8.7% y/y, below estimate $33.59 billion

- Google Cloud operating income $3.59 billion, +85% y/y, above estimates $3.01 billion

- Other Bets operating loss $1.43 billion vs. loss $1.12 billion y/y, below estimate loss $1.21 billion

- Alphabet-level activities operating loss $4.47 billion vs. loss $3.17 billion y/y, above estimate loss $3.53 billion

- Operating margin 31% vs. 32% y/y, missing estimate 32.2%

Perhaps the most important two numbers had to do with CapEx, first historical which was above estimates:

- Capital expenditure $23.95 billion, +83% y/y, beating estimate $22.38 billion

Alphabet also posted an impressive FY capex guide of $91 billion to $93 billion, up from around $85 billion previously, and smashing estimates of $84.04 billion, reflecting continued spending on AI data centers and custom chips. Gemini, Google’s flagship AI model, is increasingly being woven across search, Android, and YouTube, helping to offset rising infrastructure costs.

The company also announced that Google Cloud ended the quarter with $155B in backlog, unveiled that it haddDouble-digit growth across every major business, and that its Gemini app now has over 650 million monthly active users.

As Bloomberg notes, Alphabet’s third-quarter results reinforced the AI investment boom that has powered megacap tech stocks and broader equity benchmarks to record highs. What’s more, Alphabet’s confident guidance and ramped-up capex suggest the AI spending cycle remains in full swing — potentially adding fresh fuel to the trade that continues to define this bull market.

The results were strong enough to push the strong sharply higher after hours, rising as much as 7.5%, to a new record high.

That was the good news. The other two Mag 7s were not so good.

Meta reported Q3 earnings that were good… but not good enough for the market, and its shares tumbled after hours. Here is the breakdown:

- Revenue $51.24 billion, +26% y/y, beating estimate $49.59 billion

- Advertising rev. $50.08 billion, +26% y/y, beating estimate $48.59 billion

- Family of Apps revenue $50.77 billion, +26% y/y, beating estimate $49.04 billion

- Reality Labs revenue $470 million, +74% y/y, beating estimate $317 million

- Other revenue $690 million, +59% y/y, beating estimate $597.4 million

- Operating income was $20.54 billion, up 18% y/y

- Operating margin 40% vs. 43% y/y

Despite the revenue beat, EPS was a big miss, printing at just $1.05 below the $6.76 estimate, and the result of a $15.93 billion charge on a tax bill.

Some other details from the report:

- Family of Apps operating income $24.97 billion, +15% y/y, estimate $24.79 billion

- Reality Labs operating loss $4.43 billion vs. loss $4.43 billion y/y, estimate loss $5.16 billion

- Ad impressions +14% vs. +7% y/y, estimate +10.8%

- Average price per ad +10% vs. +11% y/y, estimate +10.5%

Average Family service users per day 3.54 billion, +7.6% y/y, estimate 3.48 billion

Looking ahead, Meta sees total expenses between $116 billion to $118 billion, an increase on the low end after it previously saw $114 billion to $118 billion, and above the estimate $115.63 billion

It also sees capital expenditure $70 billion to $72 billion, up from a range of $66 billion to $72 billion previously and above the estimate $69.3 billion.

The company says its Q4 revenue growth will be “partially offset by lower year-over-year Reality Labs revenue in the fourth quarter.” That may mean fewer headsets and glasses than anticipated at Christmastime.

And while the results were generally in line, taking a $16 billion profit hit might just be too much for investors to ignore. And certainly the market was not delighted, sending META shares tumbling sharply lower after the close.

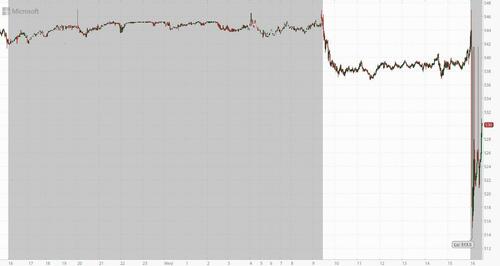

The last Mag7 to report today was Microsoft which also disappointed judging by the sharp drop in its price after hours.

Microsoft reported expansion in its Azure cloud computing unit that failed to impress investors who have grown optimistic about the business. While the Azure cloud-computing unit posted a 39% revenue gain in the quarter when adjusting for currency fluctuations, beating the Wall Street estimate of 37%, investor expectations for Microsoft were very high heading into earnings, with some buyside bogeys as high as the low 40s.

Here is what it reported for Q3:

- Revenue $77.67 billion, beating estimate $75.55 billion

- Microsoft Cloud revenue $49.1 billion, beating estimate $48.6 billion

- Intelligent Cloud revenue $30.9 billion, beating estimate $30.18 billion

- Azure and other cloud services revenue Ex-FX +39%, beating estimate +37.1%

- Productivity and Business Processes revenue $33.02 billion, beating estimate $32.29 billion

- More Personal Computing revenue $13.76 billion, beating estimate $12.88 billion

- EPS $3.72, beating est. of $3.67

- Operating income $37.96 billion, beating estimates of $35.1 billion

- Capital expenditure $19.39 billion, beating estimate $23.04 billion

- Capital expenditures including assets acquired under finance leases $34.9 billion, above estimate $30.06 billion

- Revenue at constant currency +17%, beating estimate +13.4%

Of concern to investors is that Microsoft reported a steeper climb in spending than Wall Street expected, fueling anxieties about the high costs of providing AI infrastructure. First-quarter capital expenditures including leases, an indication of data center spending, came in at $34.9 billion, up from $24 billion in the preceding quarter.

Microsoft continues “to increase our investments in AI across both capital and talent to meet the massive opportunity ahead,” Chief Executive Officer Satya Nadella said in a statement.

The world’s largest software maker has seen rapid growth in its cloud computing business, thanks largely to a landmark partnership with leading artificial intelligence startup OpenAI. On Tuesday, the two companies revised their agreement, giving Microsoft access to OpenAI technology and its AI inference business for years to come. The updated pact was widely applauded on Wall Street.

And while the kneejerk stock reaction may well be a headfake as MSFT tends to provide forward-looking guidance on the call and it may once again surprise positively there, for now, however, the stock is down after the close if off the lows.

Tyler Durden

Wed, 10/29/2025 – 16:37ZeroHedge NewsRead More

R1

R1

T1

T1