Un-Sustainables: ESG Outflow Bloodbath Hits Ninth Consecutive Month

The downward spiral of sustainable equity stocks built on the environmental, social, and governance (ESG) globalist movement has deepened under the Trump era, as investor focus and capital flows have pivoted sharply toward the booming artificial intelligence trade.

A Goldman Sachs team led by analyst Varsha Venugopal offered clients a fresh snapshot of the darkening ESG space, cautioning that:

Sustainable equity outflows continued in September (-$8.4 bn) for the ninth consecutive month. Outflows were driven by W. European active funds (-$8.3 bn), while active funds in N. America (-$2.5 bn) and RoW (-$0.4 bn) saw more modest outflows. Passive strategies saw inflows (+$2.8 bn) across all regions in the latest month. Integration strategies saw outflows (-$8.3 bn), as did thematic strategies (-$0.8 bn), though only marginally. Global Sustainable fixed income flows turned modestly negative in September (-$1.8 bn).

The broader picture for sustainable equity fund flows reveals a continued wave of outflows, driven mainly by heavy redemptions across Europe and the U.S. during the summer months.

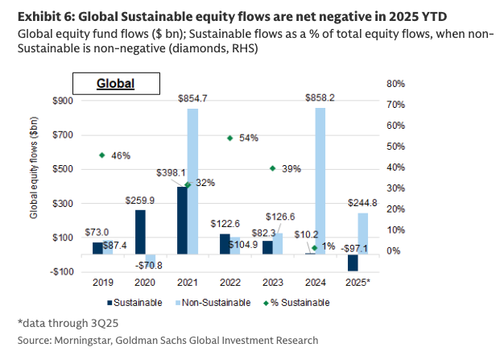

Sustainable equity funds saw outflows in 3Q25 (-$70.1 bn), largely driven by redemptions from select funds in July (Exhibit 6).

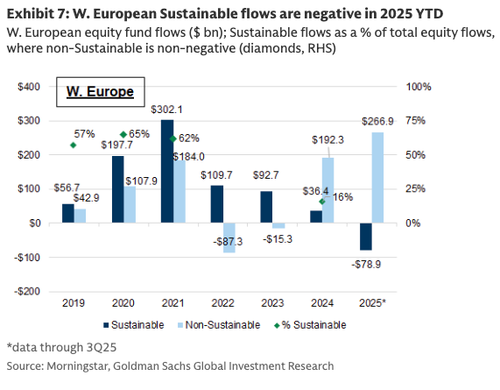

W. Europe drove outflows in September (-$6.2 bn), while N. America (-$2.1 bn) and RoW (-$0.01 bn) saw marginal to negligible outflows.

Europe

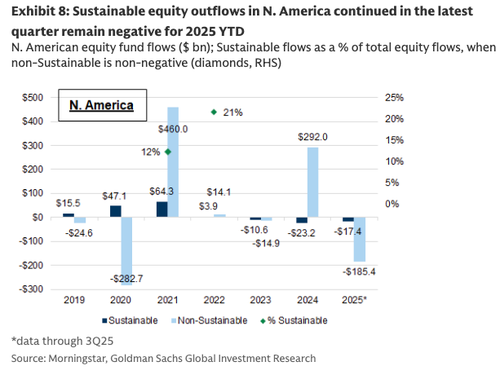

North America

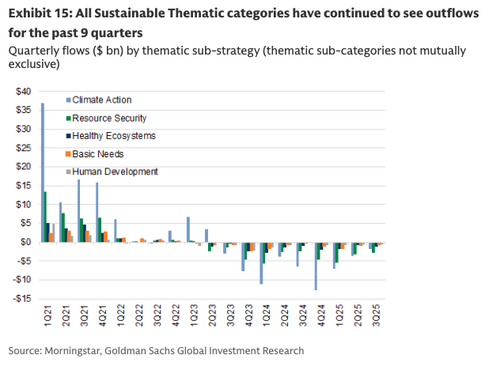

All sustainable thematic categories, climate, human development, etc., have recorded nonstop outflows for nine consecutive quarters.

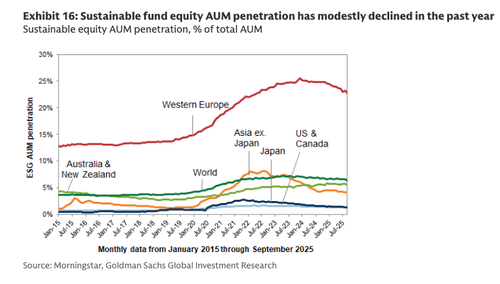

“Sustainable fund equity AUM penetration” refers to the percentage of total equity assets under management (AUM) invested in ESG-labeled funds. The data below shows that this phenomenon has largely lost momentum after globalist Wall Street bankers drove the ESG bubble into hyperdrive during the Biden–Harris regime era.

For the last few years, we’ve pointed out that the ESG and climate-driven investment bubble was destined to burst. This latest report confirms that equity outflows are continuing and that the ESG obsession, which forced the premature retirement of reliable fossil-fuel power generation in favor of unreliable solar and wind, has proven a disaster for grid stability in the age of energy-hungry AI data centers.

ZeroHedge Pro Subs can read the full report in the usual place.

Tyler Durden

Fri, 11/07/2025 – 15:05ZeroHedge NewsRead More

R1

R1

T1

T1