Consumer Inflation Expectations Slide Amid Deterioration Job Market, Personal Finances

There was good and bad news in this month’s NY Fed survey of consumer expectations.

Starting with the former, expectations for consumer price increases in the year ahead ticked down to 3.2% in October from 3.4% in September – which was the highest since April – while measures for three and five years ahead were unchanged changed at 3%.

Putting the inflation expectations in context to other forward looking inflation metrics, we can see that the NY Fed is among the lowest predictors of future price growth.

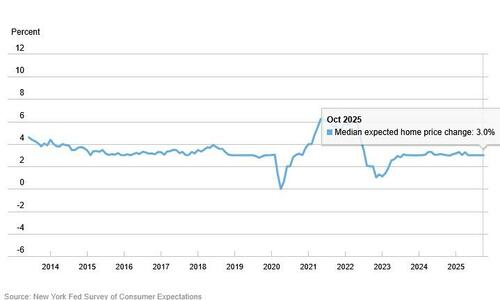

Taking a closer look at the components, median home price growth expectations remained unchanged at 3.0% for the fifth consecutive month (the series has moved in a narrow range between 3.0% and 3.3% since August 2023)…

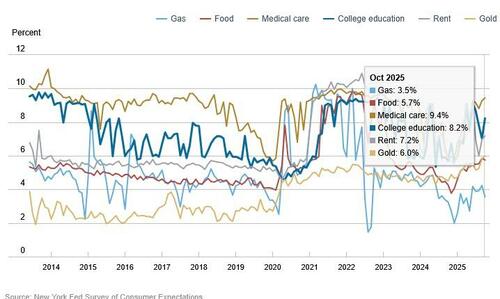

… while year-ahead commodity price change expectations declined by 0.7 percentage point for gas to 3.5% and by 0.1 percentage point for food to 5.7%. The year-ahead price change expectations increased by 1.2 percentage points for the cost of college education to 8.2%, by 0.1 percentage point for the cost of medical care to 9.4% (the highest reading since February 2023), and by 0.2 percentage point for rent to 7.2%.

That’s the good news; the bad news is that despite the decline in inflation, overall sentiment deteriorated as Americans’ perceptions of the job market worsened in October.

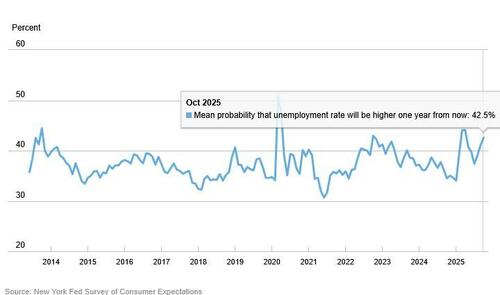

Unemployment expectations rose for a third straight month as consumers assigned an average 43% probability – the highest since April – to the likelihood the US unemployment rate will be higher one year from now.

Yet ironically, the NY Fed Survey also showed that the mean perceived probability of losing one’s job in the next 12 months dropped by 0.9 percentage point to 14.0%, so once again we have a direct contradiction.

Tied to that, the survey showed consumers saw a smaller chance in October of finding a new position in the event of job loss. In line with what economists have described as a low-firing, low-hiring job environment, the perceived chances of voluntarily leaving a job fell, while the odds of job loss also declined.

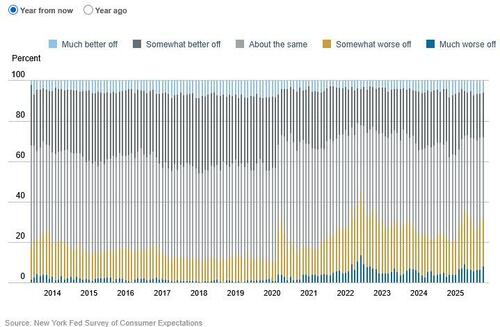

At the same time, expectations for household finances continued to deteriorate, with more respondents saying their finances were worse off than a year ago and would be worse a year from now.

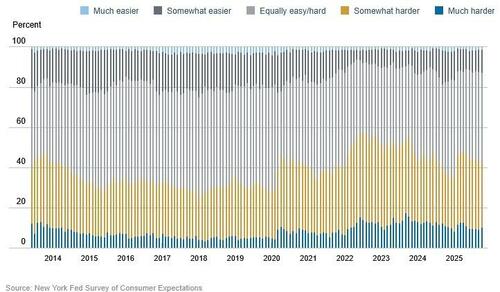

Yet perceptions of credit access improved, as the share of households saying it’s harder to get loans fell to the lowest level since 2022.

Finally, a larger percentage of consumers, 13.1% vs 12.6% in prior month, expect to not be able to make minimum debt payments over the next three months

The data will worsen the growing (political) divide among Fed voters as signs of weakness in the job market pile up even as inflation expectations continue to drop (and ironically confirm that Trump was right to slam Powell for waiting too long to cut rates). Last week, the Fed lowered interest rates by a quarter percentage point, but a number of policymakers have since voiced concerns about extending their easing cycle saying concerns about inflation were greater than employment worries.

Tyler Durden

Mon, 11/10/2025 – 05:45ZeroHedge NewsRead More

R1

R1

T1

T1