A Giant Problem For The AI Revolution: A Power Shortfall Of 44 Nuclear Power Plants By 2028

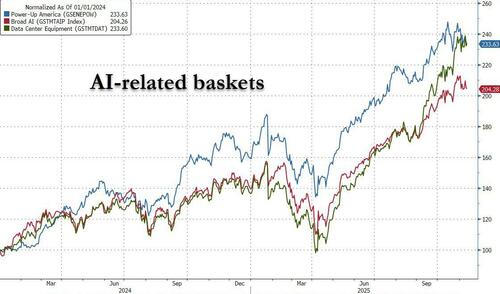

For much of the past 18 months we have been banging the table on what we said would be the Next AI Trade (which we first discussed in April 2024) pitching the “picks and shovels” angle of the AI revolution, namely going long the “Power-Up America” basket – i.e., companies that produce and support the massive energy backbone that will be needed to energize the hundreds of new data centers popping up across the country (and which in some cases are now dark because they don’t have access to energy) predicting that energy would materially outperform the pure AI/data center trade. That’s precisely what has happened as the following chart breaking down the AI trade into its three core components – broad AI, data center equipment, and our preferred trade, Power Up America (or energize the grid) – shows. The blue line has doubled since we first discussed its merits in April ’24.

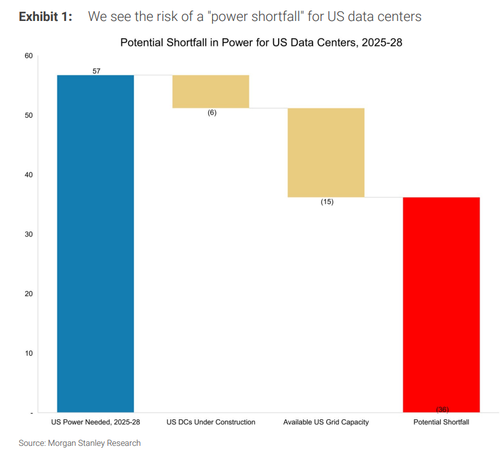

Our conviction in this trade was only reinforced by an analysis from Morgan Stanley last December, which found that for the 2025-28 period, “we project ~57 gigawatts (GW) of US data center power demand, and we quantify available power capacity to serve this demand as: near-term grid access of ~12-15 GW, plus ~6 GW of data centers under construction, resulting in a ~36 GW shortfall of US power access for data centers in 2025-28.” Indicatively 36GW is sufficient to power ~27 million homes. Instead it will be going to power chatbots.

Fast forward one year since Morgan Stanley published its original estimate when this morning Morgan Stanley’s strategist Stephen Byrd published his follow up report, “Powering AI: Bitcoin Conversion: Business Models, a US Power Shortage, and the Big Picture” (available to pro subs), in which he reassessed US power needs through 2028.

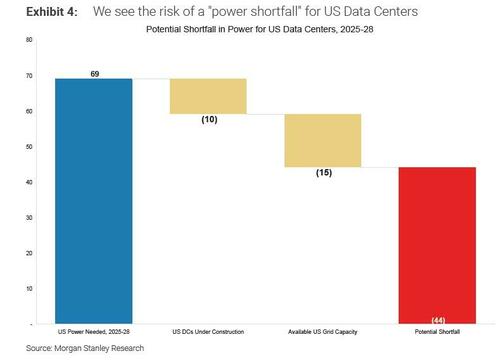

It will probably not come as a surprise to anyone, that his latest estimate is materially higher, rising to a staggering 44GW…

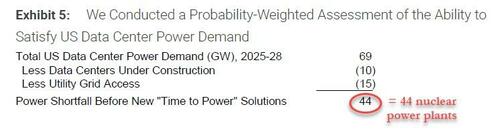

… or roughly the output equivalent of 44 nuclear power plants!

No wonder the Trump admin recently announced that it was prepared to lend hundreds of billions from the Energy Department’s Loan Programs Office almost exclusively to nuclear power plants to kickstart this process.

While the full Morgan Stanley note is a must read for those who have an interest in the AI trade, and certainly in the details of the “Next AI trade”, and includes a detailed analysis on Bitcoin-to-Data center conversions, the non-linear rate of AI improvement and the continued upward growth in compute demand (we urge all pro subscribers to read it), what we focus on in this post is the bank’s revised estimate of power shortfall facing US data center developers (we will discuss the financial implications in a subsequent post, suffice to note that 1GW in data center capacity costs roughly $50 – 60 billion in total capex spend).

For its revised projection, Morgan Stanley conducted a probability-weighted assessment of the ability to satisfy US data center power demand, and found that with 69GW in total data center power demand from today until 2028, some 10GW will be satisfied with Data Centers under construction, and another 15GW through Utility Grid Access.

That leaves a 44GW power shortfall, or a number so staggering any hopes of the AI revolution growing into Wall Street’s optimistic projections implodes instantly… unless of course the government steps in to foot the bill (we will have more to say on that in a subsequent post).

