Key Events This Week: ISM, ADP, PMI, More Earnings, More Fed Speakers, And Longest Gov’t Shutdown In History

The market bonanza continues: the S&P 500 posted a 6th monthly gain for the first time since 2021, and those factors outweighed concerns around private credit and fears of an AI bubble. Meanwhile, Japan’s Nikkei had its best month in 35 years as the new government came to office, a meltup driven almost entirely by just 4 stocks.

The Nikkei rose 7580 points in October. 4 Companies accounted for 75% of the move https://t.co/V2JuRQ4hjc pic.twitter.com/9XX0nP16ZM

— zerohedge (@zerohedge) November 2, 2025

And despite the late pullback, precious metals continued their advance, with gold moving above $4,000/oz, whilst silver posted a 6th consecutive monthly gain for the first time in 45 years.

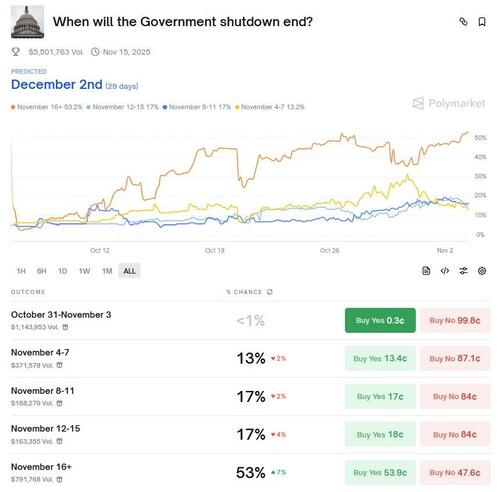

As DB’s Jim Reid writes, one of this week’s major landmarks is that, by midnight tomorrow, the current US government shutdown will officially become the longest in history—assuming there isn’t a highly unlikely near-term resolution. This will surpass the previous record of 35 days, which ended on 25 January 2019. There is growing speculation that we may be nearing the last stages of the shutdown, driven by increased cross-party dialogue, mounting public pressure, and economic and political considerations. One example is the US food aid program, which supports around 42 million Americans and may not have sufficient funding to last through November.

Yet despite this, the Polymarket probabilities show little sign of shifting. For instance, the likelihood of the shutdown ending by 15 November stands at 51%, having edged lower in recent days, while the probability of it ending by 30 November remains consistently in the 80–90% range, currently at 86%. So, while markets expect a November, expectations haven’t accelerated.

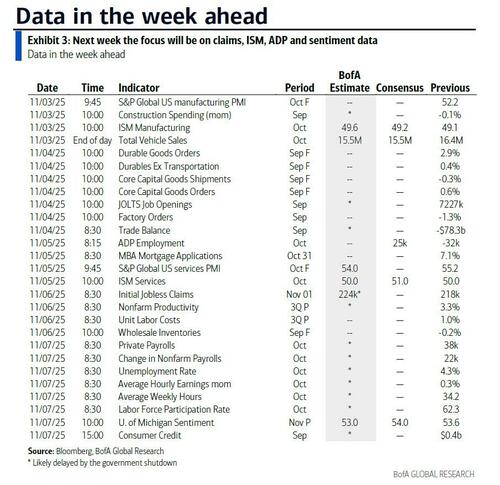

If it weren’t for the shutdown, we’d be looking forward to the US jobs report for October on Friday. But given we aren’t getting the government data releases, there’s likely to be outsize attention on the ADP’s report of private payrolls on Wednesday, especially in light of Chair Powell’s hawkish press conference last week. He indicated that the Fed requires further evidence of labor market deterioration before considering additional easing, and his stance may have been influenced by recent weekly ADP data, which has pointed to a modest rebound in private sector job gains. For this month’s report, DB’s US economists expect a print of +50k, compared to -32k previously, with consensus at +30k. They think a rebound in the ADP survey would align with seasonal patterns observed over recent years during the summer and autumn. These seasonals may have artificially weakened the recent headline figures, although strict immigration curbs and subdued hiring and firing point to a fragile low level equilibrium in the labor market which wouldn’t take much to shift momentum either way.

