Goldman’s Tech Trader Lists The 3 Things Behind The Sudden AI Implosion

It was uphill fun pretty much constantly since April, but then in the past two weeks, the market has clearly gotten harder, and as Goldman TMT specialist Peter Bartlett writes in a note (available to pro subs), is set to post its second -2% session in 3 days, with under-the-hood price action feeling increasingly unsettling.

Bartlett thinks the increased chop is being caused by three facts:

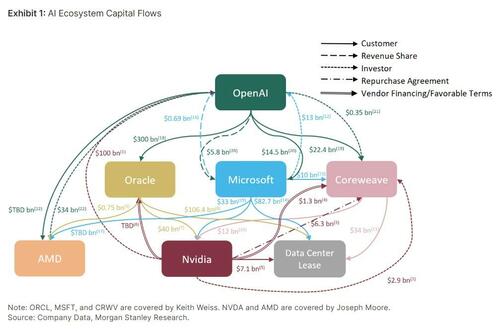

1. Uptick in AI skepticism, exacerbated by the recent OpenAI discourse around a “federal bail out” of AI infrastructure spend

From Bartlett’s seat, “a more bearish/skeptical view of the AI trade is coming up in more and more of our investor conversations… even if positioning hasn’t changed much off the highs (ie has been too hard to be short, or even underweight the momentum behind the trade).“

While there have been several drivers of increased skepticism of late (circular nature of Cloud deals, “peak feel” to cadence of news flow, general ROI concerns etc)…

… two recent comments from OpenAI (who has separated itself as the biggest consumer of AI infrastructure) appear to be spooking the market:

- 1) Sam Altman’s defensive response to Brad Gerstner’s question on “How can a company with $13bn in revenues make $1.4 trillion of spend commitments?” on the g2Pod podcast earlier this week (see “OpenAI CFO Seeks US Government Backing, Disappointed Market Doesn’t Have More AI “Exuberance“)

- 2) OpenAI’s CFO Sarah Friar mention of a potential federal government “backstop” for AI financing (WSJ) yesterday. (see “AI is the new global arms race, and capex will eventually be funded by governments (US and China).“)

Today, Trump’s AI czar David Sachs responded to the “federal bailout” comments … with many noting the bizarreness of any talk of a “bail out” given where we are in the AI cycle.

There will be no federal bailout for AI. The U.S. has at least 5 major frontier model companies. If one fails, others will take its place.

— David Sacks (@DavidSacks) November 6, 2025

2. Negative earnings asymmetry highlighting poor Risk/Reward

The difficulty of getting paid on Longs into earnings has continued (see: DASH -15%, HUBS -17%, PTC -10% today …. which comes after RBLX -15% , META -12%, NFLX -10%, ANET -9%, PLTR -7%, MSFT bleed over the last week).

– Goldman thinks the asymmetry around earnings reactions is contributing to an uptick in risk/reward considerations into YE, particularly given where positioning currently stands and how hard & fast certain pockets of the market have ran in recent months.

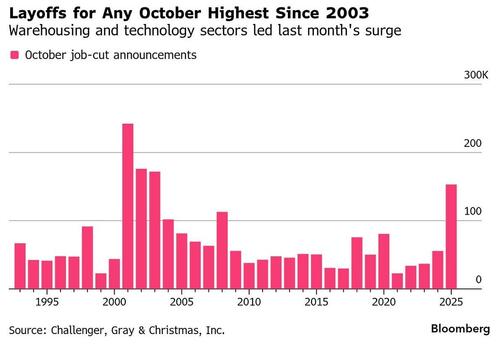

3. Concerns surrounding the Jobs situation

Noise around the health of the Jobs market in the US has increased in recent sessions, with a Bloomberg story out this morning reporting US companies announced 153k job cuts last month, triple the amount during the same month last year, and the most for any October since 2003. The story, citing data from Challenger, Gray & Christmas, pointed to AI adoption, softening consumer and corporate spending, and rising costs as the primary drivers of belt-tightening and hiring freezes.

As Bartlett concludes, “how the market responds to the potential job loss side of the AI equation is an outstanding question, with today’s price action potentially suggesting that there is a threshold where “too much job displacement” becomes a problem.“

Which sounds a little like Scenario 3 the options we presented yesterday…

Three endgame scenarios emerging

1. AI is huge “unlit fiber” dud a la Global Crossing, leads to record capital misallocation; Mag 7 crashes, dragging market with it 30-40%, Fed steps in to bailout again

2. AI is long slog, transforms into civilizational competition between US…

— zerohedge (@zerohedge) November 5, 2025

More in the full Goldman note available to pro subs.

Tyler Durden

Thu, 11/06/2025 – 23:36ZeroHedge NewsRead More

R1

R1

T1

T1