When To Expect The Key Economic Reports After The Govt Reopens

When previewing the week’s events on Monday, we said that while September’s jobs report will likely be published within days of the reopening (tentatively scheduled for this evening’s House vote), question marks swirl around the October jobs and CPI prints, and may instead not be published at all and instead will be rolled into the the November reports due in about three weeks time.

Today, White House Press Secretary Karoline Leavitt confirmed as much saying that the October jobs and consumer price index reports are unlikely to be released due to the government shutdown.

“The Democrats may have permanently damaged the federal statistical system with October CPI and jobs reports likely never being released,” Leavitt told reporters at a news briefing. She also expressed concern that the lack of data is “leaving our policymakers at the Fed flying blind at a critical period.” Federal Reserve officials next meet Dec. 9-10 to decide whether to lower interest rates for a third time this year.

Leavitt didn’t clarify whether she was referring to the entire jobs report or just part of it. The report is composed of two surveys, the Establishment survey of businesses, which produces the main payrolls number, and another of Households, which is responsible for the unemployment rate and a more granular take on the labor market. While many businesses retain their records and report the data themselves electronically, reaching workers over the phone and asking them to recall their employment status for a particular week in October will be more difficult to conduct retroactively.

The White House initially said late last month there would not be an October inflation report, noting it’d be the first time in history the figures would be skipped. At the time, the BLS said it would resume normal operations once funding is restored and would notify the public of any changes to its release schedule.

So far, the BLS has not released an updated schedule for which indicators will be released and when. According to Bloomberg, it’s possible the agency will choose to combine two months’ worth of data for a particular statistic into a singular release to get back on track.

In the meantime, investors have been relying on alternative economic measures for both the labor market, which as we noted earlier this week signal that as many as 50,000 jobs may have been lost in October (per Goldman estimates) along with a surge in mass layoff notices, and for inflation where a similar analysis shows that CPI will likely print very soft largely as a result of the biggest plunge in rents in 15 years.

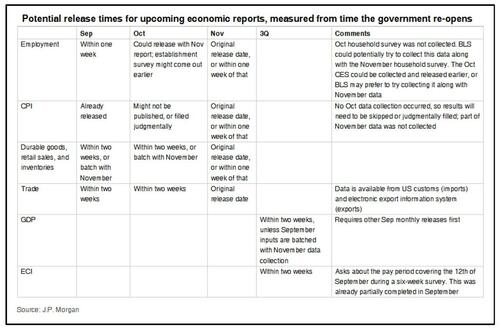

In any case, with the government set to reopen (before it partially closes again in January) here is JPMorgan’s best estimate of when we can expect various reports over the coming weeks.

Tyler Durden

Wed, 11/12/2025 – 15:40ZeroHedge NewsRead More

R1

R1

T1

T1