Elsewhere in the US, the focus will be on other private sector releases. Today’s ISM manufacturing print is forecast by DB at 48.9, down from 49.1 previously (consensus at 49.5), while Wednesday’s ISM services print (DB at 51.1, consensus 50.8, vs. 50.0 last month) will also be closely watched, particularly its subcomponents such as employment and prices paid. The PMIs are also out this week, as well as the University of Michigan’s consumer sentiment on Friday, where the inflation expectations series will be key. Bear in mind that the October FOMC dissenter Schmid recently remarked, “I view inflation expectations not as an input into Fed’s decisions, but as the outcome of the policy decisions that the Fed makes.” There will also be extensive Fed commentary this week, which will be closely scrutinised following last week’s FOMC.

Aside from the data, one of the big events is that on Wednesday, the US Supreme Court will hear oral arguments regarding the Trump administration’s IEEPA tariffs, which account for roughly half of tariff revenue collections in 2025. Two lower courts have ruled these tariffs illegal, and the eventual outcome could significantly impact the fiscal outlook, even though Trump may pursue alternative measures if he loses. Bear in mind that Polymarket probabilities only point to a 36% chance of the Supreme Court ruling in favour of the Trump tariffs, so one to keep an eye on.

Globally, central bank meetings are scheduled with the RBA (Tuesday), Riksbank (Wednesday), Norges Bank and BoE (Thursday). No changes are expected, though the BoE holds the most uncertainty with markets pricing a 29% likelihood of a cut, compared to negligible probabilities for the others. See our economists’ preview of the BoE meeting here.

Outside the US, key data releases include October CPIs in Switzerland (today) and Sweden (Thursday), trade balances in Germany, France, and China (all Friday), and wage data in Japan (Wednesday). Germany will also publish factory orders (Wednesday) and industrial production figures (Thursday).

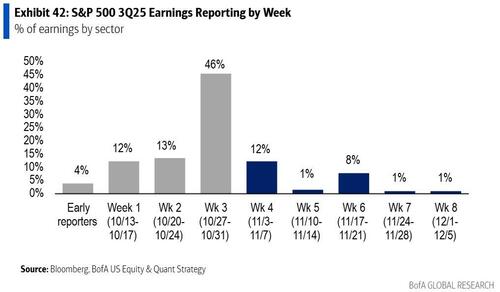

Earnings season will also continue apace this week, with several US tech firms in the spotlight, including Palantir, AMD, and Qualcomm. Other notable S&P 500 names reporting include McDonald’s, Uber, and Pfizer. Energy firms Saudi Aramco, ConocoPhillips, and BP are also set to report. Meanwhile in Europe, highlights include AstraZeneca, Novo Nordisk, Ferrari, and defence firms Rheinmetall and Leonardo.

Day-by-day calendar of events

Monday November 3

- Data: US October ISM manufacturing Italy October manufacturing PMI, new car registrations, budget balance, Canada October manufacturing PMI, Switzerland October CPI

- Central banks: Fed’s Daly and Cook speak, ECB’s Simkus and Escriva speak

- Earnings: Palantir, Vertex, Williams Cos, Ares, Grab

Tuesday November 4

- Data: Japan October monetary base, France September budget balance

- Central banks: Fed’s Bowman speaks, ECB’s Lagarde, Patsalides and Nagel speak, BoJ’s minutes of the September meeting, BoE’s Breeden speaks, RBA decision

- Earnings: Saudi Aramco, AMD, Shopify, Uber, Arista Networks, Amgen, Pfizer, Spotify, Nintendo, BP, Marriott, Ferrari, Apollo

- Politics: US state elections

Wednesday November 5

- Data: US October ISM services, ADP report, UK October official reserves changes, new car registrations, Japan September labor cash earnings, Germany September factory orders, France September manufacturing production, Italy October services PMI, September retail sales, Eurozone September PPI

- Central banks: ECB’s Kocher, Nagel and Villeroy speak, BoE’s Breeden speaks, Riksbank decision

