Jamaica’s Catastrophe Bond Poised For Big Payout Within Weeks After Hurricane Melissa’s Insane Strength

Hurricane Melissa was the most powerful storm to make landfall in Jamaica in over 170 years, ripping through the Caribbean island’s western region with 185 mph winds and leaving widespread destruction to infrastructure, towns, resorts, and farmland. The storm’s central pressure is likely to have fallen below the threshold that would trigger a $150 million catastrophe bond designed to offset weather-related losses through the capital markets.

According to CNBC, the government of Jamaica’s $150 million cat bond was structured by insurance broker Aon using the International Bank for Reconstruction and Development’s “capital at risk” program and could be triggered as soon as next month.

For the island nation’s government to receive funds, the storm’s central pressure must be less than 900 millibars upon landfall. Early indications from the National Hurricane Center show the Category 5 hurricane with 185 mph winds met that threshold in several regions in the western part of the island.

Key details about $150 million cat bond:

-

The cat bond, structured by Aon and effective through 2027, provides parametric coverage, meaning payouts are based on storm intensity metrics rather than assessed damages.

-

Triggering paypout requires the storm’s central pressure must be <900 millibars upon landfall. Early National Hurricane Center data confirm Melissa met this threshold in multiple regions, now pending verification by an independent agent which could take weeks.

-

If triggered, funds could reach Jamaica within about one month, far faster than traditional insurance settlements, which often take several months.

Jamaica is the first Caribbean and small-island nation to sponsor a cat bond, according to Aon.

“While the final numbers are still being verified, the early signs suggest the transaction is doing what it was designed to do: getting critical funds to the country quickly after a major disaster,” Chris Lefferdink, Aon’s head of insurance-linked securities for North America, told CNBC in a statement.

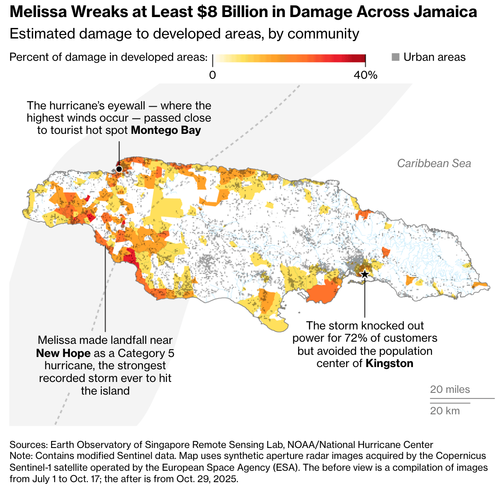

The question of whether the $150 million cat bond will cover all the damage remains in question. New satellite data from Bloomberg shows extensive damage.

Damage report so far:

-

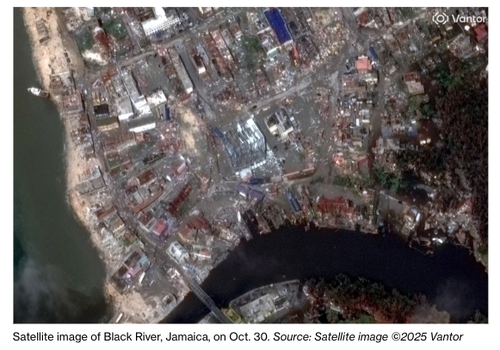

Montego Bay, Black River, and surrounding parishes (Saint James, Westmoreland, Saint Elizabeth) suffered the heaviest damage, with around 40% of buildings and roads destroyed.

-

Power outages persist for about 72% of customers, while many communities remain isolated due to blocked roads and debris.

-

At least 19 people were killed, and economic losses are estimated at $8 billion, about one-third of Jamaica’s GDP, according to Enki Research.

Satellite imagery showing power outages across Jamaica. Top taken before Melissa. Bottom taken after. Represents lights you normally would see. https://t.co/Hk3pbO84Yf pic.twitter.com/s9NDDyLJ47

— Mike’s Weather Page (@tropicalupdate) October 31, 2025

Jamaica’s use of a cat bond and its likely trigger event in the coming weeks could spark significant interest among other Caribbean nations for next year’s Atlantic hurricane season.

Tyler Durden

Fri, 10/31/2025 – 10:05ZeroHedge NewsRead More

R1

R1

T1

T1