Stocks Extend Rally Into 7th Month As AI Bubble Rally Just Won’t Stop

US equity futures are signaling a solid start to November, led by Tech with small caps flat, as traders gauge the durability of a seven-month global equity rally fueled recently by strong tech earnings and easing US–China trade tensions. S&P 500 futures were up 0.2% while Nasdaq 100 futs rose 0.6% as of 8:00 am ET. Pre-market, Mag7 are all higher with Semis also bid; Cyclicals poised to lead Defensives with both higher. European and Asian equities also rose. Global bonds softened, with the 10-year US Treasury yield at 4.11%. Commodities are mixed with Ags leading, Metals weaker, and Energy mostly lower ex-natgas. Oil fluctuated after OPEC+ signaled that it’ll pause output increases next quarter ahead of expected demand declines / supply glut. China suspended curbs on rare earths and suspends chips investigation. Gold first dropped but then rebounded back over $4k after China imposed a 7% value-added tax on gold for jewellery and industrial use. Today SCOTUS will hear IEEPA tariff challenges with JPM noting that the market expects those tariffs to be struck down and later replaced by sectoral tariffs and could trigger a near-term squeeze/broadening subject to moves in the bond market. We also get US manufacturing PMI (9:45am) and October ISM manufacturing (10am); US government data continue to be postponed by shutdown that began Oct. 1. Fed speaker slate includes Daly (12pm) and Cook (2pm). Earnings from Palantir and Diamondback Energy follow later in the day.

In premarket trading, Mag 7 stocks are all higher (Nvidia +1.8%, Meta +0.9%, Alphabet +0.5%, Amazon +0.2%, Tesla +0.5%, Apple +0.01%, Microsoft +0.4%).

- Alvotech (ALVO) plunges 23% after the drugmaker said the FDA rejected its biologics application for a biosimilar candidate to Johnson & Johnson’s Simponi, and cut its 2025 outlook as a result.

- Cipher Mining (CIFR) rises 21% after signing a $5.5 billion, 15-year lease agreement with Amazon to provide turnkey space and power for AI workloads.

- Eaton (ETN) slips 1% after agreeing to buy the Boyd Thermal business of Boyd Corp. from Goldman Sachs for $9.5 billion.

- IREN Ltd. (IREN) soars 22% after Microsoft Corp. signed an approximately $9.7 billion deal to purchase AI cloud capacity from the Australian company, becoming its largest customer.

- Kenvue (KVUE) jumps 19% after Kimberly-Clark agreed to buy the struggling Tylenol maker in a deal worth roughly $40 billion. Kimberly-Clark (KMB) shares slump 15%.

- Liquidia (LQDA) rises 11% after the drugmaker reported revenue for the third quarter that exceeded the average analyst estimate. The company also reported loss per share for the quarter that was lower than expectations.

- New Gold Inc. (NGD) climbs 10% after agreeing to be acquired by Coeur Mining Inc. for about $7 billion in an all-stock deal.

- SM Energy Co. (SM) and Civitas Resources Inc. (CIVI) agreed to combine in an all-stock transaction, the latest move to consolidate the US shale industry. Shares of SM Energy are up about 1%, while the stock of Civitas Resources (CIVI) rises 2%.

- Vertiv (VRT) rises 1.8% after entering into an agreement to buy Purge Rite Intermediate from Milton Street Capital LLC for ~$1b in cash at closing plus the potential additional consideration of up to $250 million in cash based on achieving certain 2026 performance metrics.

In corporate news, Pfizer sued Metsera and Novo Nordisk to block Novo’s rival bid for the obesity startup. Alphabet is expected to raise a total of at least €3 billion ($3.5 billion) in six euro-denominated bonds, to help fund AI expansion. BP agreed to divest stakes in US shale assets to Sixth Street for $1.5 billion as it seeks to shore up its balance sheet and win back investor confidence.

The six-month bull run in US stocks is set to continue as markets brush aside concerns over stretched valuations, with earnings beating expectations and big tech fueling optimism around AI. Investors are gearing up for earnings from Palantir and a slate of private economic reports for fresh direction on the path for interest rates. Palantir, one of the year’s biggest beneficiaries of the artificial-intelligence boom with a 165% gain, was poised rally further ahead of results due after the close.

Investors are set to again rely on private data this week given the government shutdown, which includes the ISM manufacturing index on Monday and ADP employment figures on Wednesday. While there is a risk that a flood of economic data could hit once the shutdown is over and reignite volatility, the subdued VIX gauge has seen call buying at a high pace. And speaking of the shutdown, it is on track to become the longest in history.

“Earnings growth is there, the momentum is there and on a macro level — although it’s still very volatile — things are moving in the right direction,” said Andrea Gabellone, head of global equities at KBC Global Services. “I don’t see any reason for the rally not to consolidate and even go higher.”