- Earnings: Toyota Motor, Novo Nordisk, McDonald’s, Qualcomm, ARM, Robinhood, DoorDash, Siemens Healthineers, BMW, Telecom Italia

Thursday November 6

- Data: UK October construction PMI, Japan September household spending, Germany September industrial production, October construction PMI, France Q3 private sector payrolls, Eurozone September retail sales, Sweden October CPI

- Central banks: Fed’s Williams, Barr, Hammack, Waller, Paulson and Musalem speak, ECB’s Schnabel, Kocher, Nagel and Lane speak, BoE and Norges decisions, BoE’s October DMP survey, BoJ minutes of the September meeting

- Earnings: AstraZeneca, ConocoPhillips, Rheinmetall, Airbnb, National Grid, Petrobras, Deutsche Post, Commerzbank, ArcelorMittal, Moderna, Peloton

Friday November 7

- Data: November University of Michigan survey, China October foreign reserves, trade balance, Q3 BoP current account balance, Germany September trade balance, France September trade balance, current account balance, Q3 wages, Canada October labour survey

- Central banks: Fed’s Williams, Jefferson and Miran speak, ECB’s Nagel and Elderson speak, BoE’s Pill speaks

- Earnings: Constellation Energy, KKR, Mitsubishi Heavy Industries

Looking at just the US, there are several speaking engagements by Fed officials this week, including events with Vice Chair Jefferson on Friday, Governor Waller on Thursday, and New York Fed President Williams on Thursday and Friday. As Goldman notes, several data releases will be postponed this week because of the government shutdown, including the construction spending, trade balance, factory orders, JOLTS, productivity and costs, wholesale trade, and employment reports. The Department of Labor will also postpone the official release of the jobless claims report if the government shutdown continues through Thursday, but preliminary state-level claims data will likely be available as in previous weeks. Assuming the shutdown ends in mid-November, the release of the September employment report will be published a few days after reopening. The statistical agencies will announce new release dates for the other postponed releases in advance. If the BLS decides to release the October employment report, expect its release along with the November report either on schedule on December 5 or delayed by one week.

Monday, November 3

- 09:45 AM S&P Global US manufacturing PMI, October final (consensus 52.2, last 52.2)

- 10:00 AM ISM manufacturing index, October (GS 49.6, consensus 49.5, last 49.1): We estimate the ISM manufacturing index increased 0.5pt to 49.6 in October, reflecting an improvement in our manufacturing survey tracker (+0.9pt to 51.6).

- 12:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will participate in a moderated conversation at the Forum Club of the Palm Beaches in West Palm Beach, Florida. Moderated Q&A is expected. On September 25, President Daly said that she thinks “a little more will be needed over time to get interest rates where they are balancing out the [employment and inflation] risks.”

- 02:00 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will speak on the outlook for the economy and monetary policy at the Brookings Institution in Washington DC. Speech text and moderated Q&A with audience are expected. In her last comments on the outlook and monetary policy on August 6, Governor Cook said that “the [July] jobs report is concerning,” noting that “these revisions are somewhat typical of turning points.”

- 05:00 PM Lightweight motor vehicle sales, October (GS 15.2mn, consensus 15.5mn, last 16.4mn)

Tuesday, November 4

- 06:35 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will speak on banking supervision and monetary policy at the 2025 Santander International Banking Conference in Madrid, Spain. Moderated Q&A is expected. On October 14, Vice Chair Bowman said that she “continue[s] to see two more cuts before the end of this year.”

Wednesday, November 5

- 08:15 AM ADP employment change, October (GS +70k, consensus +30k, last -32k)

- 09:45 AM S&P Global US services PMI, October final (consensus 55.2, last 55.2)

- 10:00 AM ISM services index, October (GS 51.0, consensus 50.8, last 50.0): We estimate that the ISM services index rebounded 1pt to 51.0 in October, reflecting a sequential improvement in our non-manufacturing survey tracker (+0.3pt to 52.2).

