Recession Watch: Could The Next One Be Right Around The Corner

Authored by Carlo Putti via BondVigilantes.com,

Recessions often appear crystal clear when analysed in retrospect.

It’s easy to sit back, glance at the Bloomberg screen, and spot the evident recession we had in 2008 or the dot-com bubble of 2000.

However, discerning whether an economy is on the brink of a recession, or even if it is already are in one, is considerably more challenging. Recessions often become obvious only once they are well underway, and by then, significant economic damage may have occurred. For instance, during the GFC (Great Financial Crisis), many viewed Lehman Brothers’ collapse in September 2008 and the simultaneous surge in unemployment as the onset of the recession. However, the recession started almost a year earlier in the fourth quarter of 2007. This shows that by the time most people realise there’s a recession, it is typically already in full swing. Additionally, macroeconomic data poses another challenge in early recession identification because it tends to be lagging and subject to sharp revisions, altering the perceived state of the economy. Looking back at the GFC, labour market data in early 2008 still was showing a picture of positive job growth, suggesting economic robustness. It was only after subsequent revisions that these numbers were adjusted to reflect negative job growth, exposing the real extent of economic deterioration. These dynamics highlight why recessions seem obvious only after substantial damage has unfolded.

With that in mind, what can we discern about the current state of the US economy? Macroeconomic data doesn’t paint a bleak picture: the labour market appears robust and real growth is decent. Additionally, equity markets are at or near all-time highs while credit spreads remain historically low, suggesting that investors’ confidence in the economy’s durability is strong. But what if this perception is wrong? What if the US is on the edge of a recession, or even, what if it is already in one?

Typically, recessions are triggered by a substantial slowdown in monetary flow. When liquidity abounds and money flows smoothly, as it did post-Covid, the economy tends to boom. Conversely, when money flow halts and reverses, economic activity decelerates, ultimately causing significant job losses and a further downturn in economic growth. Therefore, monitoring monetary flows is crucial to gauging the future trajectory of the economy.

At a high level, money flows are primarily influenced by monetary and fiscal policies. During the Covid pandemic, both policies were expansionary, spurring the subsequent economic boom. Since then, monetary policy has become more restrictive, yet fiscal easing has replenished this shift, continuing to support economic expansion. However, today, we are confronted with a scenario where both monetary and fiscal policies appear to be restrictive, impeding the flow of money into the economy.

On the monetary front, commercial banks exhibit drastically muted lending activity, while the Federal Reserve is shrinking its balance sheet and maintaining relatively high interest rates.

On the fiscal side, things started to change under President Trump, driven by cuts and the introduction of tariffs, which increasingly appear to be paid domestically as opposed to be borne by the exporters.

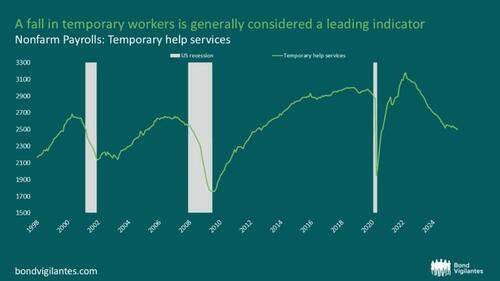

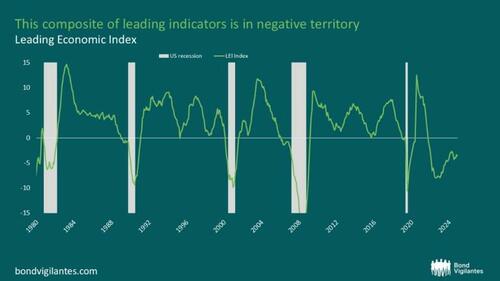

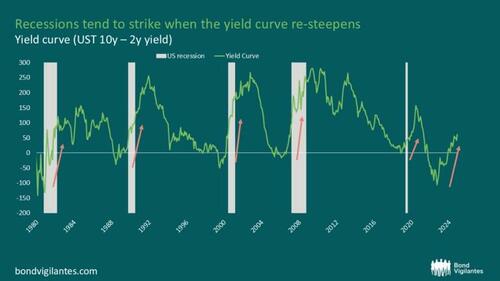

This leaves us in a very different position compared to the post-Covid boom era. Now, monetary flows are stalling and reversing. While this trend might not yet be evident in widely followed macroeconomic data, it is beginning to appear in traditional recession indicators that investors have historically relied upon. Richard Woolnough recently discussed Dr. Copper, a long-standing indicator used by many to evaluate economic growth prospects. Building on this, below is a selection of other indicators that also suggest a similarly bleak economic outlook.

Source: University of Michigan, Bloomberg (CONSUEXR Index), 31 August 2025

Source: Conference Board, Bloomberg (USESTEMP Index), 31 August 2025

Source: Conference Board, Bloomberg (LEI YOY Index), 31 August 2025

Source: Conference Board, Bloomberg (NHSPATOT Index), 31 August 2025

Source: Bloomberg (USYC2Y10 Index), 31 August 2025

In conclusion, identifying a recession after it has happened is often very straightforward, but identifying one when you’re on the brink of it, or even in the middle of it, is much more challenging. Recessions don’t start when the labour market cracks. That’s only a consequence of the recession, not the cause. They begin when money stops flowing through the economy, slowing down growth, cutting profits, and leading to layoffs.

Since Covid, governments and central banks have been pouring money into the global economy, helping it to grow quickly. But now, both are tightening up, making it harder for money to move around freely, which is a big concern for the future. Some recession indicators are already suggesting a potential downturn in the US, yet investors seem overly optimistic, assuming a negligible chance of an impending recession. I believe this could be a mistake, and given the current macroeconomic environment, we should be more cautious and start discussing recession probabilities.

Tyler Durden

Wed, 11/05/2025 – 08:05ZeroHedge NewsRead More

R1

R1

T1

T1