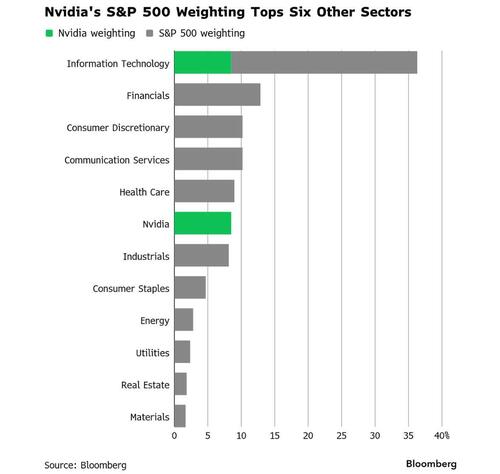

With earnings in from six of the Mag-7, quarterly profit growth is tracking at ~27% for the group, compared with 15% expansion anticipated before the reporting season started, according to data compiled by Bloomberg Intelligence. Nvidia is now larger than six of the 11 sectors in the S&P 500 Index and all but five of the world’s stock markets.

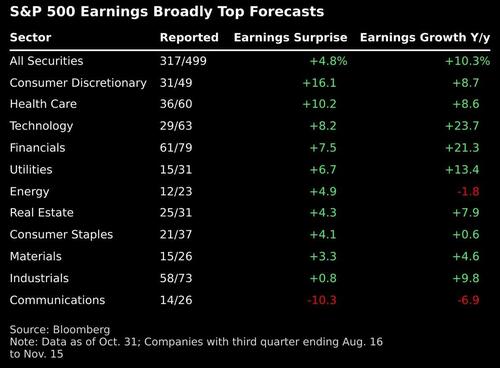

Out of the 318 S&P 500 companies that have reported so far in the earnings season, 83% have managed to beat analyst forecasts, while 13% have missed. The S&P 500 is on pace for 13% earnings growth, up from 7.2% expected at the beginning of October. US earnings are surging across the board with the median stock in the Russell 3000 tracking its fastest growth since 3Q21, Morgan Stanley said, supporting a view that a new cycle and bull market began in April. Goldman Sachs’ David Kostin sees earnings beats as unprecedented except the Covid reopening in 25 years of data.

As reported over the weekend, Berkshire Hathaway’s cash pile soared to a record $381.7 billion in the third quarter, while the firm declined to buy back shares for a fifth straight quarter. Operating earnings surged 34% as its insurance underwriting profit more than tripled.

In trade, China ended a gold tax break, in a setback for consumers in one of the world’s top bullion markets. The US is expected to suspend port fees for a year on China-linked vessels starting next week. China is said to seek buying US wheat for the first time in a year.

In Europe, the Stoxx 600 is up 0.4%, with automakers leading gains after it was announced China would ease its chip export ban. Energy shares advance alongside oil prices as OPEC+ is set to pause its output increases in the first quarter of next year. Autos gain after it was announced China would ease its chip export ban. Here are some of the biggest movers on Monday:

- GTT advances as much as 6.2%, to a new record high, following an upgrade to its guidance after the market close on Friday.

- European energy companies are outperforming this morning as oil prices advanced after OPEC+ signaled that it’ll pause output increases next quarter, following a modest hike for next month.

- A2A gains as much as 6.4% as Morgan Stanley upgrades to overweight, saying the firm is an “under-the-radar” potential beneficiary of any Milan-region data center build-out.

- European autos shares rise after it was announced China would ease its chip export ban in a decision that should “alleviate short-term supply risk for OEMs and their suppliers,” say Oddo BHF analysts.

- MFE-MediaForEurope’s Class A shares gain as much as 5.7% as JPMorgan initiates coverage with an overweight rating.

- BFF Bank surges as much as 11%, the most since May, after the Italian firm said the Bank of Italy has lifted the ban on the distribution of profits, which analysts at Deutsche Bank say is fueling a relief rally in the shares.

- Paradox Interactive gains as much as 12% after video-game critics published their reviews of the Swedish studio’s key 2H 2025 release, strategy game Europa Universalis V.

- Davide Campari-Milano shares fall as much as 6%. Italian prosecutors have ordered the seizure of around €1.3 billion in shares from the holding company that controls Campari as part of an alleged tax-fraud probe, according to a statement late Friday.

- Ryanair shares fall as much as 3.6%, taking a breather after ongoing strength in share performance. Europe’s largest budget airline reported post-tax profit in the second quarter that topped estimates, driven by in-line fare growth and strong cost control.

- FLSmidth falls as much as 4.6% after Nordea cut its recommendation on the Danish industrial equipment firm to hold from buy.

Asian stocks rose, lifted by gains in South Korea’s chipmakers after a slew of technology partnerships bolstered sentiment. Equities in Hong Kong extended their advances in afternoon trading. The MSCI Asia Pacific excluding Japan Index climbed as much as 0.9%, rebounding after two sessions of losses. Gauges in South Korea were the biggest gainers in the region, with the benchmark Kospi hitting a fresh record high. Shares on mainland China reversed early losses to close higher, while those in the Philippines fell. A series of partnerships between Nvidia and some of South Korea’s biggest companies has reinforced optimism in the country’s equities, supported by an improving relationship with the US. Sentiment in Asia also got a boost following several trade deals struck during US President Donald Trump’s tour of the region last week.

