A Tale Of Two Consumer Worlds – Captured In A Single Chart

Our extensive reporting across household income tiers reveals a widening divide across the economy, increasingly bifurcated into two separate worlds.

At the top, affluent households are reaping the windfall of wealth generated by soaring AI-linked stocks. Meanwhile, middle- and lower-income consumers remain squeezed by persistent inflation, a softening labor market, and depleted savings.

UBS analysts, led by Jonathan Pingle, describe President Trump’s economy as “a big bet on AI and upper-income households.” So far, expansion is very narrow, with equity market wealth propping up upper-income households, while middle- and lower-income cohorts, who generally don’t own stocks, are facing growing hardships.

Pingle and the analysts warned, “If there is an equity bubble, and it bursts, for the real economy, look out below.”

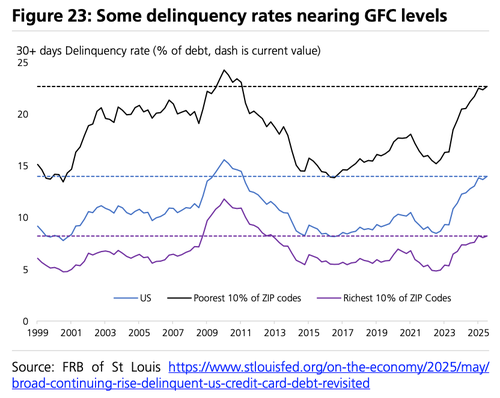

This tale of two consumer worlds is brilliantly illustrated in Federal Reserve credit card delinquency data, which shows financial stress for lower-income households and even the U.S. average now topping Great Financial Crisis levels. Yet among the wealthiest households, those same signs of strain have yet to materialize.

However, there is good news from the analysts: “Our base case is that an equity market drawdown is avoided. Households suffer for the next two quarters.”

Pingle expects a $55 billion boost to disposable income in 2Q 2026 from retroactive tax relief in the One Big Beautiful Bill Act (OBBBA). He said these “bumper refunds” should temporarily revive household spending in mid-2026, which is just in time for the midterm election cycle.

The takeaway is that consumers are living in entirely different economic environments depending on their income tier. Lower-income households will receive temporary relief from the OBBBA tax cuts early in 2026, while the administration has effectively placed a massive bet on AI to sustain broader economic growth, which should ramp up in 2H 2026.

Incoming economic tailwinds:

We suspect the Trump administration will need to take more decisive action to strengthen the financial footing of lower-income households, or risk seeing some of these voters drift toward Marxist-aligned Democrats promising “free stuff” in exchange for votes in 2026.

How Trump and Bessent plan to deliver that relief remains unclear. There’s been speculation about possible “tariff stimulus” checks, Trump’s recent pledge to tackle soaring food prices, and renewed vows to overhaul the disastrous Affordable Care Act, which has become anything but affordable as premiums keep rising.

ZeroHedge Pro subscribers can read the full note in the usual spot. It’s packed with more in-depth consumer data, detailed breakdowns, and charts that add more color about the consumer health.

Tyler Durden

Thu, 11/13/2025 – 05:45ZeroHedge NewsRead More

R1

R1

T1

T1