Abrupt Sentiment Shift Rocks Gen Z: Restaurants Warn Of Spending Drop As Student Loan “Default Cliff” Arrives

The Trump administration faces a worsening macroeconomic backdrop for younger, lower- and middle-income consumers, burdened by student debt, costly auto loans, high apartment rents, and depleted savings amid a persistently high interest rate environment.

Early signs of financial strain emerged at the tail end of the summer, outlined in our note:

We’ve been tracking this alarming trend, which was reinforced by the latest warning from Goldman Delta One, Rich Privorotsky, who has gone “Defcon 1” on the rapidly deteriorating consumer.

Early signs of strain have emerged across the restaurant and casual dining segment, where management teams are flagging a noticeable pullback in discretionary spending among younger consumers. This cohort is increasingly shifting from dining out to at-home consumption, opting for groceries over restaurants as they can no longer justify $8 Starbucks coffee and $15 Chipotle burritos.

Last week, Goldman’s Consumer specialist Scott Feiler published a red alert on “The Shifting Health of the US Consumer,” warning of acute deterioration among the US middle class.

Feiler followed up the warning with a weekend note that said, “Something has clearly changed with the consumer. Commentary from restaurants and grocers last week made that clear.”

He noted that consumer stocks are massive underperformers year-to-date (Restaurant group -21% YTD, Housing -7% YTD, Retail -3% YTD).

However, he said, “It is worth noting that November is the best month for Consumer Discretionary of the year. The last 5 years, the group is +8.4% during November, on average, with an 80% hit rate. It is the largest outperformance month vs the market, on average, as well.”

Consumer Discretionary (GSXUCOND Index) Average Price Action By Month. November is The Strongest Month of the Year on an Absolute & Relative Basis.

Feiler previously noted that more companies are warning of signs of a slowdown across the consumer space, with weakness mainly across middle-income consumers, particularly those aged 25 to 35. The brunt of this has been observed across the restaurant space:

$CMG Chipotle CEO: “A particularly challenged cohort is the 25- to 35-year-old age group. We believe that this trend is not unique to Chipotle and is occurring across all restaurants as well as many discretionary categories. This group is facing several headwinds, including…

— The Transcript (@TheTranscript_) November 2, 2025

$CAVA CEO also flags decline in visit frequency among guests aged 25–35.

“When we look at the data, it’s more that the younger cohort that 25 to 35…. they don’t have the steam that they had last year in the way that they were visiting or their frequency of visiting.” https://t.co/o01FmE7PlC

— The Transcript (@TheTranscript_) November 5, 2025

$MCD McDonald’s CEO: Low-income traffic is still down double digits

“We continue to see a bifurcated consumer base with QSR traffic from lower income consumers declining, nearly double digits in the third quarter, a trend that’s persisted for nearly two years..and we believe the… https://t.co/lluh7PneDN

— The Transcript (@TheTranscript_) November 5, 2025

There’s been increasing chatter about the notable negative shift in sentiment among younger consumers, which happened quite abruptly. We spoke with a senior analyst at one of the world’s largest U.S.-based beverage companies who attributed the slowdown to tariffs. However, we disagree and believe the actual shock was the student loan “default cliff” that hit in late summer.

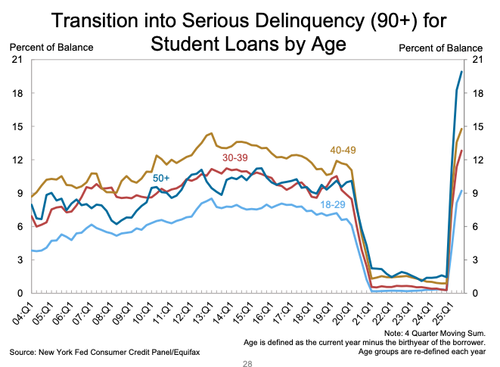

There are about 5.3 million student loan borrowers in default, and another 4.3 million borrowers are in “late-stage delinquency,” or between 181 and 270 days late on their payments, according to a recent Congressional Research Service report based on Education Department data. Payments 270 days past due are considered in default.

We don’t disagree that a slowing jobs market and tariffs are compounding pressures on consumers, but the unfolding mess tied to the student loan default cliff hitting younger borrowers is clearly a major driver behind the sharp shift in sentiment.

Given that Democrats have shifted so far to the left by fully embracing socialism and a sprinkle of Marxism, promising those who vote for them free bus rides, government-run supermarkets, and other free stuff, the question becomes how the Trump administration will win some of these youngsters struggling to survive. We do note the Trump administration recently offered to bail out farmers with tariff revenues… The admin should start looking at the kids ahead of the 2026 midterms.

Tyler Durden

Wed, 11/05/2025 – 15:40ZeroHedge NewsRead More

R1

R1

T1

T1