Germany’s Debt Cannon Fails: Special Fund Fuels Bureaucracy, Not Growth

Submitted by Thomas Kolbe

The German federal government is firing its big debt cannon at the ongoing recession. So far, with zero effect. Berlin is about to learn the hard way that you cannot create prosperity with a money printer.

In March, the federal government launched its major investment offensive – starting with the first bond tranche meant to fuel the so-called “special fund” with fresh credit.

Credit Pump Running Hot

Every year, new bonds with maturities of five to thirty years are to be issued in volumes of €50 billion. With broad support from the Bundestag and Bundesrat, the government is going all in. Half a trillion euros are to be pumped into infrastructure projects over the next decade – and naturally, everything that can be booked under “climate neutrality.”

That a significant part of this credit volume will be diverted to cover gaping deficits in social funds is almost beside the point. The verdict remains unchanged: German policymakers have fully committed to a brute-force Keynesianism – maximum artificial state demand, now coupled with the ECB’s again negative real interest rates.

A textbook of the central bank era, repeatedly seen in the 20th century – always leaving the same trail: growing mountains of debt and the systematic crowding out of private investment from the capital markets.

A vacuum effect. Price guarantees, subsidies, and electricity cost allowances keep this artificial economy liquid – even attracting private capital with guaranteed returns – capital that would be far more productive elsewhere. A fatal vicious cycle.

Scarce resources are diverted into unproductive sectors of the economy. A poverty program hailed by state-aligned media, NGOs, and government economic institutes as some magical potion that is supposed to breathe new life into a bloodless economy.

Zero Growth Despite Debt Spree

In Berlin, hope was last pinned on firing the “Big Bertha” to buy some breathing room. With polling numbers for the Union and SPD plummeting, the goal was to spark a temporary boom to carry them over the finish line of the upcoming state elections. That is the real purpose of the special fund – an expensive political trick that will plunge children and grandchildren into even deeper debt.

Even the Chancellor counts among those dazzled by artificially created credit. Once a champion of a lean state, he switched immediately after taking office to full-blown state expansion.

A weather vane in Berlin, blown by Brussels, carrying the unmistakable siren song of socialism.

The creation of the special fund was, according to Merz in spring, a state-politically necessary step, marking a significant new economic policy beginning amid the debt orgy of the Federal Republic.

Classic “road construction” is meant to ignite economic growth. Stone-age economic thinking from a long-gone era, when governments could still afford such short-lived fiscal fires – though that hardly made it better socially.

For this economic acrobatics, taxpayers will bleed for decades. Irresponsible. Unethical. Inadequate economic policy.

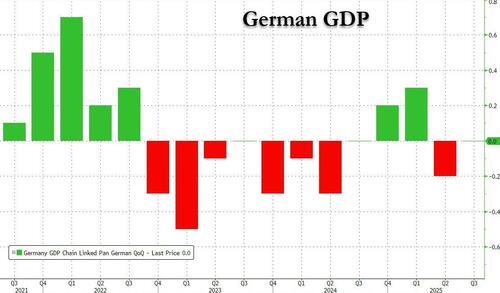

The news from the Federal Statistical Office that growth again came to a standstill in Q3 hit even harder.

Never forget: with net new public debt at 4.7% and a state share of GDP over 50%, private business collapses in practice. That is the only way to mathematically explain a zero growth outcome.

This is the real message from Wiesbaden’s disaster report.

Offloading State Bureaucracy

In German politics, fatal economic illiteracy combines with a dangerous drive to expand the political apparatus – with every intervention in the free economy, every new debt package, every climate-policy justification. This excess shrinks Germany’s future economic potential in favor of an ever more powerful bureaucracy.

Employer president Rainer Dulger’s urgent warning should be taken seriously. He called it a “scandal for the business location,” highlighting that in the past three years alone, 325,000 new employees had to be hired just to manage growing bureaucratic demands.

Biggest cost drivers include GDPR, with its endless documentation and reporting obligations, as well as EU IT security regulations. Add the ever-expanding Supply Chain Due Diligence Act and a flood of new hospitality reporting requirements.

Politics is increasingly outsourcing its bureaucratic monsters to the private economy. A reality not reflected in GDP calculations. In truth, Germany’s state share has long exceeded 50%, possibly already 55%. The state balloons – and German productivity continues to suffer.

Like a Chain Letter

Ideological statism persists like a chain letter. Olaf Scholz’s “double whammy” ultimately became the special fund – bureaucratically less infantile in appearance but essentially the same. State bureaucracy continues to grow to centrally manage this massive debt mountain.

The drying financing channels of the green patronage economy are being flooded again with fresh money. The party goes on. A few fill their pockets while future generations pay via higher taxes and inflation. That part of the new credit is now going to the military economy shows one thing: internally, there is no longer belief that the climate economy is the saving haven.

With the military economy, an old Keynesian classic returns: production above all else – regardless of what is being produced. Even if goods and services benefit only a small, select group of economic profiteers.

China Caught in the Intervention Trap

Europeans are not alone. China, which grants the private sector broad free-market space, repeatedly resorts to Keynesian emergency measures in crises. The creation of massive real estate overcapacity is one example.

The crisis that peaked with the Evergrande collapse is far from over. Millions of apartments were built solely to artificially maintain a short-term economic fire and prevent labor market collapse after the 2008 financial shock. Today, China’s export engine, fueled by high subsidies, serves a similar function – feeding a true mercantilist machine.

Wherever one looks, German politics exists in a fatal echo chamber, where every ideological misstep amplifies itself – the rhetoric grotesquely magnified. In its seven-year planning, the EU Commission under Ursula von der Leyen inflates the central Brussels budget to about €2 trillion.

This provides fiscal cover for the EU’s debt kings. One wonders: wasn’t the EU Commission originally meant to enforce the Maastricht debt rules?

Centralizer Headquarters

In Brussels centralism, the illusion of controlling the economy thrives within a self-reinforcing bureaucratic dynamic. Every new law, every additional regulation may harm the economy, but simultaneously expands the influence of Brussels.

It was only a matter of time before the last inhibition fell and the EU Commission’s borrowing ban was circumvented. This step came with the establishment of the “NextGenerationEU” fund.

In Brussels, the motto is clear: never let a good crisis go to waste. The result is always a new agency, whose archives fill with the latest regulatory ideas of bored civil servants – always financed by new Ponzi-style debt.

Debt piles on debt in an inverted pyramid structure. It cannot end well – and it will not.

The ideological contrast Americans are demonstrating – with massive deregulation – finds no reception in German politics, media, or philosophical debate. All focus is on the combative figure of US President Donald Trump, who thus secures America’s competitive advantage in the media spotlight for the long term.

Tyler Durden

Sat, 11/01/2025 – 20:00ZeroHedge NewsRead More

R1

R1

T1

T1