In rates, treasuries are marginally cheaper across the curve, following similar price action in German bonds while gilts outperform slightly. US yields are as much as 3bps cheaper on the day with the curve slightly steeper. 10-year near 4.11% outperforms Germany’s and trails UK’s, each by about 1bp. US session includes manufacturing PMIs and at least two Fed speakers. IG dollar issuance slate includes two items so far and is expected to grow, with underwriters anticipating $55 billion this week and around $120 billion for November; Treasury auctions resume next week with 3-, 10- and 30-year new issues. Google announced another massive, 8-part debt deal as the funding scramble to use debt to pay for datacenters continues.

In FX, the Bloomberg Dollar Spot Index is steady while the Swiss franc is the weakest of the G-10 currencies, falling 0.3% against the greenback. Spot gold slips back below $4,000/oz.

In commodities, oil prices are near flat after giving up earlier gains seen after OPEC+ said it planned to pause output increases in the first quarter of 2026. WTI crude futures are just below $61 a barrel. Gold trimmed early gains but remained above $4k as haven demand faded, while the dollar held steady. On Friday, China ended a gold tax break, in a setback for consumers in one of the world’s top bullion markets.

Today’s economic calendar slate includes October S&P Global US manufacturing PMI (9:45am) and October ISM manufacturing (10am); US government data continue to be postponed by shutdown that began Oct. 1. Fed speaker slate includes Daly (12pm) and Cook (2pm)

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini little changed

- Stoxx Europe 600 +0.4%

- DAX +0.8%

- CAC 40 little changed

- 10-year Treasury yield little changed at 4.08%

- VIX +0.4 points at 17.8

- Bloomberg Dollar Index little changed at 1221.48

- euro -0.2% at $1.1515

- WTI crude little changed at $60.96/barrel

Top Overnight News

- The Trump administration has begun detailed planning for a potential new mission to send U.S. troops and intelligence officers into Mexico to target drug cartels. NBC

- More than 735,000 New Yorkers cast early ballots ahead of Tuesday’s mayoral election, the highest ever early in-person turnout for a nonpresidential vote in the city. NYT

- US Democratic and Republican Senators are talking and focused on finding agreement on FY26 spending bills; the hope being that a spending agreement could help to resolve the shutdown. On spending, talks continued over the weekend and there is some optimism around a resolution. However, there are no signs from Trump/Republicans around giving ground on extending the expiring premium Obamacare subsidies: PunchBowl

- Fed’s Miran (voter) warned that the Fed risks a recession if it doesn’t cut rates rapidly: NYT

- President Trump says that Chinese President Xi Jinping has given him assurances that Beijing would take no action toward its long-stated goal of unifying Taiwan with mainland China while the Republican leader is in office. CNBC

- Trump threatened to take military action in Nigeria and cut off US aid if the government doesn’t halt militants’ “killing of Christians.” The country’s dollar bonds tumbled, suffering the biggest losses across emerging markets. BBG

- Trump urged Senate Republicans to terminate the filibuster rule. Trump separately commented that they will ask the courts how they can legally fund SNAP benefits as soon as possible.

- Bessent said the Trump administration will not appeal the judge’s ruling on SNAP benefits, while he also commented that the Fed should be cutting rates if inflation is dropping, according to an interview with CNN.

- NVDA’s most advanced chips will be reserved for U.S. companies and kept out of China and other countries, U.S. Trump confirmed in 60 Minutes last night. RTRS

- A private gauge of China’s manufacturing activity showed Chinese factories continued to expand production in October, albeit at a slower pace, signaling weaker growth momentum heading into the fourth quarter of the year. China’s RatingDog manufacturing PMI for Oct came in at 50.6, down from 51.2 in Sept and a bit below the consensus forecast of 50.7. WSJ

- China is seeking to buy US wheat in what would be the first purchase in more than a year, following last week’s trade truce between the two nations. BBG

- China will suspend implementation of additional export controls on rare-earth metals and terminate investigations targeting US companies in the chip supply chain, the White House said. BBG

- Microsoft and Alphabet plan more deals to build out their AI infrastructure. Microsoft signed a $9.7 billion agreement to buy cloud capacity from Australia’s IREN, giving it to access more Nvidia chips, while Alphabet plans to raise at least €3 billion in a debt offering, a person familiar said. IREN also said it agreed to buy equipment from Dell for $5.8 billion. Shares of both firms jumped in premarket trading. BBG

Trade/Tariffs

- US President Trump commented on Friday about China, in which he stated that he would love to get rid of the extra 10% tariff and that the meeting with China was incredible, while he believes the deal with China will be long-lasting. It was also reported that US President Trump told Chinese President Xi that chip sales are “between you and NVIDIA”.

- US President Trump said the US will not let China have NVIDIA’s (NVDA) most advanced chips, while he also commented that he will not attend Supreme Court tariff case arguments and doesn’t want to do anything to deflect the importance of that decision. Furthermore, Trump posted that the case on tariffs is one of the most important in the history of the country, and if a President is not allowed to use tariffs, the US will be at a major disadvantage against all other countries throughout the world, while he warned if they lose the decision, the US could be reduced to almost third-world status.

