Mediocre, Tailing 10Y Auction Sees Subdued Foreign Demand

With the bond market closed on Tuesday for Veterans Day, the week’s staggered Treasury auction schedule caught up with where it should be at 1pm ET today when the Treasury sold $42BN in 10Y notes as part of the quarterly refunding exercise, in what was a mediocre auction.

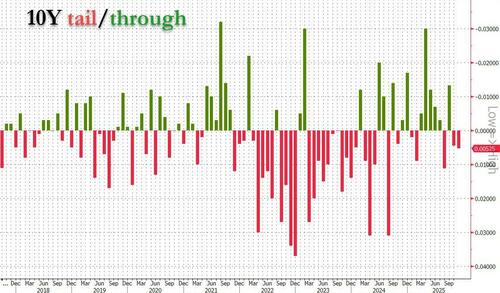

The auction priced at a high yield of 4.074% down from 4.117% last month, and the second lowest since last October; it also tailed the When Issued 4.068% by 0.6bps, the second straight tail (followed a 0.3bps tail in October).

The bid to cover also disappointed, dropping from 2.478 to 2.433, which was the second lowest since August 2024.

The internals were mediocre at best, with Indirects taking down 67.0%, up from 66.8% but well below the 70.2% recent average. And with Directs awarded 22.55%, Dealers were left holding 10.5%, the most since August.

While the tailing 10Y auction was on the weak side, and the market reacted with pushing yields out modestly across the curve, they were already at session lows so there was certainly space for the move in a day that has another midday swoon across the tech space, with bitcoin plunged all morning (again).

Tyler Durden

Wed, 11/12/2025 – 13:21ZeroHedge NewsRead More

R1

R1

T1

T1