WTI Holds Losses After Big Crude Build, Record US Production

Oil prices weakened for a second session early on Wednesday as a report showed an unexpected surge in U.S. oil inventories, keeping demand and over-supply concerns top of mind for traders.

“API data indicated the largest US crude inventory build in more than three months, with stockpiles rising by 6.5 million barrels last week. If confirmed by the EIA later today, it would mark the biggest gain since late July,” Saxo Bank noted.

The unexpected rise in stocks comes amid persistent warnings the oil market is oversupplied as rising production from OPEC+ and Western Hemisphere producers climbs above demand growth. The concerns were amplified by OPEC+’s weekend decision to hike supply for a third month by 137,000 barrels per day in December, following on the September end to the return of 2.2-million bpd of production cuts.

The question now, is will the official data confirm API’s worrying build.

API

-

Crude +6.5mm

-

Cushing +400k

-

Gasoline -5.7mm

-

Distillates -2.5mm

DOE

-

Crude +5.2mm – biggest build since July

-

Cushing +300k

-

Gasoline -4.7mm

-

Distillates -643k

The official data confirmed API’s large crude build (biggest weekly addition since July) but we are also seeing product inventory drawdowns for a fifth straight week

Source: Bloomberg

US Crude production rose once again to a new record high of 13.65mm b/d despite recent rig count stability…

Source: Bloomberg

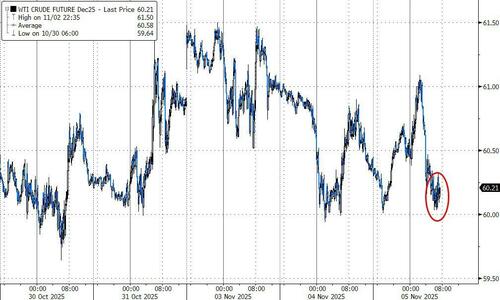

Oil price are holding at the lows of the day after the official data with WTI finding support at $60 for now…

Finally, as MT Newswires reports, rising output comes as the global economy slows with U.S. tariff policies hampering global trade and cutting into demand. Economic data this week showed slowing manufacturing activity in the United States, China and Japan, pushing investors away from over-heated risk assets.

“Japan’s manufacturing sector shrank at its fastest pace in 19 months. Tepid new orders in the US led to the eighth consecutive monthly contraction in factory activity. A private survey reached the same conclusion in China, where expansion slowed last month, while manufacturers across other Asian economies are clearly feeling the impact of US tariffs in the form of declining orders,” PVM Oil Associates noted.

Still, concerns over Russian supply is offering support for the energy complex, as Ukraine continues its strikes on Russian oil infrastructure. Reports said Ukrainian drones on Tuesday struck at a Lukoil oil refinery in Russia, the second attack on Russian refineries this week, while Russia suspended exports from its main Black Sea oil export port following a Ukrainian attack.

Tyler Durden

Wed, 11/05/2025 – 10:35ZeroHedge NewsRead More

R1

R1

T1

T1