- US Treasury Secretary Bessent said China has shown itself to be an unreliable partner in many areas, while he also commented, “we’ll see” if a 10% tariff will be enacted on Canada after the Reagan advertisement, and he is not planning on going to the Supreme Court arguments on trade policy on Wednesday, according to CNN.

- China’s Commerce Ministry said it will consider exemptions for the Nexperia chip export ban. It was separately reported that Nexperia’s Dutch headquarters said it welcomes announcements lifting the block on shipping chips, while the Dutch government said that China talks continue regarding a constructive way forward in Nexperia.

- Chinese President Xi proposed that China and South Korea properly manage differences through friendly consultations, while he called for the sides to strengthen strategic communication and consolidate the foundation of mutual trust. Xi also called for deepening China and South Korea cooperation in emerging sectors such as AI and biopharmaceuticals, as well as urged South Korea to work with China to practice true multilateralism and safeguard the multilateral trading system.

- South Korea’s presidential office said South Korea and China signed 7 MOUs, including a currency swap. It was also reported that a South Korean presidential adviser said they agreed with China to cooperate on stabilising supply chains and will continue working-level communication on China’s ban on Korean culture, while South Korea and China were said to have made progress on China’s effective ban on Korean culture.

- Japanese PM Takaichi said they agreed with Chinese President Xi to build a constructive and stable relationship, while she said they reaffirmed a strong US-Japan alliance through US President Trump’s visit. Furthermore, Takaichi said they are not planning to renegotiate the USD 550bln investment package with the US even after seeing the US-South Korea package.

- Canadian PM Carney met with Japanese PM Takaichi on the APEC sidelines and discussed the potential to expand a productive economic relationship between the two countries, building on USD 32bln in annual two-way merchandise trade, while the Canadian PM’s office said they stand ready to negotiate an even better trade deal for both Canada and the US.

- China’s MOFCOM says China and the EU held in-depth and constructive talks on mutual export control concerns; both sides agreed to maintain dialogue to support stable and smooth supply chains between the economies.

- China is said to be seeking to buy US wheat for the first time in a year, according to Bloomberg sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks trade mostly higher despite a lack of fresh major macro developments over the weekend and with thinned conditions as Japanese markets were shut for a holiday. ASX 200 lacked conviction as gains in tech, energy and financials were offset by weakness in healthcare, real estate and miners, while the RBA also began its two-day policy meeting, where the central bank is unanimously forecast to maintain its Cash Rate at 2.60%. KOSPI rallied to a fresh all-time high amid tech strength with notable gains in SK Hynix and Samsung Electronics, while South Korea and China reportedly signed 7 MOUs and agreed to cooperate on stabilising supply chains. Hang Seng and Shanghai Comp were ultimately higher although price action in the mainland was choppy with risk sentiment flimsy as participants digested disappointing Chinese RatingDog Manufacturing PMI data.

Top Asian News

- Hong Kong’s Financial Secretary Chan said the city is set to achieve its annual target of 2%-3% for 2025 and noted that the economy grew 3.8% in Q3, which was the fastest pace of growth since Q4 2023.

- South Korea and Singapore agreed to cooperate on defence technology and signed an MOU on AI and green shipping, according to Korea’s presidential office.

- RBNZ 2025 stress test results noted that large banks are well placed to withstand the solvency and liquidity impact of a severe scenario caused by worsening geopolitical risks.

European bourses (STOXX 600 +0.4%) opened modestly mixed and either side of the unchanged mark, but then caught a bid soon after the cash open. Upside lacked any specific drivers, but does come in the context of positive Nexperia-related developments and constructive EU-China trade talks over the weekend. European sectors opened with a negative bias, but are now mixed. Autos is by far the clear outperformer today, driven higher by the Nexperia developments over the weekend. In brief, China is to loosen its chip export ban to Europe – chips which were widely used amongst European automakers; Mercedes-Benz (+3.6%). Basic Resources is found right at the bottom of the pile, following China’s decision to pause rare earth export controls to the EU; Rio Tinto (-1.2%).

Top European News

- UK Chancellor Reeves is reportedly considering higher bands of council tax to target expensive homes, via FT citing sources who said the idea is well established, the discussion is on the implementation; would reportedly raise several billion pounds. (FT)

- EU is devising plans to expand supervision of key financial markets infrastructure, including stock exchanges, crypto exchanges and clearing houses, as it seeks to eliminate fragmentation in the single market, according to FT.

- German VDMA says German engineering order fell 19% Y/Y in September; domestic orders -5%, Foreign Orders -24%; July-Sept -6% Y/Y.

- ECB’s Kazimir says there’s no time or need to fine-tune or overengineer monetary policy. Would not read too much into small deviations from a desired inflation path. There’s a risk as broadly balanced for both the economy and inflation. The next move could be in either direction depending on the signals the ECB receives.

