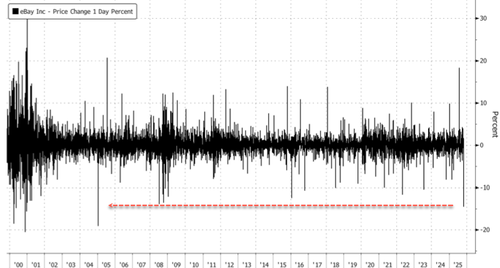

EBay Shares Plunge Most Since 2005 As Soft Outlook Overshadows Solid Earnings

EBay shares plunged as much as 16% on Thursday, the biggest intraday drop since January 2005, after the company issued disappointing fourth-quarter guidance. The outlook for adjusted earnings and operating margins came in below Bloomberg Consensus estimates, overshadowing what had been solid third-quarter earnings.

EBay delivered a strong third quarter, beating estimates across the board. However, Bloomberg Intelligence analysts said investors were focused on the disappointing fourth-quarter adjusted earnings-per-share forecast, which could “reflect consumer and tariff uncertainty.”

Snapshot of Third-Quarter Results (via Bloomberg):

Adjusted EPS: $1.36, up from $1.19 a year ago and above the $1.34 estimate.

Net Revenue: $2.82 billion, a 9.5% year-over-year increase, topping the $2.73 billion consensus.

Active Buyers: 134 million, up 0.8% year-over-year, slightly below expectations of 135.1 million.

Gross Merchandise Volume (GMV): $20.11 billion, up 9.8% year-over-year, beating the $19.37 billion estimate.

U.S. GMV: $9.87 billion, up 13% year-over-year, versus $9.36 billion expected.

International GMV: $10.23 billion, up 7% year-over-year, compared with $10.06 billion estimated.

Free Cash Flow: $803 million, up 24% year-over-year, exceeding the $688.3 million estimate.

The spotlight was on eBay’s fourth-quarter forecast, which guided adjusted EPS between $1.31 and $1.36, missing the Bloomberg Consensus of $1.39 and signaling margin pressure ahead. The online auction platform projected net revenue between $2.83 billion and $2.89 billion, roughly in line with the $2.8 billion estimate, pointing to modest top-line growth but a softer profit outlook ahead of Black Friday and Christmas holiday shopping season.

Full-Year Forecast:

-

Sees adjusted EPS from continuing operations $5.42 to $5.47, estimate $5.46

-

Sees net revenue $10.97 billion to $11.03 billion, estimate $10.85 billion

“Given solid 3Q trends, we think eBay’s 4Q guidance appears to be set too low to reflect consumer and tariff uncertainty,” Bloomberg Intelligence analysts wrote in a note, adding that the outlook for fourth quarter adjusted operating margin “missed consensus as its strategic investments may weigh on results.”

Stifel analyst said earnings were solid but this report was “overshadowed by 4Q guidance of GMV growth decelerating to +4-6% y/y (FXN), citing tough comps and the full impact of the de minimis changes.”

The dismal outlook sent shares crashing – the most in an intraday session since January 20, 2005 – down 14% by early afternoon in New York.

$100 handle has been rejected for the second time.

Double top?

Tyler Durden

Thu, 10/30/2025 – 12:45ZeroHedge NewsRead More

R1

R1

T1

T1