Thursday, November 6

- 08:30 AM Initial jobless claims, week ended November 1 (GS 225k, consensus 224k, GS estimate of last 218k); Continuing jobless claims, week ended October 25 (consensus 1,942k, GS estimate of last 1,949k)

- 11:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver a distinguished lecture at the Goethe University Institute for Monetary and Financial Stability in Frankfurt, Germany. Speech text and moderated Q&A are expected. On October 9, President Williams said that “the risk of a further slowdown in the labor market is something I’m very focused on.” He added that “if anything, the information suggested that the tariffs effects have been a little smaller than I expected,” highlighting that “there are more downside risks to the labor market and employment.”

- 11:00 AM Fed Governor Barr speaks: Fed Governor Michael Barr will speak in a moderated conversation on community development at a St. Louis Fed virtual event. Moderated Q&A is expected. On October 9, Governor Barr said that “although several data points indicate that the labor market may be roughly in balance, we also know there has been a sharp drop in job creation since May, which suggests risks to the labor market going forward.” However, he also noted that the “Federal Reserve’s price stability goal faces significant risks,” adding that he is “skeptical of assurances that we should fully look through higher inflation from import tariffs.”

- 12:00 PM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will address the Economic Club of New York. Speech text and Q&A are expected. On October 31, President Hammack said that she “would have preferred to have held rates steady” at the October FOMC meeting. She added that she thinks “we need to maintain some amount of restriction to help get inflation back down to target.”

03:30 PM Fed Governor Waller speaks

- Fed Governor Christopher Waller will participate in a panel on central banking and the future of payments at the Bank of Canada 2025 Annual Economic Conference in Ottawa, Canada. Moderated Q&A is expected. On October 31, Governor Waller said that “the biggest concern we have right now is the labor market.” He added that “we know inflation is going to come back down, so this is why I’m still advocating that we cut policy rates in December, because that’s what all the data is telling me to do.”

- 04:30 PM Philadelphia Fed President Paulson (FOMC non-voter) speaks: Philadelphia Fed President Anna Paulson will speak at the New Perspectives on Consumer Behavior in Credit and Payments Markets Conference in Philadelphia. Speech text is expected. On October 13, President Paulson noted that her “base case is that tariffs will increase the price level, but they won’t leave a lasting imprint on inflation” and that “given this base case, monetary policy should look through tariff effects on prices.” She added that “over the rest of this year, I view easing along the lines of the median Summary of Economic Projections policy path as appropriate.”

- 05:30 PM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will speak at a fireside chat on the US economy and monetary policy in New York City. Moderated Q&A with audience is expected. On October 17, President Musalem said that “we should tread with caution, because I perceive limited space for easing before monetary policy could become overly accommodative, and we haven’t finished the job on inflation.” He also assessed financial conditions as “very accommodative of economic activity.”

Friday, November 7

- 03:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver the keynote speech at the 2025 ECB Conference on Money Markets in Frankfurt, Germany.

- 07:00 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will speak on AI and the economy at the Euro20+ event in Frankfurt, Germany. The event will include a Q&A with Bundesbank President Joachim Nagel. Speech text and moderated Q&A with audience are expected. On October 3, Vice Chair Jefferson said that he “expect[s] the disinflation process to resume after this year and inflation to return to the two percent target in the coming years.” He added that “trends across several data series indicate that the labor market is softening, which suggests that, left unsupported, it could experience stress.”

- 10:00 AM University of Michigan consumer sentiment, November preliminary (GS 52.5, consensus 53.0, last 53.6); University of Michigan 5-10-year inflation expectations, November preliminary (GS 3.8%, consensus 3.8%, last 3.9%)

- 03:00 PM Fed Governor Miran speaks: Fed Governor Stephen Miran will speak on stablecoins and monetary policy at the Harvard Club of New York. Speech text and moderated Q&A are expected. At the October FOMC meeting, Governor Miran dissented in favor of a 50bps cut to the fed funds rate. On October 16, Governor Miran said that his “view is that the policy rate has become much more restrictive this year, and therefore we have to get close to neutral in a fast way.”

Source: DB, Goldman

Tyler Durden

Mon, 11/03/2025 – 09:43ZeroHedge NewsRead More

R1

R1

T1

T1