The Chart That Oracle Equity Bulls Don’t Want You To See

It’s not the AI economy; it’s the debt, stupid!

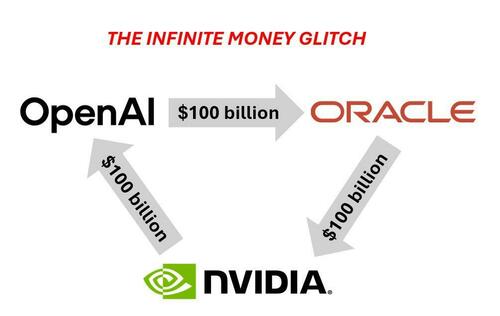

That was the (somewhat less snarky) message from a detailed breakdown we did three weeks ago highlighting the fact that “AI Is Now A Debt Bubble Too, Quietly Surpassing All Banks To Become The Largest Sector In The Market” discussing the current generation’s (because every generation has one, just ask Global Crossing) “infinite money” circle jerk circular deals which have become the de jour staple of the AI bubble and which, simplified, look something like this…

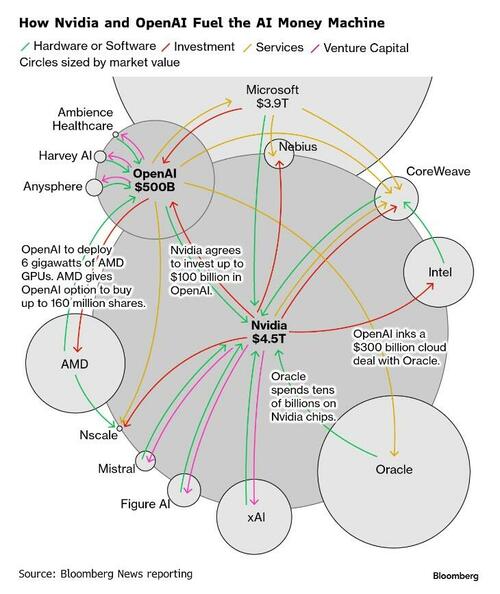

… or, using a slightly more sophisticated variation from Bloomberg, like this…

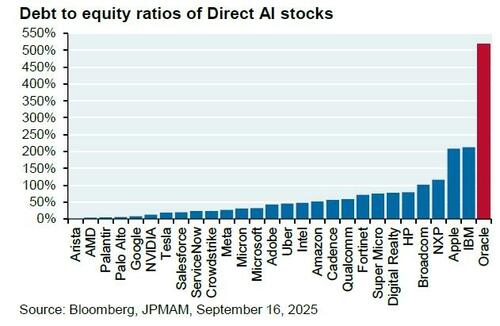

… which JPM’s Michael Cembalest described laconically as follows…

Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google.

There is no way for Oracle to pay for this with cash flow. They must raise equity or debt to fund their ambitions. Until now, the AI infrastructure boom has been almost entirely self-funded by the cash flows of a select few hyperscalers. Oracle has broken the pattern. It is willing to leverage up to hundreds of billions to seize a share. The stable oligopoly is cracking…The implications are profound. Amazon, Microsoft and Google can no longer treat AI infrastructure as a discretionary investment. They must defend their turf. What had been a disciplined, cash-flow-funded race may now turn into a debt-fueled arms race.

And judging by the surge in credit risk perceptions, this is a chart that AI-driven equity bulls don’t want the market to be aware of.

The dissonance between ORCL equity dreamers and credit realists is dramatic to say the least.

The cost to insure against default on the company debt over the next five years is hovering near its highest since Oct. 2023, while equity prices (and valuations) near record highs.

“Near-term credit deterioration and uncertainty may drive further bondholder and lender hedging,” Morgan Stanley analysts Lindsay Tyler and David Hamburger wrote in a note Monday.

As JPMorgan’s Cembalest noted, Oracle’s debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google.

In other words, the tech capital cycle may be about to change..

Amid this indisputable debt bubble euphoria, we were pleasantly surprised that at least some are aware of what’s going on. Earlier today, BBG reported that the Bank of England is reviewing lending to data centers that are a one way bet on the future of artificial intelligence.

The BOE has already called out the market risk from a surge in the valuations of firms in the industry, warning of the dangers of a sharp correction if “expectations around the impact of AI become less optimistic.”

Now, the central bank’s attention is moving to the links between AI companies and the financial sector, having perhaps finally read our report from July in which we warned of precisely this thing. While lending at the moment is modest, with much of the early construction works funded by equity, it’s expected to grow significantly.

One person said the BOE was looking into the area after growing concerned as the nascent sector’s spending migrated from hiring staff to spending billions of dollars on building and financing data centers with limited other uses.

“If the projected scale of debt-financed AI and associated energy infrastructure investment materializes over this decade, financial stability risks are likely to grow,” Bank of England staff wrote in a blog post on Friday.

“Banks would be exposed to this directly through their credit exposures to AI companies, as well as indirectly through their provision of loans and credit facilities to private credit funds and other financial institutions.”

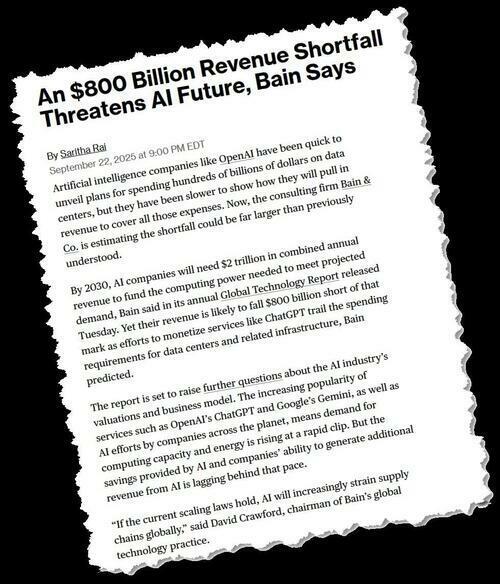

Three weeks ago, in “The Stunning Math Behind The AI Vendor Financing “Circle Jerk” (which in turn referenced our analysis from late July when seemingly nobody cared who will fund this tidal wave of looming datacenter spending), we explained how even an optimistic outlook on the AI industry and its gargantuan capex needs, reveals that there is an $800 billion funding need by the end of the decade.

… one which will most likely be filled by credit, and especially private credit once public markets balk, the same private credit which is suddenly under the microscope as a result of the Tricolor and First Brands bankruptcies.

And the canary in the coalmine is the surge in credit spreads that is evident in Oracle as we remind readers that both of these measures are directly linked to asset valuations and volatilities of the underlying business… meaning one of them is ‘wrong’.

Tyler Durden

Wed, 10/29/2025 – 15:05ZeroHedge NewsRead More

R1

R1

T1

T1