FX

- USD has kicked the week off on the front foot in a slight extension of last week’s upside which was triggered primarily by the combination of a more hawkish-than-expected Fed announcement and a thawing in trade relations between China and the US. Whilst official data releases are still lacking, this week will present a slew of private surveys, kicking off today with the ISM manufacturing print, which is expected to remain in contractionary territory vs. expectations of an expansionary print in the services metric on Wednesday. Today’s speaker docket includes Fed’s Daly and Cook. DXY has risen as high as 99.92 with focus on a potential test of 100; not breached since August 1st (100.25 was the high that day).

- EUR is softer vs. the broadly firmer USD with incremental macro drivers for the Eurozone on the light side in the wake of last week’s uneventful ECB policy announcement. Messaging since has reaffirmed the tone struck by ECB Lagarde with Nagel of Germany the latest to make the case that there is no need to adjust policy in the near-term based on the current outlook for the ECB. Note, Chief Economist Lane is due to speak @ 12:00GMT. Eurozone manufacturing PMI was unrevised at 50, as expected with the accompanying report noting that “demand across the eurozone economy remained subdued”. On a more encouraging footing, China’s MOFCOM said China and the EU held in-depth and constructive talks on mutual export control concerns with both sides agreeing to maintain dialogue to support stable and smooth supply chains between the economies. EUR/USD has slipped to its lowest level since 1st August with a session trough at 1.1511.

- JPY is a touch lower vs. the USD with USD/JPY holding above the 154 mark. Japan was away from market overnight with newsflow surrounding Japan subsequently on the light side. The Japanese calendar is a light one this week aside from Cash Earnings data on Thursday. As it stands, markets price just a circa 28% chance of a BoJ rate hike in December. USD/JPY has ventured as high as 154.28 but is yet to test Friday’s best at 154.41.

- GBP is soft vs. the USD but flat vs. the EUR. Newsflow continues to centre on the November 26th budget with the latest reporting suggesting that UK Chancellor Reeves will target pensions of high earners and expensive homes. The potential outcomes for the budget are vast at this stage. However, consensus is gradually coalescing around the view that Reeves will attempt to establish a greater financial buffer via a range of tax increases (e.g. freezing income thresholds, expanding NIC coverage, etc) that are expected to be non-inflationary and growth restrictive. Elsewhere, UK manufacturing PMI has been revised a touch higher but ultimately still remains below the 50 mark. Cable has slipped to a low of 1.3118 but is holding above Friday’s 1.3097 base.

- Antipodeans are both are slightly more resilient than most peers vs. the USD with AUD managing to overlook a disappointing Chinese RatingDog Manufacturing PMI print overnight, which was hampered by a sharp decline in export orders. Instead, attention is on tomorrow’s RBA policy announcement, with markets assigning a circa 94% chance of an unchanged rate in the wake of last week’s hotter-than-expected Q3 inflation report.

- CHF is one of the laggards across the majors in the wake of softer-than-expected Swiss inflation data for October. Y/Y CPI unexpectedly slowed to 0.1% from 0.2% vs. consensus of a pick-up to 0.3%, whilst the M/M rate printed at just -0.3% (expected -0.1%, previous -0.2%); both prints were below the bottom-end of analyst forecasts.

Fixed Income

- USTs are firmer by a handful of ticks. Price action this morning was limited for USTs at first owing to the Japanese closure for Culture Day. USTs picked up a bit more into the European day alongside benchmarks generally and despite an uptick in equity performance. Action that took USTs to a 112-27 peak, nearly matching Friday’s 112-27+ high, last week’s 112-29+ best just above. Markets will get Cook (voter) and Daly (2027) later today, in addition to the refinancing estimates ahead of Wednesday’s Quarterly Refunding Announcement. Before that, ISM Manufacturing hits and given the lack of NFP on Friday owing to the shutdown the employment component may draw even-greater attention than usual. This week, we will get ADP and Challenger but no JOLTs, weekly claims or as mentioned, NFP.

- OATs are modestly firmer. Friday’s Zucman tax measures failed to garner support in the National Assembly on Friday, though a slight adjustment was made to a real estate tax to target “unproductive wealth”. Supported by the Socialist Party, but markedly shy of the measures they seek. Amidst this, the OAT-Bund 10yr yield spread has narrowed a touch to just above the 78bps mark, potentially trading off the c. 10 day reprieve Lecornu may very well have.

- Bunds drifted lower overnight and then came under pressure this morning on the announcement of six-part EUR denominated Alphabet issuance, an update that sent Bunds to a 129.24 trough with downside of 15 ticks at most. However, the move proved somewhat short-lived with Bunds bouncing thereafter to 129.41, but still shy of the overnight early doors 129.46 peak. Upside that started around the European cash equity open and despite the equity tone picking up at the time amid the MOFCOM announcing in-depth China-EU talks. While firmer the action, as is the case with USTs, leaves Bunds just shy of Friday’s 129.49 best and last week’s peak at 129.73. No substantial move to the Final Manufacturing PMIs this morning, neatly surmised by HCOB as “fragile in Germany, in recession in France, persistently weak in Italy, and showing only subdued growth in Spain.“

- Gilts opened with upside of a handful of ticks at 93.65 before extending to a 93.74 peak in tandem with peers as outlined above, a high that just about eclipses Friday’s 93.71 best but stopped shy of 93.89 and 93.96 from earlier that week. No move to a slight upward revision to the Final Manufacturing PMI, but one that left it in contractionary territory. The release highlighted that manufacturing is in a holding pattern, awaiting clarity on the domestic fiscal and geopolitical backdrop. Weekend press reports focussed on the fiscal situation, as Reeves is said to be preparing a pension tax raid of as much as GBP 4bln, according to The Telegraph. Additionally, the FT reports that the Treasury is looking into higher council tax bands, a tweak that could raise several billion pounds.

