“Most Expensive Stock I’ve Ever Seen”: Palantir Smashes Estimates But Stock Fades After Hours Surge As Valuation Questions Swirl

Palantir, which after Nvidia is perhaps the current AI bubble’s most symbolic stock trading at a forward PE of over 300x, reported Q3 earnings which saw the company beat on the top and bottom line and boosted its revenue guidance for the full year; beating the average analyst estimate, sending the stock to fresh all time highs although the after hours action has been decidedly soggy with the stock first surging 7% before reversing all gains.

The company, whose market cap is just shy of $500 billion and which has quarterly revenue which is about 1/500th of this amount, posted its best-ever quarterly results reporting $1.18 billion in revenue and adjusted EPS of 21 cents per share, above the 17c median estimate. Palantir broke records once again with its third-quarter earnings as the company’s artificial-intelligence offerings drove aggressive business growth.

Here is what the company reported for the just concluded 3rd quarter:

- Adjusted EPS 21c, beating estimates 17c (EPS 18c vs. also beat 6.0c y/y)

- Revenue $1.18 billion, +63% y/y, beating estimate $1.09 billion

- US commercial revenue grew 121% y/y to $397m

- US government revenue grew 52% y/y to $486m

The 63% revenue growth was largely driven by Palantir’s biggest segment, US commercial, which saw sales rise by 121% year-over-year. Ryan Taylor, Palantir’s chief revenue and legal officer, said that Palantir is prioritizing the domestic market, which now comprises 75% of the business’ total revenue. The latest quarter was the fourth in a row in which Palantir’s U.S. commercial business was larger than its U.S. government segment.

Looking inside the income statement everything was good here too:

- Operating profit $393.3 million vs. $113.1 million y/y, estimate $255.6 million

- Adjusted operating profit $600.5 million vs. $275.5 million y/y, beating estimates of $498.7 million

- Adjusted operating margin 51% vs. 38% y/y, beating estimate 45.8%

- Adjusted EBITDA $606.5 million, beating estimates of $502.1 million

- Adjusted free cash flow $539.9 million, +24% y/y

- Cash and cash equivalents $1.62 billion, estimate $1.31 billion

In keeping with tradition, the company raised its full-year guidance as a result of its momentum. Palantir now anticipates around $4.40 billion in revenues for the 2025 fiscal year, up from the $4.14 billion to $4.15 billion the company had guided for in the second quarter. Here are the details for the coming quarter…

- Sees revenue $1.33 billion to $1.33 billion, above the estimate $1.19 billion

- Sees adjusted operating profit $695 million to $699 million, above the estimate $574.7 million

… and the full year:

- Sees revenue $4.40 billion to $4.4 billion, saw $4.14 billion to $4.15 billion, beating estimate $4.17 billion

- Sees adjusted operating profit $2.15 billion to $2.16 billion, saw $1.91 billion to $1.92 billion, beating estimate $1.93 billion

- Sees adjusted free cash flow $1.9 billion to $2.1 billion, saw $1.8 billion to $2.0 billion

- Sees US Commercial revenue above $1.43 billion

The company’s earnings beat sends a strong message of continuing demand for Palantir’s products. Prior to the earnings report, Citi analyst Tyler Radke questioned if Palantir could surpass the high expectations set by last quarter’s results, which saw the company crossing $1 billion in quarterly revenue for the first time.

Analysts expect Palantir to post a 50% increase in third-quarter revenue, with adjusted earnings per share jumping nearly 70%. Those are impressive numbers. But whether they’re enough to keep the rally going is another issue.

Commenting on the quarter, CEO Alexander Karp said in a letter to investors that the “business generated $1.2 billion in revenue for the third quarter of the year, a new record in our more than twenty-year history, representing an accelerating and otherworldly growth rate of 63% over the same period the year before.”

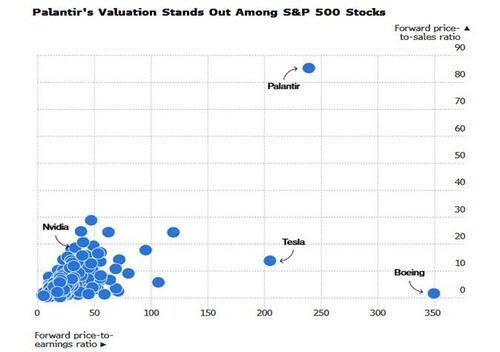

Palantir has been a controversial name on Wall Street due to its rich valuation: the stock trades at 85 times forward sales, and a stunning 240x forward PE ratio according to Bloomberg; and reliance on government contracts which can flip quickly especially if Republicans lose control.

“Valuation is our big stumbling block,” said Morgan Stanley analyst Sanjit Singh, who has the equivalent of a hold rating on the shares. “The most expensive I’ve seen in my career.”

That said, concerns about the data analysis company’s hefty price tag are nothing new. Most analysts continue to shy away from full-throated recommendations, with twice as many assigning the stock sell or hold ratings than buy.

Indeed, only 24% of the analysts covering Palantir polled by FactSet assign the stock a buy or buy-equivalent rating. But what Palantir lacks in institutional support, it makes up for with its fervent retail following, which CEO Alex Karp emphasized as a key part of what distinguishes Palantir from other software businesses.

“People who are most excited about our results in America now are average Americans,” Karp told MarketWatch.

In the shareholder letter, he said Palantir “has made it possible for retail investors to achieve rates of return previously limited to the most successful venture capitalists in Palo Alto.”

Perhaps, but beyond Wall Street, Palantir has a controversial reputation. According to Bloomberg, its involvement with government programs like immigration control, an AI fraud detection partnership with mortgage finance giant Fannie Mae and relationship with the Israeli goverment have all sparked criticism. And its Chief Executive Officer Alex Karp has himself been outspoken on various political topics.

Palantir has a “great CEO, a legitimate business, and a great product,” said Vikram Rai, portfolio manager and macro trader at First New York. But its stock price is being fueled by broader trends lifting momentum plays rather than fundamentals, he said.

Others agree. “When the music stops, this stock is going to get hit harder than others,” said Matt Maley, chief market strategist at Miller Tabak + Co. He applauds Karp and notes that Palantir is one of the few companies out there that’s making money from its AI investments. However, the stock price gives him pause.

“There are other AI plays which are cheaper, like Nvidia, that will be a little safer right now,” Maley said.

Others are more optimistic: Palantir “will grow into its valuation,” tech bull Dan Ives wrote in a research note last week. Wall Street is “still underestimating the company’s commercial efforts,” he added.

On the commercial side, Gil Luria, managing director and head of technology research at DA Davidson & Co., expects strength because Palantir can “get their customers to an AI solution faster and more effectively than anybody else.” He’s kept his stock rating at neutral due to its high price, but doesn’t “see a reason for the valuation to come down right now either,” he sa

PLTR shares closed Monday above $207, after opening at $10 when the company conducted its 2020 direct listing. And while they spiked as high as $222 after hours, they have since faded to their closing price as the market assesses how much higher the forward multiple can rise.

The stock jumped as much as 3.5% on Monday ahead of results due after the close of trading, putting it on track to close at an all-time high.

Tyler Durden

Mon, 11/03/2025 – 16:46ZeroHedge NewsRead More

R1

R1

T1

T1