“Fragile”: Bitcoin Battered Below Key Technical Level, But Liquidity Offers Hope

After its worst October performance in nearly a decade, and sentiment among traders already reeling from a historic liquidation event last month, Bitcoin has accelerated losses today, breaking back below its 200DMA and testing down to $101k for the first time since June…

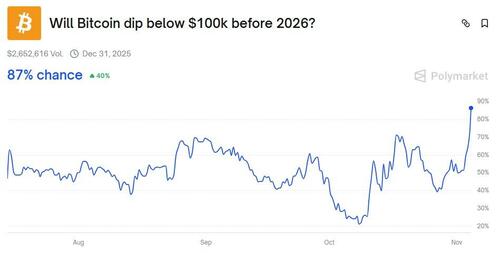

According to updated Polymarket data, there’s now an 87% chance of the Bitcoin price falling below $100,000 before 2026…

According to market analyst Damian Chmiel, a sustained break below $100,000 could trigger a sharper sell-off toward the April lows near $74,000, implying a potential 30% downside from current levels.

As Bitcoin Magazine notes, the broader macro backdrop remains unfavorable for risk assets.

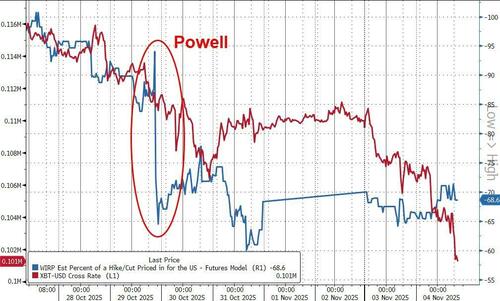

Federal Reserve Chair Jerome Powell’s comments last week walked back expectations of a December rate cut, reinforcing the “higher for longer” interest rate narrative.

That shift has boosted the U.S. dollar while simultaneously pressuring non-yielding assets such as Bitcoin.

Adding to the selling pressure, ETF investors have withdrawn more than $1.8 billion from Bitcoin and Ether products over the past four trading days, data shows, while open interest in BTC perpetual futures has fallen about 30% from its October peak, signaling a pullback in leveraged exposure.

Traders are eyeing $96,000 as the next significant support zone.

“The crypto market is facing multiple near-term headwinds,” said Derek Lim, head of research at Caladan, according to Bloomberg.

“It’s already fragile from October’s massive liquidation event and a string of protocol exploits.”

On the upside, bulls must reclaim the 21-day EMA and Point of Control around $111,000 to reestablish momentum, followed by resistance at $114,600 and $122,000.

Bitcoin has decoupled from global liquidity’s incessant rise (for now)…

Relative to Gold, Bitcoin is back at a key support level also…

Earlier today, Fundstrat’s Tom Lee remained bullish on Bitcoin, predicting it could still surge to $150,000–$200,000 by the end of 2025 despite recent market turbulence.

He noted that the mid-October liquidation event — the largest in crypto history, even bigger than FTX – occurred just weeks ago.

Earlier today, Strategy announced they reinforced its aggressive Bitcoin accumulation approach, purchasing 397 BTC for about $45.6 million at an average price of $114,771 per BTC.

According to a November 3, 2025 SEC Form 8-K filing, Strategy now holds a total of 641,205 BTC, with an aggregate purchase cost of $47.49 billion and an average price of $74,057 per BTC, including fees and expenses.

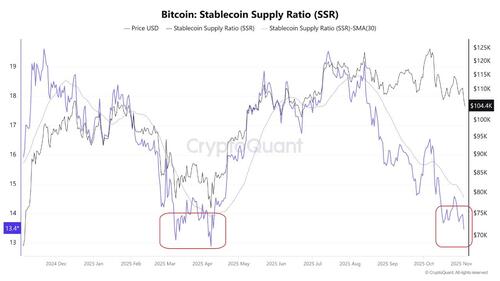

Bitcoin liquidity signals turning point

Data from CryptoQuant suggested that the Stablecoin Supply Ratio (SSR) has dropped back to the 13–14 range, the same zone seen before Bitcoin’s rebound earlier this year. Historically, this level has marked liquidity turning points, where increasing stablecoin balances signal rising “buying power” on the sidelines.

Bitcoin Stablecoin Supply Ratio: Source: CryptoQuant

Currently, with Bitcoin trading at $101,800, the low SSR suggests that stablecoin liquidity is quietly building again, potentially setting the stage for a relief rally or the final bullish leg of this cycle.

However, each successive SSR rebound has grown weaker, suggesting that while another upside phase may still be possible, the market’s underlying liquidity momentum could be fading.

Tyler Durden

Tue, 11/04/2025 – 12:51ZeroHedge NewsRead More

R1

R1

T1

T1