- Alphabet (GOOGL) mandates EUR-denominated 3yr, 6yr, 9yr, 13yr, 19yr & 39yr bonds; proceeds for general corporate purposes, incl. the repayment of outstanding debt,

Commodities

- Crude benchmarks initially gapped higher following the OPEC+ meeting on Sunday but have failed to hold onto gains, reversing back to the closing price of Friday’s session. WTI and Brent gapped and extended to a peak of USD 61.50/bbl and USD 65.32/bbl respectively before falling c. USD 0.80/bbl to a trough of USD 60.70/bbl and USD 63.98/bbl. Over the weekend, OPEC+ agreed to an oil production hike of 137k BPD for December but then to hold on oil hikes for the following three months. The three-month hold has been described by analysts as an acknowledgement by the group that the oil market is facing a sizable surplus.

- Spot XAU fell straight on the open of the APAC session to a trough of USD 3962/oz before gradually reversing to a peak of USD 4028/oz just as the European session got underway. Currently, XAU is trading shy of best levels at USD 4006/oz as the global equity bid weighs on the yellow metal.

- Base metals initially dropped as the APAC session got underway but reversed higher, with 3M LME Aluminium reaching near its highest prices since May 2022, as the market follows the wider positive sentiment in global equities. 3M LME Copper dipped to a trough of USD 10.84k/t early in the trading day before reversing to a peak of USD 10.93k/t and currently oscillating within this tight c. USD 100/t band. Overnight the red-metal lacked direction after disappointing Chinese PMI data.

- Eight OPEC+ countries agreed to raise oil output in December by 137k bpd and then pause for Q1.

- Turkish oil refiners are to cut Russian crude imports for December arrival with Azeri Socar buying four non-Russian cargoes, while Turkish state refiner Tupras increases purchases of non-Russian crude, according to sources cited by Reuters.

- Morgan Stanley raises H1’26 Brent estimate to USD 60/bbl (prev. saw USD 57.50/bbl)

- BP (BP /LN) CEO says oil demand remains robust, adds that 1% oil demand growth was helped by aviation and petchems.

- UBS sees upside risks for gold towards USD 4,700/oz if political or financial market volatility increases again.

- OPEC Secretary-General says the group has been consistently and regularly returning barrels to the market, have the flexibility to alter, pause and reverse past decisions. Making sure to maintain supply-demand balance. Group sees oil demand growth at 1.3mln BPD this year. Still sees good signs for demand. Not expecting any surprises in the market.

Geopolitics: Middle East

- Israeli PM Netanyahu warned that Israel was prepared to take further action against Iran-allied groups, Hezbollah in Lebanon and Houthis in Yemen, according to FT.

- Israel’s Defence Minister said the Lebanese government must fulfil its commitment to disarm Hezbollah and remove it from south Lebanon, while Israel vowed maximum enforcement will continue and intensify to protect northern residents.

- Israel reportedly conducted artillery strikes and destroyed residential blocks in Khan Younis, southern Gaza Strip.

- Israel announced on Sunday that it received the bodies of three hostages from the Red Cross in Gaza.

- Iran’s President said Tehran will rebuild its nuclear facilities with greater power, according to state media.

- Iranian Foreign Minister Araghchi reiterates Iran is not interested in direct negotiations with the US, via Iran International.

- Iranian Foreign Ministry spokesperson Baghaei says Tehran remains committed to the Non-Proliferation Treaty (NPT) and its safeguards agreement, via Iran International.

Geopolitics: Ukraine

- US Pentagon was reported on Friday to have approved the White House to transfer US Tomahawk missiles to Ukraine, although left the final decision to the US President Trump, according to CNN, while the Russian Foreign Ministry said regarding reports about the US approval of Tomahawk supplies to Ukraine, that sending weapons to Kyiv will not help any settlement, according to RIA. However, US President Trump commented on Sunday that he is not really considering giving Ukraine Tomahawk missiles.

- Ukraine drone attack causes fire at Russian Black Sea port of Tuapse, while authorities announced that an oil tanker and two foreign civilian vessels were damaged as a result of the drone attack on Russia’s Tuapse.

- Ukraine’s military said it is raising the number of its assault groups to counteract Russian troops and that it has improved positions in several districts in Pokrovsk. However, it also stated that the situation in Pokrovsk remains complicated and dynamic, while Russia’s Defence Ministry said Ukrainian soldiers surrounded in Pokrovsk began to surrender.

- Russia says it struck Ukrainian gas facilities, a military airfield, and a Ukrainian military equipment repair base in large overnight strikes.

Geopolitics: Other

- US President Trump’s administration is reportedly planning a new mission in Mexico to target cartels, via NBC citing current & former officials; would include US troops on the ground, though deployment is not imminent.