Clearly, with precisely 0 nuclear reactors being built in the US (vs 29 for China)…

… and even if they were, the construction would take a decade if not longer – this is a massive problem, as it means that absent some miracles, the US simply can not grow its grid to support the massive data center power drain that is looming… and that generously assumes the trillions of dollars needed to build said data centers were readily available. They are not, which is why Sam Altman has been begging US taxpayers to bail him out (again, we will have more to say on this shortly).

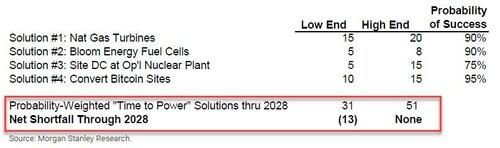

So what then? To provide some possible solutions, Morgan Stanley has focused on so called “time to power” solutions which do not rely on the typical grid interconnection process, that have the potential to eliminate the shortfall.

Assuming these Time to Power solutions are implemented, Morgan Stanley concludes that through 2028, we could experience a power shortfall totaling as much as 20%, which equates to a ~13 gigawatt (GW) shortfall, better than the 44GW base case above but still a huge gap of roughly 13 nuclear power plant. That said, an even more rapid increase in “time to power” solutions have the potential to eliminate this shortfall (and would certainly cost an arm and a leg).

Stephen Byrd details his proposed solutions as follows:

- Natural gas turbine transactions could provide an incremental 15-20 GW of power

- Bloom Energy (BE) could provide 5-8 GW of power (perhaps more in a bullish scenario in which BE increases its annual production capacity to 3 GW),

- 5-15 GW of nuclear Data Center deals drawing on operational plants (MS does not include nuclear deals in which the generator provides incremental natural gas–fired power generation to offset the nuclear power used by the DC – that would be included in the ~20 GW of natural gas turbine transactions).

- Finally, MS believes that existing Bitcoin miners have almost 20 GW of large (100 MW or greater) sites that have a firm grid interconnection agreement, which could result between 10GW and 15GW of supply.

Of the above, Morgan Stanley believes that Bitcoin miners/sites offer AI players the fastest time to power with the lowest execution risk, and believe this will increasingly be valued/ recognized. The bank also continues to believe Bloom Energy (BE) can be a highly reliable, “time to power” solution that drives rapid volume growth. Beyond these two categories of solutions (fuel cells and Bitcoin conversions), we would expect to see “all of the above” in terms of “time to power” transactions — involving merchant power companies, turbine manufacturers, energy companies and others.

For those eager to jump down the rabbit hole with Morgan Stanley and contemplate – or trade – the conversion of bitcoin miners into data centers, the bank has an extended discussion of this particular opportunity, from which we excerpt below:

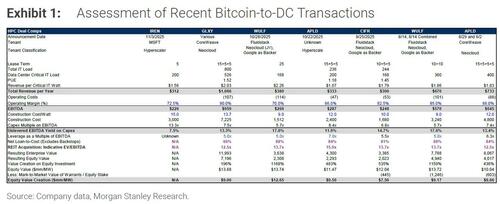

Continued trend of repurposing Bitcoin mining centers to host HPC data centers, with 2 different business models: (A) the “new neocloud” and (B) the “REIT endgame.”

Under the “new neocloud” model, most notably exhibited by IREN, the Bitcoin miner purchases GPUs/TPUs, builds the entire data center and leases the facility to hyperscalers and other customers – potentially under leases with relatively short durations (such as the 5-year lease signed by IREN with Microsoft). Under the “REIT endgame” model, the Bitcoin miner builds the “powered shell” (typically, everything but the chips + servers) and signs a lease with a neocloud and/ or hyperscaler, typically under fairly long-term leases (such as the APLD 15-year lease with an unnamed hyperscaler). We see value creation potential with respect to both approaches. The following chart provides an overview of the Bitcoin-to-DC conversion transactions, including the “colocation” portion of the “new neocloud” transaction recently entered into between IREN and Microsoft:

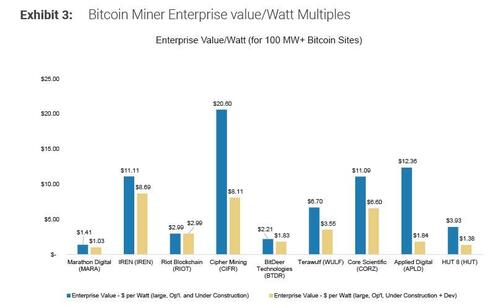

Finally, for those seeking relative Bitcoin to DC conversion metrics, the following table shows the latest Enterprise Value/ watt multiples for Bitcoin stocks – it includes all large sites (>100 MW) with firm grid access. Needless to say, the lower the column, the cheaper the potential conversion opportunity.

Much more in the full must read Morgan Stanley report available to pro subscribers.

Tyler Durden

Wed, 11/12/2025 – 14:03ZeroHedge NewsRead More

R1

R1

T1

T1