Amazon & OpenAI Strike $38 Billion Compute Deal As Microsoft Exclusive Ends

The circular AI funding headline arrived 30 minutes ahead of the U.S. cash session.

And the circular funding headlines arrive

*AMAZON INKS $38 BILLION DEAL WITH OPENAI TO SUPPLY NVIDIA CHIPS

— zerohedge (@zerohedge) November 3, 2025

This time, Amazon shares jumped 6%, extending last week’s post-earnings rally after news broke of a massive $38 billion deal between Amazon Web Services (AWS) and OpenAI.

*AMAZON JUMPS 6.1% ON DEAL TO SUPPLY OPENAI WITH NVIDIA CHIPS https://t.co/hubchYVq5T

— zerohedge (@zerohedge) November 3, 2025

The seven-year contract will see OpenAI run and scale its core AI workloads on AWS’s cloud infrastructure, an agreement that takes effect immediately and positions AWS as a key compute provider for OpenAI’s expanding portfolio of generative-AI products, including ChatGPT.

The AWS-OpenAI deal comes just one week after Microsoft’s exclusive cloud rights with OpenAI expired, freeing up Sam Altman’s AI chatbot startup to sign compute deals with other hyperscalers.

Amazon said the new partnership will provide dedicated compute capacity for both AI training and inference, powering next-generation models and ChatGPT-like services:

The infrastructure deployment that AWS is building for OpenAI features a sophisticated architectural design optimized for maximum AI processing efficiency and performance. Clustering the NVIDIA GPUs—both GB200s and GB300s—via Amazon EC2 UltraServers on the same network enables low-latency performance across interconnected systems, allowing OpenAI to efficiently run workloads with optimal performance. The clusters are designed to support various workloads, from serving inference for ChatGPT to training next generation models, with the flexibility to adapt to OpenAI’s evolving needs.

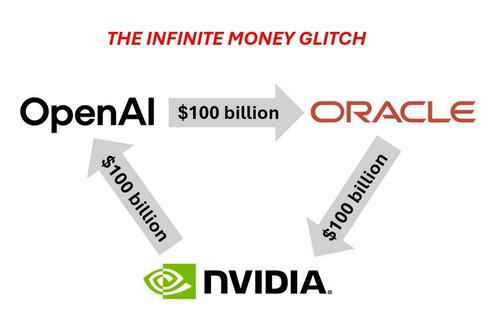

OpenAI has been on a dealmaking spree, signing cloud and hardware pacts totaling a staggering $1.4 trillion with Nvidia, Broadcom, Oracle, and Google as AI data center bubble concerns mount.

ZeroHedge Premium subs have been informed about how these circular flowing deals work, described in a recent note titled The Stunning Math Behind The AI Vendor Financing “Circle Jerk”…

“OpenAI will immediately start utilizing AWS compute as part of this partnership, with all capacity targeted to be deployed before the end of 2026, and the ability to expand further into 2027 and beyond,” Amazon wrote in a statement.

The deal highlights AWS’s large-scale AI infrastructure and brings it closer to frontier model developers, including clients such as Peloton, Thomson Reuters, Comscore, and Triomics.

OpenAI co-founder and CEO Sam Altman stated, “Scaling frontier AI requires massive, reliable compute,” adding, “Our partnership with AWS strengthens the broad compute ecosystem that will power this next era and bring advanced AI to everyone.”

However, doesn’t Amazon need all these vast computing resources for its own operations, yet in this case, it serves as a seller of computing capacity…

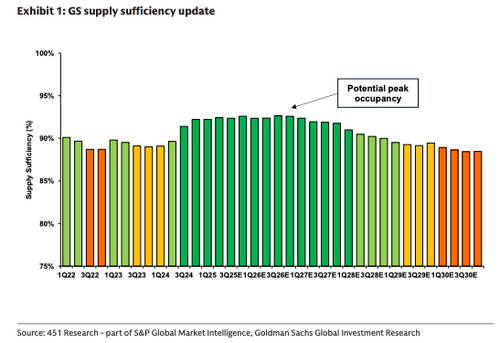

In recent weeks, Goldman’s James Schneider told clients, “The net impact of our model updates extends the duration of peak datacenter occupancy well into 2026 (from the end of 2025 previously). After this point, we forecast a modest, but gradual loosening of supply/demand balance in 2027…”

Is this GS model wrong, and peak datacenter occupancy comes much earlier?

Related:

- OpenAI-Microsoft Friction Grows As ChatGPT App Growth Slows, Data Center Buildout Risks Overcapacity

The AWS-OpenAI compute deal was enough to send Amazon shares up 5% in the early cash session in New York, building on gains from last week’s earnings.

It’s only a matter of time before another AI compute deal is unveiled … you can almost guarantee it’ll happen when AI stocks start to lose momentum … like clockwork.

Tyler Durden

Mon, 11/03/2025 – 09:50ZeroHedge NewsRead More

R1

R1

T1

T1