- US President Trump threatened to cut off all US aid to Nigeria over the killing of Christians and said the US might go into Nigeria with “guns-a-blazing”, while he instructed the Department of War to prepare for possible action and separately commented that there could be US troops on the ground in Nigeria or airstrikes.

- US Secretary of War Hegseth posted “The killing of innocent Christians in Nigeria — and anywhere — must end immediately. The Department of War is preparing for action. Either the Nigerian Government protects Christians, or we will kill the Islamic Terrorists who are committing these horrible atrocities.”

- US and China agreed to set up direct communication between their militaries to help avoid conflict, according to US Secretary of War Hegseth, who also said the administration supports a strong and independent Vietnam, while the US wants a deeper military relationship with Vietnam and wants to expand the partnership with Vietnam and work to advance shared interests. Furthermore, Hegseth announced that the US military carried out another ‘lethal kinetic strike’ on a vessel in the Caribbean.

- South Korean President Lee said they will aid US President Trump to play a peacemaker role on North Korea.

- China criticised Japanese PM Takaichi for meeting with Taiwanese officials on the sidelines of APEC.

- Philippines signed a military pact with Canada as the former seeks to build a coalition of allies to deter China’s aggression in the South China Sea.

US Event Calendar

- Oct Wards Total Vehicle Sales, est. 15.5m, prior 16.39m

- 9:45 am: Oct F S&P Global U.S. Manufacturing PMI, est. 52.2, prior 52.2

- 10:00 am: Oct ISM Manufacturing, est. 49.45, prior 49.1

- 10:00 am: Oct ISM Prices Paid, est. 62.5, prior 61.9

- 10:00 am: Sep Construction Spending MoM

Central Bank Speakers:

- 12:00 pm: Fed’s Daly in Moderated Conversation

- 2:00 pm: Fed’s Cook Speaks on Economy and Monetary Policy

DB’s Jim Reid concludes the overnight wrap

Welcome to the first business day of November. As it’s the start of the month, Henry has just released our regular performance review of markets in October. It was an incredibly eventful month, and financial assets were supported by the US-China trade truce, strong data and decent earnings. So the S&P 500 posted a 6th monthly gain for the first time since 2021, and those factors outweighed concerns around private credit and fears of an AI bubble. Meanwhile, Japan’s Nikkei had its best month in 35 years as the new government came to office. And despite the late pullback, precious metals continued their advance, with gold moving above $4,000/oz, whilst silver posted a 6th consecutive monthly gain for the first time in 45 years. See the full report here.

One of this week’s major landmarks is that, by midnight tomorrow, the current US government shutdown will officially become the longest in history—assuming there isn’t a highly unlikely near-term resolution. This will surpass the previous record of 35 days, which ended on 25 January 2019. There is growing speculation that we may be nearing the last stages of the shutdown, driven by increased cross-party dialogue, mounting public pressure, and economic and political considerations. One example is the US food aid programme, which supports around 42 million Americans and may not have sufficient funding to last through November.

Yet despite this, the Polymarket probabilities show little sign of shifting. For instance, the likelihood of the shutdown ending by 15 November stands at 51%, having edged lower in recent days, while the probability of it ending by 30 November remains consistently in the 80–90% range, currently at 86%. So, while markets expect a November, expectations haven’t accelerated.

If it weren’t for the shutdown, we’d be looking forward to the US jobs report for October on Friday. But given we aren’t getting the government data releases, there’s likely to be outsize attention on the ADP’s report of private payrolls on Wednesday, especially in light of Chair Powell’s hawkish press conference last week. He indicated that the Fed requires further evidence of labour market deterioration before considering additional easing, and his stance may have been influenced by recent weekly ADP data, which has pointed to a modest rebound in private sector job gains. For this month’s report, DB’s US economists expect a print of +50k, compared to -32k previously, with consensus at +30k. They think a rebound in the ADP survey would align with seasonal patterns observed over recent years during the summer and autumn. These seasonals may have artificially weakened the recent headline figures, although strict immigration curbs and subdued hiring and firing point to a fragile low level equilibrium in the labour market which wouldn’t take much to shift momentum either way.

Elsewhere in the US, the focus will be on other private sector releases. Today’s ISM manufacturing print is forecast by DB at 48.9, down from 49.1 previously (consensus at 49.5), while Wednesday’s ISM services print (DB at 51.1, consensus 50.8, vs. 50.0 last month) will also be closely watched, particularly its subcomponents such as employment and prices paid. The PMIs are also out this week, as well as the University of Michigan’s consumer sentiment on Friday, where the inflation expectations series will be key. Bear in mind that the October FOMC dissenter Schmid recently remarked, “I view inflation expectations not as an input into Fed’s decisions, but as the outcome of the policy decisions that the Fed makes.” There will also be extensive Fed commentary this week, which will be closely scrutinised following last week’s FOMC.

Aside from the data, one of the big events is that on Wednesday, the US Supreme Court will hear oral arguments regarding the Trump administration’s IEEPA tariffs, which account for roughly half of tariff revenue collections in 2025. Two lower courts have ruled these tariffs illegal, and the eventual outcome could significantly impact the fiscal outlook—even though Trump may pursue alternative measures if he loses. Bear in mind that Polymarket probabilities only point to a 36% chance of the Supreme Court ruling in favour of the Trump tariffs, so one to keep an eye on.

Globally, central bank meetings are scheduled with the RBA (Tuesday), Riksbank (Wednesday), Norges Bank and BoE (Thursday). No changes are expected, though the BoE holds the most uncertainty with markets pricing a 29% likelihood of a cut, compared to negligible probabilities for the others. See our economists’ preview of the BoE meeting here.

Outside the US, key data releases include October CPIs in Switzerland (today) and Sweden (Thursday), trade balances in Germany, France, and China (all Friday), and wage data in Japan (Wednesday). Germany will also publish factory orders (Wednesday) and industrial production figures (Thursday).

Earnings season will also continue apace this week, with several US tech firms in the spotlight, including Palantir, AMD, and Qualcomm. Other notable S&P 500 names reporting include McDonald’s, Uber, and Pfizer. Energy firms Saudi Aramco, ConocoPhillips, and BP are also set to report. Meanwhile in Europe, highlights include AstraZeneca, Novo Nordisk, Ferrari, and defence firms Rheinmetall and Leonardo. See our day-by-day calendar of events at the end as usual.

Overnight in Asia, equities have generally got November off to a strong start. For instance in South Korea, the KOSPI (+2.48%) has surged to another record high, and in Hong Kong the Hang Seng is also up +0.89%. The performance has been a bit softer in mainland China, with the Shanghai Comp (+0.26%) posting a more modest increase alongside a decline for the CSI 300 (-0.12%). But looking forward, US and European equity futures are also positive, with those on the S&P 500 (+0.17%) and the DAX (+0.26%) both pointing higher. Otherwise, WTI oil prices (+0.46%) have risen for a 4th consecutive session after the OPEC+ group said they would be pausing output hikes in Q1, moving up to $61.26/bbl.

Recapping a hectic week now, markets were buoyed by strong tech earnings, a positive Trump–Xi meeting, and new AI-related deals. Tech outperformed, with the NASDAQ up +2.24% (+0.61% Friday) and the Mag-7 rising +3.30% (+1.22% Friday). The Philadelphia Semiconductor Index gained +3.61% (+0.18% Friday), driven by Qualcomm’s +7.08% chip announcement and Nvidia’s +8.71% surge following new partnerships, pushing its market cap past $5 trillion at one point. AI and cloud revenue stories dominated earnings from five Mag-7 firms. Alphabet rose +8.18% and Amazon +8.92% on strong cloud growth, while Apple gained +2.87% on improved iPhone sales projections. Microsoft fell -1.11% despite early-week gains after revealing a 27% stake in OpenAI. Meta was the laggard, down -12.19% (-2.72% Friday), as markets questioned its high capex plans and rationale for last week’s $30bn bond issuance.

Outside tech, equities were more subdued. The S&P 500 rose +0.71% (+0.26% Friday), but the equal-weighted S&P 500 fell -1.75% and the Russell 2000 declined -1.36%. US IG credit spreads widened +3bps to 78bps, impacted by Meta’s mega deal. European credit outperformed, with IG and HY spreads tightening -1bps and -9bps respectively, even as equities declined — the STOXX 600 fell -0.67% (-0.51% Friday).

A key geopolitical event was the Trump–Xi meeting during Trump’s Asia visit. The US agreed to reduce its fentanyl-related tariff from 20% to 10%, while China removed its 10–15% retaliatory tariffs on various US agricultural products and delayed rare earth export controls. The Nikkei (+6.31%) and KOSPI (+4.21%) hit new records, but Chinese equities underperformed (CSI 300 -0.43%) amid lingering US–China tensions and a weak China manufacturing PMI on Friday.

Turning to rates, the Fed cut the fed funds rate by 25bps to 3.75–4.00%, but internal divisions remain. Two Governors dissented in opposite directions, and Powell noted “strongly differing views” within the FOMC, stating that a December rate cut is “far from…a foregone conclusion”. So by the end of the week, futures were pricing a 68% probability of a December cut, down from over 90% before the FOMC. Consequently, 10yr Treasury yields rose +7.5bps (-2.1bps Friday), and 2yr yields increased +9.2bps (-3.5bps Friday). Higher US rates supported the dollar, with the dollar index up +0.86%, marking its highest weekly close since May. In contrast, gold fell -2.68% to $4,003/oz.

Finally in Europe, the ECB held rates steady at 2% for the third consecutive meeting. President Lagarde stated that policy is in a “good place”, though not a “fixed place”. European bonds saw mixed movements against that backdrop: 10yr bund yields rose +0.7bps, while OATs and BTPs declined -1.1bps and -3.2bps respectively. Elsewhere, the Bank of Canada cut rates by 25bps, and the Bank of Japan maintained its rate at 0.5%.

Tyler Durden

Mon, 11/03/2025 – 08:46ZeroHedge NewsRead More

R1

R1

T1

T1